Air Purifier Market Outlook:

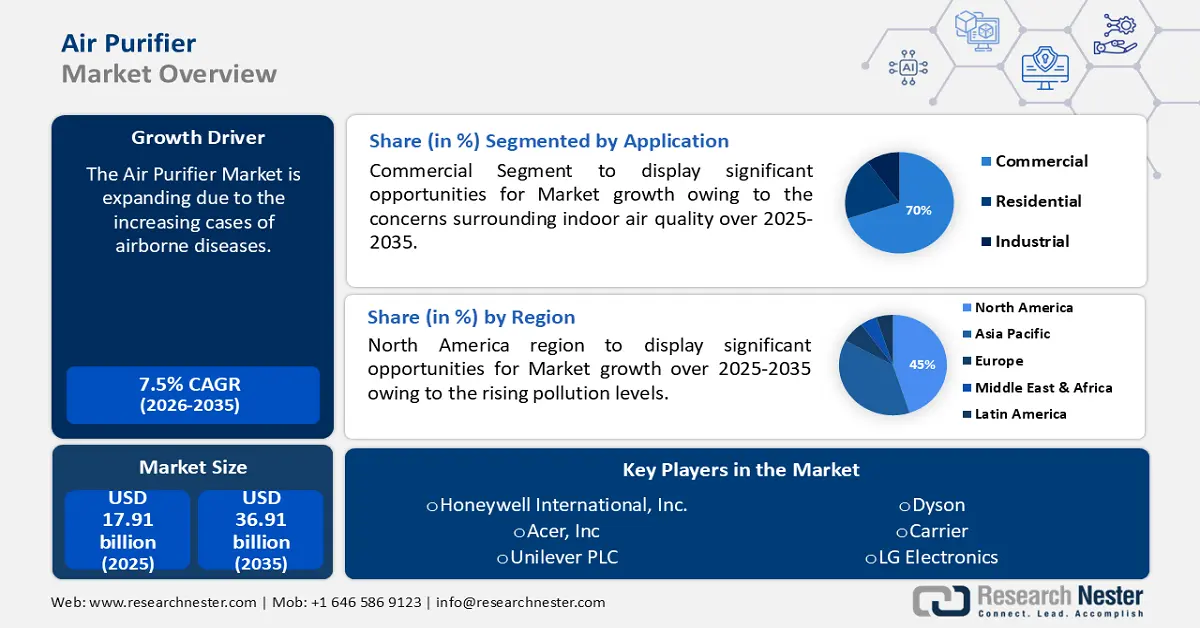

Air Purifier Market size was over USD 17.91 billion in 2025 and is poised to exceed USD 36.91 billion by 2035, witnessing over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of air purifier is estimated at USD 19.12 billion.

The factors driving the market are increasing cases of airborne diseases and rising levels of pollution in urban cities. As per the World Health Organization (WHO), 99% of the population is exposed to high air pollution levels.

Key Air Purifier Market Insights Summary:

Regional Highlights:

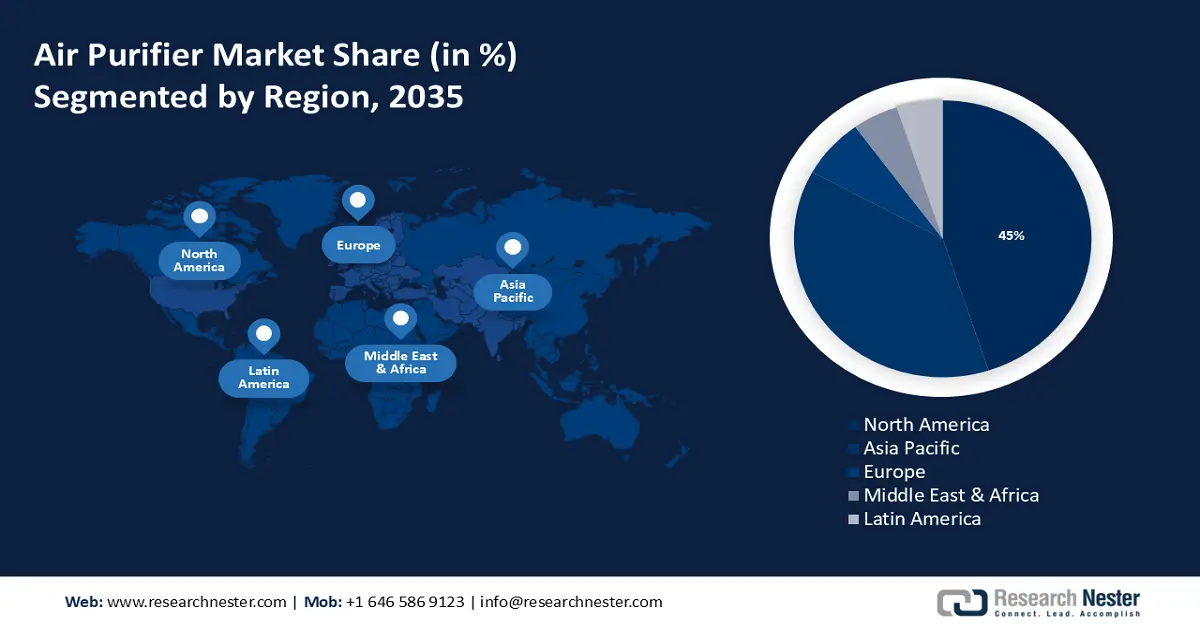

- The North America air purifier market will secure over 45% share by 2035, driven by air quality policies, rising air pollution levels, and industrial activities.

- The Asia Pacific market will achieve substantial share by 2035, driven by increasing air pollution and prevalence of airborne infections.

Segment Insights:

- The commercial segment in the air purifier market is projected to hold a 70.10% share by 2035, influenced by growing concerns over indoor air quality in public spaces such as businesses, hospitals, and schools.

- The hepa segment in the air purifier market is anticipated to grow significantly by 2035, driven by HEPA’s high efficiency in capturing airborne particles.

Key Growth Trends:

- Emergence of advanced air purifiers

- Growing emphasis on public health and awareness around environmental sustainability

Major Challenges:

- Overheating

- Irregular maintenance

Key Players: Dyson Ltd., Honeywell International Inc., Blueair AB (Unilever), IQAir, Philips N.V., LG Electronics Inc., Sharp Corporation, Coway Co., Ltd., Samsung Electronics Co., Ltd., Whirlpool Corporation.

Global Air Purifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.91 billion

- 2026 Market Size: USD 19.12 billion

- Projected Market Size: USD 36.91 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Air Purifier Market Growth Drivers and Challenges:

Growth Drivers

-

Emergence of advanced air purifiers – Metal pollution due to rampant industrialization has emerged as a global environmental concern. Conventional filtering methods including ion exchange and chemical precipitation have limitations such as low efficiency and generation of secondary pollutants. Ongoing research on the use of nanotechnology by public and private organizations including the National Laboratory of Medicine (NIM) showcases promising results in filtering heavy metals. According to a January 2024 Nature report, carbon-based nanomaterials (CBNMs) emerged as potential alternatives owing to their high surface area, providing multiple binding sites for heavy metal ions.

Nanotechnology-based filters can efficiently trap air pollutants such as volatile organic compounds (VOCs), particulate matter, and airborne pathogens. Other novel applications include photocatalytic nanomaterials, activated by UV/visible light, which have the unique property of breaking pollutants into harmless byproducts.

PHILIPS 1000i Series NanoProtect HEPA and VitaShield Technology Smart Air Purifier, Nano Aerpod Personal air purifier, and SWASA Nanoguard Air Purifier are a few examples of cost-effective and sustainable nanotechnology-based air purifiers that offer real-time monitoring of air quality, reduced energy consumption, higher efficiency, and extended filter lifespans. -

Growing emphasis on public health and awareness around environmental sustainability - In 2021, the World Economic Forum (WEF) initiated the Alliance for Clean Air to advocate the role of private players in measuring carbon footprint and harnessing innovation to pilot projects that can drive sustainability.

Companies such as IKEA, GoTo, and Biogen have successfully decoupled from the adverse impact of carbon footprint and embedded the highest ESG standards in their operation ecosystems.Such programs are estimated to create growth opportunities for air purifier manufacturers during the forecast period. -

Rising pollution levels in the residential sector - As per a December 2023 report by the WHO, poor household air quality increases the burden of respiratory and cardiovascular diseases. The burning of fuels such as animal dung, wood, charcoal, kerosene, and agricultural waste primarily causes it. The study further adds that around 3 million people die each year globally due to household air pollution. Of these, 32% succumb to ischaemic heart disease, 23% to stroke, 19% to chronic obstructive pulmonary disease (COPD), 21% to lower respiratory infections, and 6% to lung cancer. The alarming mortality rate due to poor indoor air quality has impelled the adoption of air purifiers in the residential sector.

Challenges

-

Overheating - Availability of duplicate air purifiers is posing a threat to the market penetration. It creates a sense of confusion among the consumer while purchasing a suitable one. Additionally, the air purifier with low quality, does not constitute a standard cooling system which leads to overheating and damage to the motor.

-

Irregular maintenance - For optimum performance of the air purifier, regular maintenance is crucial. The more utilization increases, the more cleaning is required. Keeping the air purifier dust-free and timely replacement of filters, which otherwise hampers the longevity of the product.

Air Purifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 17.91 billion |

|

Forecast Year Market Size (2035) |

USD 36.91 billion |

|

Regional Scope |

|

Air Purifier Market Segmentation:

Application Segment Analysis

Commercial segment is projected to dominate over 70.1% air purifier market share by 2035. Indoor air quality (IAQ) is a major concern in the public sector including businesses, hospitals, and schools, amongst others. According to the Centers for Disease Control and Prevention (CDC), approximately 90% of U.S. citizens spend their time indoors and office workers on average spend 40 hours a week in office premises.

The employees work and consume food in the same work settings, where the recirculated air may be compromised. For this reason, more people are likely to suffer from the effects of indoor air pollution than outdoor air pollution.

Technology Segment Analysis

By 2035, high-efficiency particulate air (HEPA) segment is expected to account for around 40% air purifier market share. The segment is growing owing to the efficiency of HEPA in capturing airborne particles. That’s why many experts recommend HEPA filters in healthcare facilities. It is theorized that the HEPA filters can remove airborne particles such as dust, and pollen with a size of 0.3 microns (µm). In homes, where there is no central HVAC filters available, a HEPA air purifier is an excellent choice.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Coverage |

|

|

Sales |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Purifier Market Regional Analysis:

North America Market Insights

North America industry is predicted to hold largest revenue share of 45% by 2035. The region’s growth is attributed to the air quality policies, the rise in the air pollution level and industrial activities. In North America, the worst air quality station is FNSB NP Fire, Alaska.

The market in the U.S. is driven by the growth in residential and commercial real estate. According to an April 2024 report by the Census, the privately-owned housing sector has witnessed 5.7% growth than the revised March estimate. The steady growth in the housing sector is expected to propel the demand for air purifiers in the country.

The market is flourishing in Canada due to the emergence of new air purifier distributors and the integration of the latest technologies such as UV-LEDs. A Canada-based startup – CleanAir offers an energy-efficient advanced air purifier named ALVI SMART which also lasts longer and provides cleaner air.

Asia Pacific Market Insights

The Asia Pacific region is poised to hold the substantial market share in the air purifier market in the coming years. The region’s growth is attributed to the increasing air pollution and prevalence of airborne infections.

In Asia Pacific, over 2.3 billion people, which is 92% of the population are exposed to high levels of air toxins. As per the 2020 World Air Quality Report, 37 out of 40 most polluted cities globally were in South Asia.

The air purifier market in China has observed remarkable growth, with the growing expenditure on air purifiers in public spaces including hospitals and offices. The prevalence of high air pollution and the subsequent demand for air purifiers have attracted noteworthy foreign investments. For instance, in October 2021, Freudenberg Filtration Technologies opened its largest manufacturing facility in Shunde, China. This has enabled the company to strengthen its global footprint and capitalize on the booming opportunity.

The market is growing in India owing to the increased focus on consumer health and rising awareness concerning serious diseases that may be caused by harmful particles. Additionally, the presence of a large number of air purifier manufacturers in India is also driving growth in the market. Electrolux expanded its product portfolio with the launch of UltimateHome 500 air purifier which has 4-stage filters for 570ft² room coverage that claims to efficiently neutralize airborne particulates with its 4-step filter.

Air Purifier Market Players:

- Honeywell International, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IQAir

- Acer, Inc.

- Unilever PLC

- Sharp Electronics Corporation

- Samsung Electronics Co., Ltd.

- LG Electronics

- Whirlpool Corporation

- Dyson

- Carrier

The air purifier market is dominated by key market players who are gaining traction in the market by the increasing focused on health and strict policies on air quality.

Recent Developments

- In April 2023, Acer launched the Acerpure Pro Vero air purifier under its eco-conscious Vero line of products. It is made from 35% post-consumer recycled (PCR) materials, significantly decreasing CO2 emissions during its manufacturing. It is equipped with an advanced 3-in-1+ HEPA Filter and energy-saving green mode that facilitates lower energy costs.

- In November 2022, IQAir unveiled Atem X, a smart bionic air purifier. Its BionicCore technology offers maximum air cleaning regardless of the air purifier's position or the room's size or shape.

- Report ID: 6260

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Purifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.