Methyl Acrylate Market Outlook:

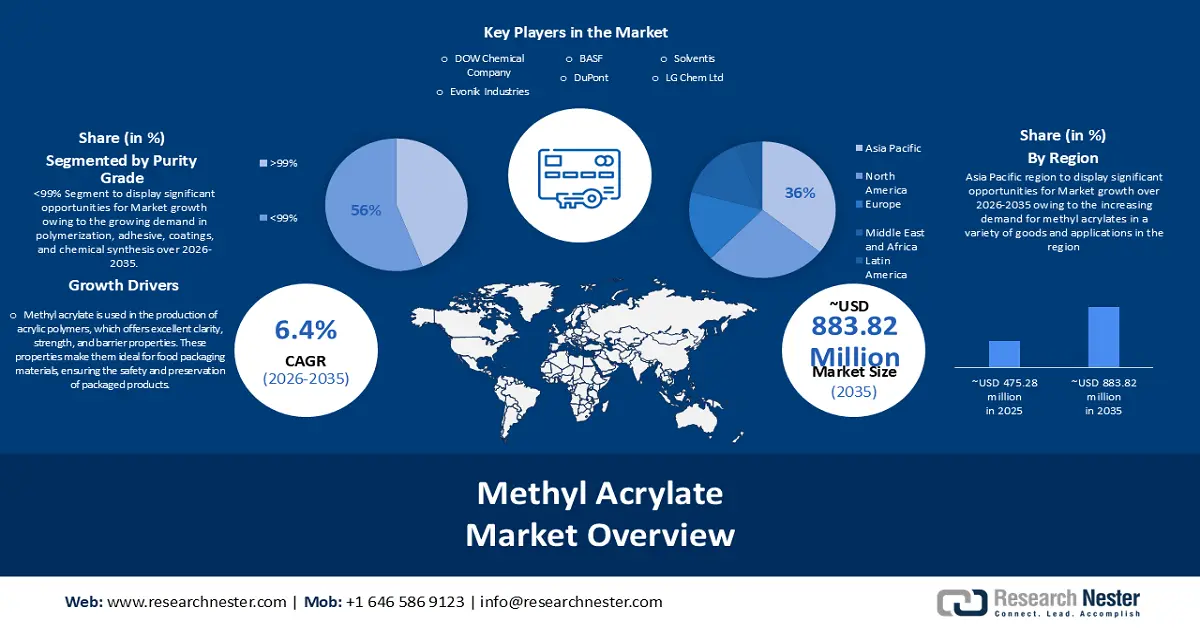

Methyl Acrylate Market size was valued at USD 475.28 million in 2025 and is likely to cross USD 883.82 million by 2035, expanding at more than 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of methyl acrylate is assessed at USD 502.66 million.

Methyl acrylate is used in the production of acrylic polymers, which offers excellent clarity, strength, and barrier properties. These properties make them ideal for food packaging materials, ensuring the safety and preservation of packaged products. These films are appropriate for applications needing protective packaging materials because of their transparency, flexibility, and barrier qualities. According to a recent report, 34 % of the acrylate was used for packaging purposes in the year 2020.

Methyl acrylate can undergo polymerization to form polymethyl acrylate, which is used in adhesives, coatings, and textiles. To create photopolymers and copolymers for use in a variety of industrial applications, including latex and synthetic rubbers, cleaning and waxing products, etc., methyl acrylate is utilized. Methyl acrylate reacts additionally with a broad range of both inorganic and organic substances. Several pharmaceutical intermediates are synthesized using methyl acrylate as a reagent.

Key Methyl Acrylate Market Insights Summary:

Regional Highlights:

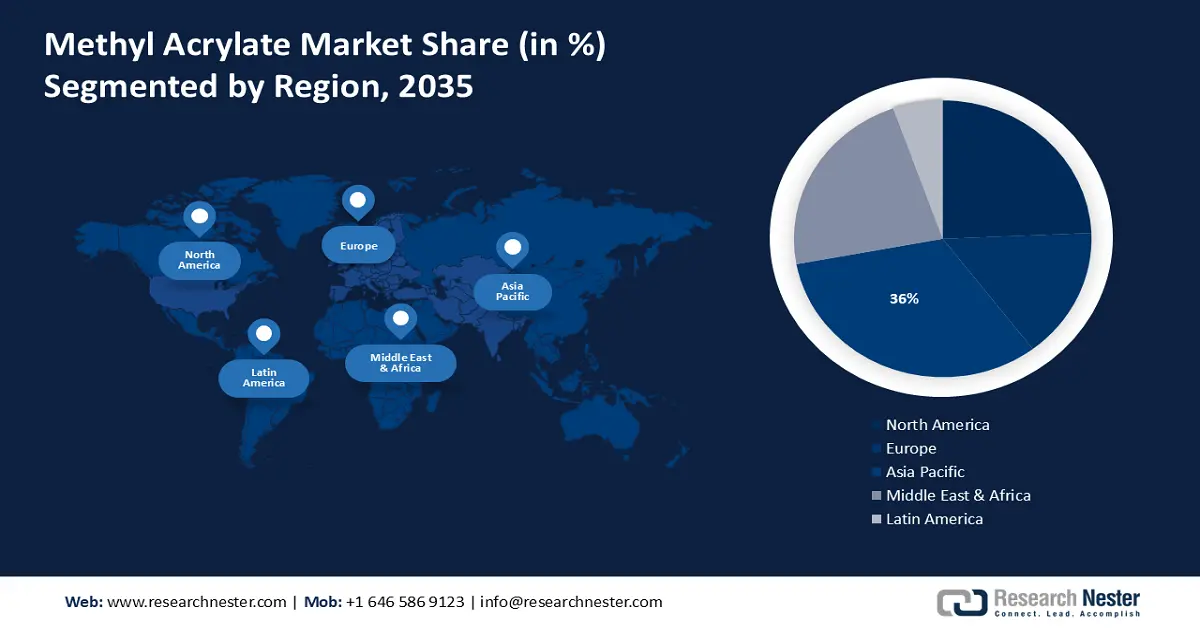

- The Asia Pacific region is expected to capture a 36% share by 2035 in the methyl acrylate market, underpinned by escalating urbanization and industrialization across textiles, adhesives, coatings, and polymers.

- North America is projected to attain a 27% share by 2035, sustained by strong automotive manufacturing activity and rising demand for sustainable packaging solutions.

Segment Insights:

- The <99% segment in the methyl acrylate market is anticipated to command a 56% share by 2035, supported by its wide-ranging use across key industrial applications.

- The adhesives & sealants segment is projected to secure a 35% share by 2035, propelled by expanding construction requirements and increased utilization in medical and packaging products.

Key Growth Trends:

- Growing Utilization in the Coating Industry

- Growing Shift Towards Sustainability

Major Challenges:

- Strict Regulations by the Government

- Fluctuating Prices of Raw Materials may Hinder Market Growth

Key Players: Dow Chemical Company, Evonik Industries AG, Arkema S.A., LG Chem Ltd., Shanghai Huayi Acrylic Acid Co., Ltd, BASF, Cjsc Sibur Holding, DuPont, Solventis, ISU Chemical.

Global Methyl Acrylate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 475.28 million

- 2026 Market Size: USD 502.66 million

- Projected Market Size: USD 883.82 million by 2035

- Growth Forecasts: 6.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 28 November, 2025

Methyl Acrylate Market - Growth Drivers and Challenges

Growth Drivers

- Growing Utilization in the Coating Industry - The need for coatings is fueled by the rapidly developing infrastructure in emerging economies as well as rising investment in the building, transportation, and energy sectors. Coatings based on methyl acrylate are essential for prolonging the service life of infrastructure assets and shielding them from environmental deterioration. Methyl acrylate-based advanced coatings provide improved performance qualities such as weather resistance, UV stability, chemical resistance, scratch resistance, and durability. High-performance coatings that provide durability, protection, and aesthetic appeal are also in greater demand. Manufacturers can meet these needs and maintain their competitiveness in the methyl acrylate market due to advancements in coatings technology driven by methyl acrylate. Furthermore, by modifying the formulation and polymerization process, coatings based on methyl acrylate can be made to match particular performance requirements.

- Growing Shift Towards Sustainability - Demand for environmentally friendly products and growing consumer awareness are driving demand for sustainable adhesives and coatings. Methyl acrylate can be utilized to create solvent-free or water-based coatings, adhesives, and polymers that support environmental objectives. Compared to conventional solvent-based treatments, these formulations decrease environmental impact and lower emissions of volatile organic compounds (VOCs). Additionally, methyl acrylate can be produced using bio-based feedstocks or biomass, which provides an alternative to raw materials obtained from petroleum. For instance, Herma will introduce a novel self-adhesive substance for labels that, in terms of the emission balance sheet, temporarily binds more CO2 than is emitted for its manufacturing.

- Growing Demand in Water Treatment Industry - Rapid industrialization, urbanization, and population growth in developing regions lead to increased demand for water treatment solutions to address water pollution and scarcity issues. For instance, 56% of domestic wastewater flows were safely treated worldwide in 2020, according to data extrapolated from 128 nations, which account for 80% of the world's population. Methyl acrylate-based polymers, such as polyacrylamide and its derivatives, are widely used as coagulants and flocculants in water treatment processes. Also, as water scarcity becomes a growing concern globally, there is an increasing emphasis on treated wastewater reuse for non-potable purposes such as irrigation processes, and environmental restoration.

Challenges

- Strict Regulations by the Government - Limits on volatile organic compound (VOC) emissions from industrial activities, such as the manufacturing and use of products containing methyl acrylate, are frequently enforced by government rules designed to mitigate air pollution and safeguard public health. Businesses may have trouble complying with regulations and incur extra expenses because of VOC emission controls and abatement technology. Therefore, the release of harmful gases by methyl acrylate may impede its methyl acrylate market growth.

- Fluctuating Prices of Raw Materials may Hinder Market Growth

- Growing Intense Competition from Alternatives may Hamper Methyl Acrylate Market Growth

Methyl Acrylate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 475.28 million |

|

Forecast Year Market Size (2035) |

USD 883.82 million |

|

Regional Scope |

|

Methyl Acrylate Market Segmentation:

Purity Grade Segment Analysis

<99% segment for methyl acrylate market is anticipated to hold the largest share of 56% during the forecast period. The demand for methyl acrylate spans a wide range of industries, including automotive, construction, textiles, packaging, and electronics, and is propelling the growth of the segment. For instance, in 2022, the automobile manufacturing sector brought in about 2.52 trillion dollars in sales. Also, in numerous applications, especially in polymerization, adhesive, coatings, and chemical synthesis, high purity levels may not be necessary. Also, these purity grades of methyl acrylate are typically more cost-effective compared to higher purity grades.

Application Segment Analysis

Adhesives & sealants segment in the methyl acrylate market is poised to hold a share of 35% by the end of 2035. Adhesives and sealants are widely utilized in the construction sector for a variety of purposes, including structural bonding, flooring, roofing, and insulation. The need for adhesives and sealants to suit the needs of building and infrastructure projects is rising due to the world's fast urbanization and construction activity. Additionally, adhesives and sealants are essential in the production of wound care items, pharmaceutical packaging, and medical devices. Green adhesives and sealants made from renewable resources and featuring reduced volatile organic compounds (VOCs) and enhanced recyclable properties are becoming more and more popular due to growing environmental restrictions and consumer preferences for eco-friendly products.

Our in-depth analysis of the global methyl acrylate market includes the following segments:

|

Purity Grade |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Methyl Acrylate Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 36% by 2035. The region is rapidly becoming more urbanized and industrialized, which is increasing the demand for methyl acrylates in a variety of goods and applications, including textiles, adhesives, coatings, and polymers. For instance, according to a 2015 research, the textile industry was valued at about 25 billion dollars, and by 2020, it was expected to grow to about 34 billion dollars. Additionally, the Asia Pacific packaging market is expanding rapidly as a result of shifting consumer preferences, rising e-commerce, and changing lifestyles. In addition, the Asia Pacific construction sector is seeing rapid expansion due to factors such as urbanization, infrastructure development initiatives, and population growth.

North American Market Insights

North American methyl acrylate market is expected to hold the second-largest share of 27% by the end of 2035. The region is a hub for automotive manufacturing and assembly. Methyl acrylate-based adhesives and sealants are widely used in automotive industry processes for bonding lightweight materials, sealing joints, and reducing noise and vibration. Furthermore, the packaging industry in North America is witnessing steady growth due to increasing consumer demand for packaged goods, e-commerce, and sustainability trends. For instance, a convergence of industry-specific developments, investor expectations, legislative changes, and consumer preferences has led to a larger shift towards more sustainable and responsible business practices, which is reflected in the growing significance of ESG elements in North America.

Methyl Acrylate Market Players:

- Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Arkema S.A.

- LG Chem Ltd.

- Shanghai Huayi Acrylic Acid Co., Ltd

- BASF

- Cjsc Sibur Holding

- DuPont

- Solventis

- ISU Chemical

Recent Developments

- In an effort to increase dependability and accessibility to raw materials through more centralized capacity, Dow stated that it is investing in the US Gulf Coast's methyl acrylate manufacturing. With an emphasis on meeting North American demand, the new 50 kiloton nameplate capacity of methyl acrylate, which is scheduled to go online in the first half of 2022, will be manufactured at St. Charles Operations in Louisiana, USA, and will facilitate worldwide growth.

- Long-lasting phosphate methacrylate monomer with nonmigratory properties, VISIOMER® HEMA-P 100, is released by Evonik. Polymerization allows HEMA-P to be integrated, which enhances adhesion, lowers corrosion, and offers clear flame retardancy. It works well as an anti-corrosive and adhesion enhancer. VISIOMER® HEMA-P functions as a complexing agent and enhances dispersibility. Because of its versatility, VISIOMER® HEMA-P can be utilized as a monomer for cast PMMA, acrylic adhesives, vinyl ester and unsaturated polyester composites, emulsion and solution polymers, and acrylic water proofing resins.

- Report ID: 5784

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Methyl Acrylate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.