Enteral Collagen Peptide Protein Market Outlook:

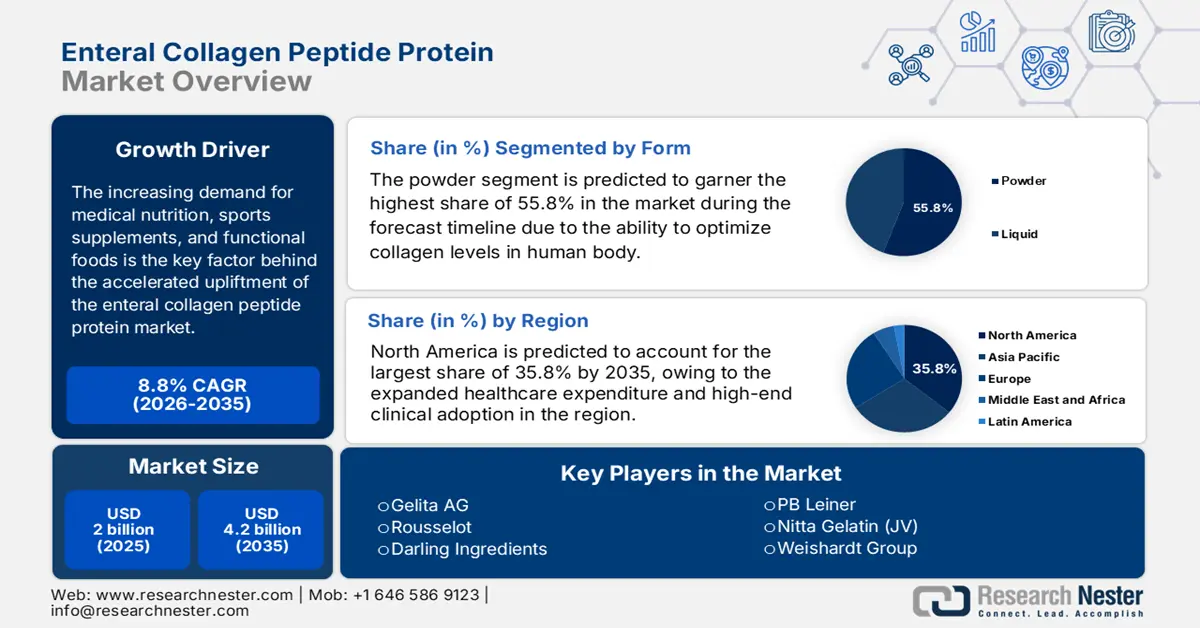

Enteral Collagen Peptide Protein Market size was USD 2 billion in 2025 and is anticipated to reach USD 4.2 billion by the end of 2035, increasing at a CAGR of 8.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of enteral collagen peptide protein is estimated at USD 2.1 billion.

The increasing requirement for medical nutrition, functional foods, and sports supplements is the key factor behind the accelerated development of the enteral collagen peptide protein market globally. In addition, the industry significantly serves a substantial patient pool demanding clinical nutrition, particularly in geriatric and chronic disease management. As per an article published by NLM in May 2022, enteral nutrition is readily recommended to be provided to patients within 24 to 48 hours. In addition, it can be initiated at 20 to 40 ml/h and at an advanced 20 to 30 ml/h within every 4 to 12 hours. Therefore, this denotes a huge growth opportunity for the overall market across different nations.

Moreover, the aspect of insurance and government support, along with an expansion in healthcare accessibility in developing countries, is also uplifting the enteral collagen peptide protein market internationally. According to the 2025 NFSA Government data report, the National Food Security Act 2013 has readily entitled to 75% of the rural population, along with 50% of the urban population in India to gain standard food grains under the Targeted Public Distribution System. Besides, an effective rise in disposable income, along with administrative strategies are readily improving healthcare facilities, thereby leading to specialized medical nutrition products, which in turn is boosting the market’s exposure.

Key Enteral Collagen Peptide Protein Market Insights Summary:

Regional Highlights:

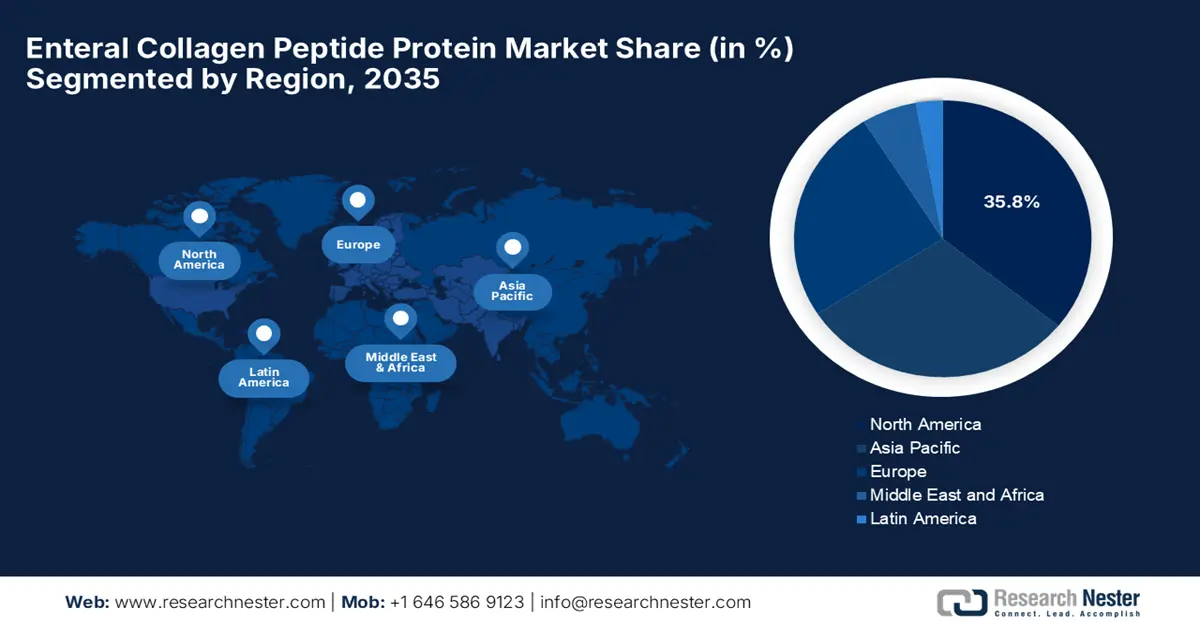

- North America is projected to secure a 35.8% share by 2035, driven by rising demand for medical nutrition, healthcare expenditure, and innovative manufacturing automation.

- Europe is expected to be the fastest-growing region, owing to aging demographics, chronic disease prevalence, and strong R&D investment.

Segment Insights:

- Powder segment is projected to hold a 55.8% share by 2035, propelled by its effectiveness in replenishing collagen crucial for muscles, bones, skin, and cartilage integrity.

- Medical nutrition segment is expected to secure the second-highest share during the forecast period, owing to its role in supporting patients’ dietary needs and improving survival outcomes in clinical nutrition therapy.

Key Growth Trends:

- Standard and preventive health trends

- Unmet demands in developing countries

Major Challenges:

- Compliance and bureaucratic obstacles

- Intense competition from synthetic alternatives

Key Players: Gelita AG, Rousselot, Darling Ingredients, PB Leiner, Nitta Gelatin (JV), Weishardt Group, Tessenderlo Group, Lapi Gelatine, Rousselot China, Gelnex, Collagen Solutions, Advanced BioMatrix, Amicogen, Hainan Huayan Collagen, Cosen Biochemical

Global Enteral Collagen Peptide Protein Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 4.2 billion by 2035

- Growth Forecasts: 8.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, France, U.K., Japan

- Emerging Countries: China, India, Malaysia, South Korea, Australia

Last updated on : 22 October, 2025

Enteral Collagen Peptide Protein Market - Growth Drivers and Challenges

Growth Drivers

- Standard and preventive health trends: The sports nutrition and preventive health approaches are readily driving the enteral collagen peptide protein market internationally. According to an article published by the CDC in April 2023, 34.8% of children as well as adolescents, along with 58.5% of adults, undertake at least one dietary supplement within a month. Besides, multivitamin mineral is readily utilized by 23.5% of youths and 31.5% of adults. In addition, 3% of children reported including vitamin D, while 18.5% of adults include vitamin D in their regular diet, thus making it suitable for bolstering the market.

- Unmet demands in developing countries: Despite an increase in demand, certain nations continue to witness disparities in terms of accessibility that have effectively created a massive growth opportunity for manufacturers to successfully capitalize in this particular industry. In this regard, the 2025 WHO article indicated that elderly patients above 60 years of age are projected to increase from 12.2% to 22.9% by the end of 2050, particularly in South East Asia, further denoting a lack of cost-effective enteral nutrition. Therefore, this denotes a huge opportunity for the market to gain increased exposure across emerging nations.

- Advancements in product and technological innovation: This is yet another growth driver for the enteral collagen peptide protein market, and companies are readily investing in proprietary processes. This results in the development of collagen peptides with increased bioavailability, targeted efficiency, and better solubility for specific health applications. Besides, innovation is not limited only to powder formulations, but ready-to-drink liquids, convenient single-serve packets, and gummies are also effectively optimizing patient compliance, along with consumer convenience, thereby extending the overall market’s global reach.

Dietary Intake Boosting the Enteral Collagen Peptide Protein Market (2025)

|

Nutrition Type |

Rate (kilocalories) |

|

Mean carbohydrate intake for men |

45.9% |

|

Mean carbohydrate intake for women |

47.4% |

|

Mean protein intake for men |

16% |

|

Mean protein intake for women |

15.7% |

|

Mean total fat intake for men |

35.6% |

|

Mean total fat intake for women |

36.1% |

Source: CDC

Prevention and Ailment of Refeeding Syndrome in Adults (2022)

|

Care Aspect |

Recommendations |

|

Feeding initiation |

Limited dextrose with 100 to 150 g/d or 10 to 20 kcal/kg for 24 hours |

|

Feeding advancement |

Advance by 1/3 of the objective every 1 to 2 days |

|

Electrolytes, including Phosphorus, Potassium, and Magnesium |

Monitoring every 12 hours for first 3 days, especially among high-risk patients |

|

Thiamin |

Provide 100 mg before feeding high-risk patients and 100 mg/d for 5 to 7 days among patients with critical starvation |

|

Monitoring |

Critical signs every 4 hours for 24 hours |

Source: NLM

Challenges

- Compliance and bureaucratic obstacles: These have created a huge hurdle for notable pioneers in the enteral collagen peptide protein market globally, resulting in a delay in the product’s market entry. For instance, administrative bodies generally add a 6-month delay for approving peptides, which leads to an exacerbated expense in lost revenue. Besides, in 2024, the U.S. FDA’s testing mandate readily made an addition in research and development (R&D) expenses, thereby further making it immensely challenging for manufacturers to leverage products related to enteral collagen peptide protein.

- Intense competition from synthetic alternatives: This is yet another challenge that has readily caused a hindrance in the development of the enteral collagen peptide protein market internationally. Based on this, the NIH indicated that the U.S. FDA has successfully cleared all synthetic peptides and gradually gained a considerable share within the U.S. market as of 2023. This has effectively reflected an increased acceptance among the global population, which in turn has created a challenging atmosphere for collagen peptide manufacturers.

Enteral Collagen Peptide Protein Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 2 billion |

|

Forecast Year Market Size (2035) |

USD 4.2 billion |

|

Regional Scope |

|

Enteral Collagen Peptide Protein Market Segmentation:

Form Segment Analysis

Based on the form, the powder segment in the enteral collagen peptide protein market is anticipated to account for the highest share of 55.8% by the end of 2035. The segment’s upliftment is highly attributed to its capability to effectively replenish the body’s declined collagen levels, which are extremely crucial for muscles, bones, skin, and cartilage integrity. According to an article published by NLM in December 2023, protein powders have readily dominated with a revenue share of 56% for the past four years. Besides, ready-to-drink protein is projected to grow rapidly at a growth rate of 8.5%, thus making it suitable for the segment’s growth globally.

Application Segment Analysis

Based on application, the medical nutrition segment in the enteral collagen peptide protein market is expected to garner the second-highest share during the predicted duration. The segment’s development is highly fueled by its usability in diet to combat, administer, and aid disorders, along with their symptoms and ensuring the required nutrients to be consumed by patients. As per the March 2024 NLM article, medical nutrition therapy (MNT) has been readily suitable for head and neck cancer (HNC), with a 5-year survival rate of 63%, along with a 10-year survival rate of 53%, which is a huge growth opportunity for the overall segment’s growth.

Source Segment Analysis

Based on the source, the bovine segment in the enteral collagen peptide protein market is projected to cater to the third-highest share by the end of the forecast timeline. The segment’s upliftment is highly driven by it being essential for international food security, supplying nutrient-based milk and meat, while offering valuable by-products, such as fertilizer and leather for industry and agriculture. Besides, the bovine serves as an indispensable draft animal for labor, enhances soil fertility through manure, and readily contributes to global cultures and economies, wherein it effectively has gained religious, wealth, and symbolic importance.

Our in-depth analysis of the enteral collagen peptide protein market includes the following segments:

|

Segment |

Subsegments |

|

Form |

|

|

Application |

|

|

Source |

|

|

Distribution Channel |

|

|

Product Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enteral Collagen Peptide Protein Market - Regional Analysis

North America Market Insights

North America in the enteral collagen peptide protein market is anticipated to be the dominating region, garnering the largest share of 35.8% by the end of 2035. The market’s growth in the region is highly attributed to an increase in the demand for medical and clinical nutrition, a surge in healthcare expenditure, an established reimbursement landscape, surgical applications for chronic diseases, and innovative manufacturing automation. As per an article published by NLM in May 2023, chronic conditions, such as cardiovascular disease, which is attributed to dyslipidemia in the U.S., increased from USD 103.5 billion to USD 226.2 billion, thus effectively driving the market’s demand.

The enteral collagen peptide protein market in the U.S. holds a predominant position in the regional enteral collagen peptide protein market, largely driven by the expansion of Medicare and Medicaid, as well as research grants from public healthcare systems. According to an article published by NLM in July 2025, biofilms have the capability to form within 10 hours after an injury incidence for almost 60% of overall chronic wounds. Besides, the November 2024 CMS Government report indicated that more than 160 million people in the region achieve health coverage through Medicaid and Medicare, which is also uplifting the market in the country.

The enteral collagen peptide protein market in Canada is also growing due to the high support from provincial healthcare investments. In this regard, Health Canada, as of March 2025, reported that the organization has readily spent USD 13.7 billion as of 2024, which effectively caters to 2.7% of federal expenditure. In addition, an estimated 10 government-based departments in the country accounted for almost 73.2% of federal spending for enhancing the health of patients. This includes 26.4% from Finance Canada, 3.7% from Global Affairs Canada, and 2.7% from Public Safety Canada, thus suitable for uplifting the market.

Chronic Disease Prevalence in North America (2023-2024)

|

Components |

Incidence/Rate |

|

Population affected |

129 million |

|

Preventable and treatable chronic disease |

5 in 10 |

|

Increase in cases |

42% have more than 2 conditions 12% have 5 conditions |

|

Healthcare spending |

USD 4.1 trillion |

|

Prevalence in Atlantic province |

59.5 in Newfoundland 55.8% in Prince Edward Island 54.2% in Nova Scotia 55% in New Brunswick |

|

Prevalence in Manitoba |

49.4% |

|

Rural areas |

10,000 residents affected with heart disease, blood pressure, arthritis, obesity, and diabetes |

Sources: CDC; Statistics Canada

Europe Market Insights

Europe in the enteral collagen peptide protein market is predicted to emerge as the fastest-growing region. The market’s upliftment in the region is highly driven by aging demographics and chronic diseases, which is effectively followed by the presence of leading countries such as Germany, France, and the U.K. with unique developmental approaches. According to an article published by Europe Commission in June 2025, the initial domestic-based research funding programme generously allocated EUR 2.6 billion to ensure artificial intelligence (AI) for research and development, which positively impacts the overall market.

The enteral collagen peptide protein market in Germany is gaining increased traction, owing to the presence of a robust healthcare infrastructure and progressive reimbursement policies. Besides, the G-BA currently offers coverage to collagen peptides for wound care and geriatric malnutrition, and has been providing coverage improvement since 2022. According to the 2023 Federal Ministry for Economic Affairs and Climate Action data report, there has been an expansion in the gross domestic product (GDP) in the country by 1.9% as of 2022, while the federal government also witnessed an increase in GDP by 0.2% in 2023, which denotes an optimistic outlook for the overall market growth in the country.

The enteral collagen peptide protein market in France is also developing due to leveraged marine collagen innovation and tax incentives. In this regard, an article has been published by NLM in September 2022, wherein collagen caters for almost 30% of the overall body protein content in human beings and 90% comprises fibrillar collagen, including Type I, II, III, V, and XI. Besides, there exists different commercially available three-dimensional collagen biomaterials for numerous applications, such as Hemocollagene, a product of Saint-Maur-des-Fossés, thus suitable for the market’s development in the country.

APAC Market Insights

Asia Pacific in the enteral collagen peptide protein market is projected to account for a considerable share. The market’s development in the region is highly fueled by the increasing disease burden, rapid aging demographics, the existence of emerging economies, Japan, China, India, Malaysia, and their unique progressive approaches. Besides, administrative allocations and reimbursement policies have been highly prioritized among global investors, while the region’s escalating patient population, along with fast-track approvals, are further responsible for elevating the market’s development in the overall region.

The enteral collagen peptide protein market in China is gaining increased exposure, owing to the aspect of massive government investments and a huge consumer base. As per an article published by NLM in August 2022, the Healthy China 2030 has readily formulated an increase in nutrition knowledge by 10%, and reducing per capita regular salt intake by 20%. Besides, the presence of nutrition screening tools has also been encouraged for the elderly population, for which pilot programs are initiated for over 80% of the population in the country.

The enteral collagen peptide protein market in India is also developing due to its emergence as the targeted center for global leaders, along with the Ayushman Bharat Scheme implementation by the country’s government, which serves an extensive patient pool with cost-effective nutrition. Based on this, the July 2024 data report published by the PIB indicated that there has been an upsurge in health expenditure from 1.4% to 1.9% between 2023 and 2024. In this regard, the spending on social services recorded a surge to 2.6% within the same duration, of which health spending accounts for 6.5%, thus suitable for the market’s growth.

Key Enteral Collagen Peptide Protein Market Players:

- Gelita AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rousselot

- Darling Ingredients

- PB Leiner

- Nitta Gelatin (JV)

- Weishardt Group

- Tessenderlo Group

- Lapi Gelatine

- Rousselot China

- Gelnex

- Collagen Solutions

- Advanced BioMatrix

- Amicogen

- Hainan Huayan Collagen

- Cosen Biochemical

The international enteral collagen peptide protein market effectively represents an intensified landscape with dominating organizations from Europe, rigidly emphasizing hydrolysis technologies. Besides, suitable pioneers in the U.S. tend to compete with established medical applications. Meanwhile, notable players have readily undertaken different approaches, including sustainable production, pharmaceutical collaborations, and vertical integration, with the intention of successfully securing their respective market positions. Therefore, all these models are projected to effectively demonstrate standard growth opportunities for the market in the upcoming years.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2024, Regenity Biosciences declared that it has successfully received the administrative approval from the NMPS regarding its notable crosslinked bioresorbable and implantable collagen, which is intended to be utilized for oral surgical procedures.

- In January 2024, Abbott notified the successful unveiling of its latest PROTALITY brand, which effectively caters to a high-protein nutrition shake to provide support for the increasing number of adults readily interested in losing weight.

- Report ID: 7847

- Published Date: Oct 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.