1. Introduction

1.1. Market Definition

1.2. Market Segmentation

2. Research Methodology

2.1. Variables (Dependent and Independent)

2.2. Multi Factor Based Sensitivity Model

3. Market Dynamics

3.1. Drivers

3.2. Challenges

3.3. Opportunities

3.4 Recent Developments

4. Japan SaaS Market Outlook

4.1. Market Size and Forecast, 2018-2027

4.1.1. By Value (USD Million)

4.2. Market Share and Forecast, 2018-2027

4.2.1. By Deployment Model

4.2.1.1. Japan SaaS Market, By Deployment Model (2018-2027F)

4.2.1.1.1. Private, 2018-2027F (USD Million)

4.2.1.1.2. Public, 2018-2027F (USD Million)

4.2.1.1.3. Hybrid, 2018-2027F (USD Million)

4.2.2. By End User

4.2.2.1. Japan SaaS Market, By End User (2018-2027F)

4.2.1.2.1. Manufacturing, 2018-2027F (USD Million)

4.2.1.2.2. BFSI, 2018-2027F (USD Million)

4.2.1.2.3. Retail, 2018-2027F (USD Million)

4.2.1.2.1. Healthcare, 2018-2027F (USD Million)

4.2.1.2.1. Others, 2018-2027F (USD Million)

5. Competitive Landscape

5.1. Company Profiles

5.1.1. Microsoft

5.1.1.1. Company Overview

5.1.1.2. Business Strategy

5.1.1.2.1. Growth Expansion Strategy

5.1.1.2.2. Distribution Channel Strategy

5.1.1.2.3. Product Strategy

5.1.1.3. Key Product Offerings

5.1.1.4. Financial Performance

5.1.1.5. Key Performance Indicators

5.1.1.6. Risk Analysis

5.1.1.7. Recent Development

5.1.1.8. Regional Presence

5.1.1.9. SWOT Analysis

5.1.2. Alphabet Inc.

5.1.3. IBM

5.1.4. Hewlett-Packard Company

5.1.5. Oracle

5.1.6. Salesforce.Com, Inc.

5.1.7. SoftBank Corp.

5.1.8. Fujitsu

Japan Software as a Service (SaaS) Market Outlook:

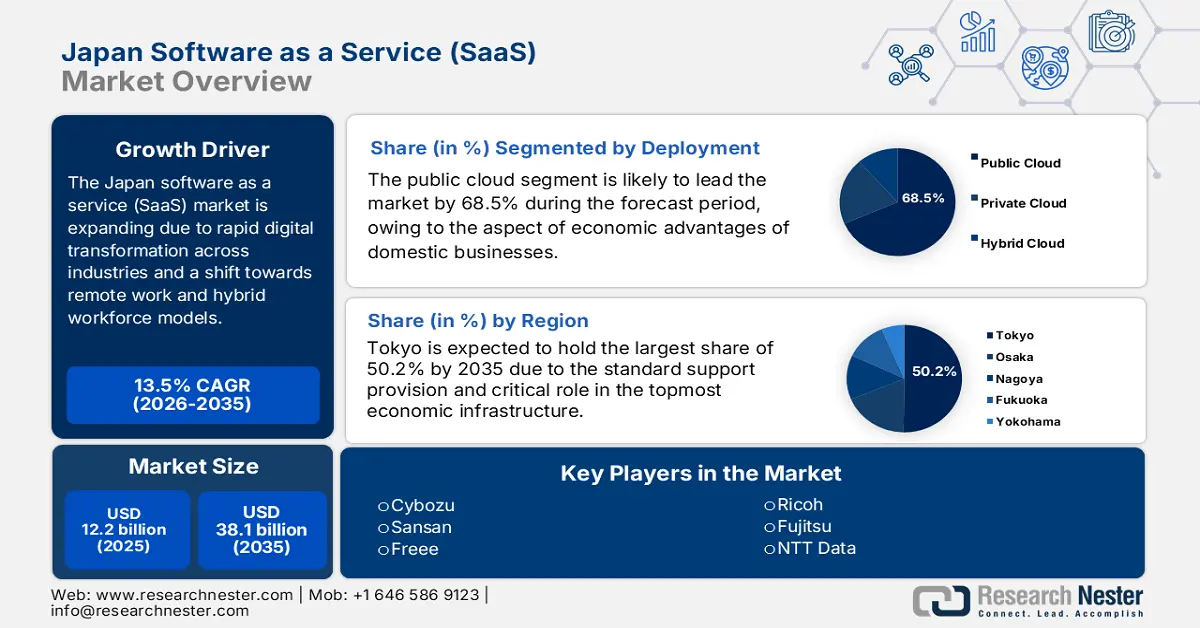

Japan Software as a Service (SaaS) Market size was over USD 12.2 billion in 2025 and is estimated to reach USD 38.1 billion by the end of 2035, expanding at a CAGR of 13.5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of the Japan software as a service (SaaS) is assessed at USD 13.8 billion.

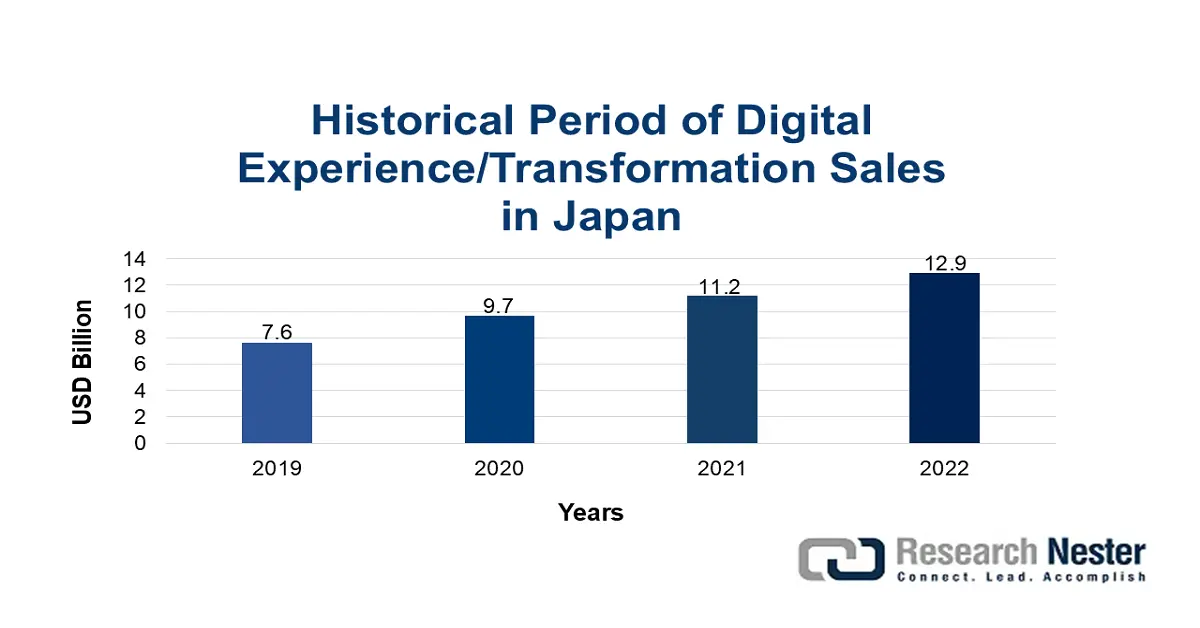

The aspect of speedy digitalized transformation in different sectors, including e-commerce, healthcare, retail, BFSI, and manufacturing, is one of the key factors, which driving the Japan SaaS market globally. According to a data report published by the Japan External Trade Organization in April 2024, the digital transformation-based service market in Japan continued to grow at 17.7% in 2019 to 23.4% in 2020, 28.6% in 2021, and 32.2% in 2022. In addition, this continuous growth denoted a yearly upliftment rate of more than 19.0%, which is readily bolstering the SaaS technology in the overall country.

Source: Japan External Trade Organization

Meanwhile, organizations, particularly large enterprises and SMEs, are escalating digital transformation approaches to optimize customer engagement, scalability, and efficiency, which is also driving the Japan software as a service market. Further, the country has witnessed a massive growth in the artificial intelligence adoption, which caters to the market’s development. In this regard, as per a data report published by ITA in August 2025, the AI market in the country is valued at USD 8.9 billion as of 2024, and it is expected to triple to USD 27.9 billion by the end of 2029. Based on this, the country’s government is proactively promoting AI integration across different regional sectors, and organizations are eager to partner with U.S.-based companies with innovative sector-based expertise and advanced technologies.

Key Japan Software as a Service Market Insights Summary:

Regional Highlights:

- Tokyo in the japan software as a service (saas) market is anticipated to capture a 50.2% share by 2035, stemming from its role as the country’s foremost technology and economic hub supported by leading enterprises.

- Nagoya is expected to emerge as the fastest-growing region by 2035, underpinned by the city’s expansive manufacturing base and accelerating automotive transformation.

Segment Insights:

- The public cloud segment in the japan software as a service (saas) market is projected to secure a 68.5% share by 2035, propelled by tactical economic advantages and reduced IT infrastructure burdens.

- The large enterprises segment is anticipated to hold the second-largest share by 2035, enabled by greater financial capacity, operational complexity, and strong alignment with national digital transformation priorities.

Key Growth Trends:

- Transition towards hybrid and remote workforce models

- Regulatory support and government strategies

Major Challenges:

- Shortage of cybersecurity and skilled IT professionals

- Cultural resistance to cloud-specific business models and operational shifts

Key Players: Microsoft Japan (U.S.), Amazon Web Services (AWS) Japan (U.S.), Salesforce (U.S.), Google Japan (U.S.), Oracle Japan (U.S.), SAP Japan (Germany), Workday (U.S.), ServiceNow (U.S.), Adobe (U.S.), Zoom Video Communications (U.S.), Slack (U.S.), Cybozu (Japan), Sansan (Japan), Freee (Japan), Ricoh (Japan), Fujitsu (Japan), NTT Data (Japan), Samsung SDS (South Korea), Infosys (India), Xero (Australia).

Global Japan Software as a Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.2 billion

- 2026 Market Size: USD 13.8 billion

- Projected Market Size: USD 38.1 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Tokyo (50.2% Share by 2035)

- Fastest Growing Region: Nagoya

- Dominating Countries: United States, Japan, China, United Kingdom, Germany

- Emerging Countries: India, Brazil, Singapore, Indonesia, United Arab Emirates

Last updated on : 4 November, 2025

Japan Software as a Service (SaaS) Market - Growth Drivers and Challenges

Growth Drivers

- Transition towards hybrid and remote workforce models: The COVID-19 pandemic, along with its aftermath lead to a sudden shift towards hybrid and remote work culture in Japan, which increased the Japan software as a service market’s demand. Based on this driver, as per the November 2024 NLM article, there has been an increase in the telework adoption among domestic organizations, ranging between an estimated 25% to 40%, post the COVID-19 pandemic as of 2023. Therefore, this transition as well as the adoption has thus enhanced the need for SaaS tools, thus ensuring remote project management, communication, and collaboration.

- Regulatory support and government strategies: The government is readily promoting digitalization through approaches, such as the Digital Agency, which promotes digital transformation in public services and infrastructure. Besides, regulations in Japan, for instance, the Act on the Protection of Personal Information (APPI), have shaped SaaS design by making data localization and consent management mandatory. Besides, in April 2024, Microsoft declared its investment of USD 2.9 billion for the upcoming 2 years to enhance its AI facility and hyperscale cloud computing in Japan, which readily caters to uplift the market.

- Addressing productivity crisis and labor shortage: The Japan SaaS market has gained immense exposure, since domestic organizations are witnessing huge pressure to boost operational efficacy. Businesses in the country are turning towards cloud computing software adoption to empower the current workforce for increased productivity. As per an article published by ITA in September 2022, the overall cloud market size in the country has been USD 32.5 billion, with a 24.3% growth rate, and 109.8 as the exchange rate, which denotes a huge growth opportunity for the SaaS market.

Challenges

- Shortage of cybersecurity and skilled IT professionals: The Japan SaaS market is increasing across domestic industries, and there has been a rise in the need for individuals capable of supporting digital transformation, ensuring data security, and managing cloud infrastructure. However, the country is predicted to face a labor shortage of cybersecurity professionals, creating a critical skills gap. This shortage of labor is likely to impact everything from SaaS implementation and maintenance to the ability to respond effectively to cyber threats.

- Cultural resistance to cloud-specific business models and operational shifts: A profound challenge hindering the Japan software as a service (SaaS) market adoption is deeply rooted in the domestic corporate aspect. Different established regional businesses, especially SMEs and conventional industries readily maintain a robust preference for on-premise software systems. This originates from a perceived greater control, data security, and customization when the physical facility is managed and owned internally. Therefore, there is a frequent inherent distrust of the subscription-specific rental SaaS model, with organizations demanding one-time capital spending on software licenses over recurring and small operational costs.

Japan Software as a Service (SaaS) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 12.2 billion |

|

Forecast Year Market Size (2035) |

USD 38.1 billion |

|

Regional Scope |

|

Japan Software as a Service (SaaS) Market Segmentation:

Deployment Segment Analysis

Based on deployment, the public cloud segment is anticipated to garner the largest share of 68.5% by the end of 2035. The segment’s upliftment is highly attributed to tactical and compelling economic benefits for regional businesses. The segment readily eliminates the continuous maintenance burdens and substantial upfront capital spending of an on-premise facility, transforming IT expenses into predictable operational expenses. This is essential for SMEs as well as enterprises adopting asset-light digital transformation. Besides, the majority of domestic and international providers, such as Fujitsu, Microsoft Azure, and AWS, have significantly invested in localized data, thus ensuring compliance with the country’s stringent data residency legal policies.

Enterprise Size Segment Analysis

Based on the enterprise size, the large enterprises segment is projected to account for the second-largest share during the predicted period. The segment’s growth is driven by its effective financial resources, tactical capacity, and complex operational requirements for large-scale digital alteration. These particular enterprises possess dedicated IT teams and budgets to administer the governance, integration, and procurement of sophisticated enterprise-based SaaS suites, such as CRM and ERP systems. Furthermore, these are considered primary targets of domestic strategies, including the country’s governmental digital transformation promotion, which pressures large-scale corporations to advance.

Service Model Segment Analysis

Based on the service model, the platform as a service (PaaS) segment is expected to cater to the third-largest share by the end of the forecast duration. The segment’s development is fueled by its escalation in digital transformation by enabling businesses in deploying applications rapidly and efficiently, as well as with huge agility to cater to market demands. According to an article published by the World Economic Forum in April 2024, businesses in Japan are at a point of losing JPY 12 trillion (USD 77.6 billion) every year for failing to adopt digital practices. Therefore, the PaaS adoption will assist companies in combating labor shortage and cost-effectiveness risks, thus driving the segment’s growth.

Our in-depth analysis of the Japan software as a service market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Enterprise Size |

|

|

Service Model |

|

|

Application |

|

|

Vertical |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Japan Software as a Service (SaaS) Market - Regional Analysis

Tokyo Market Insights

Tokyo’s Japan software as a service market is anticipated to account for the highest share of 50.2% by the end of 2035. The market’s growth in the city is highly attributed to its notable position, which is significantly supported by its vital role as the topmost technology and economic center, along with the existence of organizations such as Fujitsu and NTT DATA. Besides, according to an article published by the EU-Japan Center in February 2022, over 60% of core IT systems are projected to be operational for more than 21 years in the country. Moreover, the Digital Agency has declared a funding of ¥472 billion in 2022 to ensure digital policies, thereby denoting a huge growth opportunity for the market.

Digitalized Competitiveness in Tokyo (2022)

|

Components |

Relevance |

|

Digital talent |

1% of the workforce |

|

Citizens utilizing digitalized government applications |

7.5% |

|

E-commerce penetration |

6.7% |

|

Telemedicine penetration |

5.0% |

|

Mobile banking penetration |

6.9% |

|

Expenditure on public cloud |

3.0% |

|

International AI conference papers for digital technology |

6.0% |

|

Startup economy |

11 |

Source: EU-Japan Center

Nagoya Market Insights

Nagoya in the Japan SaaS market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the city is driven by the presence of the country’s vast manufacturing and advanced automotive industry. In addition, the tactical pivot of the automotive sector towards electric vehicles, with the combined implementation of artificial intelligence and Internet of Things, is driving the market. For instance, in October 2025, UrbanChain Group Limited created full-service parking solutions in the city by using AIoT technology to provide application-specific service for searching, thus bolstering the Japan software as a service market’s growth.

Osaka Market Insights

Osaka in the Japan SaaS market is projected to grow steadily by the end of the forecast duration. The market’s exposure in the city is fueled by the digitalized transition towards the automotive and manufacturing sectors. Besides, as per an article published by the University of Osaka Institutional Knowledge in November 2024, the SaaS adoption level accounts for 96% in the city. Additionally, a survey-based study was conducted on 97 Higher Education Institutions in the overall country, wherein 70% recognized that cloud-specific applications readily facilitated efficient learning, thus denoting a positive impact on the market.

Fukuoka Market Insights

Fukuoka in the Japan software as a service market is also gaining increased traction during the predicted timeline. The market’s exposure in the city is highly uplifted by the existence of its policy to readily attract IT startups as well as talent. The market’s upliftment is also propelled by the City Government’s specialized zone strategies that have developed a suitable ecosystem for creating the latest SaaS solutions. These are aimed at small and medium-sized enterprises (SMEs) and the public sector, thus ensuring its role as one of the most notable growth aspects outside the conventional Kansai and Kanto powerhouses.

Key Japan Software as a Service Market Players:

- Microsoft Japan (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services (AWS) Japan (U.S.)

- Salesforce (U.S.)

- Google Japan (U.S.)

- Oracle Japan (U.S.)

- SAP Japan (Germany)

- Workday (U.S.)

- ServiceNow (U.S.)

- Adobe (U.S.)

- Zoom Video Communications (U.S.)

- Slack (U.S.)

- Cybozu (Japan)

- Sansan (Japan)

- Freee (Japan)

- Ricoh (Japan)

- Fujitsu (Japan)

- NTT Data (Japan)

- Samsung SDS (South Korea)

- Infosys (India)

- Xero (Australia)

- Microsoft Japan is considered a dominating force in the Japan software as a service market, usually fueled by its ubiquitous Azure and Microsoft 365 cloud platform. The organization has achieved the majority of enterprise and public sector contracts by developing localized data centers. Based on this, as stated in its 2024 annual report, the company successfully delivered more than 245 billion in yearly revenue, denoting a 16% year-over-year (YoY) increase.

- Amazon Web Services (AWS) Japan is one of the leading cloud infrastructure providers, and the ultimate backbone for its massive ecosystem of both international and domestic SaaS applications in Japan. Its huge scale, along with continuous advancement in AI services, storage, and compute, has made it the most default option for enterprises and startups deploying cloud-based solutions.

- Salesforce is the pioneer and readily continues to lead the CRM-based SaaS segment in Japan, assisting the majority of organizations in digitizing marketing, service, and sales functions. Its extended partnership network and increased focus on industry-based solutions have penetrated within regional enterprise market. Meanwhile, as per its 2025 annual report, based on AI adoption, the company accounted for a USD 37.9 billion as the highest revenue and USD 10 billion in the quarter.

- Google Japan readily competes in the Japan software as a service (SaaS) market through its challenging Microsoft’s productivity and Google Workplace suite, particularly within the startup and tech communities. Moreover, its Google Cloud Platform is a crucial growth driver, offering innovative data analytics, along with AI/ML services that uplift traditional SaaS applications.

- Oracle Japan significantly maintains a robust existence in the Japan-based market through its cloud-specific Fusion ERP and database-as-a-service provision, which are essential for large-scale enterprises that are undergoing digitalized transformation. The firm has readily leveraged its long-term reputation for strong and secure enterprise software to overcome its extended on-premise consumer base to its cloud SaaS solutions.

Here is a list of key players operating in the global market:

The Japan software as a service market is extremely competitive, with international players, such as Microsoft and Salesforce, competing along with localized companies, including NTT DATA and Fujitsu. Notable strategies comprise partnerships, which include Fujitsu’s deal with Salesforce, and major investments in cloud infrastructure. Besides, U.S.-based firms have focused on scalability and AI, while Japan-based organizations have readily prioritized local customization and compliance. Meanwhile, in May 2025, Volution introduced the latest USD 100 million fund in partnership with Japan-based venture capital investors, such as SBI Investment Co., Ltd., with advice from JTC. The purpose is to tackle the international productivity risk, thus uplifting the Japan software as a service market.

Corporate Landscape of the Japan Software as a Service (SaaS) Market:

Recent Developments

- In October 2025, Fujitsu Limited, JTB Corp., and Toda Corporation declared that altogether they carried out a suitable field trial for ECHIZEN Quest, which is considered a digital transformation project.

- In August 2025, Kotoba Technologies, Inc. announced that it has successfully raised JPY 1.7 billion (USD 11.8 million) in a Seed 2 round to escalate commercialization, which pertains to real-time AI-based speech generation.

- In May 2025, Accenture effectively agreed to acquire Yumemi, which is a leading digital service provider in Japan, to bolster its capabilities to create and unveil products for customers at a rapid speed.

- Report ID: 2216

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Japan Software as a Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.