Enterprise Performance Management Market Outlook:

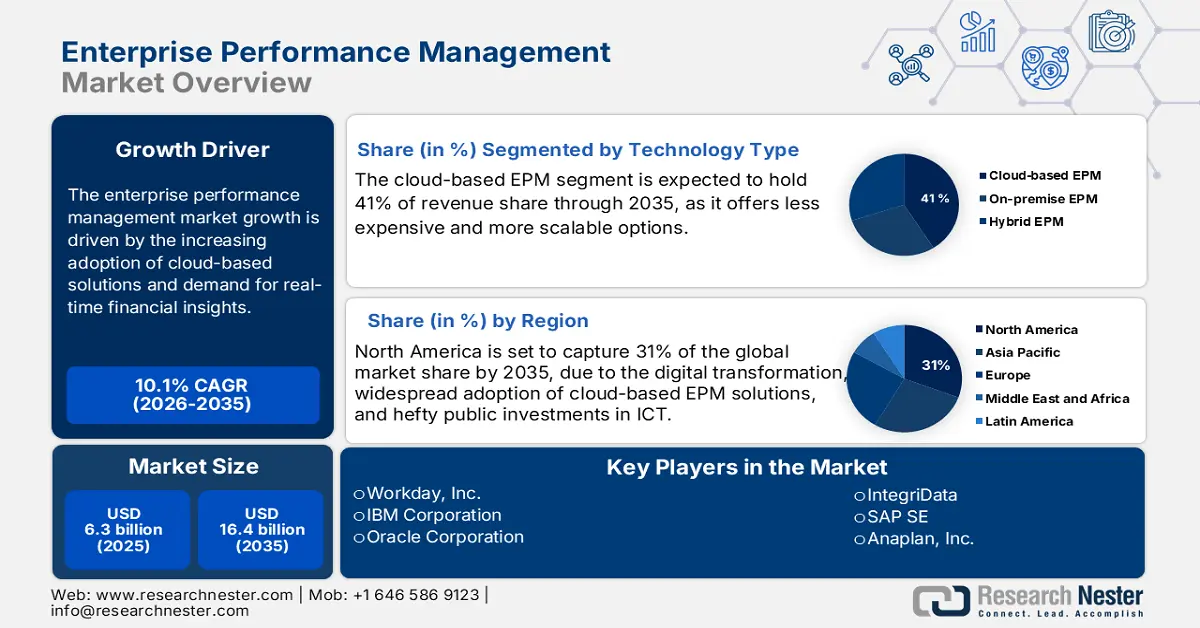

Enterprise Performance Management Market size was valued at USD 6.3 billion in 2025 and is projected to reach USD 16.4 billion by the end of 2035, rising at a CAGR of 10.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of enterprise performance management is estimated at USD 6.9 billion.

The global enterprise performance management sector tracks supply chain, producer and consumer pricing, and technology-driven investment. The U.S. Bureau of Labor Statistics shows that the Producer Price Index (PPI) for final demand increased by 0.1% in June 2025. While service prices rose 0.1%, prices for processed goods decreased by 0.3%. This suggests volatility in materials prices. The Consumer Price Index (CPI) is another primary inflation measurement. With regards to trade and logistics, BLS and the Bureau of Economic Analysis routinely report on U.S. import prices, export prices, GDP results, and foreign direct investment. In summary, export values grew by 0.5% in June 2025, whereas import prices increased by 0.1%. Furthermore, pricing pressures cross-border, and inventory strategies are all contributing upstream to the cost of goods sold.

Key Enterprise Performance Management Market Insights Summary:

Regional Insights:

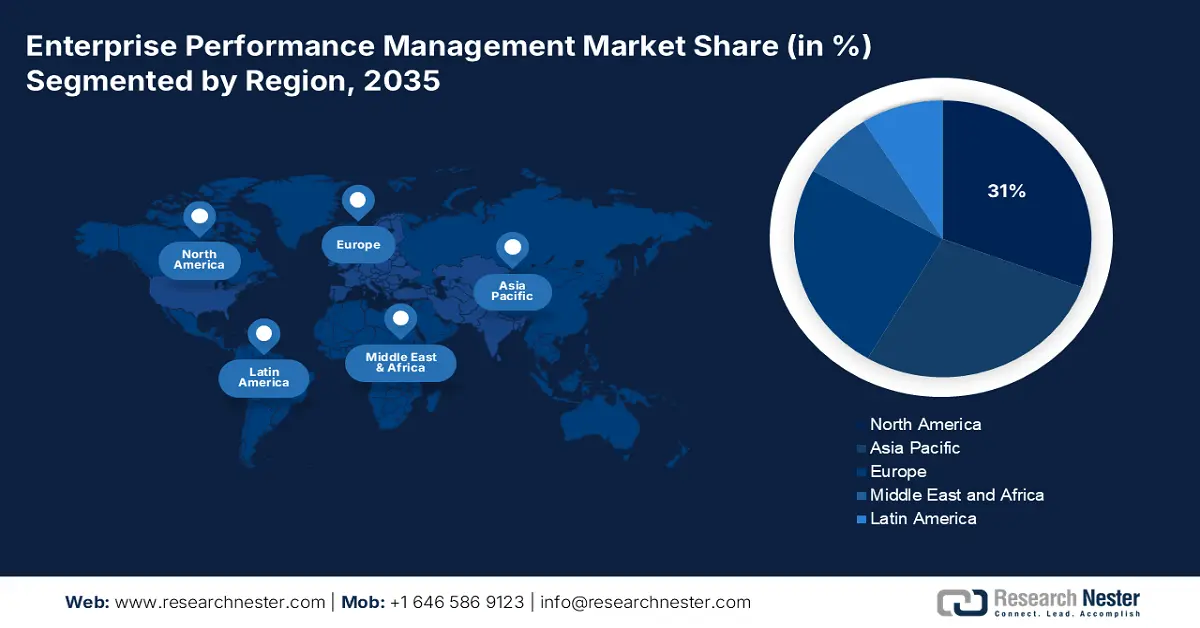

- By 2035, North America is projected to command a 31% share of the enterprise performance management market, underpinned by rapid digital transformation and expanding adoption of cloud-based EPM solutions.

- Asia Pacific is anticipated to post the fastest CAGR through 2026–2035 as surging uptake of cloud platforms and AI-enabled EPM tools accelerates growth, supported by strong government investments in digital infrastructure.

Segment Insights:

- The cloud-based EPM segment is expected to account for a 41% share by 2035 in the enterprise performance management market, propelled by its cost efficiency, scalability, and real-time decision-making capabilities.

- The financial management segment is projected to capture a 36% share by 2035, supported by rising demand for optimized financial operations, streamlined budgeting, and improved forecasting enabled by advanced automation.

Key Growth Trends:

- Adoption of cloud-based solutions

- Rise of remote work and digital transformation

Major Challenges:

- Pricing pressures and cost competition

- Cybersecurity challenges and high compliance costs

Key Players: Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Workday, Inc., Adaptive Insights (A Workday Company), IntegriData, Anaplan, Inc., SAS Institute Inc., Unit4, Infor, Inc., Epicor Software Corporation, Deltek, Inc., TIBCO Software Inc., Zycus, Inc.

Global Enterprise Performance Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.3 billion

- 2026 Market Size: USD 6.9 billion

- Projected Market Size: USD 16.4 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 22 August, 2025

Enterprise Performance Management Market - Growth Drivers and Challenges

Growth Drivers

-

Adoption of cloud-based solutions: The global shift toward cloud EPM solutions is a major influence on the market. As the National Institute of Standards and Technology (NIST) emphasizes, the flexibility of cloud computing helps businesses manage massive amounts of data to maintain the data security that comes with distributed teams. Cloud adoption has been a vital component for distinguished enterprises seeking to accelerate their financial planning, forecasting, and reporting efforts in real-time. The World Bank reveals that high-income countries score an average of 7.5 out of 10 on the Global Cloud Ecosystem Index, which measures how well their environments support cloud technology adoption. In comparison, low-income countries average around 3.25 on the same index. Organizations considering a move toward cloud EPM platforms likely have much to gain in terms of enhanced flexibility and lower costs because many cloud vendors provide GDPR compliance or cybersecurity standards that apply specifically to cloud solutions for enterprises.

-

Rise of remote work and digital transformation: The growing need for remote work and the rapid shift to digital tools are boosting the sales of teamwork-focused enterprise performance management solutions. These solutions aid enterprises in maintaining operations remotely while ensuring performance metrics are accessible to distributed teams in real time. The U.S. BLS discloses that more than 41% of employees in professional, scientific, and technical services worked remotely in 2022. The number crossed 38% for the information services. This highlights that the remote and hybrid work model is likely to boost the revenues of key players in the years ahead. To earn lucrative gains from his trend, companies are increasingly focusing on the introduction of EPM systems that enable real-time collaboration and streamline workflow across remote teams.

Challenges

-

Pricing pressures and cost competition: Intense price competition is one of the significant challenges faced by EPM solution providers. The competition among smaller EPM manufacturers is severe, leading to low price points. Moreover, data privacy laws, particularly in Europe and Asia, create delays for product launches. For instance, the General Data Protection Regulation (GDPR) in Europe and the new data protection laws in India impose restrictions on data flows. This is making it difficult to launch EPM solutions in many jurisdictions.

-

Cybersecurity challenges and high compliance costs: Cybersecurity is a key challenge expected to hamper the EPM market. Especially in the U.S., where the high standards for cybersecurity compliance are likely to raise costs for EPM providers. The establishment of strong encryption, security monitoring options, third-party audits, and a host of additional monitoring requirements places a considerable burden on smaller businesses as well.

Enterprise Performance Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 6.3 billion |

|

Forecast Year Market Size (2035) |

USD 16.4 billion |

|

Regional Scope |

|

Enterprise Performance Management Market Segmentation:

Technology Type Segment Analysis

The cloud-based EPM segment is projected to capture the largest share of 41% in the market over the assessed period, as it is less expensive and has more scalable options. Organizations are likely to handle much larger data more effectively through cloud-based EPM, as it adds flexibility to make decisions and collaborate in a real-time environment. The European Commission reveals that more than 40% of the EU enterprises had employed cloud computing services in 2023. The increase in urgency around digital transformation and/or reducing IT costs is an additional factor.

Application Segment Analysis

The financial management segment is anticipated to hold the highest share of 36% throughout the anticipated timeframe as organizations require optimization of financial operations, simplified budgeting, and enhanced financial forecasting. With the volatility of the global economy and increasing regulatory complexity, organizations are willing to invest in financial management solutions to make better decisions immediately. The advancements in AI and automation also contribute to the simplification of financial processes.

Organization Size Segment Analysis

The large enterprises are set to expand at a rapid pace throughout the study period. The scale, complexity, and regulatory requirements are pushing large businesses to invest in EPM solutions. The big organizations typically operate across multiple geographies, currencies, and business units, creating a need for real-time consolidation, rolling forecasts, and advanced analytics. The regional expansion of these businesses also fuels the demand for advanced cloud EPM solutions. CFOs and finance teams are leading the deployment of enterprise performance management technologies at a faster pace.

Our in-depth analysis of the global enterprise performance management market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Technology Type |

|

|

Application |

|

|

End user |

|

|

Functionality |

|

|

Organization Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise Performance Management Market - Regional Analysis

North America Market Insights

North America is expected to dominate the global enterprise performance management market with a share of 31% by the end of 2035, driven by digital transformation and widespread adoption of cloud-based EPM solutions. Governments have invested in many Cloud Connective Technologies (CCT) and expanded broadband through federal programs in the U.S. The FCC has made millions in investments in broadband programs. This enhances the uptake of cloud-based EPM solutions. In 2023, more than a million households gained access to high-speed broadband, which helped fuel demand for EPM services.

The U.S. enterprise performance management market is likely to register rapid growth owing to hefty government investments. The FCC and NTIA have made broadband expansion and 5G infrastructure a critical policy priority for both access and improvement of data strategy. Furthermore, federal initiatives, such as the Broadband Equity, Access, and Deployment (BEAD) program, allocated USD 42.45 billion in 2023. As broadband access grows, it also increases businesses' capabilities for adopting cloud EPM holistic solutions.

The Canada enterprise performance management market is anticipated to expand swiftly through 2035 as the government's initiatives bolster the digital transformation focused on strengthening its economy. To stimulate the adoption of digital tools, the government’s Innovation, Science and Economic Development (ISED) launched in 2022, allocating CAD 1.2 billion for the expansion of digital technologies. This primarily helps local businesses on their digital transformation journey. Further investments are projected to stimulate digital equity. The Canadian Radio-television and Telecommunications Commission (CRTC) is set to support the expansion of its 5G and broadband infrastructure. This is crucial in adopting enterprise-level software solutions such as EPM.

APAC Market Insights

Asia Pacific is poised to register the highest CAGR during the forecast period. The region's growth in cloud solutions and artificial intelligence (AI) integrated in EPM systems is opening high-earning opportunities. One of the key growth drivers is government investment in digital infrastructure transformation. China, India, and Japan are leading the sales of enterprise performance management solutions, owing to the strong presence of early adopters.

China leads the sales of enterprise performance management solutions due to the strong presence of big state-owned enterprises and large private groups. Cloud adoption in the finance and manufacturing sectors is also boosting the trade of EPM systems. Supportive government policies and funding are also contributing to the increasing adoption of enterprise performance management technologies. The country’s Statistics Bureau reports that in 2023, the digital economy's core industries added 12.76 trillion yuan, making up nearly 10% of the country's total GDP. The emerging private firms are also an important growth corridor for SaaS EPM platforms.

The India market for enterprise performance management is poised to expand at the fastest CAGR from 2026 to 2035. The rapid scaling needs in services and product firms, and a high focus on working-capital optimization, are creating a profitable environment for key players. The strong preference for cloud-first EPM due to lower upfront infrastructure cost and a growing pool of finance transformation partners is further propelling the deployment of EPM technologies. The IT spending in the country registered double-digit growth of around 11% in 2024, per the India Brand Equity Foundation (IBEF).

Europe Market Insights

The Europe enterprise performance management market is estimated to garner a significant revenue share throughout the study period. Overall, the growth of this region is driven by a strong emphasis on both cloud computing and digital transformation. Concrete government support is set to offer considerable strength through several programs. Germany and the U.K. are leading the way with new ICT investments that are expected to boost the EPM adoption within sectors. France, with their Digital Economy Policy, is also driving their spending on EPM technologies. This is creating a favorable market space for key players. Moreover, the increase in data privacy regulations in the EU and the policies from the European Telecommunications Network Operators' Association (ETNO) have induced a demand from companies for more secure, efficient, and scalable EPM solutions.

The sales of enterprise performance management solutions in Germany are expected to be driven by a mature corporate landscape and strict regulatory standards. Large enterprises are dominating EPM adoption, owing to the complex reporting requirements under IFRS, German GAAP (HGB), and EU sustainability reporting directives. Automotive, manufacturing, and chemical sectors are prime end users of enterprise performance management technologies in the country. Cloud adoption is likely to gain traction, whereas hybrid deployments are set to remain common due to the complex data protection rules. Overall, investing in Germany is expected to offer lucrative gains throughout the anticipated period.

Key Enterprise Performance Management Market Players:

- Oracle Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Workday, Inc.

- Adaptive Insights (A Workday Company)

- IntegriData

- Anaplan, Inc.

- SAS Institute Inc.

- Unit4

- Infor, Inc.

- Epicor Software Corporation

- Deltek, Inc.

- TIBCO Software Inc.

- Zycus, Inc.

The market is highly competitive, with key players operating at global and regional levels. These companies are fueling their strategic edge through AI-enhanced forecasting, integrated platforms, and consulting support. Strategic initiatives such as partnerships with consulting firms for global rollouts, acquisitions to enhance analytics capabilities, and investments in machine learning and predictive tools.

Here is a list of key players operating in the global EPM market:

Recent Developments

- In May 2025, Peloton Consulting Group unveiled the launch of InsuranceXcelerate. This is a specialized planning solution designed specifically for the insurance industry.

- In April 2025, Oracle NetSuite introduced its latest NetSuite enterprise performance management (EPM). This platform includes NetSuite Planning and Budgeting and NetSuite Account Reconciliation, and is available to organisations in Singapore.

- In November 2024, Watlow previewed its revolutionary Eurotherm-branded Edge Process Management (EPM) platform. The company strategically showcased this solution at SPS 2024 in Nuremberg, Germany.

- Report ID: 1509

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.