Glycerine Market TOC

- An Outline of the Global Glycerine Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of Market Constituents

- Factors/Drivers Impacting the Growth of the Market

- Market Trends for Better Business Practices

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Government Regulation

- Pricing Analysis

- Industry Risk Analysis

- Demand risk analysis

- Supply risk analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Glycerine Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Impact of COVID-19 on Global Glycerine Market

- Industry Growth Outlook w.r.t Product Type

- Industry Value Chain Analysis

- Application Analysis

- Region-wise Demand Analysis

- Porter’s Five Forces Analysis

- EXIM Analysis

- Analysis on Key Biodiesel Producing Countries

- Competitive Positioning: Strategies to Differentiate a Company From its Competitor

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2023)

- Business Profile of Key Enterprise

- Emery Oleochemicals

- Detailed Overview

- Assessment of key offerings

- Analysis of growth strategies

- Exhaustive analysis on key financial indicators

- Recent developments and strategies

- Wilmar International Ltd.

- KLK OLEO

- GLACONCHEMIE GmbH

- Sakatomo Yakuhin Kogyo Co., Ltd.

- Granol

- IOI Oleochemical

- Scortis Healthcare

- Cargill, Incorporated

- Global Green Chemicals Public Company Limited

- Godrej Industries Limited

- Procter & Gamble

- Kao Corporation

- New Japan Chemical Co., Ltd.

- Kowa Emori Company Ltd.

- Emery Oleochemicals

- Global Glycerine Market Outlook

- Market Overview

- Analysis on Trends, Growth Factors in the Region, & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Global Glycerine Market Segmentation Analysis (2023-2036)

- By Product Type

- Refined Glycerine, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Crude Glycerine, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Source

- Biodiesel, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Vegetable Oils, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Animal Fats, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Synthetic, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Grade

- USP Grade, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Technical Grade, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Manufacturing Process

- Transesterification, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Saponification, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Fat Splitting, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cosmetics & Personal Care, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Food & Beverage, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Polyether Polyols, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Alkyd Resins, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others (Inks, Paper & Printing, Explosives, Lubricants, Tobacco), Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Geography

- North America, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Europe, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Asia Pacific, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East and Africa, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Product Type

- Cross Analysis of Product Type w.r.t. Application

- North America Glycerine Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- North America Glycerine Market Segmentation Analysis (2018-2036)

- By Product Type

- Refined Glycerine, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Crude Glycerine, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Source

- Biodiesel, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Vegetable Oils, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Animal Fats, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Synthetic, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Grade

- USP Grade, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Technical Grade, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Manufacturing Process

- Transesterification, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Saponification, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Fat Splitting, Market Value (USD Million), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Application

- Chemical Intermediates, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Cosmetics & Personal Care, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Food & Beverage, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Pharmaceutical & Healthcare, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Polyether Polyols, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Alkyd Resins, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Others (Inks, Paper & Printing, Explosives, Lubricants, Tobacco), Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Country

- US, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Canada, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- By Product Type

- Europe Glycerine Market Outlook

- Market Overview

- Analysis on Govt. Guidelines, Growth Factors in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Europe Glycerine Market Segmentation Analysis (2023-2036)

- By Product Type

- By Source

- By Grade

- By Manufacturing Process

- By Application

- By Country

- Germany, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- UK, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- France, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Italy, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Spain, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Russia, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Netherlands, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Europe, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Part 26

- Asia Pacific Glycerine Market Outlook

- Market Overview

- Analysis on Govt. Guidelines, Growth Factors in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia Pacific Glycerine Market Segmentation Analysis (2023-2036)

- By Product Type

- By Source

- By Grade

- By Manufacturing Process

- By Application

- By Country

- China, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- India, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Japan, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- South Korea, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Singapore, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Australia, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Asia Pacific, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Latin America Glycerine Market Outlook

- Market Overview

- Analysis on Govt. Guidelines, Growth Factors in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Latin America Glycerine Market Segmentation Analysis (2023-2036)

- By Product Type

- By Source

- By Grade

- By Manufacturing Process

- By Application

- By Country

- Brazil, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Argentina, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Mexico, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Latin America, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Middle East and Africa Glycerine Market Outlook

- Market Overview

- Analysis on Govt. Guidelines, Growth Factors in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Middle East and Africa Glycerine Market Segmentation Analysis (2023-2036)

- By Product Type

- By Source

- By Grade

- By Manufacturing Process

- By Application

- By Country

- GCC, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Israel, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- South Africa, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Thousand Tons), and CAGR & Y-o-Y Growth Trend, 2023-2036F

Glycerin Market Outlook:

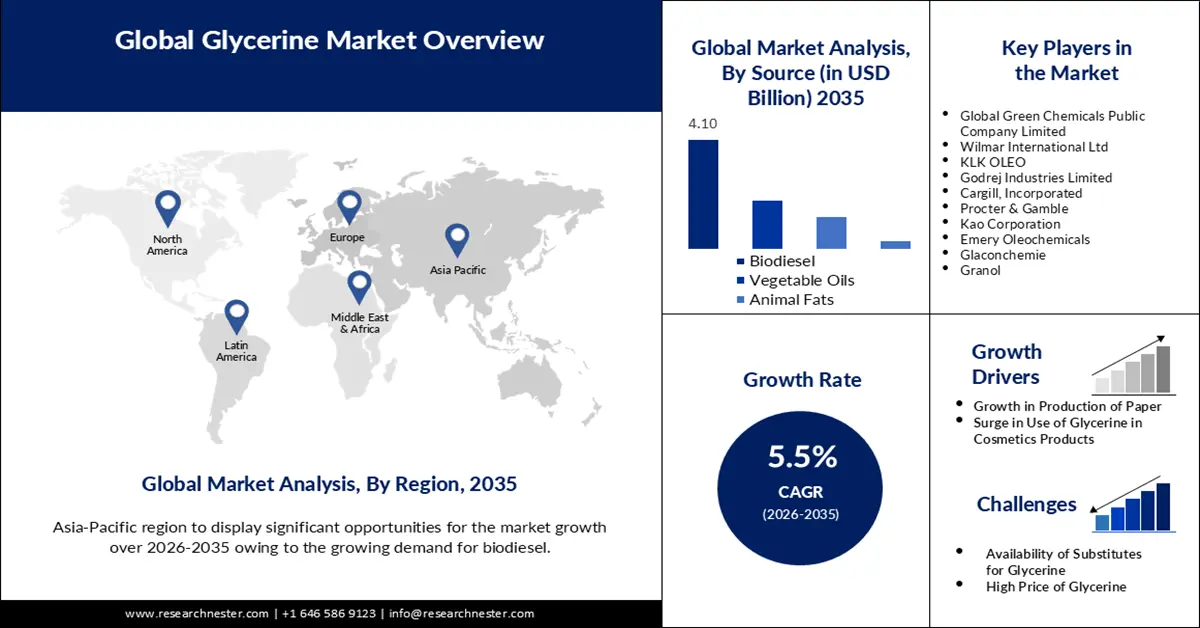

Glycerin Market size was over USD 3.13 billion in 2025 and is anticipated to cross USD 5.35 billion by 2035, growing at more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of glycerin is estimated at USD 3.28 billion.

The market growth is driven by rising demand for beverages and dairy products. Milk and milk products are consumed by over 6 billion people globally, most of whom reside in developing nations. As a food ingredient, glycerin is primarily used as a sweetener, thickener, and humectant.

Moreover, glycerin also has one of the major uses in tobacco and cigarettes to give it a sweet taste and produce vapor. As a consequence, with the growing consumption of tobacco and cigarettes, the market is experiencing great expansion. According to the World Health Organization, all across the world there are about 1.3 billion of population who consume tobacco products among most of them resides low- and middle-income nations.

Key Glycerin Market Insights Summary:

Regional Highlights:

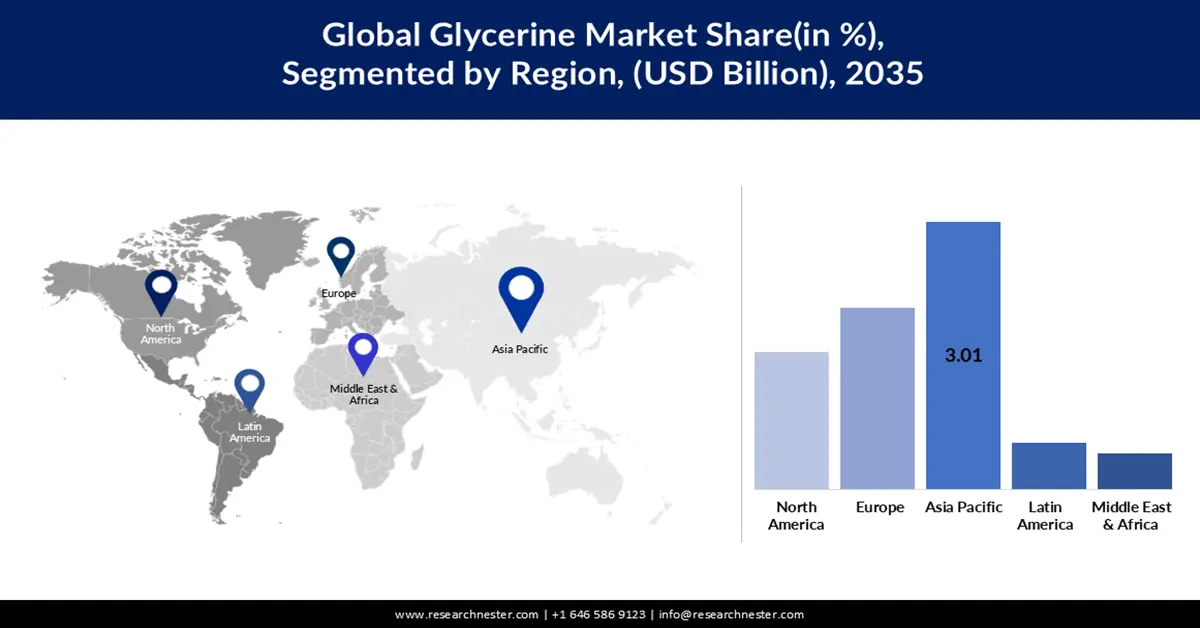

- Asia Pacific glycerin market will hold around 40% share by 2035, driven by growing demand for biodiesel and regional biofuel production capacity.

- North America market projects significant growth during the forecast timeline, driven by growing biodiesel business and reliable glycerin production facilities.

Segment Insights:

- The usp grade segment in the glycerin market is expected to secure the highest market share by 2035, driven by increasing use of high-purity glycerin in food and pharmaceuticals.

- The vegetable oils segment in the glycerin market anticipates substantial growth from 2026-2035, driven by rising adoption of vegetable oil glycerin with lower impurity levels.

Key Growth Trends:

- Growth in the Production of Paper

- Surge in Use of Glycerin in Cosmetics Products

Major Challenges:

- Availability of Substitutes for Glycerin

- High Price of Glycerin

Key Players: Global Green Chemicals Public Company Limited, Wilmar International Ltd, KLK OLEO, Godrej Industries Limited, Cargill, Incorporated, Procter & Gamble, Kao Corporation, Emery Oleochemicals, Glaconchemie, Granol.

Global Glycerin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.13 billion

- 2026 Market Size: USD 3.28 billion

- Projected Market Size: USD 5.35 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Brazil

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Glycerin Market Growth Drivers and Challenges:

Growth Drivers

- Growth in the Production of Paper: In the manufacture of paper, glycerin serves as a plasticizer, humectant, and lubricant. Additionally, it may be added to other ingredients in specialized treatments, such as grease-proofing. Because numerous papers are used as food wrappers or in hygienic products, glycerin's nontoxicity, odor lessness, and stability meet additional crucial quality standards. Hence, with the growing production of paper the market is also growing.

- Surge in Use of Glycerin in Cosmetics Products: To add smoothness and lubrication, glycerin is a harmless ingredient encompassed in many cosmetic and personal care items, such as toothpaste, soap, shaving cream, and skin/hair care items. Glycerol is an effective humectant in cosmetics as a result of its hygroscopicity, hydrophilicity, and solubility in water. This allows for a more gradual process of drying by reducing moisture loss from the product.

- Rise in Production of Biofuel: For about every 5 to 6 gallons of biodiesel generated, production facilities for the fuel produce significant amounts of crude glycerol as a byproduct product. The largest by-product of biodiesel manufacturing is typically glycerol, which accounts for around 11% of the total weight. In other words, the production of biodiesel results in the production of about 2 pounds of glycerol per gallon. This means that a biodiesel plant that produces approximately 29 million gallons per year will produce around 11499 tonnes of 99.9% pure glycerol.

Challenges

- Availability of Substitutes for Glycerin - Over the future years, market expansion is anticipated to be constrained by the accessibility of numerous replacements with superior qualities. For instance, propylene glycol is frequently utilized as a cheaper alternative to glycerin in cosmetic and toiletry goods. Additionally, glycerin can be replaced by ceramides in skincare products including moisturizers and lotions.

- High Price of Glycerin

- Adverse Effect of Glycerin on Health for Some People when Consumed

Glycerin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 3.13 billion |

|

Forecast Year Market Size (2035) |

USD 5.35 billion |

|

Regional Scope |

|

Glycerin Market Segmentation:

Source Segment Analysis

The vegetable oils segment is poised to grow at substantial CAGR over the forecast period, propelled by increasing use of vegetable oil glycerin. Vegetable fats that contain triglycerides, such as soybean, coconut, or palm oils, undergo heating under pressure with an alkaline catalyst and water in a process known as hydrolysis to produce vegetable glycerin. The glycerin separates from the fatty acids as a result of hydrolysis and mixes with the water. Moreover, vegetable oil glycerin can potentially be of slightly better quality considering the usually lower impurity levels seen in vegetable oils compared to animal fats.

Grade Segment Analysis

Glycerin market from the USP grade segment is anticipated to generate the highest revenue by the end of 2035. This could be owing to growing use of glycerin in food products and medicines. Pharmaceutical grade is a very high purity grade of chemical or solvent that is safe to be used in many pharmaceutical and personal care products, chemicals must meet strict potency and purity requirements specified by the USP or US Pharmacopoeia. Therefore, this grade is estimated to be necessary for the growth of any food or pharmaceutical products that contain glycerin.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Source |

|

|

Grade |

|

|

Manufacturing Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Glycerin Market Regional Analysis:

APAC Market Insights

The glycerin market in Asia Pacific is set to capture the largest revenue of 40% by the end of 2035. The growth of this sector in the region is influenced by growing demand for biodiesel. In 2022, the Asia-Pacific region produced about 385 thousand barrels of oil equivalent per day of biofuel.

North American Market Insights

The North America glycerin market is estimated to have significant growth during the forecast period. Due to plentiful supplies of soybean oil and great profitability, the biodiesel business in North America has been growing rapidly, which has also positively impacted the glycerin sector. Another cause for market expansion is thought to be the existence of significant important companies within the region in addition to the presence of reliable glycerin production facilities in the area.

Glycerin Market Players:

- Global Green Chemicals Public Company Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Wilmar International Ltd

- KLK OLEO

- Godrej Industries Limited

- Cargill, Incorporated

- Procter & Gamble

- Kao Corporation

- Emery Oleochemicals

- Glaconchemie

- Granol

- Other Players

Recent Developments

- UNLICS is a cosmetics brand that Kao Corporation has introduced for Gen Z guys who desire a deeper sense of beauty beyond just personal grooming. On December 1, 2022, UNLICS items made their debut on Rakuten and Amazon, the company's official online retail sites.

- Cargill, Incorporated and Croda have signed an agreement for Cargill to buy the majority of Croda's performance technologies and industrial chemicals business for USD 1.03 billion, cash-free and debt-free. Cargill's bioindustrial footprint would be significantly increased thanks to the investment, better enabling it to assist industrial producers looking for "greener" ingredient options.

- Report ID: 2681

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Glycerin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.