Geochemical Services Market Outlook:

Geochemical Services Market size was over USD 1.36 billion in 2025 and is anticipated to cross USD 2.13 billion by 2035, growing at more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of geochemical services is assessed at USD 1.42 billion.

The developing regions are emerging as the most profitable marketplaces for geochemical service providers owing to a rise in mining activities. Asia Pacific, the Middle East & Africa, and Latin America have favorable mining policies, which are creating a lucrative environment for geochemical service companies to expand their operations. For instance, in February 2024, Veracio announced the start of its project in Chile, Latin America, in which the company is set to offer core scanning and geochemical analysis of 15,000 meters for Sierra Gorda SCM. Thus, tapping into high-potential markets is anticipated to double the revenues of geochemical service providers.

The World Gold Council report highlights that in 2023, in terms of country-level, China dominated the global gold mining production by capturing 10.0% of the share. Russia, Australia, Canada, the U.S., Ghana, Indonesia, and Peru are some leading gold-producing countries. The growing mining activities are underscoring the lucrativeness of these marketplaces for geochemical service providers. The International Energy Agency (IEA) states that Chile (23.0%), the Democratic Republic of the Congo (14.0%), and Peru (10.0%) are the top three copper-producing countries across the world. Furthermore, the World Nuclear Association unveils that 2/3rd of the global uranium production is from mines in Kazakhstan, Canada, and Australia. The majority of demand for these critical metals & minerals is from the clean power plants, construction, and other industries.

Key Geochemical Services Market Insights Summary:

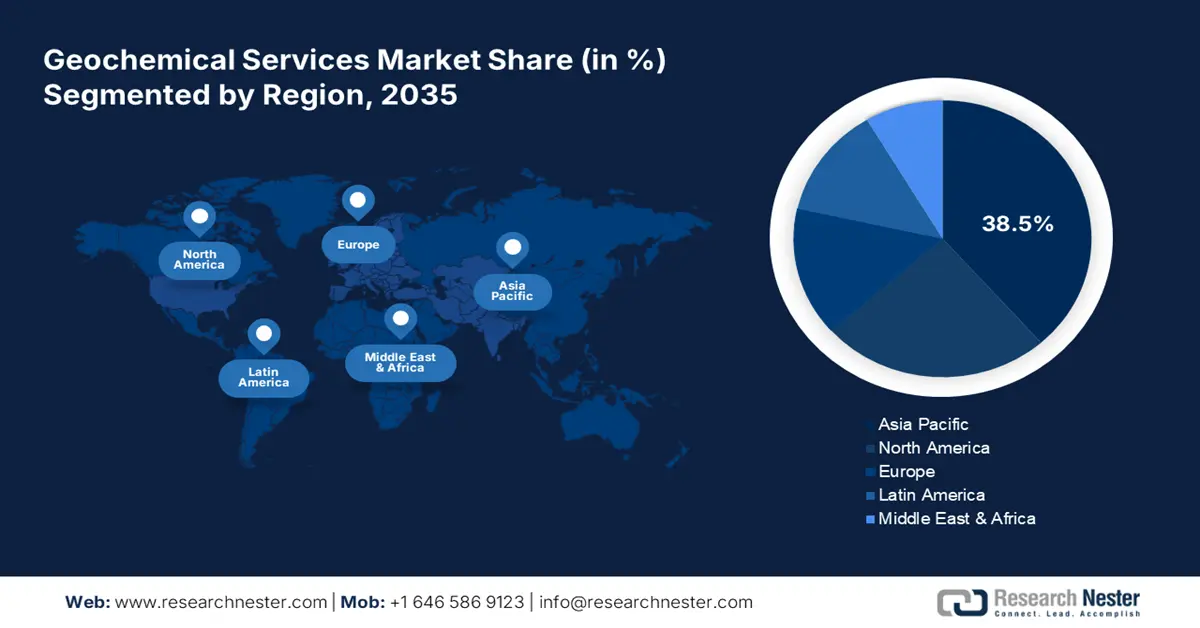

Regional Highlights:

- Asia Pacific geochemical services market will account for 38.50% share by 2035, driven by infrastructure development and favorable regulatory policies increasing mining activities.

- North America market will exhibit the fastest growth during the forecast period 2026-2035, attributed to rising demand for transition metals and government funding for mining exploration.

Segment Insights:

- The laboratory-based segment in the geochemical services market is projected to hold a 63.10% share by 2035, driven by the presence of advanced technologies for precise results.

- The machine learning segment in the geochemical services market is expected to achieve significant growth till 2035, driven by its role in predictive analysis and reduced exploration costs.

Key Growth Trends:

- High applications in the oil and gas sector

- Advancements in archaeological surveys

Major Challenges:

- Lack of skilled workforce

- A capital-intensive business

Key Players: SGS SA, Bureau Veritas S.A., Intertek Group plc, ALS Limited, Activation Laboratories Ltd. (Actlabs), AGAT Laboratories Ltd., Eurofins Scientific, Alex Stewart International, Geochemic Ltd., Applied Spectra, Inc.

Global Geochemical Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.36 billion

- 2026 Market Size: USD 1.42 billion

- Projected Market Size: USD 2.13 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Australia, China, United Kingdom

- Emerging Countries: China, India, Indonesia, Thailand, Brazil

Last updated on : 18 September, 2025

Geochemical Services Market Growth Drivers and Challenges:

Growth Drivers

-

High applications in the oil and gas sector: The oil and gas manufacturers are driving a high demand for geochemical services market for the analysis of hydrocarbons and related compounds. These services play a vital role in enhancing the exploration and production efficiency in hydrocarbon plants. The U.S. Energy Information Administration (EIA) projects that the worldwide liquid fuels production is estimated to grow by 1.3 million b/d in 2025 and 1.2 million b/d in 2026. The IEA report states that oil demand is expected to average 1.1 mb/d globally in 2025, with Asia Pacific countries grabbing high shares. The rise in deepwater hydrocarbon exploration activities is also set to boost the revenues of geochemical service providers during the foreseeable period.

-

Advancements in archaeological surveys: The increasing investments and technological advancements in archaeological activities are anticipated to boost the sales of geochemical services. The leading companies are investing in R&D to introduce next-gen geochemical technologies and meet the modern archaeological demands. For instance, in August 2024, Flinders University revealed the findings from its first-ever archaeological survey in space. The results include the research on the use of the surrounding space, which is expected to aid in improving the design of future space stations. The survey also includes findings on the creation and management of gravity on board of ISS. Such significant advancements in the archaeological sector are set to fuel the sales of geochemical technologies and services in the years ahead.

Challenges

- Lack of skilled workforce: The geochemical services market requires a skilled workforce and advanced technologies for effective and efficient results. The shortage of qualified geochemists, particularly in developing regions, is expected to lower the geochemical services market growth to some extent. The companies are required to provide specialized training to their workforce to uplift their geochemical services, which is adding to operational costs. Such factors are anticipated to offer low profit margins to market players in the years ahead.

- A capital-intensive business: The geochemical service providers are required to invest heavily in advanced technologies and equipment for precise analysis. The small-scale companies and start-ups often find it challenging to enter the market due to high capital expenditure. Thus, the capital-intensive geochemical services business is dominated by the leading companies. However, strategic partnerships with other players and public entities are likely to make market entries easier. Supportive government policies in the form of schemes, incentives, or subsidies are also anticipated to open lucrative doors for small-scale companies.

Geochemical Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 1.36 billion |

|

Forecast Year Market Size (2035) |

USD 2.13 billion |

|

Regional Scope |

|

Geochemical Services Market Segmentation:

Type Segment Analysis

Laboratory-based segment is likely to capture geochemical services market share of around 63.1% by the end of 2035. The presence of the latest technologies and devices in the laboratory leads to enhanced and effective findings. Most of the advanced geochemical technologies are fixed and immovable, which drives the sample analysis process in the laboratory. Most of the end users also prefer opting for laboratory-based geochemical services to get accurate and precise results. Furthermore, the growth in academic and government research in environmental monitoring is augmenting the demand for laboratory-based geochemical services. The increasing investments in geoscience and climate-based research are estimated to drive the overall segmental growth in the coming years.

Technology Segment Analysis

In geochemical services market, machine learning segment is predicted to capture revenue share of over 35.6% by 2035. The integration of machine learning in geochemical technologies is set to accelerate and enhance the finding process. The machine learning-based models aid in predictive analysis, geoscientific mapping, and reduced exploration costs by identifying potential mineral and substance deposits. Many companies are investing in digital technology-based geochemical services to boost yield and minimize dry drilling. Furthermore, the increasing demand for eco-friendly mining and strict regulatory pressures are necessitating end users to employ smart technology-based geochemical services, which is directly boosting the applications of machine learning-based systems.

Our in-depth analysis of the global geochemical services market includes the following segments:

|

Type |

|

|

Service Type |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Geochemical Services Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific geochemical services market is poised to dominate over 38.5% revenue share by 2035. The swiftly increasing infrastructure development activities are driving a high demand for transition metals, and are subsequently creating profitable space for geochemical services companies. The favorable regulatory policies are increasing the mining activities in the region and fueling the need for advanced geochemical services. China and India lead the mining production, while Japan and South Korea are ahead in innovations, which is set to increase the advanced geochemical service sales and technology demand in the years ahead.

The rise in hydrocarbon exploration activities in China is likely to augment the sales of geochemical services in the coming years. The preliminary research of IEA estimates that in January 2025, the total worldwide inventories fell further by 49.3 mb and were driven by a big crude stock draw in China. Increasing investments in offshore hydrocarbon exploration are also fueling the demand for advanced geochemical services market in the country. For instance, in March 2025, the China National Offshore Oil Corporation (CNOOC) found a deepwater hydrocarbons pay zone in the Beibu Gulf of the South China Sea.

The robust mining activities in India are set to boost the sales of geochemical services during the projected period. The government support in the form of policies, schemes, and incentives is supporting the mining actions in the country. The India Brand Equity Foundation (IBEF) study highlights that the number of reporting mines in the country increased from 1,319 in FY2022 to 2,036 by FY2024. The coal production amounted to 104.4 MT in January 2025, while the aluminium production is expected to be calculated at 3.15 million tonnes in FY25. The rise in mineral and metal mining production is foreseen to fuel the demand for geochemical services.

North America Market Insights

The North America geochemical services market is projected to increase at the fastest pace between 2026 and 2035. The rising demand for transition metals in various industries such as automotive, consumer electronics, and aerospace is anticipated to propel the demand for advanced geochemical services. Government funding for hydrocarbon gas liquids mining and exploration activities is further creating a high-earning environment for geochemical service companies. The U.S. and Canada are both estimated to offer lucrative gains to the geochemical service providers in the years ahead.

The increasing crude oil production and exploration activities are poised to drive the sales of geochemical services in the U.S. The study by EIA highlights that the field production of crude oil in the country amounted to 13,146 thousand barrels per day in January 2025. The increasing adoption of advanced technologies and the presence of modern infrastructure are boosting crude oil production. To align with the decarbonization goals, oil and gas companies are employing advanced geochemical services for precise results.

Canada’s increasing investment in deepwater hydrocarbon exploration is forecast to increase the demand for geochemical services in the years ahead. High import and export trade of hydrocarbons is likely to drive the need for sustainable and advanced geochemical services. For instance, the Canadian Association of Petroleum Producers (CAPP) underscores that the offshore exploration holds 4.0% of the country’s total oil generation. Furthermore, in 2022, the country was responsible for 97.0% of the hydrocarbon gas liquids imports alone in the U.S., according to the EIA.

Geochemical Services Market Players:

- SGS S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Golden Compass

- Endurance Gold Corporation

- Actlabs Group

- ALS Limited

- Bureau Veritas Group

- Capital Limited

- Chinook Consulting Services Ltd.

- Enviros

- FLSmidth

- Fugro

- Intertek Group plc

- Saudi Aramco

- Schlumberger Limited

- Shiva Analyticals& Testing Laboratories India

- Geochemic Ltd.

- Activation Laboratories Ltd.

- ACZ Laboratories Inc.

- Alex Stewart International

- AGAT Laboratories Ltd.

- Nexus Gold

- Premier Oilfield Group

- GeoMark Research

- Weatherford International

The leading companies in the geochemical services market are employing various organic and inorganic marketing strategies to double their revenue and reach. The industry giants are investing in research and development activities to introduce next-gen geochemical technologies. They are also collaborating with high-tech companies to expand their product portfolio with digital technologies. Partnerships with other players are helping them to reach a wider customer base. The organic sales are poised to offer double-digit percent revenue growth opportunities to geochemical service providers in the years ahead.

Some of the key players includes in geochemical services market:

Recent Developments

- In June 2024, SGS S.A. announced that it had entered into a joint venture agreement with Golden Compass to open and operate a new geochemistry laboratory in Saudi Arabia. This laboratory is expected to offer sample preparation and geochemistry analysis to the mining and mineral companies in the country.

- In January 2023, Endurance Gold Corporation revealed the results from soil and biogeochemical orientation surveys conducted on the Olympic Claims of its Reliance Gold Project in southern British Columbia. The preliminary work defined a 1.6 km anomaly and grabbed samples up to 9.66 Gpt Gold.

- Report ID: 7530

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Geochemical Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.