Leuprolide Acetate Market Outlook:

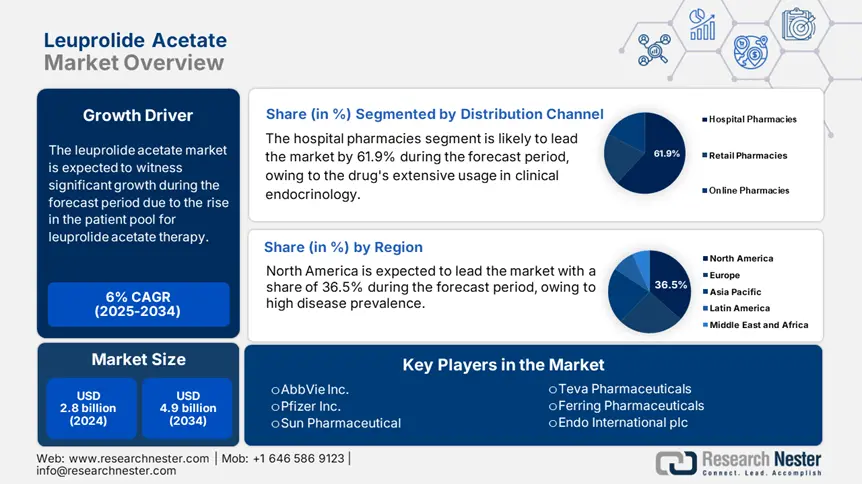

Leuprolide Acetate Market size was valued at USD 2.8 billion in 2024 and is projected to reach USD 4.9 billion by the end of 2034, rising at a CAGR of 6% during the forecast period, i.e., 2025-2034. In 2025, the industry size of leuprolide acetate is assessed at 3 billion by the end of 2025.

The global patient pool expands for leuprolide acetate therapy for gynecology, oncology, transgender care, and endocrinology. As per the National Cancer Institute report, prostate cancer is the primary driver, holding 1.7 million global cases yearly and increasing incidence in males in Europe, North America, and parts of East Asia. Further, in the U.S., nearly 288,250 new prostate cancer diagnoses were registered in 2023. As per the NIH report, endometriosis affects 10.5% of reproductive-aged women, while central precocious puberty has seen a rise in post-pandemic, with 4 to 11 times the number of CPP cases in Europe and South Korea, over the past five years. This trend highlights the rise in treatment-eligible patients among various specialties.

On the supply chain side, the API manufacturing is primarily sourced from China, India, and parts of Europe. The producer price index increased to 5.2% for pharmaceutical biological products such as GnRH analogs in 2024, while the consumer price index increased to 2.5% for prescription drugs. These impact the cost in production, inflationary pressure on ingredients, and regulatory compliance expenses, particularly in long-acting injectables. The research, development, and deployment expenditures in hormone analogs such as leuprolide acetate are rising the private and public sectors. Manufacturers in the U.S. are completely dependent on imports for critical precursors, with a 27.5% rise in import volume of intermediates in the last five years.