Thin-film Photovoltaic Market Outlook:

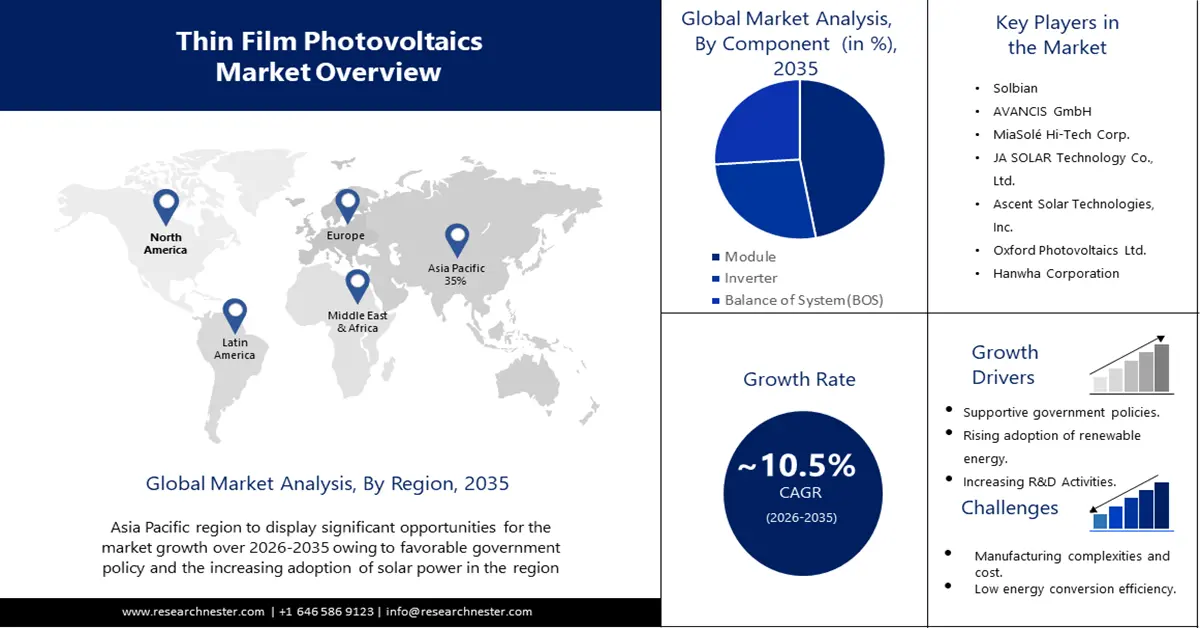

Thin-film Photovoltaic Market size was over USD 12.25 billion in 2025 and is projected to reach USD 33.25 billion by 2035, witnessing around 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thin-film photovoltaic is evaluated at USD 13.41 billion.

Increasing demand for the adoption of renewable energy as a primary fuel is projected to boost demand for thin-film PV. According to analysts at Research Nester, approximately one seventh of the world's energy today is produced from renewables. In addition, initiatives are taken by various governments across different countries to reduce greenhouse emissions and help increase environmental benefits in the long run, which is further expected to escalate the demand in the market. For instance, a significant new project to lower greenhouse gas emissions worldwide was unveiled by Administrator Samantha Power on November 3 as part of the US government's efforts to address the climate problem. By 2030, USAID will help partner nations avoid emitting six billion metric tons of carbon dioxide equivalent. This figure is nearly equivalent to the annual domestic emissions in the United States or the equivalent of taking more than 1 billion gasoline-powered cars off the road, thus promoting the segment.

Additionally, increasing concerns about reducing dependency on conventional sources of energy have led to the need for low-cost sustainable options, leading to advancements in photovoltaic technology to increase the production of electricity and reduce overall cost and weight. This will increase the affordability, resulting in the growth of the thin-film photovoltaic market.

Key Thin-film Photovoltaic Market Insights Summary:

Regional Highlights:

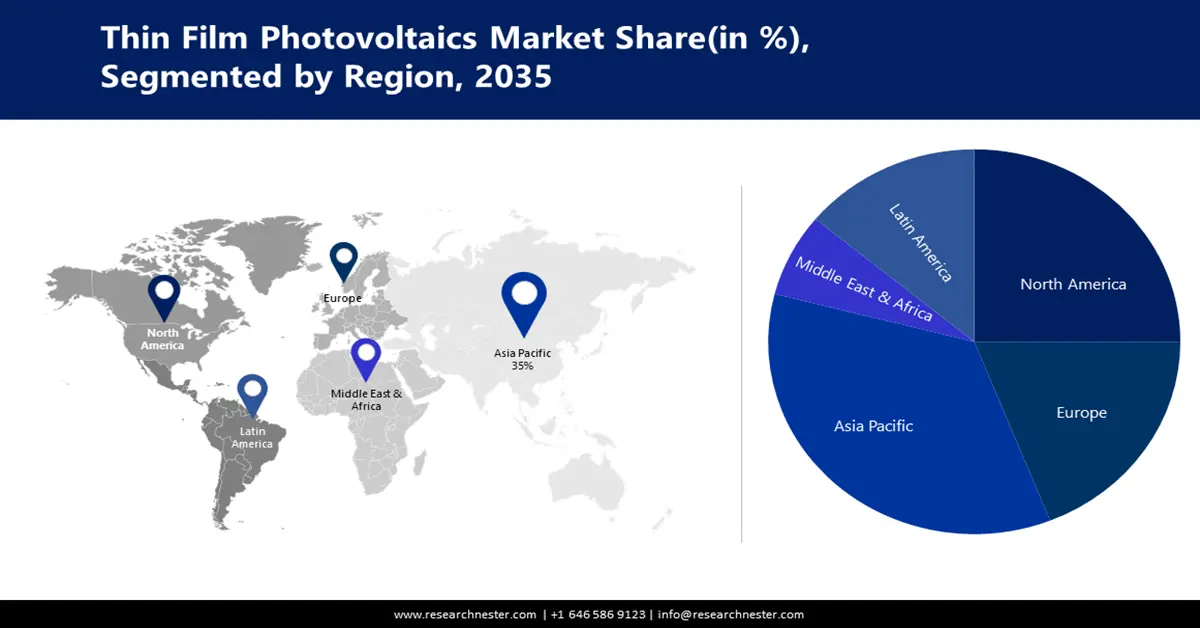

- Asia Pacific thin-film photovoltaic market is expected to capture 35% share by 2035, attributed to favorable government policies, the increasing use of solar power, and China, Japan, and India’s adoption of thin-film solar technologies.

- North America market will achieve significant revenue share by 2035, driven by the growing adoption of renewable energy, government incentives, and advancements in thin-film photovoltaic technologies.

Segment Insights:

- The module segment in the thin-film photovoltaic market is expected to witness robust growth through 2035, driven by advances in thin-film technology offering cost efficiency and flexibility.

Key Growth Trends:

- Government Incentives and Policies

- Technological Innovations and Research Investments

Major Challenges:

- Lower Energy Conversion Efficiency

- Initial set-up costs and the need for sophisticated manufacturing facilities can be barriers to entry for some companies.

Key Players: Solbian, AVANCIS GmbH, MiaSolé Hi-Tech Corp., JA SOLAR Technology Co., Ltd., Ascent Solar Technologies, Inc., Oxford Photovoltaic Ltd., Hanwha Corporation, Sharp Corporation, crystalsol GmbH, Mitsubishi Electric Corporation.

Global Thin-film Photovoltaic Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.25 billion

- 2026 Market Size: USD 13.41 billion

- Projected Market Size: USD 33.25 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Thin-film Photovoltaic Market Growth Drivers and Challenges:

Growth Drivers

-

Government Incentives and Policies- supportive government policies, incentives, and subsidies can significantly drive the adoption of thin-film photovoltaic. Financial incentives, tax credits, and favorable regulatory frameworks encourage businesses and individuals to invest in solar energy. The solar sector generated more than USD 36 billion of private investment in the US economy in 2022. Government initiatives aimed at promoting renewable energy adoption contribute to the overall growth of the thin-film photovoltaic market.

-

Technological Innovations and Research Investments- Ongoing research and development activities, coupled with investments in technological innovations, contribute to the continuous improvement of thin-film photovoltaic technologies. Breakthroughs in materials, processes, and device architectures can lead to advancements in efficiency, durability, and overall performance, making thin-film solar more competitive in the evolving renewable energy landscape.

- Enhanced Performance in Low-Light Conditions- Thin-film solar technologies often perform better in low light conditions compared to crystalline silicon solar panels. This characteristic makes them suitable for environments with partial shading, cloudy weather, or indirect sunlight. Enhanced performance in challenging lighting conditions expands the geographic range where thin-film photovoltaic can be effectively deployed.

- Scalability and Mass Production- Thin-film photovoltaic manufacturing processes are often conductive to large-scale and high-throughput production. This scalability allows for mass production, reducing the cost per unit and making thin-film solar technologies more economically viable for utility-scale solar projects. The ability to produce a significant volume of panels quickly is crucial for meeting the growing demand for renewable energy utilized for power generation technologies.

Challenges

-

Lower Energy Conversion Efficiency- Traditional crystalline silicon solar panels often have higher energy conversion efficiency compared to thin-film technologies. The lower efficiency of thin-film photovoltaic means that more significant surface areas are required to generate the same amount of power, impacting the overall cost-effectiveness of the technology.

-

Initial set-up costs and the need for sophisticated manufacturing facilities can be barriers to entry for some companies.

- The established dominance of crystalline silicon solar panels in the market poses a challenge for thin-film technologies.

Thin-film Photovoltaic Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 12.25 billion |

|

Forecast Year Market Size (2035) |

USD 33.25 billion |

|

Regional Scope |

|

Thin-film Photovoltaic Market Segmentation:

Component

Thin-film photovoltaic market from the module segment is poised to garner the largest revenue share over the forecast period, amounting to 47% of the market. Modules are the core components responsible for converting sunlight into electricity. Advances in thin-film technology, offering cost efficiency, flexibility, and improved efficiency, contribute to the dominance of the module segment. As demand for renewable energy grows, the focus on lightweight, scalable, and economically viable solar solutions amplifies the significance of thin-film modules in large scale solar projects, making it the primary driver for the anticipated major market share within the market. As per Research Nester Analysts, the market garnered a sustainable revenue of around USD 8 Billion in 2020.

Material Type

The copper indium gallium diselenide (CIGS) segment is anticipated to hold major revenue share in the global thin-film photovoltaic market. CIGS thin-film technology offers a balance of high efficiency, flexibility, and lower manufacturing costs. Its superior light absorption properties contribute to improved performance, making it suitable for various applications. As the solar industry emphasizes efficiency and cost-effectiveness, the versatility and competitive advantages of CIGS position it as a dominant material choice. The demand for lightweight, high- performance solar modules is expected to drive the significant market share held by CIGS in the evolving landscape of thin-film photovoltaic.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Material Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thin-film Photovoltaic Market Regional Analysis:

APAC Market Insights

Asia Pacific thin-film photovoltaic market is estimated to hold the largest revenue share, accounting for 35% of the global market. The favorable government policy and the increasing use of solar power are also contributing to market growth in this region. Countries such as China, Japan, and India Have been at the forefront of adopting thin-film solar technologies to meet escalating energy demands while addressing environmental concerns. China, in particular, has emerged as a global leader in thin-film manufacturing owing to key players in the region, leveraging economies of scale to drive down production costs. As regards total production capacity, Hanergy Group was the leading producer of Solar PV Thin-film modules from China during 2022. In 2022, the production capacity of Hanergy Group stood at approximately 600 megawatts. CNBM Solar, with a production capacity of 150 megawatts in the same year, was in the second position. Also, India with its ambitious renewable energy targets has contributed to the regional market expansion. The Asia Pacific market is characterized by a robust ecosystem of manufacturers, technological innovators, and government support, making it a key player in the global shift towards sustainable and efficient solar energy solutions.

North American Market Insights

North American thin-film photovoltaic market is set to attain significant revenue share. The region witnessed a dynamic evolution characterized by a blend of opportunities and challenges. The region experienced a surge in thin-film photovoltaic adoption, driven by a growing emphasis on renewable energy and government incentives promoting solar technologies. However, the market faced stiff competition from traditional crystalline silicon solar panels. Despite initial optimism, certain thin-film manufacturers encountered financial challenges, leading to industry consolidation. Further, advancements in thin-film technologies, coupled with a renewed focus on sustainability, have revitalized the market. The push for energy independence and the integration of solar power into smart grids have further fuelled interest in thin-film photovoltaic. The North American scenario reflects a resilient market, navigating technological advancements, competitive dynamics, and the broader renewable energy landscape in its pursuit of a sustainable and diversified solar future.

Thin-film Photovoltaic Market Players:

- First Solar.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solbian

- AVANCIS GmbH

- MiaSolé Hi-Tech Corp.

- JA SOLAR Technology Co., Ltd.

- Ascent Solar Technologies, Inc.

- Oxford Photovoltaic Ltd.

- Hanwha Corporation

- Sharp Corporation

- crystalsol GmbH

Recent Developments

- June, 2023- First Solar, Inc. revealed plans to produce a limited number of the first bifacial solar panels in history using cutting-edge thin-film semiconductors. At Intersolar Europe in Munich, Germany, a fully operational pre-commercial Series 6 Plus Bifacial photovoltaic (PV) module will make its industry premiere and be on show at First Solar's stand.

- June,2023- By obtaining an efficiency of 20.3%, Avancis has broken the previous record for a copper, indium, gallium, and selenium (CIGS) solar panel with an integrated series connection of 30 cm by 30 cm. The German manufacturer claims to have set a new world record for efficiency for a completely enclosed CIGS module with an integrated series connection of 30 cm × 30 cm.

- Report ID: 5615

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thin-film Photovoltaic Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.