Green Tires Market Outlook:

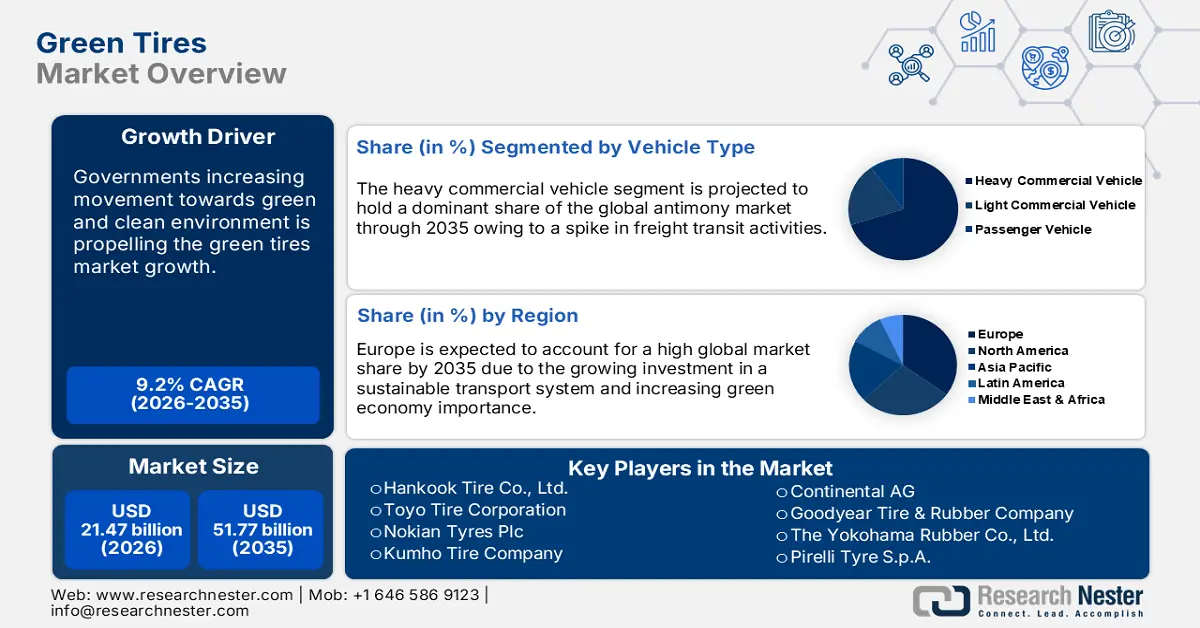

Green Tires Market size was valued at USD 21.47 billion in 2025 and is expected to reach USD 51.77 billion by 2035, expanding at around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green tires is evaluated at USD 23.25 billion.

The growth of the market can primarily be attributed to the growing demand for more sustainable products, as well as the rising use of green tires with innovative features around the globe. For instance, it is estimated globally that a reduction of 8% can be achieved in fuel consumption with green tires featuring the silica/silane system.

Global green tires market trends such as recent advancements in environment-friendly initiatives, an increasing number of tires in wheels, and the demand for green tires in the transportation sector are estimated to influence the growth of the market over the forecast period. For instance, it is estimated that in the year 2022, there were more than 35 billion wheels globally. Furthermore, rising energy prices, stringent government restrictions, increased urbanization, and globalization, rising environmental consciousness among consumers regarding fuel consumption and, utilizing green tires, as they also aid in lowering global pollution, are estimated to influence the growth of the market as well. For instance, according to the National Academies of Science, a 10% reduction in rolling resistance can save 1 to 2% in fuel. Furthermore, customers who purchase some of the green tires currently available can reduce rolling resistance by 20% and reduce fuel consumption by up to 4%.

Key Green Tires Market Insights Summary:

Regional Highlights:

- Europe green tires market, the largest share by 2035, is fueled by strong healthcare network and investment in sustainable transport.

Segment Insights:

- The heavy commercial vehicle segment in the green tires market is expected to achieve the highest market share by 2035, driven by the rising number of commercial vehicles and increasing freight transit demand globally.

- The 16"-19" segment in the green tires market is expected to hold the largest share by 2035, influenced by the popularity of larger vehicles like SUVs and CUVs, causing demand for larger diameter tires.

Key Growth Trends:

- Strict Government Laws to Reduce Pollution

- Less Rolling Resistance

Major Challenges:

- Lack of Awareness Regarding the Benefits of Green Tires

- Increasing costs for raw materials

Key Players: Bridgestone Corporation, Continental AG, Manufacture Française des Pneumatiques Michelin, Goodyear Tire & Rubber Company, The Yokohama Rubber Co., Ltd., Pirelli Tyre S.p.A., Hankook Tire Co., Ltd., Toyo Tire Corporation, Nokian Tyres plc, Kumho Tire Company.

Global Green Tires Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.47 billion

- 2026 Market Size: USD 23.25 billion

- Projected Market Size: USD 51.77 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

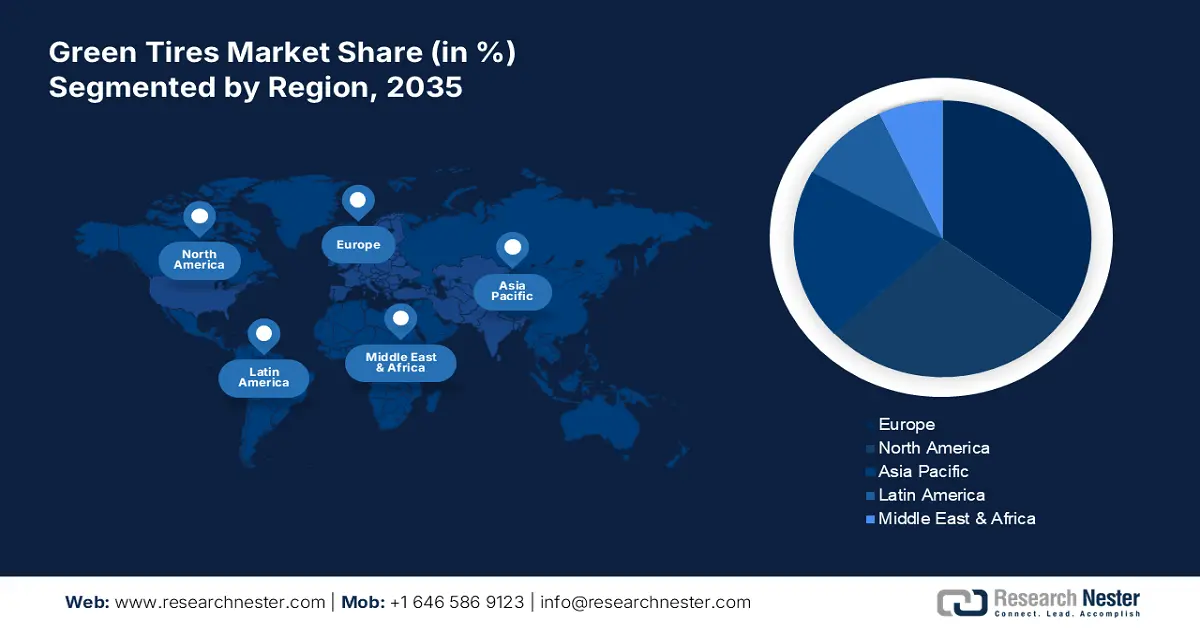

- Largest Region: Europe

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Green Tires Market Growth Drivers and Challenges:

Growth Drivers

-

Strict Government Laws to Reduce Pollution- Significant environmental issues are being caused by the rising rate of carbon emissions from vehicles. Moreover, vehicles are the most significant source of air pollution, as they use fossil fuels very frequently. Even though individual automobiles do not emit a lot of pollutants, the total number of vehicles on the planet is rather significant. When assessing how many pollutants a car emits, one of the most important parts to consider are the tires. To slow the growth of vehicle emissions, the governments of many nations have imposed several pollution standards on automakers. For instance, tire labeling is compulsory for all tires sold in Europe. The Tire Energy Label, which the European Union has introduced, provides precise information about the safety and ecological qualities of tires based on important standards such as noise levels, fuel efficiency, and wet surface braking. The embossed labels on the tires that list these standards might help the customers make better choices that reduce air pollution, improve road safety, and increase fuel efficiency. According to the three standards, the tires are ranked in order of best to worst, from A to G. When compared to tires in the "G" category, tires in the "A" category typically use 7.5% less gasoline. The tires in the "A" category also provide significantly more precise braking on wet surfaces at high speeds.

-

Less Rolling Resistance- Vehicle rolling resistance is a major factor in carbon emissions. As rolling resistance rises, the amount of energy needed to overcome friction rises as well, increasing the number of pollutants that are released. This contributes to the vehicle type's overall weight being reduced, which results in fuel savings. Green tire development makes it possible to use less gasoline and hence lower rolling resistance. The energy needed for the tires to make contact with the road and deform increases owing to rolling resistance. A thorough control of the composite interaction between the tire structure, tread pattern, and rubber compound is also necessary to decrease rolling resistance. For instance, NAS Transportation Research Board found that it was technically and economically feasible to reduce the average rolling resistance of replacement tires by 10%. This would improve the fuel economy of passenger cars by 1% to 2%, saving 1.2 to 2.3 billion gallons of fuel annually across the country.

-

Rising Penetration of Vehicles- In Europe there were 405 million vehicles in the first quarter of 2022, distributed among EU and non-EU nations.

-

Increase in the Development of Transportation Infrastructure - It is predicted that, from now until 2040, approximately USD 2 trillion in investments in transportation infrastructure would be required for its development globally.

-

Increased Investment in Energy Transition – It was determined that the global investment in the energy transition will exceed 750 billion in 2021.

Challenges

-

Lack of Awareness Regarding the Benefits of Green Tires - The barrier to the market of green tires is thought to be a lack of awareness in emerging green tires market. On the other hand, the benefits of using CNG and crossover vehicles are well-known to consumers. In any case, people are unaware of the benefits of green tires and how they help reduce fuel consumption, so they frequently choose cheaper alternatives. Additionally, it is predicted that the sale of green tires in low and middle-income countries will be affected by a few public and private-sector efforts to protect the environment in these nations through cheaper options. For instance, according to studies, the average consumer pays less attention to the benefits of green tires market such as India and Indonesia.

-

Availability of Alternate Cost-Effective Substitutes

-

Increasing costs for raw materials- The materials used to make green tires are synthetic and organic in use. Such materials can have erratic availability and costs. The cost of raw materials has also been rising rapidly in recent years. For manufacturers of green tires, the rising cost of raw materials is a serious issue. Moreover, the production of green tires, silica, butyl, and silane are the major ingredients in rubber and the demand-supply imbalance, the price of these raw materials has been rising steadily over the past few years.

Green Tires Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 21.47 billion |

|

Forecast Year Market Size (2035) |

USD 51.77 billion |

|

Regional Scope |

|

Green Tires Market Segmentation:

Vehicle Type Segment Analysis

The global green tires market is segmented and analyzed for demand and supply by vehicle type into passenger vehicle, light commercial vehicle, and heavy commercial vehicle. The heavy commercial vehicle segment is predicted to have the highest revenue among these by the end of 2035, supported by the rising number of commercial vehicles and the spike in the need for freight transit globally. Moreover, there has been increasing production of commercial vehicles across the globe, that is predicted to boost the growth of the commercial vehicle segment in the market. For instance, by 2050, the need for freight transport will increase to 300 tons-kilometer from 135 ton-kilometer in 2015 across the globe.

Product Size Segment Analysis

The global green tires market is segmented and analyzed for demand and supply by product size into below 15-", between 16"-19", and above 19". Out of these three segments the 16"-19" segment is estimated to gain the largest market share over the projected time frame. Larger vehicles, including SUVs and CUVs, are becoming more popular, which is causing larger-diameter tires to gain popularity. There has been a rise in the trend of automotive cars with large-sized tires as consumer desire comfortable and luxurious automobiles. Moreover, the tire sizes of 16"-19" are growing quickly owing to the rising need for larger, more fuel-efficient automobiles, that is expected to drive the segment’s growth in the market.

Our in-depth analysis of the global market includes the following segments:

|

By Product Size |

|

|

By Vehicle Type |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Tires Market Regional Analysis:

The Europe green tires market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035.The growth of the market can be attributed to the presence of a strong healthcare network in the region, growing investment in a sustainable transport system, rising awareness among the government agencies for the green economy, and most importantly to the usage of silica in tire treads. For instance, in the Netherlands, all new buses will use 100% renewable energy from 2025 onwards while all buses have to become fully emission-free from 2030. The green technology trend has also been quickly adopted in the North American region, where the market for green tires is currently second after Europe. Further, the presence of leading automotive manufacturers such as Mercedes, BMW, Audi, Volkswagen, Ford, and GM in these two regions, promotes the market players to opt for easy transport and supply, which is anticipated to contribute to the green tires market growth in the region.

Green Tires Market Players:

- Bridgestone Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Manufacture Française des Pneumatiques Michelin

- Goodyear Tire & Rubber Company

- The Yokohama Rubber Co., Ltd.

- Pirelli Tyre S.p.A.

- Hankook Tire Co., Ltd.

- Toyo Tire Corporation

- Nokian Tyres plc

- Kumho Tire Company

Recent Developments

-

Bridgestone Americas, Inc. (Bridgestone Corporation) - announced that its Aiken County Passenger/Light Truck Radial earned the International Sustainability and Carbon Certification (ISCC) PLUS recognition, becoming the first tire manufacturing facility in America to have it.

-

Continental AG – revealed that Conti360° Fleet Solutions helps transport companies and fleet operators to get their vehicles fit for the future. As Conti360° provides the framework for correct tire selection and digital tire management.

- Report ID: 4470

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Tires Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.