Metal Fabrication Equipment Market Outlook:

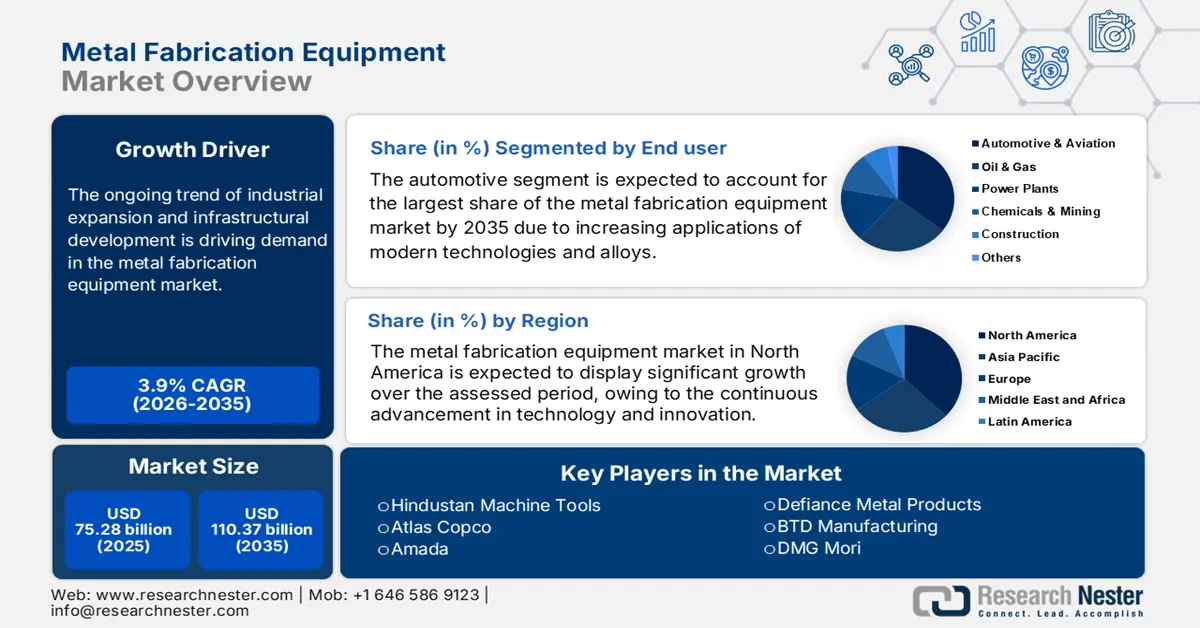

Metal Fabrication Equipment Market size was over USD 75.28 billion in 2025 and is projected to reach USD 110.37 billion by 2035, growing at around 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of metal fabrication equipment is assessed at USD 77.92 billion.

The ongoing trend of industrial expansion and infrastructural development is driving demand in the market. According to the World Bank report, the amount of value added by industries, including construction, around the globe surpassed USD 27.7 trillion in 2023, up by USD 5.4 trillion from 2020. Additionally, as the popularity of Industry 4.0 technologies grows, the surge for industry-tailored automated instruments to shape desired components increases. For instance, by 2024, the number of operating robots in factories worldwide touched 4.2 million, where annual installations crossed 0.5 million (International Federation of Robotics).

The growth in the market can also be testified by the increasing consumption and need for metals around the globe. A study stated that the global surge for major metals by 2100 is expected to increase, where the rates of increments will be 470.0%, 330.0%, 130.0%, and 100.0% for aluminum, copper, zinc, and iron, respectively (ScienceDirect). Further, the heightening utilization of these alloys in constructing critical parts in various industries, such as transportation and energy generation, is ensuring a steady business flow in this sector. On this note, OEC reported that the global trade value of metalworking machines accounted for USD 2.6 billion in 2023, showcasing an escalation of 13.5% from 2022.

Key Metal Fabrication Equipment Market Insights Summary:

Regional Highlights:

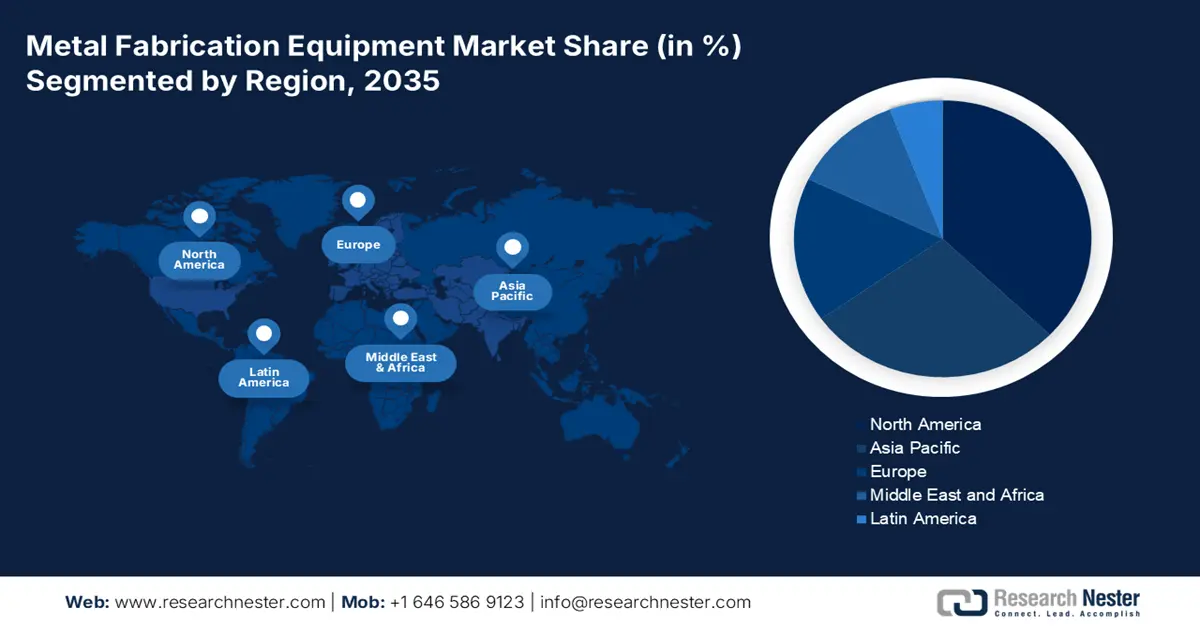

- North America metal fabrication equipment market will hold around 35% share by 2035, driven by adoption of advanced wound care solutions and chronic wound prevalence.

- Asia Pacific market will achieve the highest CAGR during 2026-2035, driven by strong emphasis on the manufacturing segment and emerging industries such as automotive and electronics.

Segment Insights:

- The automotive (end user) segment in the metal fabrication equipment market is expected to capture the largest share by 2035, fueled by modern manufacturing technologies and rising demand for customized vehicles.

- The welding segment in the metal fabrication equipment market is poised for significant growth from 2026-2035, driven by its essential role in metalworking and advancements like laser welders.

Key Growth Trends:

- Innovations in metal product manufacturing

- Rapid urban development and investments

Major Challenges:

- Disruptions in supply chain and sustainability concerns

Key Players: Amada, Atlas Copco, BTD Manufacturing, Colfax,Defiance Metal Products, DMG Mori, Hindustan Machine Tools, Interplex Holdings Pvt. Ltd., Kapco, Komaspect, ADDiTEC, xTool.

Global Metal Fabrication Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 75.28 billion

- 2026 Market Size: USD 77.92 billion

- Projected Market Size: USD 110.37 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Metal Fabrication Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Innovations in metal product manufacturing: As a result of industry automation, the adoption of technologies, 3D printing, additive manufacturing, AI, and IoT, is increasing due to enhanced workflow and productivity. Thus, these technological advancements are revolutionizing the metal fabrication equipment market by improving the efficiency, precision, and scalability of the product pipeline. For instance, in 2023, Monotech launched a next-generation composite 3D printer, FX10, which can print both metal and composite parts by combining metal fused filament fabrication (metal FFF) and continuous fiber reinforcement (CFR) + FFF technology. The components produced by these tools are significantly stronger and more flexible.

- Rapid urban development and investments: According to the United Nations, approximately 68.0% of the total number of people around the world is predicted to live in urban areas by 2050. It also mentioned the possibility of adding 2.5 billion to this volume due to the incremental population growth. Particularly, emerging economies, such as China and India, are focused on building a suitable habitat for these residents, fueling demand in the market. The capital influx from governments to construct these infrastructures is also contributing to this progress. For instance, in December 2024, the Ministry for Housing and Urban Affairs and Power revealed that urban investments in India grew 16 times higher in 2024 than in 2014.

Challenges

- Disruptions in supply chain and sustainability concerns: The reservoirs of raw materials, such as copper, aluminum, and iron, required to produce finished metal products are declining, whereas their prices are heightening. Thus, consumers tend to use plastics, composite materials, and other alternatives instead of metal. This may hinder continuous production and hence the business flow in the market. Additionally, the affordability issues in purchasing environment-friendly instruments and accessories among small-scale manufacturers often prevent them from purchasing them. As a result, wide adoption in this field becomes more difficult in price-sensitive regions.

Metal Fabrication Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 75.28 billion |

|

Forecast Year Market Size (2035) |

USD 110.37 billion |

|

Regional Scope |

|

Metal Fabrication Equipment Market Segmentation:

End user Segment Analysis

The automotive segment is expected to account for the largest share of the metal fabrication equipment market over the assessed timeline. On the back of increasing applications of modern technologies and alloys in the manufacturing process of vehicles, this segment is generating maximum revenue for this sector. Additionally, the financial benefits of implementing IoT and AI in the production line of different auto parts are projected to magnify this industry’s significance in this category. On this note, the German Electrical and Electronic Manufacturers’ Association estimated that digitalization has the potential to increase the economic output of the automotive industry by USD 59.6 billion in Germany by 2026 from 2021. Moreover, the growing demand for customized vehicle design is also fueling this segment.

Equipment Type Segment Analysis

Based on equipment type, the welding segment is predicted to encounter significant propagation in the metal fabrication equipment market by the end of 2035. Being the primary and most necessary part of the process of designing a mineral body, this section of metalworking requires major assistance from machinery. The segment’s essentiality can further be testified by the worldwide trade of welding and soldering machinery, which accounted for USD 1.1 billion in 2023, up by 8.9% from 2022 (OEC). Furthermore, the integration of technological advancements is securing its future leadership. For instance, in June 2024, Miller Electric introduced its cutting-edge handheld laser welder, OptX 2kW, to cover up for the shortage of workers and boost productivity across the U.S. and Canada.

Our in-depth analysis of the global market includes the following segments:

|

End user |

|

|

Equipment Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metal Fabrication Equipment Market Regional Analysis:

North American Market Insights

The metal fabrication equipment market in North America is expected to display significant growth throughout the discussed timeframe. Continuous advancement in technology and innovation in various industrial production lines, such as additive manufacturing, is magnifying the region’s captivity in this merchandise. On this note, the International Federation of Robotics revealed that America recorded 55,389 robot unit installations in factories in 2023. It also mentioned that installations in the metal and machinery industry in the U.S. rose by 8.0% in the same year. Moreover, the regionwide demand for metal products and the deficiency in welders are influencing manufacturing companies to adopt efficient machines to maintain productivity.

As per OEC, the U.S. ranked among the top exporters and importers of soldering and welding machinery in the world in 2023, accounting for USD 78.0 million and USD 144.0 million, respectively. Similarly, the country secured the 2nd position as a global importer of metalworking machines in the same year, which was valued at USD 329.0 million. On the other hand, the number of job openings in the U.S. for welders, cutters, solderers, and brazers was 454,500 in 2023 (U.S. Bureau of Labor Statistics), signifying the shortage of workers in the metal fabrication industry. Thus, by addressing this issue with technology, the market is becoming a lucrative landscape for global pioneers.

APAC Market Market Insights

The metal fabrication equipment market in Asia Pacific is estimated to register the highest CAGR during the forecast tenure. On account of the strong emphasis on the manufacturing segment in emerging industries, such as automotive and electronics, the region is consolidating its augmentation with a large consumer base and domestic equipment innovators. To grab this opportunity, in June 2024, ADDiTEC partnered with Bharat Fritz Werner to create a hybrid additive manufacturing platform. Both partners combined their abilities in liquid metal jetting (LMJ) and high-power laser-directed energy deposition (DED) technologies to revolutionize CNC machining, establishing a strong foundation for ADDiTEC in India.

China is augmenting the market with global leadership in large-scale production and acceptability toward factory automation. On this note, the International Federation of Robotics recognized this country as the largest landscape for industrial robots in 2023, occupying 51.0% (276,288 units) of global installations. Simultaneously, OEC identified China as the 1st and 2nd largest exporter of soldering & welding machinery and metalworking machines, with values of USD 329.0 million and USD 409.0 million, respectively, in the same year. Additionally, testifying for the market competency, in September 2024, Bodor upgraded its M series flagship fiber laser metal tube cutting machine by adding dual process parallel processing abilities.

Metal Fabrication Equipment Market Players:

- Amada

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Atlas Copco

- BTD Manufacturing

- Colfax

- Defiance Metal Products

- DMG Mori

- Hindustan Machine Tools

- Interplex Holdings Pvt. Ltd.

- Kapco

- Komaspect

- ADDiTEC

- xTool

Key players in the metal fabrication equipment market are currently following the trend of continuous innovation. Their effort to create better technology and tools is subsequently expanding the pipeline of this merchandise. For instance, in November 2024, Caracol brought a revolutionary metal part fabrication technology, Vipra AM, to large-scale production facilities. This robotic large-format metal DeD platform was displayed at Formnext in Frankfurt, promising an all-in-one solution for performance, productivity, efficiency, and sustainability. Similarly, during the same timeline, Renishaw unveiled the latest addition, RenAM 500D, to its series of metal additive manufacturing machines, RenAM 500 series, offering flexibility, productivity, and cost-efficiency. Such key players are:

Recent Developments

- In April 2025, xTool unveiled an integrated laser welder and fiber CNC cutter, MetalFab, offering enhanced user experience while fabricating metal. This DIY innovation is a versatile six-in-one powerhouse machine for handheld laser welding, precision CNC metal cutting, rust removal, and more.

- In February 2025, ADDiTEC introduced its latest innovation in point-of-demand manufacturing and metal repair, the AMDROiD X, at MILAM 2025. This laser-directed energy deposition (LDED) turnkey solution is designed for industries such as defense, construction, energy, and emergency response.

- Report ID: 1555

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metal Fabrication Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.