IV Disinfecting Caps Market Outlook:

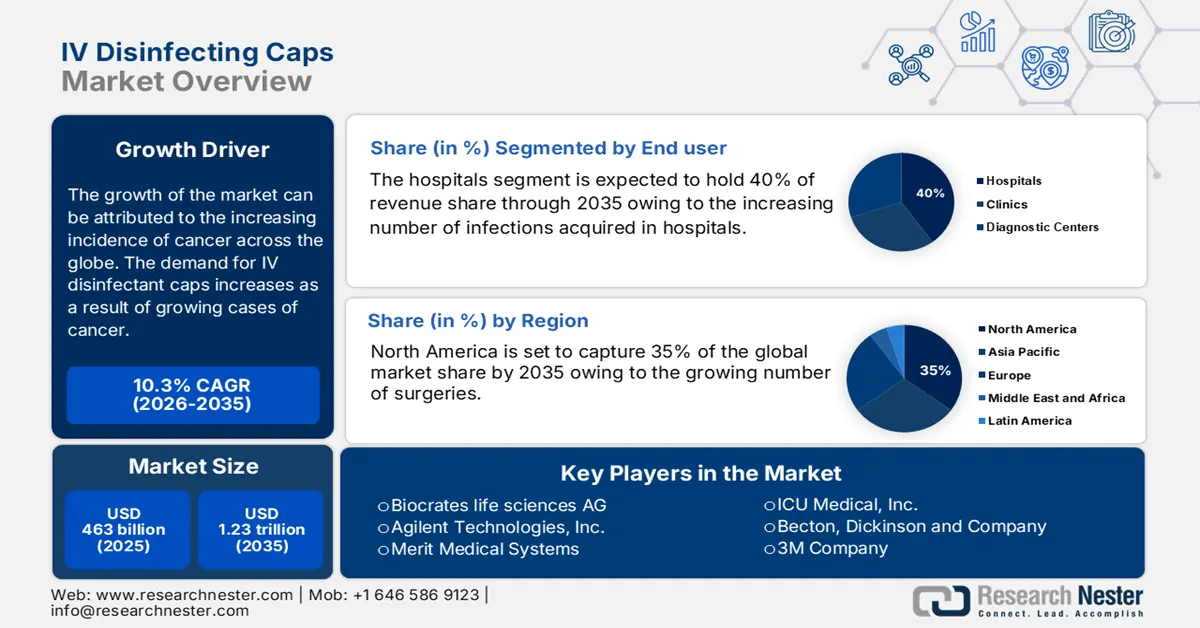

IV Disinfecting Caps Market size was valued at USD 463 billion in 2025 and is set to exceed USD 1.23 trillion by 2035, registering over 10.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IV disinfecting caps is evaluated at USD 505.92 billion.

The growth of the market can be attributed to the increasing incidence of cancer across the globe. The demand for IV disinfectant caps increases as a result of growing cases of cancer. For instance, to avoid infections in cancer patients, the use of IV disinfectant caps can be a crucial strategy. Infection control is an essential component of these patients' care as it may make them more vulnerable to infections. Further, the growing popularity of infection prevention in healthcare settings across the globe is also expected to add to the market growth. According to estimates, there would be over 16 million cancer-related deaths and more than 29 million new instances of cancer globally by 2040.

In addition to these, factors that are believed to fuel the market growth of IV disinfecting caps include the rise in technological advancements in IV disinfectant caps. For instance, certain IV disinfectant caps now have wireless monitoring and tracking features, which enable healthcare professionals to trace IV line usage in real-time and check adherence to disinfection guidelines.

Key IV Disinfecting Caps Market Insights Summary:

Regional Highlights:

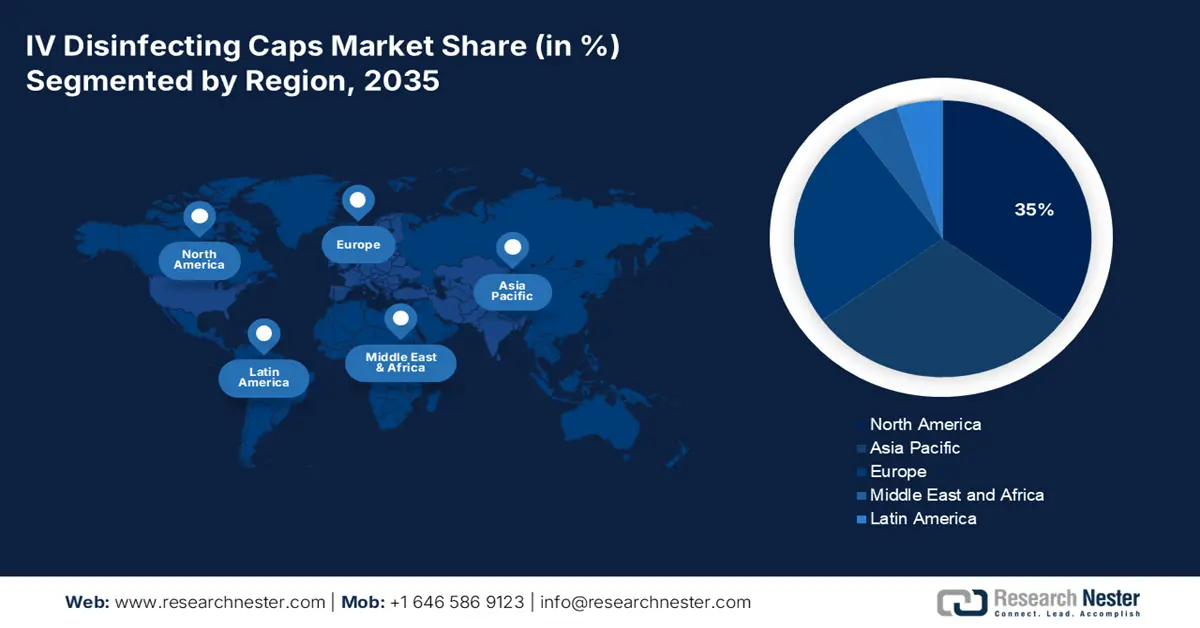

- North America is expected to command a 35% share by 2035 in the IV disinfecting caps market, stemming from the escalating volume of surgical procedures.

- The Asian Pacific region is projected to secure the second-largest share by 2035, underpinned by a surge in typhoid fever, cholera, and food-borne illnesses.

Segment Insights:

• The hospitals segment is projected to capture the largest share by 2035 in the IV disinfecting caps market, fueled by rising hospital-acquired infections.Key Growth Trends:

- Growing Health Awareness

- Rising Geriatric Population

Major Challenges:

- Risk of Not Securing the Sterile Cap

- Lack of Knowledge regarding the Use of Disinfectant Caps in Developing Nations

Key Players: Human Metabolome Technologies America Inc., Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Biocrates life sciences AG, Agilent Technologies, Inc., Merit Medical Systems, B. Braun Melsungen AG, ICU Medical, Inc., Becton, Dickinson and Company, 3M Company.

Global IV Disinfecting Caps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 463 billion

- 2026 Market Size: USD 505.92 billion

- Projected Market Size: USD 1.23 trillion by 2035

- Growth Forecasts: 10.3%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 21 November, 2025

IV Disinfecting Caps Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Health Awareness – On account of the rising consciousness of the value of maintaining good health, the market is expected to expand more in the upcoming years. In India, over 90% of people are concerned about the health of their family, compared to around 80% globally.

-

Rising Geriatric Population – The Elderly population is more prone to infectious diseases owing to weakened immune systems and the rising number of elderly populations across the globe is estimated to drive market growth. By 2060, the number of Americans aged 65 and above is expected to increase by more than 90 million.

-

Increasing Health Spending – The use of IV disinfectant caps is projected to rise as healthcare facilities are allocating more funds to quality of care and infection control procedures. According to the most recent expenditure data, global health spending has grown over the past 20 years, doubling in real terms to reach USD 8.5 trillion in 2019 and 9.8% of GDP, up from 8.5 percent in 2000. It is predicted that this boom would continue over the forecast period.

-

Growing Concern for Hygiene - It is expected that the demand for IV disinfectant caps has increased as a result of rising hygiene awareness. As people are becoming more conscious of the value of hygiene, the market is expected to expand more in the upcoming years. It was discovered that in 2020, more than 65% of people use basic hygiene services globally.

Challenges

- Risk of Not Securing the Sterile Cap- The increasing concern amongst individuals for not securing the sterile cap in IV disinfectant caps is one of the major factors predicted to slow down the market growth. For instance, the purpose of the sterile cap is to function as a barrier against bacteria, viruses, and other germs and keep them out of the IV line. The IV line may become infected if the cap is not well fastened.

- Lack of Knowledge regarding the Use of Disinfectant Caps in Developing Nations

- Availability of Substitutes

IV Disinfecting Caps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 463 billion |

|

Forecast Year Market Size (2035) |

USD 1.23 trillion |

|

Regional Scope |

|

IV Disinfecting Caps Market Segmentation:

End-user Segment Analysis

The global IV disinfecting caps market is segmented and analyzed for demand and supply by end-user in hospitals, clinics, and diagnostic centers. Out of the three end-users of IV disinfecting caps, the hospitals segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing number of infections acquired in hospitals. For instance, the need for IV disinfecting caps may rise as a result of the rise in hospital-acquired illnesses. Hospital-acquired infections are infections that patients acquire during their stay in a hospital or other healthcare facilities. Moreover, healthcare providers are focusing on infection control measures to safeguard patients from potentially fatal diseases, which might rise the demand for IV disinfecting caps. Further, IV disinfecting caps are used to prevent the transmission of infections through intravenous lines. According to estimates, healthcare-associated infections (HAIs) cause over 90,000 deaths and more than 1 million infections annually in hospitals in the United States.

The global IV disinfecting caps market is also segmented and analyzed for demand and supply by end-user into hospitals, clinics, and diagnostic centers. Amongst these three segments, the clinics segment is expected to garner a significant share in the year 2035. Patients may be at risk of contracting infections at clinics, as IV lines are frequently used to administer drugs, fluids, and other therapies to patients. However, if these lines are not thoroughly cleaned, they could spread disease. In addition, using IV disinfectant caps can aid in limiting the spread of illnesses in clinics. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IV Disinfecting Caps Market - Regional Analysis

North American Market Insights

North America industry is likely to account for largest revenue share of 35% by 2035.The growth of the market can be attributed majorly to the growing number of surgeries. There is an increase in the number of surgeries in the area owing to the rise in the aging population and increasing prevalence of chronic illness. The need for IV disinfecting caps is projected to rise as surgical procedures have become more prevalent in the region. For instance, IV disinfection caps are used to stop infections from developing during intravenous therapy, a frequent technique used in surgical settings. Moreover, the need for IV disinfecting caps rises in parallel with the number of surgeries and patients undergoing intravenous therapy. Further, the growing technological advancements in the region, along with the rising research & development activities, are also anticipated to contribute to the market growth in the region. In addition, the growing number of diseases is also anticipated to boost the market growth during the forecast period. Between 2019 and 2021, more than 12 million surgical procedures were carried out in the US.

APAC Market Insights

The Asian Pacific IV disinfecting caps market is estimated to hold the second-largest, share by the end of 2035. The growth of the market can be attributed majorly to the increasing rates of typhoid fever, cholera, food poisoning, and illnesses connected with healthcare. Typhoid fever, cholera, and food poisoning cases are on the rise in the region, which is projected to drive up demand for IV disinfection caps as healthcare professionals work to lower the risk of infections in patients. For instance, in healthcare settings such as hospitals, clinics, and other healthcare institutions, intravenous treatment is a standard technique that frequently involves the use of IV disinfection caps to avoid infections. Further, the growing awareness about home cleanliness in the region is also anticipated to contribute to the market growth in the region.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing geriatric population. The demand for IV disinfection caps is projected to rise as the aging population in the region grows. For instance, healthcare providers in the area are putting more emphasis on infection prevention and control, especially while caring for elderly patients who are more susceptible to illnesses. As the emphasis on infection prevention increases, there will likely be an increase in demand for products and technologies such as IV disinfection caps, which can help reduce the risk of infections.

IV Disinfecting Caps Market Players:

- Human Metabolome Technologies America Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.   Â

- Bio-Rad Laboratories, Inc.

- Biocrates life sciences AG

- Agilent Technologies, Inc.                      Â

- Merit Medical Systems

- B. Braun Melsungen AG

- ICU Medical, Inc.

- Becton, Dickinson and Company

- 3M Company

Recent Developments

-

Thermo Fisher Scientific Inc. introduced TrueMark Infectious Disease Research Panels to identify and classify bacteria that cause gastrointestinal, respiratory, vaginal, urinary, and sexually transmitted diseases quickly and accurately. Further, researchers can choose from more than 90 different bacterial and viral strain assays using the predefined and programmable panel options.

-

Biocrates life sciences AG a global leader in targeted metabolomics, acquired Metanomics Health GmbH to offer focused metabolomics profiling services, personalized assays, targeted screening kits, and in-depth data interpretation.

- Report ID: 4101

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IV Disinfecting Caps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.