Insulated Gate Bipolar Transistors Market Outlook:

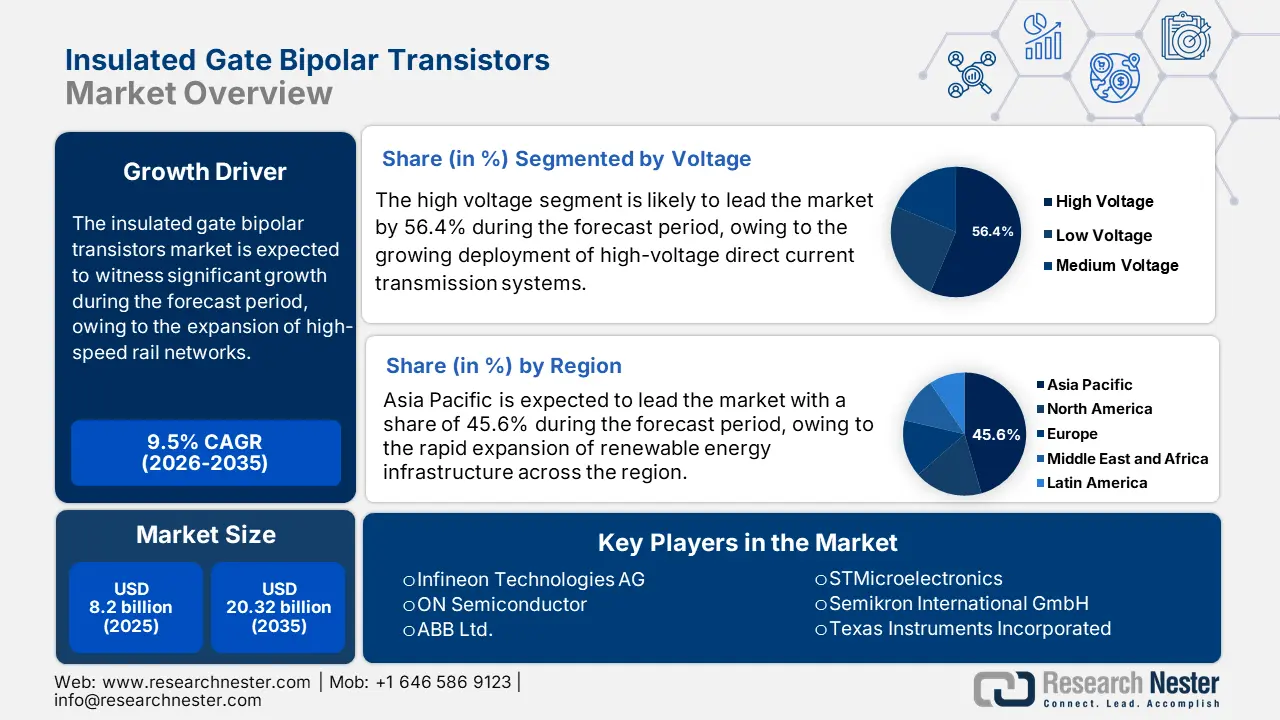

Insulated Gate Bipolar Transistors Market size was over USD 8.2 billion in 2025 and is anticipated to cross USD 20.32 billion by 2035, growing at more than 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of insulated gate bipolar transistors is assessed at USD 8.9 billion.

The continual innovations in Industry 4.0 and factory automation have accelerated the integration of insulated gate bipolar transistors (IGBTs) in applications, including robotics, motor drives, and industrial power supplies. For the requirement from automated systems, companies are developing IGBTs for efficient energy management and precise control with improved system performance and low operational expenses. For instance, in February 2024, onsemi launched its 7th generation of IGBT-based intelligent power modules to reduce energy usage in heating and cooling systems, with the industry’s focus on energy efficiency in its applications.

The power transmission and distribution efficiency of smart grids significantly relies on IGBTs due to their ability to improve the operation of power electronic devices. Various organizations are expanding their product lines specifically for attaining higher energy efficiency across industrial automation systems. For instance, in May 2023, ABB acquired Siemens’ low-voltage NEMA motor business, enhancing its position as a dominant industrial NEMA motor manufacturer and expanding its capability to deliver efficiency solutions for industrial automation systems.

Key Insulated Gate Bipolar Transistors Market Insights Summary:

Regional Highlights:

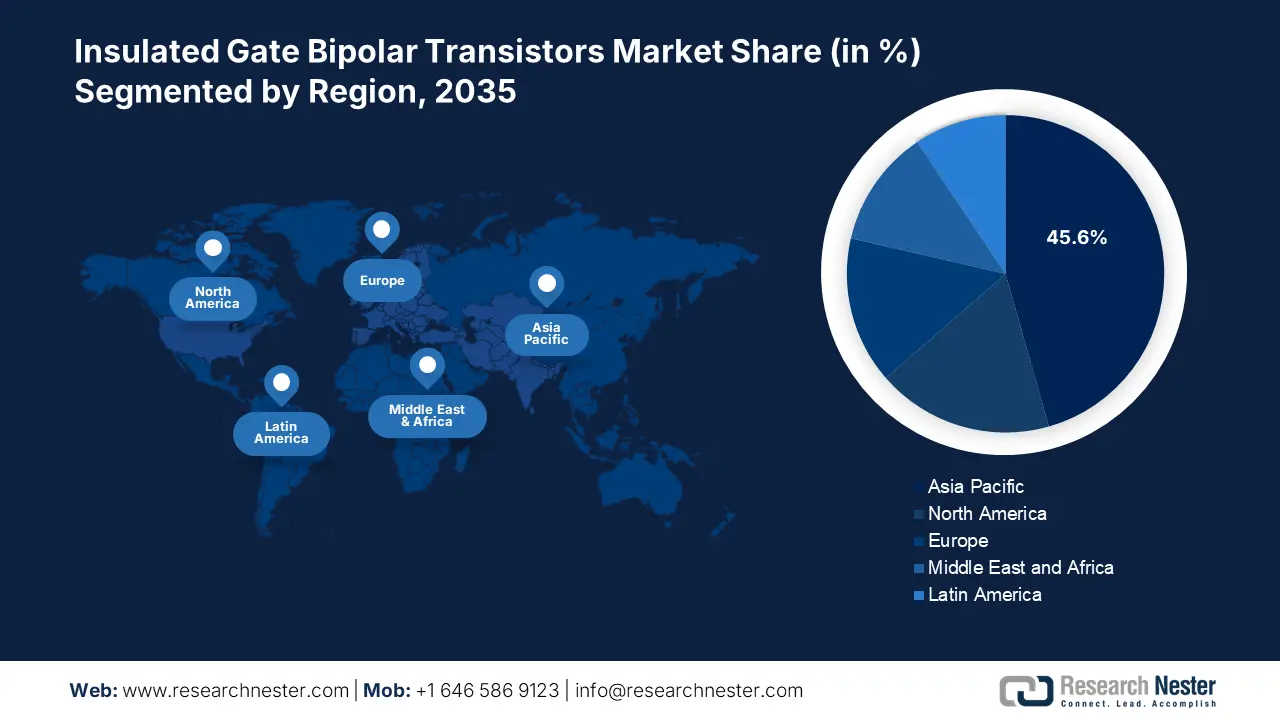

- Asia Pacific dominates the Insulated Gate Bipolar Transistors Market with a 45.6% share, propelled by rapid expansion of renewable energy infrastructure, especially solar and wind power generation, driving growth through 2026–2035.

- North America’s insulated gate bipolar transistors market is anticipated to grow rapidly by 2035, driven by rapid expansion of EV charging infrastructure and government initiatives.

Segment Insights:

- High Voltage segment is expected to capture around a 56.4% share by 2035, driven by growing deployment of high-voltage direct current transmission systems.

Key Growth Trends:

- Expansion of high-speed rail networks

- Advancements in IGBT technology

Major Challenges:

- Long development and testing cycles

- Declining demand in low-power applications

- Key Players: ON Semiconductor, ABB Ltd, STMicroelectronics, and Semikron International GmbH.

Global Insulated Gate Bipolar Transistors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.2 billion

- 2026 Market Size: USD 8.9 billion

- Projected Market Size: USD 20.32 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Insulated Gate Bipolar Transistors Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of high-speed rail networks: The expansion of high-speed railways requires insulated gate bipolar transistors, owing to their crucial role as traction inverters used for railway electrification. Countries such as India, China, and Japan are increasingly investing in high-speed rail projects to reduce carbon emissions and enhance transportation efficiency. In May 2023, the Hitachi Toshiba Supreme Consortium secured a contract of USD 1.13 billion from Taiwan High Speed Rail Corporation to deliver 12 sets of next-generation high-speed trains. The trains are designed with the implementation of the advanced N700S series to operate at speeds up to 300 km/h while using energy-efficient traction systems, including silicon carbide devices.

Governments and railway operators are emphasizing sustainable transportation, due to the railway electrification trend, resulting in an escalating need for powerful IGBT modules, capable of maintaining high power levels and reliable energy-efficient performance. These devices enhance the efficiency of overall power conversion, the longevity of rail systems, and minimize energy losses. -

Advancements in IGBT technology: The rapid advancements in IGBT technology and innovations in trench-gate and silicon carbide (SiC)-based IGBTs enable improved efficiency performance and minimized switching losses while enhancing thermal capabilities. These advancements are significant for high-power applications, including industrial equipment and electric vehicles. Several companies are leveraging these innovations by introducing new devices for electric vehicles. For instance, in November 2024, ROHM Semiconductor unveiled new automotive-grade 1200V IGBTs to offer industry-leading low-loss characteristics and high short-circuit tolerance, making them ideal for vehicle electric compressors and industrial inverters.

Challenges

-

Long development and testing cycles: The development of insulated gate bipolar transistors involves rigorous design, testing, and certification processes to ensure high reliability and performance in critical applications such as industrial automation, electric vehicles, and power grids. Extensive testing for thermal stability, switching efficiency, and durability adds significant time and costs to product development. Compliance with global safety and efficiency standards is further delaying commercialization. These prolonged cycles can slow the introduction of next-generation IGBTs, impacting innovation and adoption in rapidly evolving power electronics markets.

-

Declining demand in low-power applications: Gallium Nitride (GaN)-based transistors are rapidly gaining popularity in low-power applications, thereby limiting the growth of the IGBT market. In addition, the metal-oxide-semiconductor field effect transistors are preferred for low-voltage operations due to their cost-effectiveness and superior frequency response. As industries are shifting towards these alternatives, IGBTs are facing reduced market relevance in applications that require compact, high-efficiency power solutions.

Insulated Gate Bipolar Transistors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 8.2 billion |

|

Forecast Year Market Size (2035) |

USD 20.32 billion |

|

Regional Scope |

|

Insulated Gate Bipolar Transistors Market Segmentation:

Voltage (Low Voltage, Medium Voltage, High Voltage)

High voltage segment is set to account for around 56.4% insulated gate bipolar transistors (IGBT) market share by 2036, owing to the growing deployment of high-voltage direct current transmission systems for efficient long-distance power transmission, particularly for integrating renewable energy sources into the grid. The demand for high-voltage IGBTs is increasing due to their ability to enhance the efficiency and reliability of HVDC converters, improving grid stability and energy distribution. Various companies are introducing new high-voltage IGBT devices to improve reliability and reduce power loss, addressing the growing needs of high-voltage applications. For instance, in December 2024, Mitsubishi Electric announced the shipment of samples for its new S1-Series high voltage insulated gate bipolar transistor modules, rated at 1.7kV, targeting applications in large industrial equipment and railcars.

Application (Consumer, Electronics Industries, Industrial Manufacturing, Automotive, Inverters/UPS, Railways, Renewables)

The industrial manufacturing segment in insulated gate bipolar transistors (IGBT) market is expected to account for a significant share, owing to the rapid advancements in semiconductor technologies for enhancing the production efficiency and device performance. One such example is Hitachi Energy’s first 300 mm wafer for IGBT power semiconductor devices launched in March 2024 that offers a 2.4-fold increase in functional integrated circuits per wafer compared to the conventional 200 mm wafers. This development allows for more complex structures in 1200V IGBTs, resulting in energy-efficient power conversion and reduced operational power losses. Such innovations are crucial for industrial applications requiring high-performance power electronics.

The increasing adoption of factory automation and robotics in manufacturing is driving demand for high-voltage IGBT modules. Modern industrial robots and automated assembly lines require reliable, energy-efficient power electronics to optimize performance and minimize energy consumption. IGBTs play a crucial role in motor drives, welding equipment, and industrial power supplies by providing efficient switching capabilities and high thermal stability.

Our in-depth analysis of the global IGBT market includes the following segments:

|

Voltage |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Insulated Gate Bipolar Transistors Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in insulated gate bipolar transistors market is set to account for more than 45.6% revenue share by the end of 2036, owing to the rapid expansion of renewable energy infrastructure, particularly in solar and wind power generation. Countries such as India and China are investing more in large-scale energy projects, driving the demand for efficient power conversion solutions. The increasing adoption of automation across industries, including manufacturing, transportation, and smart grids, is fueling demand for IGBTs in high-power applications. The proliferation of electric locomotives, high-speed rail, and industrial motor drives requires advanced power electronics for efficient energy management. Also, the transition towards electric vehicles and hybrid transportation solutions is further driving demand for high-performance IGBT modules, supporting the region’s transition toward electrification and energy-efficient technologies.

The China insulated gate bipolar transistors market is experiencing a robust expansion due to the country’s domestic semiconductor manufacturing capabilities to reduce reliance on foreign suppliers. Government-backed initiatives as well as investments in power semiconductor fabrication are accelerating the development and production of IGBT modules. Local manufacturers are expanding production capacities and advancing technology to cater to the rising demand from industries such as electric vehicles, industrial automation, and power infrastructure. This self-sufficiency strategy is fostering a robust IGBT market with a focus on innovation and cost efficiency.

The India insulated gate bipolar transistors market is growing at a rapid pace, attributed to the country’s increasing focus on semiconductor self-reliance. The government's Production Linked Incentive scheme and partnerships with global semiconductor firms are fostering domestic production of power electronics components, including IGBTs. With the Make in India initiative, new fabrication units and design centers are being set up to meet the increasing demand from industrial automation, EVs, and renewable energy sectors. This localization effort is reducing dependency on imports and enhancing India's position in the global semiconductor supply chain.

India’s metro rail expansion is significantly driving demand for IGBTs used in traction inverters for electric trains. According to a report from the Press Information Bureau, as of January 2025, India’s metro network surpassed 1,000 km across 11 states and 23 cities, making it the third-largest in the world. Millions rely on metro systems for fast and efficient travel, highlighting the growing need for advanced power electronics like IGBTs to enhance energy efficiency and operational reliability. The adoption of high-power IGBTs is continually rising, with rising government investments in urban mobility.

North America Market

The insulated gate bipolar transistors market in North America is expected to register rapid growth, attributed to the rapid expansion of EV charging infrastructure. Government initiatives and private sector investments are accelerating the deployment of fast-charging stations, where IGBTs play a crucial role in managing high-voltage power conversion. With automakers shifting towards EV production, the need for advanced power semiconductor solutions to enhance charging efficiency and reduce energy losses is increasing, making IGBTs a key enabler of the region’s electrification goals.

The U.S. insulated gate bipolar transistors market is witnessing consistent growth, owing to the increasing expansion of data centers and high-performance computing infrastructure. With hyperscale data centers requiring high-power conversion systems to maintain energy efficiency and reliability, IGBTs are being used in uninterruptible power supply systems, power inverters, and voltage regulation applications. As cloud service providers and AI-driven computing grow, the adoption of high-power IGBTs in data center power electronics is increasing.

The insulated gate bipolar transistors market in Canada is progressing at a moderate pace, attributed to the increasing adoption of renewable energy, which is resulting in rising investments in battery energy storage systems. With the growing reliance on solar and wind power, BESS plays a crucial role in balancing power supply fluctuations and ensuring grid stability. IGBTs are essential in energy storage inverters, efficiently converting and managing power between batteries and the grid. As the country is expanding its clean energy initiatives, the demand for high-efficiency IGBT-based power conversion solutions is surging to optimize energy storage performance, reduce losses, and enhance system reliability.

The local maritime sector is undergoing electrification, with government-backed initiatives promoting hybrid and fully electric ferries to reduce emissions. IGBT-based propulsion systems enable precise motor control, improving energy efficiency and extending battery life in electric ships. Ports and coastal regions are increasingly adopting shore-to-ship power systems, where IGBTs facilitate seamless power conversion. As Canada strengthens its commitment to decarbonizing marine transportation, IGBT technology is becoming indispensable for shipbuilders and fleet operators, supporting the transition towards sustainable, energy-efficient marine operations.

Key Insulated Gate Bipolar Transistors Market Players:

- Infineon Technologies AG

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ON Semiconductor

- ABB Ltd

- STMicroelectronics

- Semikron International GmbH

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

- Fairchild Semiconductor

- IXYS Corporation

The insulated gate bipolar transistors market is marked by intense competition among global semiconductor manufacturers striving for technological superiority. Infineon Technologies, Mitsubishi Electric, Fuji Electric, ON Semiconductor, and STMicroelectronics are key players leveraging advanced R&D and large-scale production to maintain their market positions. Meanwhile, Chinese firms like CRRC Times Electric and BYD Semiconductor are expanding aggressively to challenge established brands. Companies are focusing on high-voltage IGBTs for EVs, renewable energy, and industrial automation, with strategic initiatives such as partnerships, acquisitions, and product innovations playing a crucial role in enhancing market share and meeting growing global demand. Here are some key players operating in the global insulated gate bipolar transistors (IGBT) market:

Recent Developments

- In July 2024, Magnachip Semiconductor Corporation completed the development of its new 1200V 75A IGBT in a TO-247PLUS package, designed for solar inverters, with mass production set for October 2024. This latest addition builds on Magnachip's previous IGBT offerings, including the 1200V 40A model launched in 2020 and the 650V 75A version introduced in 2022.

- In October 2023, Hyundai and Kia entered into a strategic partnership with Infineon Technologies AG to secure a stable supply of power semiconductors, including diodes, IGBTs, and silicon carbide (SiC) power modules. This collaboration aims to support the growing global demand for electric vehicles and enhance the performance of their electrified models through 2030.

- Report ID: 7485

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Insulated Gate Bipolar Transistors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.