Functional Cosmetics Market Outlook:

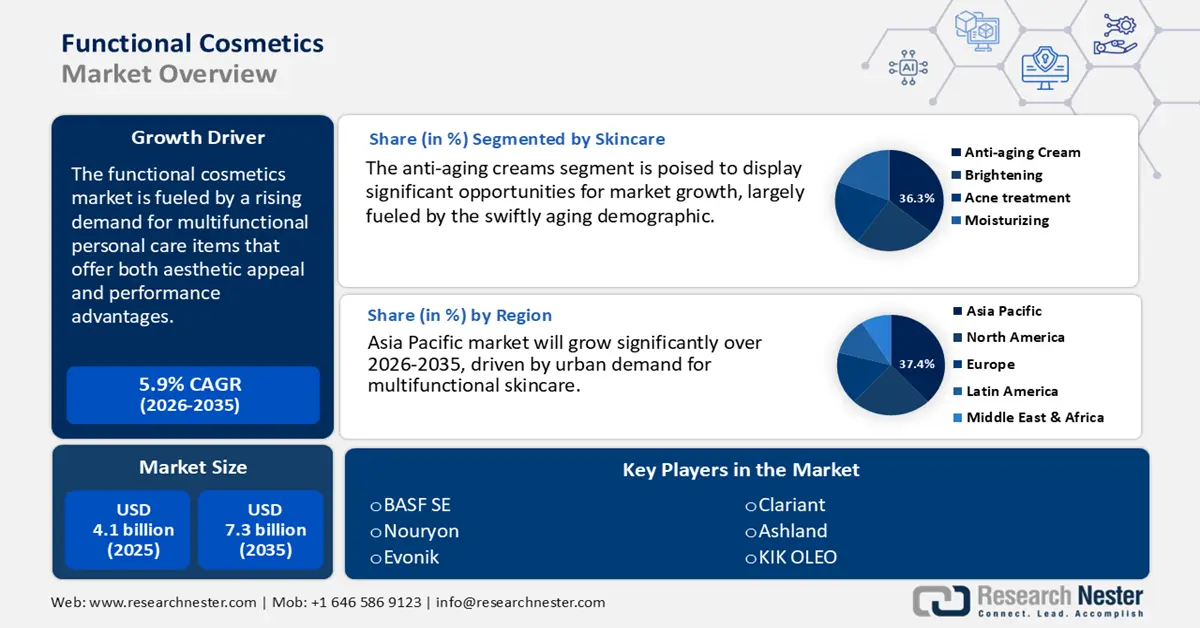

Functional Cosmetics Market size was valued at USD 4.1 billion in 2025 and is projected to reach USD 7.3 billion by the end of 2035, rising at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of functional cosmetics is assessed at USD 4.3 billion.

The functional cosmetics sector is witnessing significant growth, propelled by consumer interest in products that combine aesthetic advantages with measurable performance results, such as anti-aging, UV protection, and enhancement of the skin barrier. This shift in personal care corresponds with wider health-conscious trends, where consumers are looking for multifunctional solutions that promote wellness while providing visible outcomes. Progress in formulation science, especially the incorporation of bioactive components and nanotechnology, is allowing cosmetic brands to fulfill these changing expectations with innovative, high-performance offerings.

Public health initiatives, sustainability objectives, and targeted government funding are further driving this change. Organizations like the National Institutes of Health (NIH) and the Department of Energy (DOE) are backing research into bio-based substitutes for traditionally synthetic cosmetic ingredients, promoting safer and more environmentally friendly formulations. A notable instance is Estée Lauder Companies, which has made substantial investments in green chemistry and biotechnology collaborations to create sustainable, high-efficacy ingredients. By partnering with biotech companies and research institutions, the firm is integrating plant-derived actives and eco-conscious production techniques into its product ranges, establishing itself as a frontrunner in the functional and sustainable cosmetics industry.

Key Functional Cosmetics Market Insights Summary:

Regional Highlights:

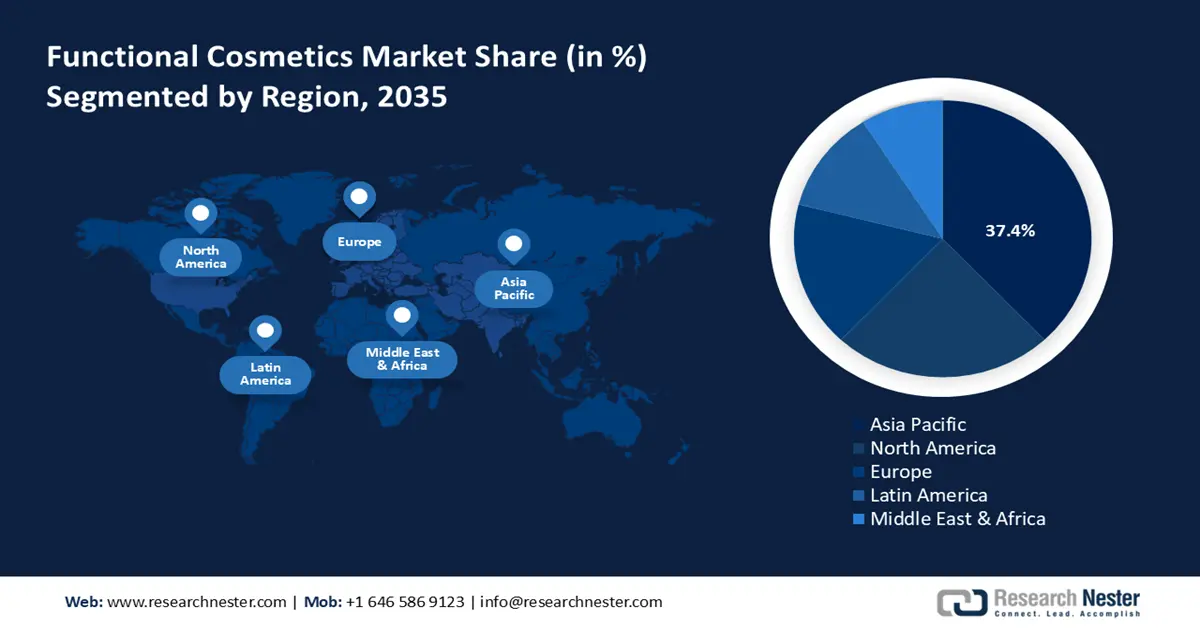

- By 2035, the functional cosmetics market in Asia-Pacific is predicted to hold a 37.4% share, driven by rising consumer awareness and technological advancements in bio-based formulations.

- North America is expected to capture a 25.4% share by 2035, impelled by growing demand for multifunctional and ethically produced skincare products.

Segment Insights:

- Anti-aging creams segment is projected to account for 36.3% share by 2035 in the functional cosmetics market, propelled by the rapidly aging population.

- Scalp treatment serums segment is expected to hold a 26.2% share by 2035, fueled by increasing demand for safe and effective scalp solutions.

Key Growth Trends:

- Shift toward bio-based ingredients

- Sustainability and carbon reduction targets

Major Challenges:

- High environmental safety costs

- Supply chain disruptions and infrastructure gaps

Key Players: BASF SE, Ashland Inc., Clariant AG, Croda International Plc, Evonik Industries AG, DSM-Firmenich, Symrise AG, Givaudan Active Beauty, Seppic (Air Liquide), LG Chem Ltd., Sami-Sabinsa Group, DuPont de Nemours, Inc., Axilone Australia (Albéa Group), KLK OLEO (Kuala Lumpur Kepong Berhad), Kao Corporation.

Global Functional Cosmetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.1 billion

- 2026 Market Size: USD 4.3 billion

- Projected Market Size: USD 7.3 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (37.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Japan, China, Germany, South Korea

- Emerging Countries: India, Brazil, Australia, Mexico, Indonesia

Last updated on : 23 October, 2025

Functional Cosmetics Market - Growth Drivers and Challenges

Growth Drivers

- Shift toward bio-based ingredients: The functional cosmetics sector is experiencing a significant transition towards bio-based ingredients, influenced by consumer preferences and changing regulatory standards. There is a growing preference for plant-derived surfactants, emulsifiers, and active agents due to their biodegradability and lower environmental impact. The USDA BioPreferred Program reports a 12% increase in the use of bio-based chemicals in personal care products in 2023, highlighting a notable market shift. This trend indicates a wider industry movement away from petrochemical sources, increasing the demand for fermented and botanical-based compounds that comply with sustainability criteria while improving product safety and effectiveness by global green chemistry goals.

- Sustainability and carbon reduction targets: The objectives of sustainability and carbon reduction are transforming procurement strategies within the functional cosmetics sector, as leading brands pledge to achieve net-zero emissions. These ambitions are propelling a shift towards low-carbon ingredients and more environmentally friendly production methods. Consequently, there is an increasing demand for sustainable functional chemicals, such as biodegradable surfactants, stabilizers, and active agents. The OECD projects that the green chemicals market will expand by $11 billion by 2027, with functional cosmetics significantly contributing to this growth. This transition highlights the industry's commitment to global climate goals, emphasizing the necessity of sustainable sourcing and carbon-aware formulation practices.

- Growing demand for multifunctional skincare products: Consumers are progressively looking for skincare items that provide various advantages within a single formulation, including hydration, anti-aging properties, sun protection, and skin repair. This trend is motivated by the desire for convenience and a commitment to holistic wellness. As a result, there is a surge in innovation regarding ingredient technologies and product design. For instance, Shiseido has introduced multifunctional offerings such as its Vital Perfection line, which delivers lifting, brightening, and firming effects, merging cosmetic outcomes with dermatological effectiveness for users who prioritize efficiency and results.

1. Functional Cosmetics Market: Trade Dynamics

Global Production of Personal Care (2023)

|

Country |

Trade Value 1000USD |

Quantity (Kg) |

|

European Union |

12,886,419.74 |

518,831,000 |

|

U.S. |

4,697,580.28 |

143,760,000 |

|

Germany |

3,434,890.81 |

188,739,000 |

|

Japan |

3,181,532.34 |

64,462,200 |

|

China |

2,068,091.00 |

161,489,000 |

|

UK |

1,812,614.10 |

72,188,000 |

|

Canada |

1,509,244.14 |

51,853,900 |

|

India |

737,698.90 |

34,177,300 |

Source: World Bank

2. Analysis of Aging Population

Population Age 65 and Above (2024)

|

Country |

Most Recent Values |

|

U.S. |

60,977,581 |

|

UK |

13,498,909 |

|

Japan |

36,920,821 |

|

Germany |

19,370,855

|

|

Canada |

8,174,974

|

Source: World Bank

Challenges

- High environmental safety costs: The EPA standards require costly testing and reformulation. For instance, Innospec’s operating expenses rose 10% in 2022 due to compliance. These elevated costs create significant entry and sustainability barriers, particularly for small and mid-sized manufacturers in the functional cosmetics sector.

- Supply chain disruptions and infrastructure gaps: The lack of raw materials, especially botanical and biodegradable resources, presents considerable difficulties for the functional cosmetics industry. These shortages lead to disruptions in the supply chain and reveal deficiencies in infrastructure, which in turn impact production schedules, cost-effectiveness, and the reliable availability of sustainable ingredients that are crucial for fulfilling both consumer and regulatory demands.

Functional Cosmetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 4.1 billion |

|

Forecast Year Market Size (2035) |

USD 7.3 billion |

|

Regional Scope |

|

Functional Cosmetics Market Segmentation:

Skincare Segment Analysis

Anti-aging creams segment holds a significant 36.3% share of the global functional skincare market, with robust demand particularly in developed nations like Japan and the U.S. This growth is primarily driven by the rapidly aging population, which is expected to nearly double by the year 2060, according to the U.S. Census Bureau. An increasing number of older consumers are on the lookout for clinically validated products that improve skin elasticity and diminish wrinkles. The National Institute on Aging notes a rising interest in formulations that promote collagen production and address oxidative stress. Consequently, substantial investments in research and development are being allocated towards bioactive compounds, peptides, and innovative anti-aging skincare technologies.

Haircare Segment Analysis

Scalp treatment serums account for 26.2% of the global functional cosmetics market, highlighting their increasing clinical significance in addressing hormonal, environmental, and stress-related scalp concerns. Research documented in NIH shows a growing number of clinical trials investigating botanical and probiotic-based scalp treatments, underscoring their therapeutic promise. Furthermore, the Environmental Protection Agency has implemented stricter regulations on volatile organic compound (VOC) emissions in cosmetics, leading manufacturers to reformulate their products with low-emission delivery systems, such as scalp serums that utilize cleaner emulsifiers and stabilizers, thereby meeting compliance requirements and adapting to changing consumer demands for safe and effective solutions.

Sun Protection Segment Analysis

Anti-pollution sunscreens are expected to capture a 19.5% share of the global functional cosmetics market by the year 2035, propelled by escalating urban pollution and heightened consumer awareness regarding environmental harm to the skin. These products deliver both UV protection and a barrier against detrimental pollutants, addressing the increasing demand for multifunctional skincare solutions. For instance, La Roche-Posay provides Anthelios sunscreens that not only offer broad-spectrum UV protection but also incorporate antioxidant components to protect the skin from damage associated with pollution.

Our in-depth analysis of the functional cosmetics market includes the following segments:

| Segment | Subsegment |

|

Skincare

|

|

|

Haircare |

|

|

Sun Protection

|

|

|

Oral Care

|

|

|

Makeup |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Functional Cosmetics Market - Regional Analysis

Asia Pacific Market Insights

By the year 2035, it is anticipated that the functional cosmetics market in the Asia-Pacific will account for 37.4% of global revenues. The primary factors contributing to this growth encompass heightened consumer awareness regarding skin health, a growing demand for multifunctional products, swift urbanization, an increase in disposable incomes, governmental backing for sustainable beauty innovations, and technological progress in bio-based ingredients and product formulations, especially in emerging markets such as China and India.

China's dominance in the functional cosmetics sector is attributed to significant investments in green chemistry, sustainable formulations, and an escalating urban demand for multifunctional skincare. Government backing through initiatives from the National Development and Reform Commission (NDRC) and ChemChina has fostered innovation. For instance, Proya Cosmetics has committed to eco-friendly research and development, introducing products that combine traditional Chinese botanicals with contemporary science to fulfill sustainability and performance standards.

On the other hand, India's 8.5% CAGR is driven by increasing income levels, a youth-oriented market demand, and government-supported innovations in green chemistry. National initiatives such as Startup India and DST funding are facilitating the development of cosmeceutical-grade products. Both nations are supported by robust manufacturing ecosystems, regulatory advancements, and a growing focus on biotech-driven cosmetic research, solidifying their roles as pivotal players in the APAC functional cosmetics sector.

Trade Volume of Skincare in 2023

|

Leading Exporter |

Global Share (%) |

Leading Importer |

Global Share (%) |

|

Italy |

17.6 |

U.S. |

10.6 |

|

France |

14.6 |

China |

8.78 |

|

U.S. |

10.3 |

Singapore |

5.04 |

|

Germany |

3.73 |

Japan |

4.55 |

|

UK |

2.5 |

South Korea |

3.94 |

|

Canada |

2.8 |

Canada |

3.58 |

Source: OEC

North America Market Insights

By 2035, it is projected that the functional cosmetics market in North America will attain a value of USD 5.9 billion, accounting for 25.4% of the global market share. This growth is fueled by consumer demand for multifunctional, anti-aging, and ethically produced products, especially among Generation Z and Millennials. There is a notable increase in popularity for items containing SPF, vitamins, and biotech-derived active ingredients.

The U.S. is expected to capture a significant portion of the global functional cosmetics market, propelled by advanced research and development in skincare, a high consumer demand for multifunctional and anti-aging products, and a strong emphasis on clean beauty. Additionally, the market is bolstered by regulatory support and technology-driven innovations. For instance, Neutrogena, a brand under Johnson & Johnson, utilizes dermatological research to formulate science-based products such as its Rapid Wrinkle Repair line, which includes retinol and hyaluronic acid.

Canada is also projected to secure a considerable share of the global functional cosmetics market, fueled by an increasing consumer preference for clean and multifunctional beauty products, robust regulatory standards, and a rising demand for plant-based and sustainable formulations. The nation's commitment to ethical sourcing and biotechnological innovation further enhances market expansion. For instance, DECIEM, the parent company of The Ordinary, employs science-driven, minimalist formulations that provide targeted skin benefits while ensuring affordability and transparency.

Europe Market Insights

By the year 2035, it is anticipated that the functional cosmetics market in Europe holding 18% revenue share, fueled by a growing consumer interest in multifunctional and sustainable skincare products. Contributing factors include heightened awareness regarding skin health, progress in bioactive ingredient technology, strict regulatory requirements, and a significant focus on environmentally friendly formulations. Additionally, the region's commitment to innovation and ethical beauty practices will further enhance market growth.

The UK is expected to capture a significant portion of the global functional cosmetics market, propelled by a rising consumer interest in clinically validated, multifunctional skincare, a robust commitment to sustainability, and advancements in biotech-driven formulations. Additionally, supportive regulatory environments and an increasing wellness culture contribute to the market's growth. For instance, REN Clean Skincare creates high-performance products utilizing bioactive components and zero-waste packaging, which aligns with both functional effectiveness and environmental stewardship.

Germany is projected to secure a considerable share of the global functional cosmetics market, influenced by a strong focus on natural and organic ingredients, cutting-edge research in dermatology, and rigorous regulatory standards that enhance product safety and effectiveness. The nation's dedication to sustainability and innovation fosters growth in multifunctional skincare. For instance, Dr. Hauschka is well-known for its certified organic, holistic products that merge natural botanicals with scientific research to provide effective, functional skincare solutions.

Key Functional Cosmetics Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ashland Inc.

- Clariant AG

- Croda International Plc

- Evonik Industries AG

- DSM-Firmenich

- Symrise AG

- Givaudan Active Beauty

- Seppic (Air Liquide)

- LG Chem Ltd.

- Sami-Sabinsa Group

- DuPont de Nemours, Inc.

- Axilone Australia (Albéa Group)

- KLK OLEO (Kuala Lumpur Kepong Berhad)

- Kao Corporation

The functional cosmetics market is intensely competitive, fueled by the increasing demand for bioactive, sustainable, and clinically effective ingredients. Major companies such as BASF, Ashland, and Clariant maintain their leadership through vigorous research and development, innovations in green chemistry, and strategic acquisitions. Firms in Asia, including Kao and LG Chem, are experiencing rapid growth due to the rising demand for skincare products in the region. Businesses are investing in AI-driven formulation technologies, research into skin microbiomes, and environmentally friendly emulsifiers. Additionally, startups are being integrated into larger multinational corporations to accelerate innovation. The key strategies shaping this dynamic industry include global expansion, sustainable manufacturing practices, and advancements in dermaceutical-grade products. The table below lists the top 15 global manufacturers in the functional chemical cosmetics market, including market share estimates and country of origin, followed by a brief competitive landscape summary.

Recent Developments

- In March 2024, Ashland Inc. (USA) introduced Phyteq raspberry i, a versatile preservative enhancer derived from raspberry ketones. This innovation, which aligns with current trends in antimicrobial properties and skin health, contributed to a 17% rise in revenue within Ashland's functional cosmetic ingredient division by April 2024.

- In January 2024, BASF SE, based in Germany, introduced Verdessence™ RiceTouch, a natural sensory enhancer designed for functional cosmetics. This sustainable, plant-derived component contributed to a 14% increase in year-over-year sales within BASF's Care Chemicals division during the first quarter of 2024.

- Report ID: 3884

- Published Date: Oct 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Functional Cosmetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.