Acute Lymphoblastic Leukemia Treatment Market Outlook:

Acute Lymphoblastic Leukemia Treatment Market size was valued at USD 5.27 billion in 2025 and is set to exceed USD 10.17 billion by 2035, expanding at over 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acute lymphoblastic leukemia treatment is evaluated at USD 5.59 billion.

The heightening number of cases of this form of leukemia that affect both children and adults are anticipated to result in a significant growth in the acute lymphoblastic leukemia treatment. Additionally, clinical evidence demonstrating its curability with adequate therapeutics is inflating demand in this sector. On this note, a study published by ScienceDirect in December 2024 revealed that this blood disorder accounted for around 25.0% of net cancer diagnoses among children below 15. This makes it the most occurring childhood malignancy in the world, which further was found to have a 90.0% 5-year overall survival rate with the application of risk-stratified curative methods.

Rising awareness about early detection and intervention is also prompting investments in the market. As several public and private authorities take the initiative to educate people about available options, acceptance and adoption are widening. Moreover, governing bodies from different regions are heavily investing in infrastructural and clinical development to improve access to advanced medical facilities, fuelling progress in this sector. For instance, in February 2025, the Damon Runyon Cancer Research Foundation and St. Jude Children’s Research Hospital collaboratively invested USD 1.8 million to support an innovative research project associated with pediatric cancers, including leukemia.

Key Acute Lymphoblastic Leukemia Treatment Market Insights Summary:

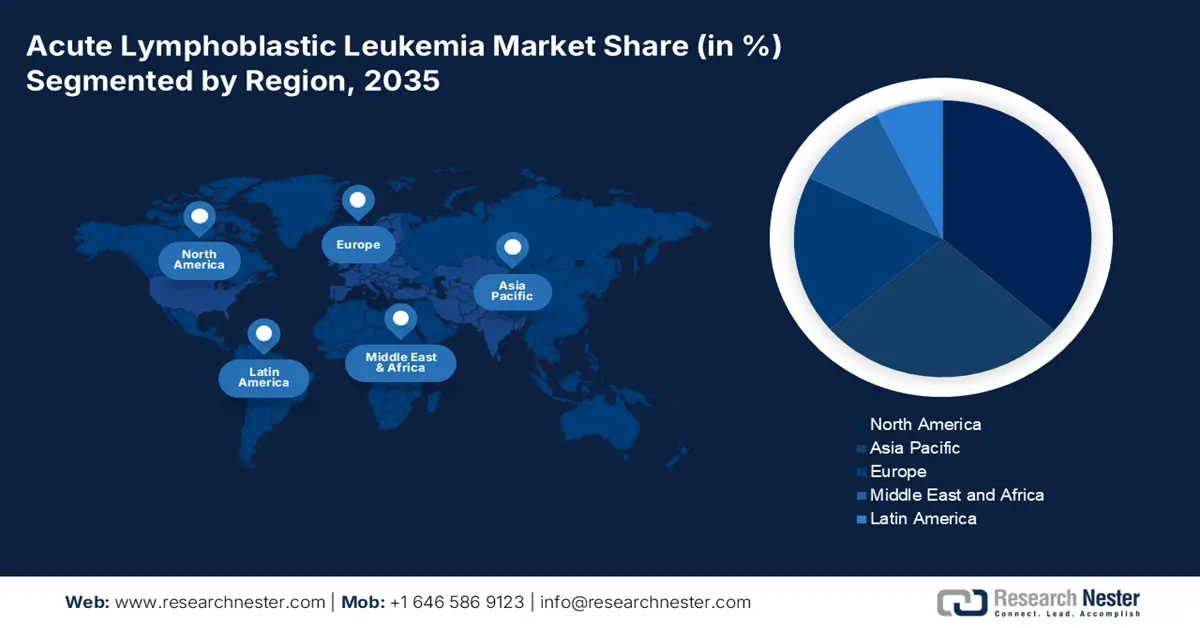

Regional Highlights:

- North America acute lymphoblastic leukemia treatment market is poised to capture 38.8% share by 2035, driven by advanced curatives, pharma presence, and favorable regulations.

- Asia Pacific market will achieve the share of 21% during 2026-2035, driven by increasing healthcare investments and aging population.

Segment Insights:

- The chemotherapy segment in the acute lymphoblastic leukemia treatment market is projected to achieve a 22.20% share by 2035, driven by high prescription rates and widespread availability.

- The b-cell ALL segment in the acute lymphoblastic leukemia treatment market is anticipated to hold the largest share by 2035, attributed to the high prevalence of b-cell ALL in adult leukemia patients.

Key Growth Trends:

- Increasing medicine and biomarker research

- Global expansion of targeted therapies industry

Major Challenges:

- Economic burden of expensive oncology treatment

- Hurdles in attaining regulatory compliance

Key Players: Amgen Inc., Bristol-Myers Squibb, Genzyme Corporation, Pfizer Inc., GlaxoSmithKline plc., Erytech, F. Hoffmann-La Roche, Celgene Corporation, Rare Disease Therapeutics, Inc., Leadiant Biosciences, Inc., Shorla Oncology.

Global Acute Lymphoblastic Leukemia Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.27 billion

- 2026 Market Size: USD 5.59 billion

- Projected Market Size: USD 10.17 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, Japan, India, South Korea, Brazil

Last updated on : 8 September, 2025

Acute Lymphoblastic Leukemia Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Increasing medicine and biomarker research: Advancements in the genetic and molecular profiling lead to significant development in therapeutic pathways from the market. Considering the health impact and growing rate of mortality across the world, many institutions are engaging their resources in finding more efficient options. For instance, in November 2024, the results from the phase Ib/II FELIX trial on obecabtagene autoleucel (obe-cel) were released by the University of Texas-affiliated MD Anderson Cancer Center. They showcased 76.6% and 55.3% response and complete remission rates, respectively, in relapsed or refractory CD19-positive B-cell acute lymphoblastic leukemia (ALL).

- Global expansion of targeted therapies industry: In search of highly effective and accurate prognosis, diagnosis, and cure of ALL, the market observed a notable surge in precision medicine. These genetically engineered therapies are designed to recognize and destroy cancer cells efficiently without harming healthy tissues. Thus, the continuously extending territory of this category is accelerating the future propagation of this field toward better outcomes.

Challenges

- Economic burden of expensive oncology treatment: Enrolling for advanced solutions from the market requires high financial investment. The prohibitive cost of CAR-T therapies, monoclonal antibodies, and others further limits adoption in low- and middle-income countries. Subsequently, this shrinks market exposure and product reach, discouraging pharma producers from participating in this field. Moreover, the insufficient coverage of reimbursement and insurance policies in these underserved regions often hinders patients’ ability to afford such expensive treatment, decreasing the consumer base.

- Hurdles in attaining regulatory compliance: The process of research and development, coupled with regulatory approval, takes several years for individual accomplishments. The government policies regarding clinical testing and approval of cancer drugs and treatments are highly strict, slowing the market launch of new therapeutics in the market. In addition, the complex and indifferent criteria of regulations from various regions makes it harder for companies to concentrate on marketing and distribution, hampering commercialization.

Acute Lymphoblastic Leukemia Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 5.27 billion |

|

Forecast Year Market Size (2035) |

USD 10.17 billion |

|

Regional Scope |

|

Acute Lymphoblastic Leukemia Treatment Market Segmentation:

Treatment Segment Analysis

Based on treatment, chemotherapy segment in the acute lymphoblastic leukemia treatment market is expected to witness dominance from the chemotherapy segment by the end of 2035. Its significant revenue generation is attributable to the high rate of prescription of this therapy, along with the availability across a large oncology consumer base. On this note, an observational study on prescription patterns of drugs in pediatric cancer patients was released by the International Journal of Research in Medical Sciences in September 2024. It revealed that the most commonly prescribed (22.2%) anticancer drug for pediatric ALL in hospital settings was vincristine (a chemotherapy drug).

Leukemia Type Segment Analysis

In terms of leukemia type, the B-cell ALL segment is projected to capture the largest share in the acute lymphoblastic leukemia treatment market over the assessed period. B cell lymphocytes are the most common type of leukemia in the world, affecting 75-80% of the adults with ALL: 2024 report from the Leukemia Foundation. Another article from Cancer Research UK, published in May 2024, stated that approximately 75 per 100 ALL cases originated from B cell lymphocytes. Thus, the frequent occurrence made this a priority segment for global leaders. Furthermore, the continuous capital influx from both private and public healthcare organizations is solidifying this segment’s proprietorship over other sub-types.

Our in-depth analysis of the global acute lymphoblastic leukemia treatment market includes the following segments:

|

Treatment |

|

|

Leukemia Type |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acute Lymphoblastic Leukemia Treatment Market Regional Analysis:

North American Market Insights

North America region is poised to dominate around 38.8% market share by 2035. The ease of availability of advanced curatives and the presence of major pharmaceutical companies are estimated to contribute to its dominance in the upcoming years. The favourable regulatory framework in the region has also played a pivotal role in improving treatment accessibility, ensuring a good flow of business for global pioneers. For instance, in November 2024, Autolus Therapeutics gained marketing clearance for its AUCATZYL (obecabtagene autoleucel) to treat adults with relapsed or refractory B-cell precursor ALL. The CAR T-cell therapy showcased complete remission among 41.0% of the candidates within three months during the FELIX clinical trial.

According to the 2023 NLM study, around 4000 habitats in the U.S. get diagnosed with ALL every year, and the majority of this patient pool are under 18. This represents a continuously growing demand in the market. In addition, the federal investment in rigorous R&D for cultivating new methodologies and therapeutics is also widening the product range for patients. For instance, in February 2025, the Leukemia & Lymphoma Society revealed that it contains over USD 250.0 million worth of research funding commitments toward the development of next-generation blood cancer care.

APAC Market Insights

Asia-Pacific region is anticipated to observe the growth rate share of 21% in the acute lymphoblastic leukemia treatment market during the forecast period. This is attributed to the increasing government investments in improving healthcare infrastructure and a high population base with an increased risk of cancer. Particularly in developing countries, such as Japan, China, and India, the aging citizens are heightening the threat of disease widespread and mortality. Thus, they are accumulating and cultivating therapeutic resources, such as precision medicine, to combat the epidemic.

India is augmenting a lucrative environment for both domestic and global leaders in the market with biopharmaceutical advances. The country’s strong emphasis on academic research and pharmacology expansion is fostering new business opportunities. This is helping pioneers generate a profitable revenue from this sector. For instance, in March 2025, Zydus Lifesciences announced its plans to produce Dasatinib Tablets in Ahmedabad after attaining manufacturing approval from the FDA. The company previously achieved annual sales of USD 1.8 billion in the U.S. market, which inspired it to expand domestic production to supply adults with Philadelphia chromosome-positive ALL with resistance or intolerance to prior therapy.

Acute Lymphoblastic Leukemia Treatment Market Players:

- Amgen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amgen Inc.

- Bristol-Myers Squibb

- Genzyme Corporation

- Pfizer Inc.

- GlaxoSmithKline plc.

- Erytech

- F. Hoffmann-La Roche

- Celgene Corporation

- Rare Disease Therapeutics, Inc.

- Leadiant Biosciences, Inc.

- Shorla Oncology

The acute lymphoblastic leukemia treatment market is evolving with the introduction of more specified and personalized approaches. Key players in this sector are proactively participating in this cohort with heavy investments and engagement in R&D. For instance, in September 2024, Vironexis Biotherapeutics gained an investigational new drug (IND) application from the FDA for its gene therapy product candidate, VNX-101, to treat CD19+ ALL. The company also secured a seed financing of USD 26.0 million to empower similar advances in AAV-delivered T-cell immunotherapy. Furthermore, they are also focusing on producing affordable therapeutics to solidify their position in price-sensitive regions. Such key players are:

Recent Developments

- In October 2024, Shorla Oncology attained FDA clearance for marketing its oral liquid methotrexate, JYLAMVO, for pediatric use. This autoimmune drug is now widely accepted for treating both adults and children with acute lymphoblastic leukemia (ALL) and polyarticular juvenile idiopathic arthritis (pJIA).

- In June 2024, Amgen received approval from the FDA for its BLINCYTO (blinatumomab), treating CD19-positive Philadelphia chromosome-negative B-ALL in the consolidation phase. This drug has been proven to be effective for both adults and adolescents (one month or older), regardless of measurable residual disease (MRD) status.

- Report ID: 1924

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acute Lymphoblastic Leukemia Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.