Polymer Coated Fabrics Market Outlook:

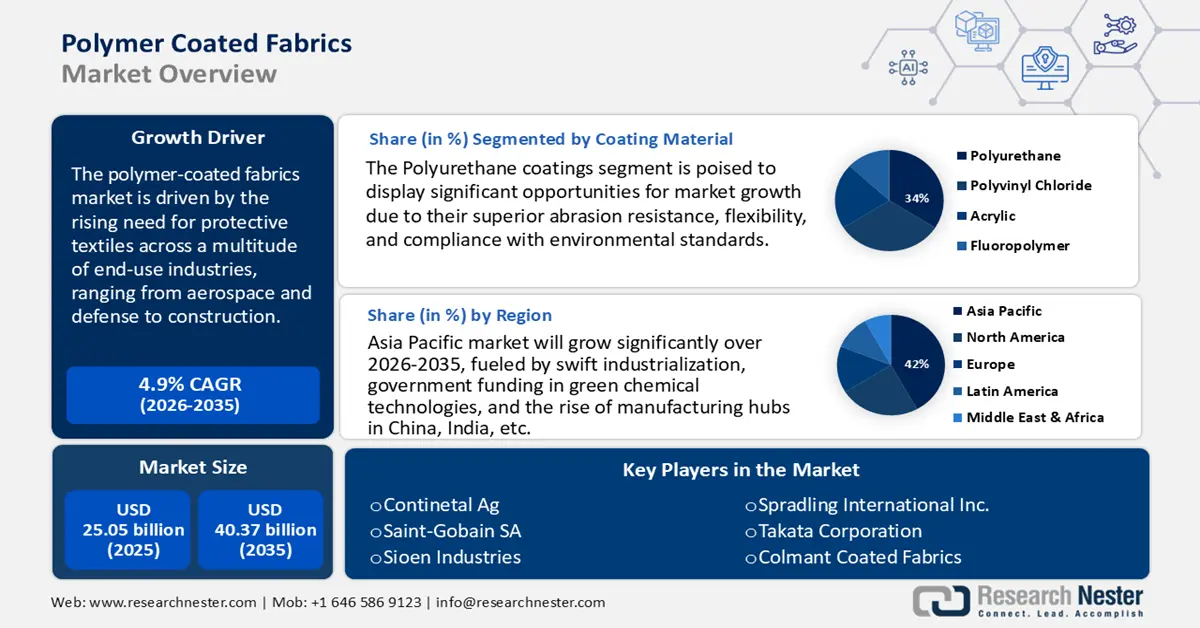

Polymer Coated Fabrics Market size was valued at approximately USD 25.05 billion in 2025 and is projected to reach USD 40.37 billion by 2035, growing at a CAGR of 4.9% during the forecast period from 2026 to 2035. In 2026, the industry size of polymer coated fabrics is assessed at USD 26.27 billion.

The primary driver for the global polymer coated fabrics market is the rising need for protective textiles across a multitude of end-use industries, ranging from aerospace and defense to construction. Such advancements stem from regulatory and safety standards instituted by OSHA and NIOSH health organizations in the United States. For example, OSHA's requirement of using protective clothing and equipment means that polymer coated fabrics are procured in agricultural, food processing, law enforcement, chemical processing, and medical industries, even defense.

Concerning materials supply and international trade, the polymer coated fabrics market has an extensive international trade network. In 2023, the international trading revenue for coated and laminated fabrics for industrial use is about $25.2 billion. The leading exporters of these types of fabrics are China ($8.08 billion) and Germany ($2.63 billion); the leading importer of such coated and laminated fabrics is the U.S. ($2.8 billion). Such numbers reflect a significant degree of trading networking that relies on international supply chains and materials. In addition, research, development, and deployment (RDD) are required for continued advancements in coating technology and compliance. Thus, several government-based initiatives and grants exist to foster a more compliant approach to coatings with more industrially advanced opportunities.

Key Polymer Coated Fabrics Market Insights Summary:

Regional Highlights:

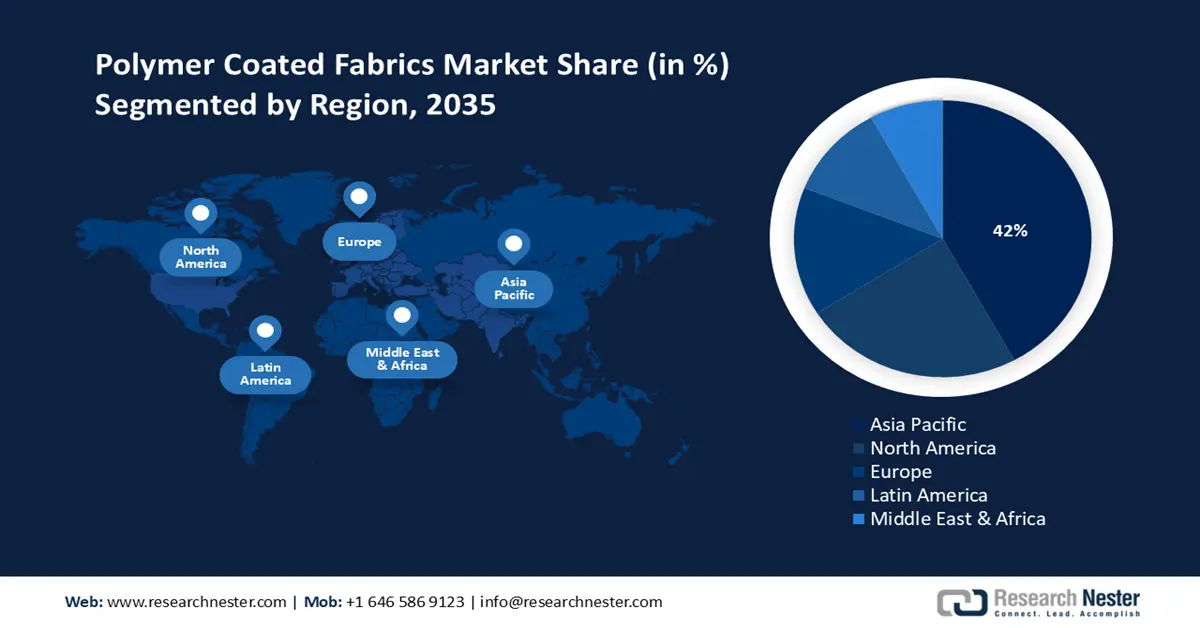

- By 2035, APAC is forecast to command a 42% share of the Polymer Coated Fabrics Market, supported by rapid industrialization, expanding manufacturing hubs, and escalating demand for lightweight and durable materials across key industries.

- North America is projected to secure a 24% revenue share by 2035, underpinned by strong industrial adoption and intensified government support for sustainable chemical production.

Segment Insights:

- The polyurethane coatings segment in the Polymer Coated Fabrics Market is projected to account for a 34% share by 2035, sustained by superior abrasion resistance, flexibility, environmental compliance, and growing automotive production.

- Polyester is expected to capture a 32% market share by 2035, reinforced by its high durability, chemical resistance, cost-effectiveness, and technological advancements in polyester coating formulations.

Key Growth Trends:

- Growing demand from the automotive industry

- Rising construction and infrastructure projects

Major Challenges:

- Price changes caused by limitations in raw material supply

- Delays in market entry due to lengthy regulatory approval processes

Key Players: BASF SE, Dow Inc., Mitsubishi Chemical Holdings, Covestro AG, LG Chem Ltd., Huntsman Corporation, UPL Limited, Wacker Chemie AG, Asahi Kasei Corporation, Solvay S.A., Syngenta Group, Formosa Chemicals & Fibre Corp, Synthomer plc, Petronas Chemicals Group, Nufarm Limited.

Global Polymer Coated Fabrics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.05 billion

- 2026 Market Size: USD 26.27 billion

- Projected Market Size: USD 40.37 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: APAC (42% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 9 September, 2025

Polymer Coated Fabrics Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand from the automotive industry: Polymer-coated fabrics are increasingly utilized in automotive applications such as seat covers, airbags, convertible tops, and interior linings. This is due to their durability, resistance to wear and tear, and aesthetic attractiveness. With a 1,480-crore investment, the National Technical Textile Mission (NTTM) seeks to establish India as a major player in the global technical textile market while simultaneously growing the domestic market. Additionally, electric vehicle (EV) manufacturers are implementing lightweight and durable materials to help increase efficiency, thus allowing for a further expansion of coated fabric usage throughout the global automotive industry.

- Rising construction and infrastructure projects: The polymer coated fabrics market size in India was Rs. 226.80 crores in 2019–20, and based on an anticipated 10% compound annual growth rate, the high-rise construction sector is forecast to drive the market's size in 2024–2025 to Rs. 365.27 crores. Global consumption in 2019–20 was approximately USD 334 million, and by 2024–2025, it is predicted to increase at a CAGR of 5% to reach USD 425.92 million. The construction industry is a significant driver of demand for polymer coated fabrics used in awnings and canopies, roofing membranes, and architectural tensile structures, as these fabrics provide weather resistance, UV protection, and flexibility of structure. The demand for coated fabrics is anticipated to grow with increasing investments in smart cities, urban housing, and commercial infrastructure development. The increasing emphasis on both sustainable and lightweight building materials continues to accelerate, which further aids in the adoption of polymer coated fabrics on today's modern construction projects and strengthens market growth.

- Expansion in healthcare and medical applications: Polymer coated fabrics are heavily utilized in medical mattresses, surgical gowns, hospital furniture, as well as protective coverings. According to ASSOCHAM and Velocity, India's medical waste production is expected to reach 775.5 tons per day by 2022, with a compound annual growth rate of almost 7%. This is because polymer coated fabric is waterproof and easy to clean, and provides excellent antibacterial properties. The demand for coated fabrics in the medical sector is increasing due to the rise of infections, as well as the growing concern about hygiene standards when it comes to healthcare facilities. Additionally, with rising budgets on healthcare infrastructure and increased demand for durable and protective materials to be used in hospitals and clinics, the issue of coated fabric is a critical piece of the medical sector.

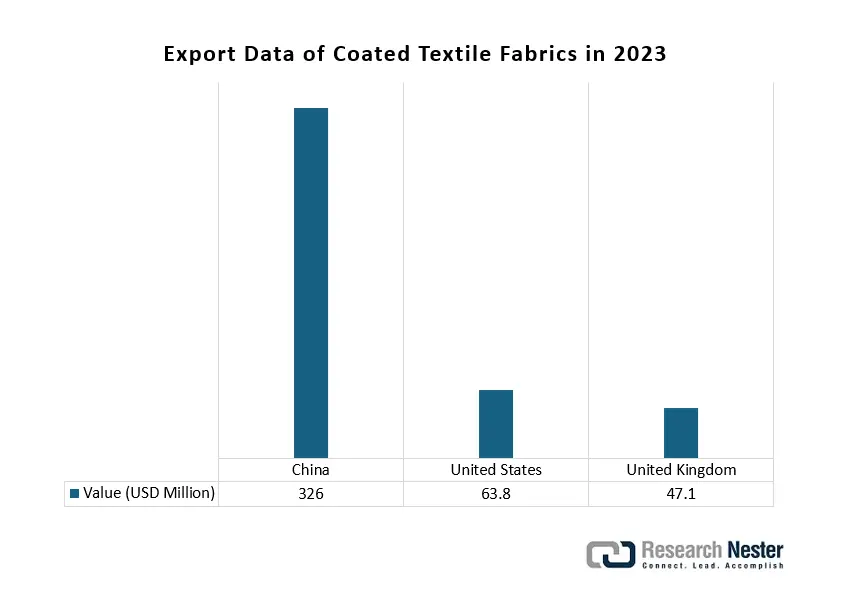

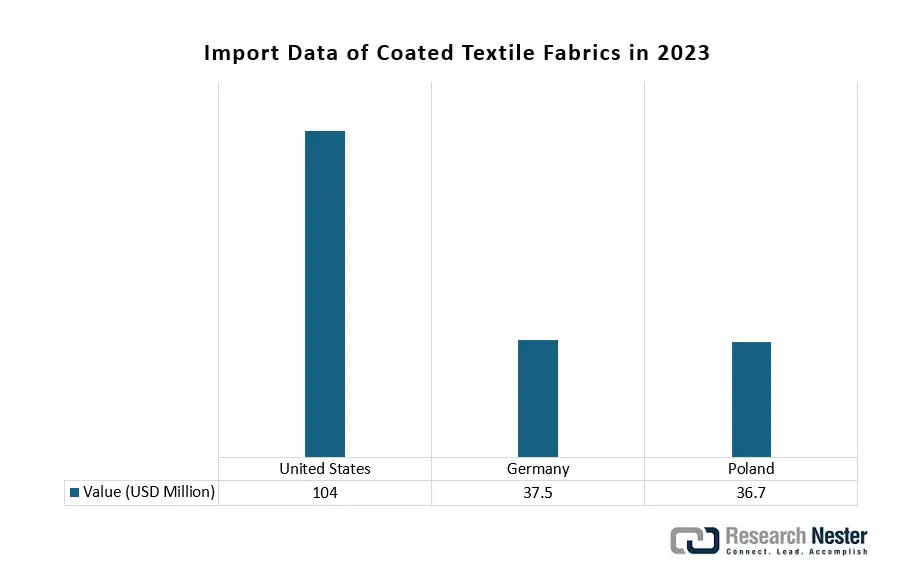

1. Emerging Trade Dynamics in Coated Textile Fabric

The global trade in coated textile fabrics is a significant catalyst for growth in the polymer-coated fabric market, as demand rises for durable, functional materials across sectors like automotive, construction, and protective gear. International supply chains facilitate the exchange of advanced coating technologies and specialty polymers, enabling manufacturers to enhance attributes such as waterproofing, flame resistance, and structural resilience. This cross-border collaboration not only expands material accessibility but also accelerates innovation in sustainable and high-performance coated textiles. As a result, trade dynamics are pivotal in shaping the development and adoption of next-generation polymer-coated fabrics worldwide.

Source: OEC

Source: OEC

2. Polyurethane Trade Dynamics in Polymer Coated Fabric

Polyurethane is a vital component of polymer-coated fabrics, providing flexibility, durability, abrasion resistance, and water repellence. The properties of polyurethane offer comfort, aesthetics, and long-term functionality, with it essential for automotive applications such as seat covers, air bags, convertible tops, and interior linings. Global polyurethane trade revenues were $7.45 billion in 2023, down 17.7% from 2022 when revenues reached $9.05 billion, with a 5-year annualized decline rate of 0.48%.

Import & Export Data of Polyurethane in 2023

|

Exporters |

Value (USD Million) |

Importers |

Value (USD Million) |

|

Germany |

1,620 |

China |

720 |

|

China |

944 |

United States |

446 |

|

United States |

781 |

Germany |

446 |

Source: OEC

Challenges

- Price changes caused by limitations in raw material supply: The ups and downs of petrochemical prices, driven by geopolitical issues, throw a wrench in the usual pricing strategies. The 2022 conflict between Russia and Ukraine led to a surge in natural gas prices throughout Europe, which subsequently increased the costs of polymer raw materials and narrowed profit margins for suppliers of polymer-coated fabrics.

- Delays in market entry due to lengthy regulatory approval processes: In 2022, new safety regulations in China pushed back the approval and market introduction of chemicals for polymer-coated fabrics by six months, negatively impacting supplier revenues and slowing down the adoption of new solutions. Polymer

Polymer Coated Fabrics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 25.05 billion |

|

Forecast Year Market Size (2035) |

USD 40.37 billion |

|

Regional Scope |

|

Polymer Coated Fabrics Market Segmentation:

Coating Material Segment Analysis

Polyurethane coatings are projected to capture a 34% share of the global polymer coated fabrics market by 2035, primarily due to their superior abrasion resistance, flexibility, and compliance with environmental standards when compared to PVC alternatives. The Environmental Protection Agency (EPA) highlights that coatings based on polyurethane exhibit a reduced environmental impact, which facilitates their broader application in the medical and automotive industries. Furthermore, advancements in environmentally friendly polyurethane formulations are in line with sustainability efforts, thereby enhancing demand. The growth of the polyurethane segment is additionally bolstered by the rising production of automobiles worldwide, as indicated by the International Energy Agency.

Fabric Base Type Segment Analysis

Polyester is anticipated to secure a notable 32% share of the global market for polymer-coated fabrics by the year 2035. Its extensive application is fueled by its remarkable durability, chemical resistance, and cost-effectiveness, rendering it suitable for use in automotive, construction, and protective textile sectors. Other polyesters were traded globally for $10.9 billion in 2023, a 17.9% drop from $13.3 billion in 2022. Trade in this category has increased by 1.31% annually over the last five years. The material's adaptability and performance in extreme conditions further strengthen its demand. Moreover, innovations in polyester coating technologies improve fabric characteristics, facilitating ongoing market expansion. Collectively, these elements establish polyester as a crucial sub-segment within the growing polymer-coated fabrics industry.

Application Type Segment Analysis

Transportation is anticipated to secure a notable 28% share of the global market for polymer-coated fabrics by the year 2035, due to extensive use in automotive, aerospace, railways, and marine applications. These fabrics offer high durability, resistance to UV, abrasion, and chemicals, making them ideal for seat covers, airbags, interiors, convertible tops, and protective covers. Rising vehicle production, growing demand for lightweight materials, and stringent safety regulations further boost adoption, positioning transportation as the leading application segment in the global market.

Our in-depth analysis of the polymer coated fabrics market includes the following segments:

| Segment | Subegment |

|

Coating Material |

|

|

Fabric Base Type |

|

|

Application Type

|

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polymer Coated Fabrics Market - Regional Analysis

Asia Pacific Market Insights

The APAC market for polymer-coated fabrics is expected to capture a 42% share of revenue by 2035. This growth is fueled by swift industrialization, government funding in green chemical technologies, and the rise of manufacturing hubs in China, India, etc. The increasing need for lightweight and durable materials in sectors like electronics, automotive, and construction is propelling market growth. Additionally, environmental regulations and sustainability efforts from regional governments are speeding up the adoption of polymer-coated fabrics. It shows budget distributions, policy initiatives, and investment trends that are fostering growth in the polymer-coated fabrics chemical industry.

By 2037, China is expected to capture the largest revenue share in the APAC region, due to its extensive industrial base, strong government support for sustainable chemical production, and a swiftly expanding manufacturing sector. As part of the nation's efforts to shift to a greener economy, China's main economic regulator, the National Development and Reform Commission, recently announced a 2.4-billion-yuan ($355 million) investment to save energy and lower carbon emissions.

India’s expanding polyurethanes trade is significantly boosting the polymer-coated fabric market, supplying key raw materials needed for producing high-performance, durable coatings. Growing domestic manufacturing of coated textiles for applications in automotive, footwear, and technical textiles is fueled by both local demand and export opportunities. This synergy supports innovation in flexible, water-resistant, and abrasion-resistant fabric technologies. As India strengthens its role in global polyurethane supply chains, it further accelerates the growth and diversification of the polymer-coated fabric sector domestically and internationally.

India’s Polyurethanes Trade Data (2023)

|

Export Destinations |

Value (USD Million) |

Import Sources |

Value (USD Million) |

|

Indonesia |

13.2 |

China |

119 |

|

Bangladesh |

10.3 |

Singapore |

55.6 |

|

United Arab Emirates |

7.35 |

South Korea |

34.2 |

|

Nigeria |

5.18 |

Netherlands |

32.8 |

|

Italy |

4.61 |

Germany |

24.7 |

Source: OEC

North America Market Insights

The polymer-coated fabrics market in North America is expected to capture a 24% share of revenue by 2035, mainly fueled by strong industrial demand and significant government backing for sustainable chemical production. Notable trends involve heightened federal investment in green chemical projects and cutting-edge manufacturing technologies, which promote innovation and adherence to regulations. The emphasis on environmental safety and energy-efficient production techniques in the U.S. and Canada also boosts market expansion, with support from EPA and DOE initiatives.

In 2022, the U.S. Department of Energy announced plans to invest $78 million to advance cross-sector industrial technologies and decarbonize the manufacturing of chemicals. This investment has helped boost polymer-coated fabrics through initiatives from the DOE and EPA. OSHA regulations have also played a role in making manufacturing safer, which in turn has built more trust in the polymer coated fabrics market. Federal grants are backing advanced technologies like Gallium Arsenide Wafer production, which is all about promoting sustainability and efficiency. The EPA’s Green Chemistry program, over 60 sustainable processes were established by 2023, leading to a reduction in hazardous waste, lowering compliance costs, and giving the polymer-coated fabrics industry a stronger competitive edge.

Europe Market Insights

The polymer-coated fabrics market in Europe is expected to capture a 15% share of revenue by 2035, mainly fueled by automotive, construction, and protective clothing end-use industries. Environmental regulatory issues, along with the European Green Deal, push fabricators and manufacturers to reduce the environmental impact of their coatings. Innovation in lightweight, durable, and weather-resistant fabrics supports uptake. There are plenty of R&D activities, several circular economy initiatives, and a very well-established industrial base in a variety of end-use industries that will contribute to the development of polymer coated fabrics.

With $960M in plastic coated textile fabric exports in 2023, Germany was the 2nd largest of the 166 plastic-coated textile Fabric exporters, and this ranked it as the 279th most exported product overall. Its imports were $327M making it the world's 8th largest importer of 219 importers, which ranked it 496th in terms of imports. The broader "polymer coated fabrics" category includes polymer coated textile fabrics because both processes coat materials with a polymer to provide durability, weather resistance, and specific functional performance.

Germany’s Plastic Coated Textile Fabric Trade (2023)

|

Exporting Country |

Value (USD Million) |

Importing Country |

Value (USD Million) |

|

Italy |

72.3 |

Italy |

74.9 |

|

Poland |

71.1 |

China |

60.7 |

|

Romania |

55.8 |

Austria |

23.2 |

|

Austria |

48.1 |

Netherlands |

22.2 |

|

United States |

46.9 |

Switzerland |

17.2 |

Source: OEC

Key Polymer Coated Fabrics Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Inc.

- Mitsubishi Chemical Holdings

- Covestro AG

- LG Chem Ltd.

- Huntsman Corporation

- UPL Limited

- Wacker Chemie AG

- Asahi Kasei Corporation

- Solvay S.A.

- Syngenta Group

- Formosa Chemicals & Fibre Corp

- Synthomer plc

- Petronas Chemicals Group

- Nufarm Limited

The market for polymer-coated fabrics chemicals is primarily led by a variety of multinational companies that prioritize innovation, sustainability, and expanding their production capabilities. Major players like BASF and Dow are at the forefront, boasting about extensive global production networks and cutting-edge research and development in green technologies. This table shows the top 15 global manufacturers in the polymer-coated fabrics chemical sector, outlining their market shares and countries of origin. It features key players from the USA, Europe, Australia, South Korea, India, and Malaysia, offering a thorough overview of the competitive environment.

Top 15 Global Manufacturers in the Polymer-Coated Fabrics Chemical Market

Recent Developments

- In June 2024, Dow introduced INNATE TF 220, the development of high-performance BOPE films for flexible packaging and recyclability. Early sales data show a 20% increase in demand for polymer-coated fabrics in the Asia-Pacific area, particularly within the construction and agriculture sectors.

- In March 2024, BASF launched Ecoflex, a biodegradable polymer coating aimed at high-performance fabrics. The initial uptake resulted in a 25% boost in BASF’s market share for sustainable coating in Europe and North America, fueled by growing demand in the automotive and electronics industries.

- Report ID: 2631

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polymer Coated Fabrics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.