Grow Lights Market Outlook:

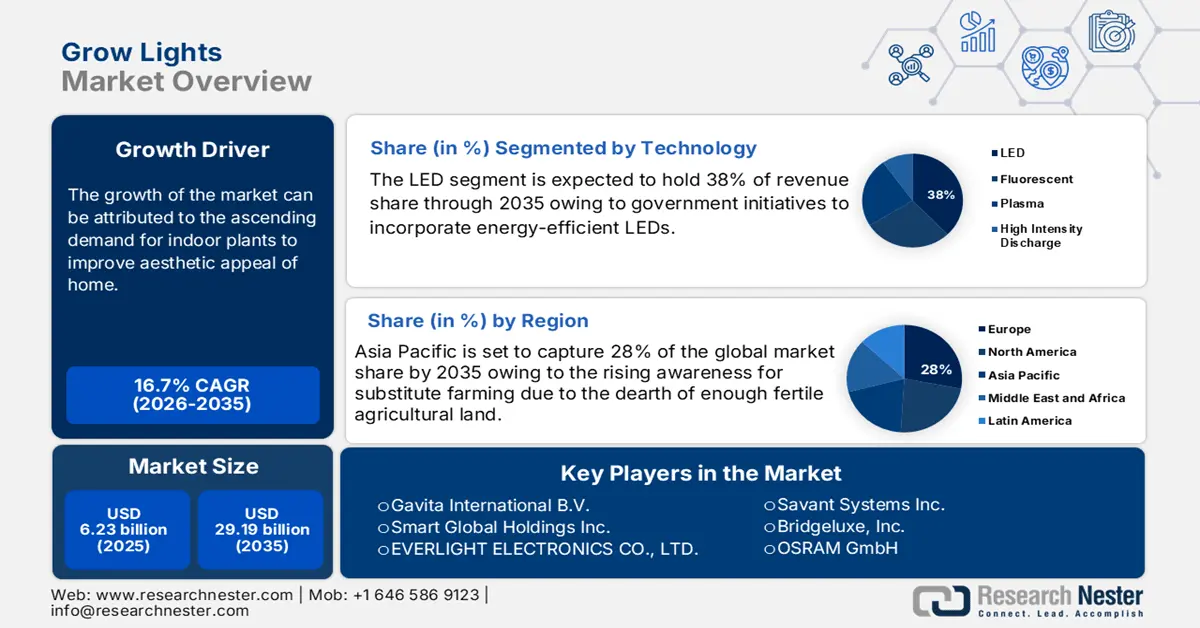

Grow Lights Market size was over USD 6.23 billion in 2025 and is poised to exceed USD 29.19 billion by 2035, growing at over 16.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of grow lights is estimated at USD 7.17 billion.

The grow lights market is experiencing rapid growth, with increasing government incentives in agricultural activities, which is promoting innovation in urban farming methods. The initiatives include significant funding that enables farmers access to basic technological developments, such as grow lights, which are essential for controlled environment agriculture systems. In July 2023, the U.S. Department of Agriculture (USDA) awarded USD 7.4 million across 25 grants to support urban agriculture and innovative food production projects. The redirected funds support purposes such as enhancing dietary access through local food networks and promoting urban agricultural development. The expanding number of urban farms is resulting in increased need for efficient grow lights since these lighting systems enable constant crop output throughout the year despite climate change, further stimulating the market growth.

Key Grow Lights Market Insights Summary:

Regional Highlights:

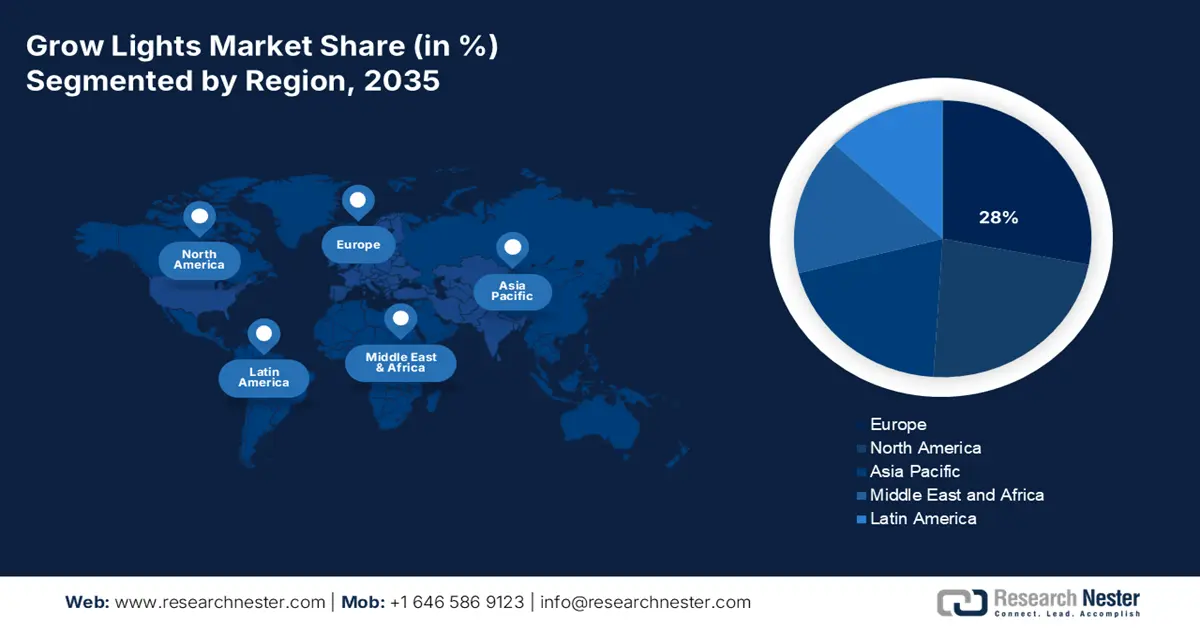

- Asia Pacific grow lights market will secure around 28% share by 2035, driven by investments in sustainable agriculture and indoor farming.

- North America market will attain a 23% share by 2035, driven by increased adoption of controlled environment agriculture.

Segment Insights:

- The led segment in the grow lights market is projected to capture a 38% share by 2035, driven by spectrum-optimized LEDs that enhance plant photosynthesis and energy efficiency.

- The vertical farming segment in the grow lights market is anticipated to capture the largest share by 2035, driven by urban space constraints and government incentives supporting indoor farming.

Key Growth Trends:

- Legalization and growth of the cannabis industry

- Customization and spectrum control features

Major Challenges:

- Heat emission and crop sensitivity

Key Players: Gavita International B.V., Smart Global Holdings, Inc., EVERLIGHT ELECTRONICS CO., LTD, Savant Systems, Inc, Bridgelux, Inc., OSRAM GmbH, Heliospectra AB, Black Dog LED, WOLFSPEED, INC., Samsung Electronics.

Global Grow Lights Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.23 billion

- 2026 Market Size: USD 7.17 billion

- Projected Market Size: USD 29.19 billion by 2035

- Growth Forecasts: 16.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (28% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Netherlands

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Grow Lights Market Growth Drivers and Challenges:

Growth Drivers

-

Legalization and growth of the cannabis industry: The high-performance grow lights market is witnessing an increased demand as medical and recreational cannabis legalization is effective across North America and Europe. Plant growth optimization in cultivation facilities demands exact light conditions, prompting enormous investments into controlled environment agriculture technology, including superior LED grow lighting systems for optimum results. This is driving companies to establish cannabis cultivation facilities, for instance, in December 2024, East Coast Growers LLC received approval to establish a cannabis cultivation facility in East Hartford, Connecticut. These solutions are fulfilling the requirements of cannabis cultivation operations.

-

Customization and spectrum control features: Modern grow lights are utilized in greenhouse and indoor cultivation through features such as spectrum tuning, automated dimming, and integrated control software systems. The advanced capabilities allow growers to duplicate solar light spectra and match light levels to plant development periods for superior output and reduced operational expenses. The grow lights market is experiencing innovation by companies, as smart lighting systems incorporate automatic functionality to meet crop requirements at different developmental stages. For instance, in May 2024, Signify, a global leader in lighting, announced a strategic partnership between Philips Horticulture LED Solutions and Hoogendoorn Growth Management. The partnership is aimed at leveraging the potential of dynamic lighting that brings together horticulture expertise with greenhouse automation experience.

Challenges

-

Heat emission and crop sensitivity: The high-density discharge grow lights generate excessive heat during their operation phase. The generated heat from these lights increases the temperature in grow spaces, which makes delicate crops unstable, leading to problems such as wilting with nutrient imbalance, and diminished yield quality. Additional cooling and ventilation systems represent significant barriers to the commercial implementation of these lights, due to their setup and operation costs. The high heat production of grow lights negatively affects profitability and deters smaller growers, since they cannot afford such equipment.

Grow Lights Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.7% |

|

Base Year Market Size (2025) |

USD 6.23 billion |

|

Forecast Year Market Size (2035) |

USD 29.19 billion |

|

Regional Scope |

|

Grow Lights Market Segmentation:

Technology Segment Analysis

The LED segment in grow lights market is expected to hold a revenue of 38% during the forecast period, as manufacturers significantly improve LED grow lights with expanded spectrum and energy efficiency to match precision agriculture requirements. In January 2023, Polymatech Electronics launched its Ravaye full-spectrum LED packages and modules, engineered specifically to optimize plant growth. The designed LEDs help plants proceed through photosynthesis at rapid rates while building chlorophyll content and boosting immune response, thus enabling reliable and high-yield indoor agriculture. These LEDs enable specific light wavelengths to provide suitable illumination during the vegetative and flowering stages, to meet the multiple lighting needs of plants grown in vertical farms and greenhouses.

Application Segment Analysis

The vertical farming segment in grow lights market is expected to account for the largest share during the forecast period. The growing urban population is resulting in enhanced fresh produce requirements among consumers, but cities are struggling with restricted space available for conventional agricultural activities. Vertical farming provides buildings with a modular cultivation system that functions effectively within dense locations such as warehouses, as well as basements and rooftops. These artificial lighting systems provide essential photons that mimic perfect sunlight regardless of sunlight accessibility in artificial agricultural systems.

Governments across the globe are implementing financial incentives, including infrastructure support grants and tax breaks, to support vertical farming. These initiatives provide financial benefits for the adoption of energy-efficient grow lighting systems, particularly LEDs, to minimize the environmental impacts of indoor farming. Such policy frameworks are promoting vertical farming ventures while accelerating the adoption of modern grow light infrastructure for these setups.

Our in-depth analysis of the global grow lights market includes the following segments:

|

End use |

|

|

Switch Type |

|

|

Technology |

|

|

Wattage |

|

|

Spectrum |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Grow Lights Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific grow lights market is expected to hold a share of 28% during the stipulated timeframe, owing to the rising emphasis on sustainable agriculture and food security, which is driving investments in controlled environment agriculture. The setups significantly depend on grow lights to support regular crop cultivation independent of environmental conditions. The expansion of vertical farms, greenhouses, and indoor cultivation facilities requires efficient lighting solutions to reinforce the importance of LED and spectrum-optimized lighting systems.

Leading producers of grow lights are developing technological breakthroughs in precise spectral efficiency and smart control features. Spectral advancements in grow lighting technology allow growers to boost yields while cutting operational expenses and streamlining growing times, thus establishing modern grow lights as fundamental components for commercial growing systems.

The grow lights market in India is projected to witness rapid growth owing to increasing governmental support for the implementation of grow lights and protected agricultural methods, with initiatives such as the Mission for Integrated Development of Horticulture and the National Horticulture Board. The government is also supporting the agriculture startups to foster advancements. For instance, in September 2024, the Indian government launched the USD 0.09 billion AgriSURE Fund to support innovative agri-tech startups. The initiative is aimed at driving startups to implement advancements in agricultural sustainability, fueling the market growth.

Changing food choices, coupled with rapid urbanization, encourage farmers to adopt indoor cultivation methods. The growing demand for pesticide-free fresh produce by consumers is resulting in increasing adoption of vertical farming, hydroponics, as well as home gardening through effective lighting system applications. The market for affordable and adaptable grow light technologies is expanding since agricultural producers focus on improved crop standards and continuous cultivation needs.

North America Market Insights

The North America grow lights market is expected to account for a share of 23% during the analysis period, as there is an increasing adoption of controlled environment agriculture in many countries, particularly the U.S. and Canada. Governments and private businesses are significantly investing in indoor farming, including grow lights, as these devices help guarantee crop performance under all environmental conditions.

The U.S. grow lights market is expected to grow at a steady pace, owing to the rising adoption of controlled environment agriculture. Large vertical and small container-based micro-farms are implementing controlled environment agriculture techniques as these methods improve crop yield while maximizing space allocation. The operation of these systems depends on exact lighting conditions to ensure plant development, so high-efficiency LED grow lights are becoming essential components in modern indoor agricultural strategies.

Grow Lights Market Players:

- Gavita International B.V.

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smart Global Holdings, Inc.

- EVERLIGHT ELECTRONICS CO., LTD

- Savant Systems, Inc.

- Bridgelux, Inc.

- OSRAM GmbH

- Heliospectra AB

- Black Dog LED

- WOLFSPEED, INC.

- Samsung Electronics

The grow lights market is highly competitive, with key players like Philips Lighting, General Electric, and Osram dominating the landscape. These companies offer a variety of solutions, including LED, fluorescent, and high-intensity discharge lights, catering to both commercial and residential sectors. Emerging players are focusing on energy-efficient technologies and smart lighting systems, capitalizing on the increasing demand for sustainable agricultural practices. Market growth is driven by innovations in light spectrum technologies, reduced energy consumption, and advancements in automation. Here are some key players operating in the global market:

Recent Developments

- In December 2024, LG Electronics introduced a groundbreaking indoor gardening appliance at CES 2025. Blending cutting-edge horticultural technology with a sleek, floor-standing lamp design, the new device is engineered to promote rapid and healthy plant growth. Tailored for beginners and urban dwellers alike, it offers a stylish and user-friendly solution for cultivating plants indoors.

- In May 2024, Heliospectra unveiled the 1500W MITRA X LED light, boasting an increased output of 5700µmol, wide beam optics, and 3.7 efficacy. This innovation aims to reduce investment costs for vegetable growers while ensuring high output and uniformity to optimize taste and yield.

- Report ID: 4842

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Grow Lights Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.