Hydrogen Fuel Cell Vehicle Market Outlook:

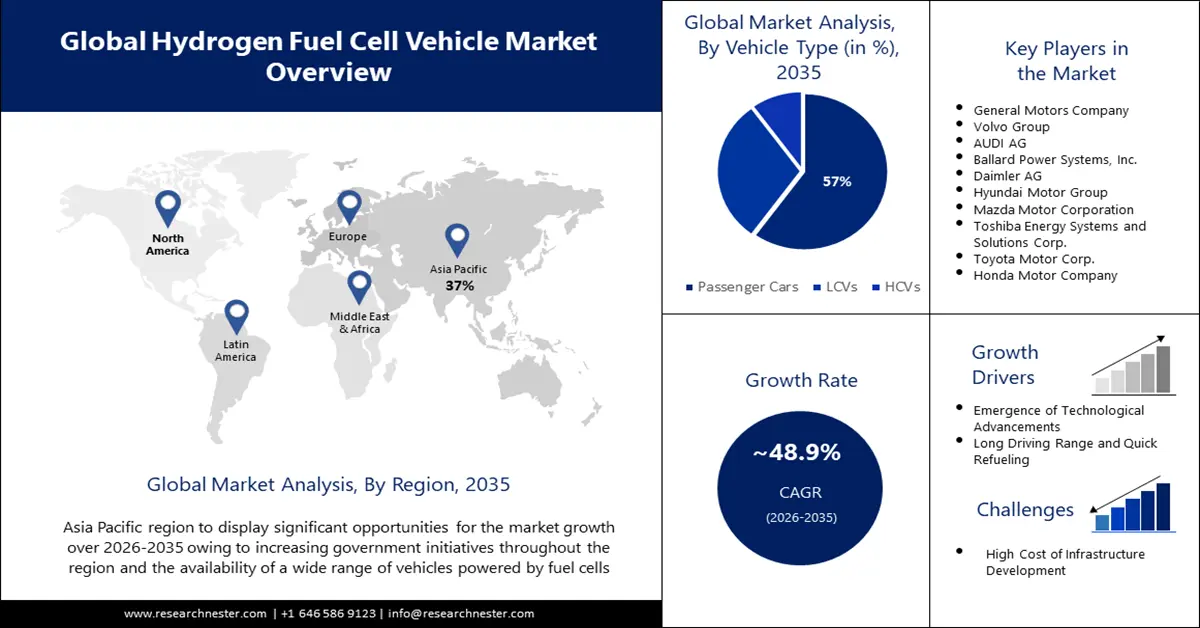

Hydrogen Fuel Cell Vehicle Market size was over USD 2.5 billion in 2025 and is projected to reach USD 133.93 billion by 2035, witnessing around 48.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrogen fuel cell vehicle is evaluated at USD 3.6 billion.

The hydrogen fuel cell vehicle market is driven by a shift in focus toward sustainable fuel alternatives and rising R&D in the area. The overarching goal of adopting fuel cells has led to high competitiveness with incumbent and novel technologies, with emphasis on heavy-duty applications, where primarily carbon emission reduction and criteria pollutants can be achieved. The U.S. DOE’s 2024 Fuel Cell Technologies Subprogram pursues this agenda with its comprehensive RD&D portfolio. Its strategy comprises near-, mid-, and long-term areas of focus aligned with the overall Hydrogen and Fuel Cell Technologies Office (HFTO) strategic framework and national clean hydrogen priorities

The near-term priority, which aligns with the highest-impact opportunities identified in the U.S. National Clean Hydrogen Strategy and Roadmap, is to develop Proton Exchange Membrane (PEM) fuel cells for heavy-duty commercial fleets. The subprogram targets USD 80/kW long-haul hydrogen fuel cell trucks by 2030 and ultimately reach USD 60/kW while prioritizing reducing system costs, boosting performance, and cell longevity for hydrogen fuel cell vehicle market liftoff and price-competitiveness. Based on the Energy Policy Act sections 815[a] and 815[b] (as presented by Clean Hydrogen Manufacturing and Recycling provisions), the subprogram focuses on aiding manufacturing heavy-duty fuel cell parts and stack production.

Pathways from Baseline Technology Parameters toward Ultimate Targets

|

End use |

2023 Status |

2030 Target |

Ultimate Target |

|

Heavy-Duty Transportation |

• Cost $170/kW • Durability >10,000 h • Peak efficiency 64% • PGM loading >0.4 mg/cm2 |

• Cost $80/kW • Durability 25,000 h • Peak efficiency 68% • PGM loading ≤0.3 mg/cm2 |

• Cost $60/kW • Durability 30,000 h • Peak efficiency 72% • PGM loading ≤0.25 mg/cm2 |

Source: U.S. DOE

A pathway to achieve the 2030 and ultimate cost targets for a heavy-duty fuel cell vehicle system, specifically showing how RD&D can help achieve the target

Source: U.S. DOE

Key Hydrogen Fuel Cell Vehicle Market Insights Summary:

Regional Highlights:

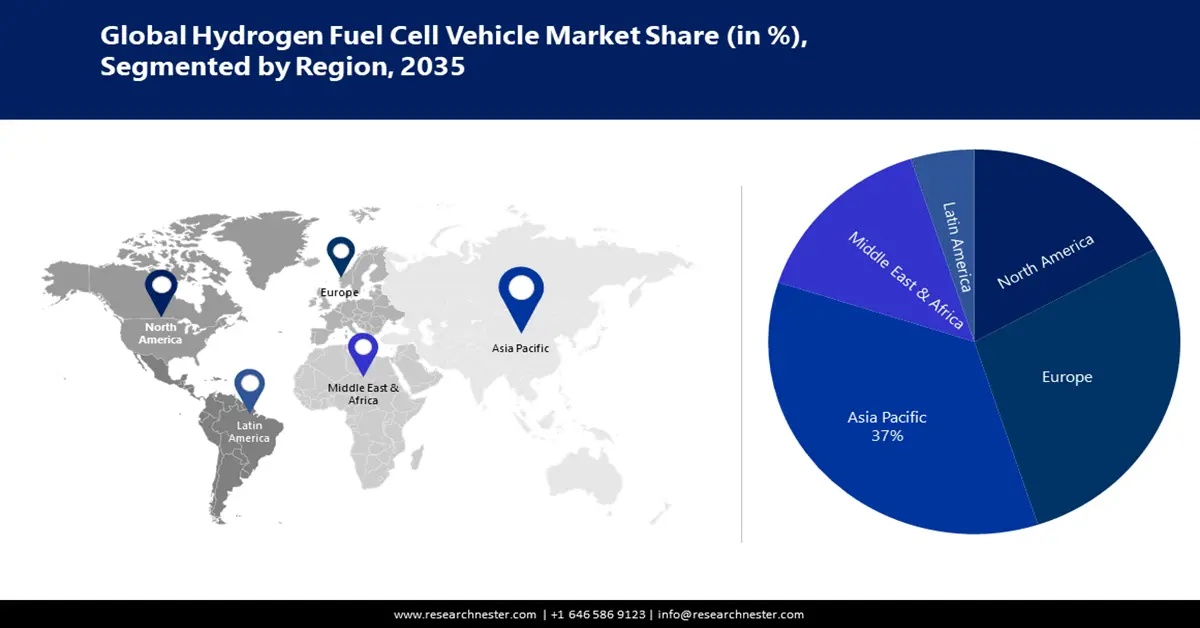

- Asia Pacific hydrogen fuel cell vehicle market will dominate over 37% share by 2035, driven by supportive government initiatives and rising FDI promoting hydrogen fuel cell vehicle adoption.

- Europe market will account for 27% share by 2035, fueled by the European Commission’s carbon reduction commitment and growing awareness of hydrogen fuel cell vehicle benefits.

Segment Insights:

- The passenger cars segment in the hydrogen fuel cell vehicle market is forecasted to achieve a 57% share by 2035, driven by booming demand from the growing middle-class population.

- The proton exchange membrane segment in the hydrogen fuel cell vehicle market is expected to achieve a substantial share by 2035, attributed to the higher efficiency and lower emissions of PEMFCs.

Key Growth Trends:

- Supportive government initiatives for infrastructure development

- Financial incentives and investments in hydrogen and fuel cell projects

Major Challenges:

- High cost of infrastructure development and barriers in the Final Investment Decision (FID)

Key Players: General Motors Company, Volvo Group, AUDI AG, Ballard Power Systems, Inc., MAN SE, BMW Group, Daimler AG, Hyundai Motor Group.

Global Hydrogen Fuel Cell Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.5 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 133.93 billion by 2035

- Growth Forecasts: 48.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, South Korea, China, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Hydrogen Fuel Cell Vehicle Market Growth Drivers and Challenges:

Growth Drivers

- Supportive government initiatives for infrastructure development: The infrastructure setup for hydrogen fueling systems is high, which is why the U.S. Government introduced the Inflation Reduction Act (IRA) in 2022. It incentivizes projects by allowing a tax credit of up to 45V, USD 3/kg of hydrogen. This comprehensive policy for taxpayers establishes certainty for hydrogen producers to stabilize their product offering in the hydrogen fuel cell vehicle market. Furthermore, in 2023, the U.S. DOE, complying with Assembly Bill 8, sanctioned the California Energy Commission (CEC) to provide financial aid of USD 20 million annually for building refueling stations for hydrogen fuel cell vehicles till July 1, 2030.

California aims to achieve carbon neutrality for buses and trucks by 2045. By Q3 2023, the State supported a network of 66 retail stations, and 54 of them operated at a 60% capacity, thereby catering to 34,800 FCEVs. CARB reported in the 2023 Annual Evaluation that the FCEV population in California could grow to 34,900 FCEVs by 2026 and to 62,600 FCEVs by 2029. In November 2023, the CEC released the GFO-23-604, a solicitation to enhance station reliability, and funded USD 11 million for operations. This has a mandatory 95% station uptime as a clause for this grant.

Additionally, in 2023, the CEC rendered USD 7.7 million to FirstElement Fuel Inc. for hydrogen refueling component production in California and to ease supply chain restraints. The Clean Transportation Program in FY 2022-23 allocated USD 257 million to light-duty hydrogen refueling station projects and the Budget Act in 2022 granted USD 100 million to the CEC to clean hydrogen generation from biofuels and electrolysis of renewable sources, which is estimated to stabilize prices in California.

Hydrogen Refueling Station Network and Quantity of FCEVs Supported

|

Station Status |

Station Quantity |

FCEVs Stations Can Support |

|

Open Retail |

66 |

58,000 |

|

Planned |

64 |

130,000 |

|

Total Funded |

130 |

188,000 |

Source: U.S. DOE

- Financial incentives and investments in hydrogen and fuel cell projects:

The IRA 2022 includes clean energy tax credits to propel in-house renewable energy manufacturing. The IRA's incentives include provisions promoting fuel cell technologies and clean hydrogen by creating new federal tax credits or extending existing federal tax credits. For instance, the Advanced Energy Project Credit allows an extension of investment tax credit by 30% and approves funding for hydrogen infrastructure, fuel cell EVs, and electrolyzers, among other products. It also expands tax credit to include projects at manufacturing facilities that want to reduce their greenhouse gas emissions by at least 20%. Also, it covers the credit sunset and extends the 30% credit cap for alternative fuel refueling projects.

Research Nester estimates that the hydrogen momentum is likely to remain strong through 2035 with the rising deployment of resources. Till October 2023, more than 1,400 green hydrogen projects were announced globally, and over 1,000 will be at a partial deployment stage by 2030. Europe has the highest number of these developments (~500), with investments announced (~USD 190 billion) and an absolute funding surge (~USD 30 billion), followed by North America with roughly 250 projects. Moreover, the DOE is keen on boosting the domestic clean hydrogen production to 10 million metric tonnes (MMT) annually by 2030 and 50 MMT by 2050. It also emphasizes the government’s strategy to reduce hydrogen costs to USD 1/Kg.

Challenges

- High cost of infrastructure development and barriers in the Final Investment Decision (FID): The development of infrastructure poses a hurdle for hydrogen fuel cell vehicles (FCVs). The limited number of hydrogen refueling stations makes potential buyers wary of investing in FCVs as they have concerns, about the convenience and range of refueling options.

Hydrogen Fuel Cell Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

48.9% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 133.93 billion |

|

Regional Scope |

|

Hydrogen Fuel Cell Vehicle Market Segmentation:

Vehicle Type Segment Analysis

The passenger cars segment is predicted to hold over 57% hydrogen fuel cell vehicle market share by the end of 2035. The segment growth can be attributed to the booming demand for passenger cars from the growing middle-class population, increasing disposable income, and the availability of affordable finance for vehicles.

Additionally, the increasing demand for electric vehicles and the ride-hailing services are also contributing to the growth of the passenger car segment. Hydrogen fuel cell vehicles provide a more efficient and cleaner form of transportation than traditional gasoline and diesel-powered vehicles. They require less maintenance, have a longer range, and are more cost-effective than other types of vehicles.

Technology Segment Analysis

The proton exchange membrane segment is poised to capture substantial Hydrogen fuel cell vehicle market share by 2035. The segment growth can be attributed to the proton exchange membrane fuel cells (PEMFCs) being an attractive alternative to traditional combustion engines because they offer higher efficiency and lower emissions. They have become increasingly popular for the production of zero-emission vehicles.

Our in-depth analysis of the global hydrogen fuel cell vehicle market includes the following segments:

|

Vehicle Type |

|

|

Technology |

|

|

Range |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Fuel Cell Vehicle Market Regional Analysis:

APAC Market Insights

By the end of 2035, Asia Pacific hydrogen fuel cell vehicle market is likely to hold the largest revenue share of over 37%, owing to supportive government initiatives and rising FDI. Programs such as the Hydrogen Road Maps and the Hydrogen Council are aiding market growth. A directive from China's Development and Reform Commission issued in November 2021 mandated the production of 5,000 hydrogen fuel cell vehicles for port transportation, buses, and intercity logistics by the end of 2025. In India, the focus on hydrogen mobility is a pivotal step toward the net-zero emission objective by 2070. Kerala’s ongoing developments in hydrogen mobility are anticipated to pave a path for the rest of India to scale sustainable transport initiatives. According to the World Economic Forum, the transit sector accounts for 8.4% of the country’s carbon footprint, which has long struggled to electrify heavy-duty vehicles.

China is the world’s largest hydrogen manufacturer, with a yield of 25 million tons (Mt). Most of it is sourced from fossil fuels (25% from natural gas and 60% from coal) as feedstocks in chemical facilities or refineries. China’s commitment to attain carbon neutrality by 2060 underscores a key policy-oriented progress that could drive a shift to renewables from fossil fuels and steadfast FCV deployment. According to the CSIS 2022 report, China’s hydrogen demand is estimated to cross 35 Mt in 2030 (5% of the country’s energy supply), by 2050 it will be about 60 Mt (10% of China's energy supply), and 100 Mt by 2060 (20%). In addition, there were 8,400 FCVs in 2020, making China the world’s third-largest FCV market. CSIS anticipates that the 1 million FCVs will be supplied and 1,000 operational HRS by 2030.

Europe Market Insights

By 2035, Europe is estimated to capture hydrogen fuel cell vehicle market share of over 27%. The hydrogen fuel cell vehicle market expansion can be attributed majorly to the European Commission’s commitment to lower carbon emissions and the increasing awareness about the benefits of hydrogen fuel cell vehicles. For instance, Daimler announced in May 2022 that they are planning to include electric vehicles and hydrogen fuel vehicles in their portfolio by 2030. This is leading to the development of more efficient and cost-effective hydrogen fuel cell vehicles.

Germany hydrogen fuel cell vehicle market is driven by government strategies that outline the goal of carbon neutrality by subsidizing hydrogen generation. In 2020, the government rolled out its National Hydrogen Strategy (NHS), and later, in May 2024, the Hydrogen Acceleration Act was introduced to fast-track this journey toward sustainability. Public funding significantly multiplied after the NHS. In June of 2020, an economic stimulus package was integrated by the government that allocated USD 7.6 billion to ramp up hydrogen technology development and another USD 2.2 billion for international partnerships.

Hydrogen Fuel Cell Vehicle Market Players:

- General Motors Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Volvo Group

- AUDI AG

- Ballard Power Systems, Inc.

- MAN SE

- BMW Group

- Daimler AG

- Hyundai Motor Group

Hydrogen fuel cell vehicles are vital for the energy transition in the transportation industry. To build an optimal and stable hydrogen economy, stakeholders are engaging in strategic partnerships, availing government subsidies to foster both demand and production, particularly catering to heavy-duty and long-haul fleets. Some of the prominent players include:

Recent Developments

- In February 2025, Toyota Motor Corporation introduced an innovative fuel cell (FC) system. This third-generation fuel cell system results from the company’s continuous efforts towards innovations in the hydrogen society.

- In February 2025, Honda Motor Co., Ltd. revealed its latest offerings Honda Next Generation Fuel Cell Module and the Fuel Cell Power Generator, at the H2 & FC exhibition conducted in Japan. The mass production of modules and generators is anticipated to start in 2027 and 2026, respectively.

- In November 2024, the Export-Import Bank of the United States (EXIM) revealed the finalization of a transaction for Connecticut-based exporter FuelCell Energy Inc. under its Project & Structured Finance Program. This is a loan guarantee of around USD 10.0 million to support the replacement of existing fuel cell modules with new ones.

- In May 2024, Toyota Motor Corporation announced the expansion of its hydrogen headquarters in North America. This move is set to boost the innovations and commercialization of the company’s fuel cell technology overseas.

- Report ID: 3616

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Fuel Cell Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.