Hosted PBX Market Outlook:

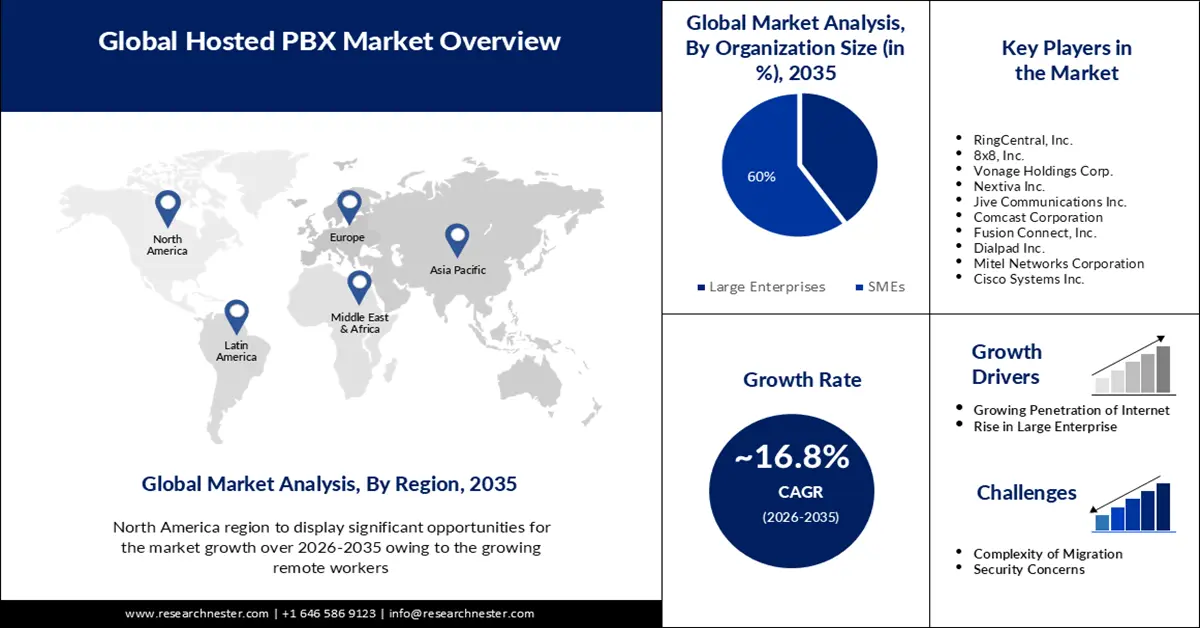

Hosted PBX Market size was over USD 15.08 billion in 2025 and is projected to reach USD 71.26 billion by 2035, witnessing around 16.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hosted PBX is evaluated at USD 17.36 billion.

The growth of the segment can be attributed to growing small sized businesses. In the US, there are about 31 million small businesses, which make up approximately 98% of all enterprises. Hosted PBX eliminates the need for small enterprises to purchase and operate costly on-premises PBX equipment. Instead, the system is managed and maintained by the service provider, lowering the overall cost of ownership.

Moreover, employees may work from any location with an internet connection and yet be linked to the same phone system as a result of hosted PBX, which is perfect for scattered and remote teams. Hence, with the growing employees working the demand for hosted PBX market is growing. The overall cost of ownership is decreased with hosted PBX since staff are no longer required to buy and maintain pricey on-premises PBX equipment. Moreover, hosted PBX companies often have strong security mechanisms in place to guard against data breaches, assisting in ensuring the privacy and security of crucial corporate conversations.

Key Hosted PBX Market Insights Summary:

Regional Highlights:

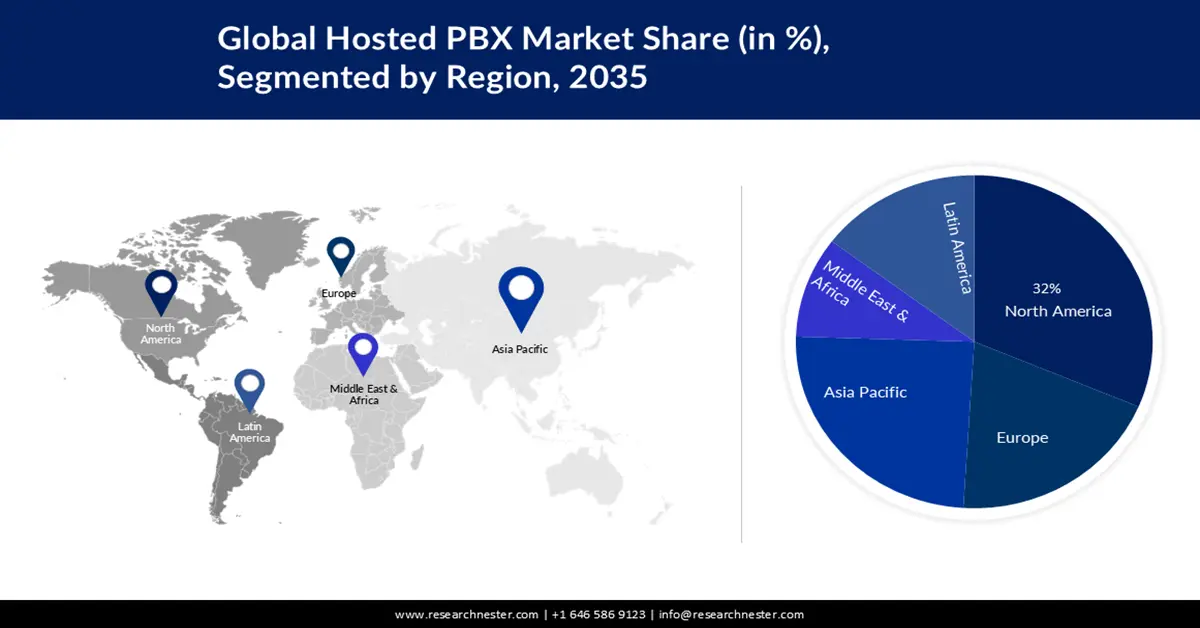

- North America hosted PBX market will secure around 32% share by 2035, driven by surge in cloud adoption and disaster recovery needs.

Segment Insights:

- The bfsi segment in the hosted pbx market is projected to capture a 35% share by 2035, influenced by the adoption of advanced analytics for fraud detection and risk management in financial services.

- The SMEs segment in the hosted PBX market is projected to witness significant growth over the forecast period, driven by limited funding for traditional PBX systems and lack of IT infrastructure and staff.

Key Growth Trends:

- Upsurge in Remote Learning

- Growth in E-commerce Industry

Major Challenges:

- Security Concerns Associated

- Complexity of migration is set to hamper the growth of market

Key Players: of Vonage Holdings Corporation, Nextiva Inc., Jive Communications Inc., Comcast Corporation, Fusion Connect, Inc., Dialpad Inc., Cisco System Inc.,.

Global Hosted PBX Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.08 billion

- 2026 Market Size: USD 17.36 billion

- Projected Market Size: USD 71.26 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 11 September, 2025

Hosted PBX Market Growth Drivers and Challenges:

Growth Drivers

- Upsurge in Remote Learning – Students could access course materials and communicate with teachers from any location that has an internet connection by using hosted PBX to promote learning. In total more than 2 million students are pursuing their higher education through online learning, globally.

- Growth in E-commerce Industry – In order to gain the trust and loyalty of their clients, e-commerce enterprises heavily rely on customer service. For customer service teams, hosted PBX could offer a dependable and adaptable phone system that would enable them to answer queries, address problems, and offer high-quality customer service.

- Growing Penetration of Internet – Businesses may use their phone system from any location with an Internet connection as a result of hosted PBX which is built on cloud-based technology. These companies need to be flexible since they may need to swiftly scale up or down their phone systems to accommodate shifting demands or if they have personnel that work across several locations.

Challenges

- Security Concerns Associated – Since hosted PBX systems could be accessed via the internet, unauthorized access is a possibility. Hackers might take advantage of system flaws to obtain private information or place unauthorized calls, which could incur expensive fees for the company. Moreover, phishing attacks may be used by cybercriminals to deceive consumers into disclosing login credentials or other sensitive data. They might then employ this information to place unauthorized calls or acquire access to the hosted PBX system. Additionally, DoS attacks could be used to flood the hosted PBX system with traffic, which would eventually cause it to crash or stop functioning. This could seriously harm corporate operations and result in losses.

- Complexity of migration is set to hamper the growth of market

- Lack of Customization is Estimated to Restrict Market Growth in Upcoming Period.

Hosted PBX Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 15.08 billion |

|

Forecast Year Market Size (2035) |

USD 71.26 billion |

|

Regional Scope |

|

Hosted PBX Market Segmentation:

End User Segment Analysis

The BFSI segment is predicted to hold 35% share of the global hosted PBX market during the time period. The growth of the segment can be attributed to growing financial services, followed by the rising economy. One of the economies in the world with the quickest growth rates was India. Real GDP increased by 7.7 percent annually over the first three quarters of the fiscal year 2022-2023, maintaining its strong overall growth, which is projected to be 6.9 percent for the entire year. During the second half of FY 22/23, there were some indications of moderation. Hosted PBX solutions frequently provide cutting-edge capabilities including call routing, call recording, and voicemail-to-email, which could be very valuable for financial services that largely rely on phone communication.

Organization Segment Analysis

Hosted PBX market from the SMEs segment is expected to have the significant growth over the forecast period. SMEs frequently lack funding for traditional PBX systems as well as employees and infrastructure in the IT department. As a result, they are more inclined to use hosted PBX systems to gain access to cutting-edge communication technologies, lower expenses, and enhance customer experience. Moreover, for SMEs who depend on mobile and remote workers, hosted PBX systems enable employees to operate remotely or while on the go. This enables them to stay in contact and keep up a high level of production regardless of where they are. Additionally, hosted PBX systems are easy to set up and administer, making them a popular solution for SMEs that don't have dedicated IT employees.

Our in-depth analysis of the global hosted PBX market includes the following segments:

|

Component |

|

|

Organization Size |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hosted PBX Market Regional Analysis:

North America Market Insights:

The hosted PBX market in North America is projected to have the highest share of 32% by the end of 2035, backed by surge in cloud adoption. As per a data approximately 48% organizations in United States are currently operating with the help of cloud system. Moreover, natural calamities including hurricanes, tornadoes, and earthquakes are common in North America, and they could interfere with communication infrastructure. Advanced disaster recovery features, such as automatic failover to backup systems, are provided by hosted PBX systems, which could assist businesses in maintaining communication even in the case of a disaster. Additionally, numerous businesses in North America are expanding quickly, and they require communication systems that can keep up with their expansion.

APAC Market Insights

The Hosted PBX Market in the Asia Pacific is set to grow significantly during the assessment period. Some of the world's fastest-growing economies are found in Asia Pacific, and as a result, many small and medium-sized firms are expanding there. These companies have access to a scalable and cost-effective communication solution with hosted PBX systems. Moreover, in recent years, Asia Pacific has seen tremendous investment in internet infrastructure, with many nations deploying high-speed broadband networks. Additionally, numerous companies in the Asia-Pacific region work in regulated fields including finance, healthcare, and the public sector, which have stringent regulations about compliance.

Hosted PBX Market Players:

- RingCentral, Inc,

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 8*8, Inc.

- Vonage Holdings Corporation

- Nextiva Inc.

- Jive Communications Inc.

- Comcast Corporation

- Fusion Connect, Inc.

- Dialpad Inc.

- Mitel Networks Corporation

- Cisco Systems Inc.

Recent Developments

- Fusion Connect, Inc. a top-tier worldwide Managed Communication Service Provider and Microsoft Cloud Solution Provider, provides Operator Connect for Microsoft Teams, enabling companies to seamlessly include calling features into the top collaboration platform.

- A leading provider of AI-powered global enterprise cloud communications, video meetings, collaboration, and contact center solutions, RingCentral, In., unveiled a next-generation communication solution for frontline workers that improves employee or company owned mobile devices with walkie-talkie, voice, AI-powered video Ai-powered video capabilities, team messaging, file sharing, and more.

- Report ID: 4932

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hosted PBX Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.