Waste Management Market Outlook:

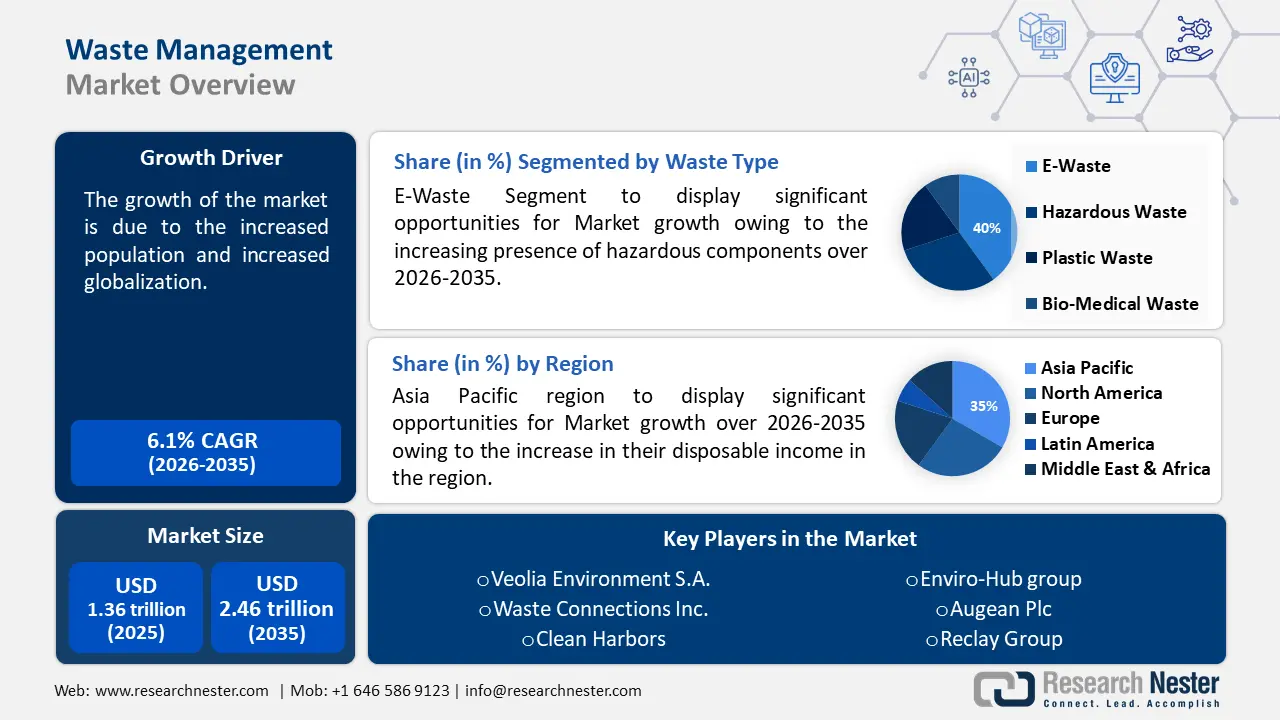

Waste Management Market size was valued at USD 1.36 trillion in 2025 and is likely to cross USD 2.46 trillion by 2035, expanding at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of waste management is assessed at USD 1.43 trillion.

Global trash volume has increased as a result of population growth and increased globalization. Municipal solid waste (MSW) generated by the urban population was estimated to be 1.3 billion tons in 2012. By 2025, that amount is predicted to increase to 2.2 billion tons. This has raised the need for efficient management of trash, thereby propelling waste management market.

In addition to this, a program called "Save the Food" has been launched by the National Research Development Corporation (NRDC) to increase public awareness of the effects of home food waste. Medical waste management procedures are a focus of the US Environmental Protection Agency (US EPA). Furthermore, new regulations have been put out all over Europe to reduce trash and promote recycling. These regulations include deposit-return schemes, financial incentives for reusing materials, and the phase-out of public subsidies for garbage promotion. The European Union decided to implement more waste-reduction strategies and higher recycling targets.

Key Waste Management Market Insights Summary:

Regional Highlights:

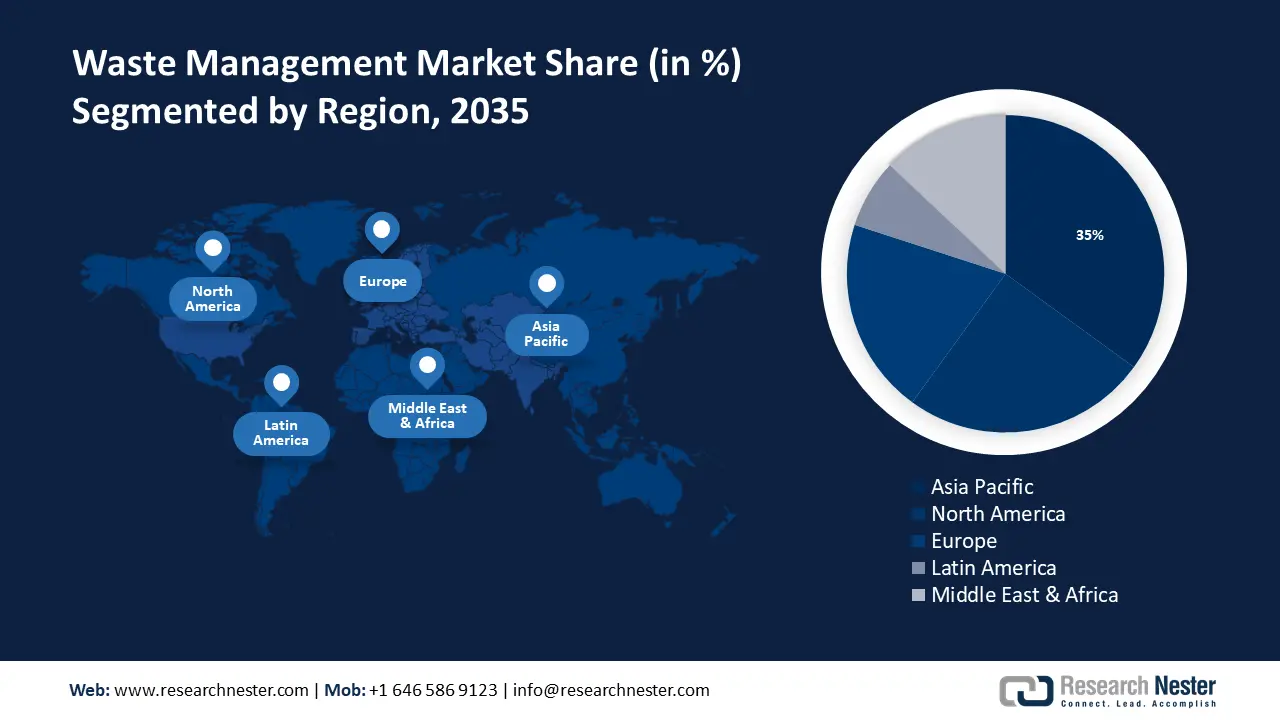

- Asia Pacific waste management market will hold more than 35% share by 2035, driven by the rise in urban population and increasing demand for waste management services due to economic growth.

- North America market will capture a 25% share by 2035, fueled by urbanization, industrialization, and rising awareness of environmental impacts.

Segment Insights:

- The e-waste segment in the waste management market is anticipated to experience robust growth till 2035, propelled by increasing environmental concerns and improper e-waste handling.

- The landfill segment in the waste management market is expected to see significant growth till 2035, fueled by stringent regulations and the need for safe solid waste disposal.

Key Growth Trends:

- Technology advancements and shorter product life cycles have increased the amount of electronic waste produced

- Growing number of construction projects coupled with an increase in the use of construction and demolition (C&D) materials in metropolitan regions

Major Challenges:

- It costs more to recycle plastic than to make new plastic

- Lack of the essential structure for garbage collection and separation may impede waste management market growth.

Key Players: Covanta Holding, Veolia Environment S.A., Cleanaway Waste Management Limited, Waste Connections Inc., Clean Harbors, Enviro-Hub group, WM Intellectual Property Holdings L.L.C, Augean Plc, Reclay Group, Clean, Harbors, Inc.

Global Waste Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.36 trillion

- 2026 Market Size: USD 1.43 trillion

- Projected Market Size: USD 2.46 trillion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Waste Management Market Growth Drivers and Challenges:

Growth Drivers

- Technology advancements and shorter product life cycles have increased the amount of electronic waste produced - New electronic devices and improved versions of current products, such as laptops, mobile phones, and televisions, are produced as a result of the rapid improvements in technology. In a similar vein, the shelf life of technological devices decreases as individual purchasing power rises.

Consequently, an increasing amount of e-waste is produced as the lifespan of electronic items gets shorter. The need for e-waste management is fueled by the need to recycle electronic items, which is in turn brought on by the accumulation of electronic garbage. This rising e-waste production raise need for waste management, thereby offering growth opportunities for waste management market.

- Growing number of construction projects coupled with an increase in the use of construction and demolition (C&D) materials in metropolitan regions - In order to reduce the need to mine and process virgin materials, the Environmental Protection Agency (EPA) supports the Sustainable Materials Management (SMM) method, which recognizes specific C&D materials as commodities that can be used in new construction projects. The majority of construction and demolition waste produced in the US is approved for disposal in landfills subject to Code of Federal Regulations (CFR) regulations.

In some areas, the whole or a portion of the waste stream from building and demolition is illegally dumped on land or in natural drainage systems, including waterways, in violation of laws meant to safeguard the environment, human health, and commerce. In light of these elements, the waste management market will expand in the upcoming years.

- Implications of poor waste management for the environment and society - Waste management is sometimes seen as waste pickers' main source of revenue because they pick up trash from door to door, sort it by hand, and then sell the recyclables to scrap dealers. Unattractive streets are the result of a shortage of trash cans on municipal streets, careless attitudes against littering, and lax enforcement of the legislation against it.

Dangerous contaminants in the air, rivers, and streams around low-income communities near landfills can have an immediate impact on them. The average European produces five tons of waste a year; of that, only 38 percent is recycled, and in certain EU nations, more than 60 percent of domestic waste ends up in landfills.

Challenges

- It costs more to recycle plastic than to make new plastic - For the production of virgin plastics, petrochemicals like natural gas and oil are essential raw resources. Polyethylene terephthalate is the recycled version of plastic (PET). The creation of a pure stream of recovered material is the issue with plastic recycling. PET plastics can be recycled into other goods like new containers and fleece garments, but they have little residual value. While producing plastic items, a number of additives are added, including colorants and fillers. The additions made to plastic, which have an impact on the recycling of plastic products, are typically unknown to recycling organizations. These factors may hinder market during the projected period.

- Lack of the essential structure for garbage collection and separation may impede waste management market growth.

- It is estimated that the high expense of operating and acquiring waste management solutions will hinder market expansion.

Waste Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.36 trillion |

|

Forecast Year Market Size (2035) |

USD 2.46 trillion |

|

Regional Scope |

|

Waste Management Market Segmentation:

Waste Type Segment Analysis

Based on waste type, e-waste segment is attributed to hold highest market share of about 40% during the forecast period. Chlorofluorocarbons (CFCs), hydrochlorofluorocarbons (HCFCs), brominated flame retardants (BFRs), mercury, and other hazardous materials are among the toxic additives and compounds found in e-waste. There are serious concerns to the environment and even human health associated with the rising amounts of e-waste, inadequate collection crates, improper dumping, and improper treatment of this garbage.

E-waste management gone wrong also adds to global warming. Initially, the materials found in e-waste cannot replace primary raw materials or lower greenhouse gas emissions from the extraction and refinement of primary raw materials if they are not recycled. Subsequently, certain temperature-control equipment produces greenhouse gasses due to the presence of refrigerants. 98 Mt of CO2 equivalents were emitted into the atmosphere as a result of abandoned air conditioners and refrigerators that were not handled sustainably. 53.6 Mt of e-waste were produced worldwide in 2019. That translates to 7.3 kilos on average per person. By 2030, 74.7 Mt of e-waste will have been produced, growing at a rate of roughly 3.5% year. In light of this, e-waste segment is expected to encounter significant growth during the projection period.

Service Type Segment Analysis

Based on service type, landfill segment garnered largest market share of about 30% and will continue the same over the projection period. For the purpose of disposing of solid waste, modern landfills are carefully designed and maintained structures. In order to guarantee adherence to specified regulations, landfills are planned, situated, run, and observed. Additionally, they are made to guard against pollutants that might be found in the waste stream and harm the ecosystem.

Environmentally sensitive locations cannot accommodate landfill construction, and their placement necessitates the use of on-site environmental monitoring equipment. These monitoring devices look for landfill gas and any indication of groundwater contamination. The Resource Conservation and Recovery Act (RCRA) imposes strict design, operation, and closing guidelines for landfills.

Our in-depth analysis of the global market includes the following segments:

|

Waste Type |

|

|

Service Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Waste Management Market Regional Analysis:

APAC Market Insights

Waste management market in Asia Pacific region is projected to hold largest market share of about 35% in the upcoming years. The Asia Pacific region's families are seeing a continual increase in their disposable income due to the region's stable economic expansion, which has ultimately increased demand for waste management services. Solid waste creation is rising quickly as more people in Asia Pacific move from rural to urban locations. By 2050, the Asia-Pacific region is estimated to have 5.1 billion people living there, of which at least 64.0% will reside in metropolitan areas. This rise in urban population will eventually support regional market development.

North American Market Insights

Waste management market in North America region is attributed to hold second largest share of about 25% during the projected period. The market in the region is seeing strong trends due to the fast-paced urbanization and industrialization. The necessity for effective trash disposal solutions is highlighted by the fact that growing populations in emerging economies lead to rising garbage generation. The North American market has been significantly impacted by the growing awareness of the negative environmental effects of non-eco-friendly packaging, such as plastic packaging and other plastic product components.

Waste Management Market Players:

- Covanta Holding

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Veolia Environment S.A.

- Cleanaway Waste Management Limited

- Waste Connections Inc.

- Clean Harbors

- Enviro-Hub group

- WM Intellectual Property Holdings L.L.C

- Augean Plc

- Reclay Group

- Clean Harbors, Inc.

Recent Developments

- Veolia Environment S.A became one of the first synthetic E-Fuel production units in Europe by installing at LIPOR's Energy Recovery Plant, close to Porto. Its cutting-edge technological setup and design have the potential to completely transform the waste-to-energy market and decarbonize the aviation industry at the same time.

- Clean Harbors, Inc., the top provider of industrial and environmental services in North America signed a definitive agreement with Energy, Inc. to purchase certain assets of Vertex's used motor oil collection and re-refinery business for $140 million in cash, subject to working capital and other adjustments. The transaction is anticipated to occur in the third quarter of 2021, pending clearance from US authorities, shareholder approval, and other standard closing requirements.

- Report ID: 6028

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Waste Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.