In-vitro Fertilization Market Outlook:

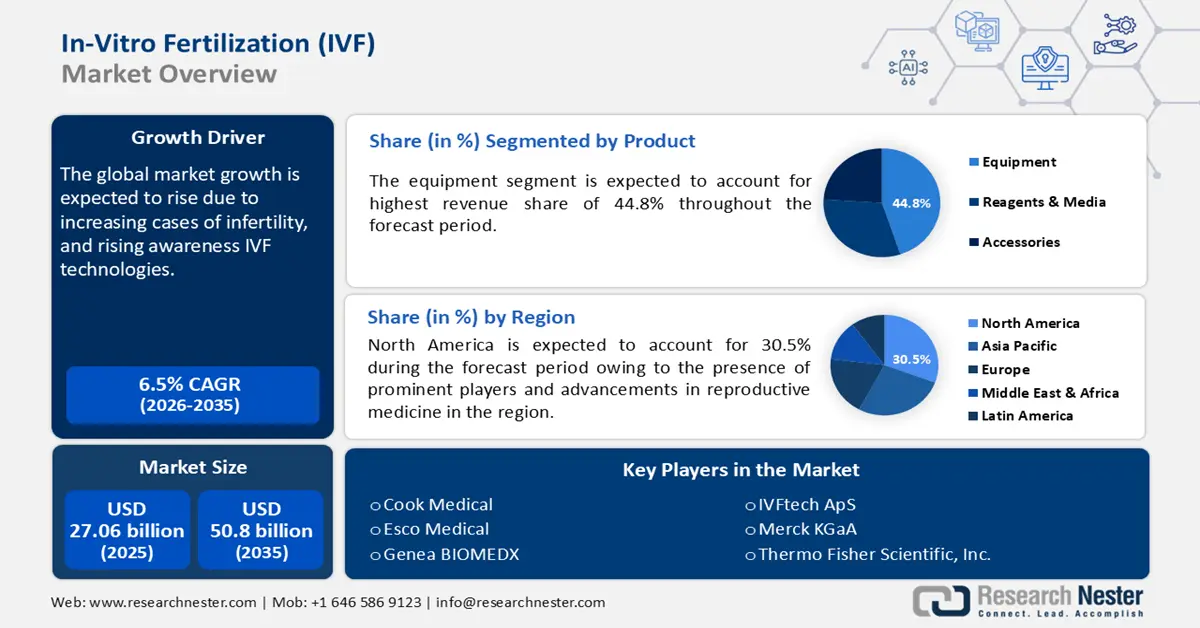

In-vitro Fertilization Market size was over USD 27.06 billion in 2025 and is anticipated to cross USD 50.8 billion by 2035, growing at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of in-vitro fertilization is assessed at USD 28.64 billion.

The in-vitro fertilization market has witnessed significant growth in recent years, driven by the increasing infertility rate, reproductive technologies advancement, and evolving social trends. Furthermore, rising awareness of fertility treatments and the growing availability of IVF services have further fueled the market.

Embryo selection techniques and effective lab equipment are some of the recent advancements in IVF technology enhancing the treatment success rate and, in turn becoming a more attractive option. Additionally, supportive government policies and insurance coverage in some regions are expanding access to these treatments. Prominent market players are also involving several R&Ds, new launches, and innovation activities. For instance, in June 2023, FUJIFILM Irvine Scientific, Inc. announced the addition of the Life Whisperer Genetics module to its Life Whisperer software package. The launch was aimed at enabling non-invasive evaluation of embryo genetic integrity during in vitro fertilization (IVF).

Key In-vitro Fertilization (IVF) Market Insights Summary:

Regional Highlights:

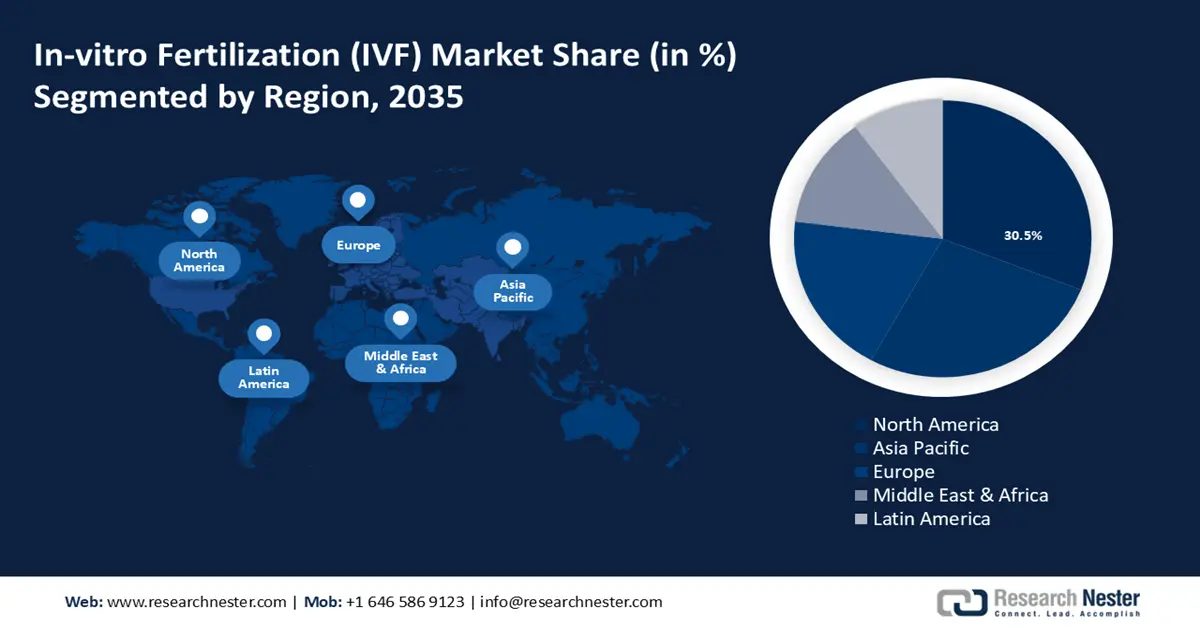

- North America in-vitro fertilization (IVF) market will account for 30.50% share by 2035, driven by developed healthcare infrastructure, IVF technology advancements, and a well-regulated medical industry.

- Asia Pacific market will grow rapidly between 2026 and 2035, driven by rising infertility rates, delayed pregnancies, and demand for advanced reproductive technologies.

Segment Insights:

- The equipment segment in the in-vitro fertilization market is projected to experience robust growth till 2035, driven by increased demand for advanced medical devices essential for successful fertility treatments.

Key Growth Trends:

- Rising success rate of IVF technology

- Delayed onset of pregnancies

Major Challenges:

- Associated complications with IVF

- Delayed onset of pregnancies

Key Players: CooperSurgical, Inc., Vitrolife AB, Cook Medical, Inc., Merck KGaA, Ferring Pharmaceuticals, Irvine Scientific (FUJIFILM), Thermo Fisher Scientific Inc., Genea Biomedx, OvaScience, Inc., Progyny, Inc.

Global In-vitro Fertilization (IVF) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.06 billion

- 2026 Market Size: USD 28.64 billion

- Projected Market Size: USD 50.8 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Turkey

Last updated on : 18 September, 2025

In-vitro Fertilization Market Growth Drivers and Challenges:

Growth Drivers

- Rising success rate of IVF technology: Several individuals and couples are pursuing fertility treatments encouraged by the increasing success rates of IVF technology. As per a press release by the American Society of Reproductive Medicine, in April 2024, the number of babies born from IVF increased from 89,208 in 2021 to 91,771 in 2022. It further states that 2.5% of all births in the U.S. result from successful ART cycles. Advancements in reproductive technologies have significantly increased the chances of successful pregnancies. As IVF becomes more effective and reliable, it boosts patient confidence, leading to a greater demand for these services. This trend is further supported by an increasing number of R&D practices, enhancing precision and safety in fertility treatments.

- Delayed onset of pregnancies: Career priorities, financial stability, and personal choices are some of the reasons driving the recent trend of delayed pregnancies. This in turn has proven highly beneficial for the in-vitro fertilization market. As more individuals opt to conceive later in life, fertility naturally declines, increasing the need for assisted reproductive technologies like IVF. This shift in societal norms has contributed to the growing demand for fertility treatments, especially among women in their late 30s and 40s. Additionally, rising awareness of fertility preservation options, such as egg freezing, further supports the use of IVF among individuals planning to conceive later in life. As per an article by BBC, June 2023, HFEA declared that over 4,000 patients froze their eggs in 2021, in comparison to 2,500 in 2019.

Challenges

- Associated complications with IVF: The treatment can lead to several complications, including multiple pregnancies, which increases the risk of premature birth and low birth weight. OHSS is another potential complication that makes the ovaries swell painfully due to excessive hormone stimulation. Additionally, IVF sometimes results in ectopic pregnancies, where the embryo implants outside the uterus. Multiple IVF cycles can prove to be emotionally and physically draining for several patients. These factors are a threat to the in-vitro fertilization market, leading to lesser adoption rates for the treatment.

- Associated social stigma, and ethical, and legal issues with IVF: These treatments often face social stigma, particularly in conservative cultures, where infertility is misunderstood or viewed as a taboo. Ethical issues arise concerning embryo selection, freezing, and disposal. Furthermore, legal challenges exist around the use of donor sperm or eggs, surrogacy, and parental rights, which vary by country or region. This further complicates the access and regulation in the IVF market. These factors are restraining the in-vitro fertilization market growth, majorly in developing countries and regions.

In-vitro Fertilization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 27.06 billion |

|

Forecast Year Market Size (2035) |

USD 50.8 billion |

|

Regional Scope |

|

In-vitro Fertilization Market Segmentation:

Product Segment Analysis

The equipment segment in the in-vitro fertilization market is projected to hold a revenue share of 44.8% by the end of 2035. The growth is attributed to increased demand for advanced medical devices and laboratory instruments essential for successful fertility treatments. The need for precise, efficient, and safe handling of gametes and embryos, and improved success rates of IVF are also driving the segment’s growth significantly. Companies in partnership with other institutions are also focusing on developing a wide array of equipment to meet this rising demand.

For instance, in May 2022, a research team from the University of Adelaide announced the development of a ground-breaking new micro-device, in partnership with medical technology company Fertilis. This micro-device was introduced to streamline the only fertility treatment procedure available for men with low sperm counts Additionally, increasing infertility rates have given rise to multiple fertility clinics all around the world. This in turn has further bolstered the demand for IVF equipment, making it the leading segment under products.

End use Segment Analysis

Fertility clinics and IVF centers dominated the end use segment as these specialized centers offer comprehensive services, including advanced diagnostic tools, personalized treatment plans, and cutting-edge IVF procedures. Moreover, the expansion of fertility clinics, in both developed and developing regions has made IVF treatments more accessible. For instance, in June 2024, Kindbody, a leading fertility clinic network in the U.S., announced the opening of a state-of-the-art clinic in Newport Beach, CA. The company will add an in vitro fertilization (IVF) lab to meet the growing demand for comprehensive fertility in the area.

The rising demand for higher success rates and expert care provided by these clinics has positioned them as the leading end use segment in the IVF market. Clinics and IVF centers usually offer a better patient-centric environment, offering streamlined processes and shorter waiting times. This enhances the overall patient experience in comparison to larger hospitals, making the clinics a better choice. As per an article by The Economic Times, September 2024, India is home to over 2,500 fertility clinics at present.

Our in-depth analysis of the in-vitro fertilization market includes the following segments:

|

Product |

|

|

Type of Cycle |

|

|

Procedure |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

In-vitro Fertilization Market Regional Analysis:

North America Market Insights

North America industry is set to dominate majority revenue share of 30.5% by 2035. The region benefits from highly developed healthcare infrastructure, significant advancements in IVF technology, and a well-regulated medical industry. For instance, the U.S. FDA regulates drugs and devices used in IVF, followed by the implementation of the Fertility Clinic Success Rate and Certification Act by the CDC. Moreover, semen analysis and sperm function tests are high-complexity tests regulated by the Clinical Laboratory Improvement Amendments of 1988 (CLIA '88) in the U.S. Strict compliance with standards and on-site inspections are essential. Factors such as these make the North America market more reliable and investment-friendly.

The U.S. is the largest shareholder of the North America in-vitro fertilization market. Companies are strategically accelerating their businesses in the U.S. market to expand their footprint and impact on the market. For instance, in April 2023, US Fertility, and Ovation Fertility announced their agreement to combine and become the leading fertility company in the United States. This enhanced platform aimed to drive growth innovation and best practices to improve patient access, experience, and outcomes. Despite the high cost of treatment, the U.S. market growth is supported by technological innovations and awareness.

Canada in-vitro fertilization market is witnessing steady growth with rising demand for fertility treatments. Factors include infertility, delayed childbearing, and improved awareness of reproductive options. Furthermore, the Canadian healthcare system is known for its accessibility. Advances in reproductive technologies and increasing acceptance of ART are also propelling the market to grow further. In addition to the existing prominent players in the country, several numbers of IVF startups have also been recently launched, predicting significant growth for the country by 2035.

APAC Market Insights

APAC in-vitro fertilization market is growing rapidly owing to the increasing infertility rates, delayed pregnancies, and the rising demand for advanced reproductive technologies. Primarily due to the increasing awareness of fertility treatments and expanding clinics across the region, the region is anticipated to witness further growth during the forecast period. Several companies are launching products and initiatives to meet the demand for IVF treatments. For instance, in May 2023, Merck announced the launch of a new initiative, Fertility Counts, to address the challenges associated with low birth rates in the APAC region. It is intended to offer research and resources to support policymakers in identifying policy interventions that will be effective in building family-friendly societies.

Changing societal attitudes towards assisted reproduction is one of the prime driving factors for the India in-vitro fertilization market. India has recently become a hub for medical tourism, offering cost-effective IVF procedures with high success rates, and attracting patients from both domestic and international markets. Supportive government initiatives, an increasing number of fertility clinics, and advancements in IVF technology are further projected to boost the in-vitro fertilization market growth of the country.

Owing to its large population and rapidly changing social norms around family planning, China is projected to witness considerable growth the relaxation of the one-child policy and the growing acceptance of ART have further fueled the demand for IVF treatments. Additionally, the rising trend of delayed pregnancies due to career-focused lifestyles, with increased infertility rates, is also boosting the in-vitro fertilization market in China. Government initiatives supporting reproductive health, and the availability of advanced IVF technologies is anticipated to drive the market further.

In-vitro Fertilization Market Players:

- Cook Medical

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Esco Medical

- FUJIFILM Irvine Scientific, Inc.

- GE HealthCare Technologies, Inc.

- Genea BIOMEDX

- Gynemed GmBH & Co. KG

- Hamilton Thorne Ltd.

- IVFtech ApS

- Merck KGaA

- Nidacon International AB

- The Baker Company Inc.

- The Cooper Companies Inc.

- Thermo Fisher Scientific Inc.

- Vitrolife Group

Key companies are focusing on technological advancements such as genetic testing and embryo selection, to enhance success rates. Additionally, many companies are forming strategic partnerships with fertility clinics and research institutes to enhance their service offering and broaden their geographic reach. Other strategies include product launches, mergers, and acquisitions, in addition to investments in automation, and AI-driven technologies. In 2024, CooperSurgical announced the acquisition of ZyMot Fertility, a subsidiary of DxNow, Inc. The acquisition is aimed at adding ZyMot’s first-of-its-kind sperm separation device to CooperSurgical’s portfolio of assisted reproductive technology products and services. Streamlining processes, improving outcomes, reduction in costs, and catering to the growing demand for accessible and efficient IVF treatments are propelling the market players further.

Recent Developments

- In October 2023, Hamilton Throne announced the acquisition of Gynetics Medical Products, N.V., and Gynetics Services B.V. The acquisition is aimed at expanding Gynetics product offerings into additional international markets and increasing direct sales through existing Hamilton Thorne sales channels.

- In May 2023, AIVF partnered with Genea Biomedx to launch their integrated system by combining Genea Biomedx's leading Geri time-lapse incubator with AIVF's advanced EMA AI platform. The integrated system is aimed at providing widespread access to personalized, optimized IVF care.

- In January 2021, Philips and Merck KGaA collaboratively launched a multi-year partnership aiming at the inclusion of digital technologies in fertility treatments—combining informatics, mobile ultrasound diagnostics, and more.

- Report ID: 6483

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

In-vitro Fertilization (IVF) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.