Electric Power Steering Market Outlook:

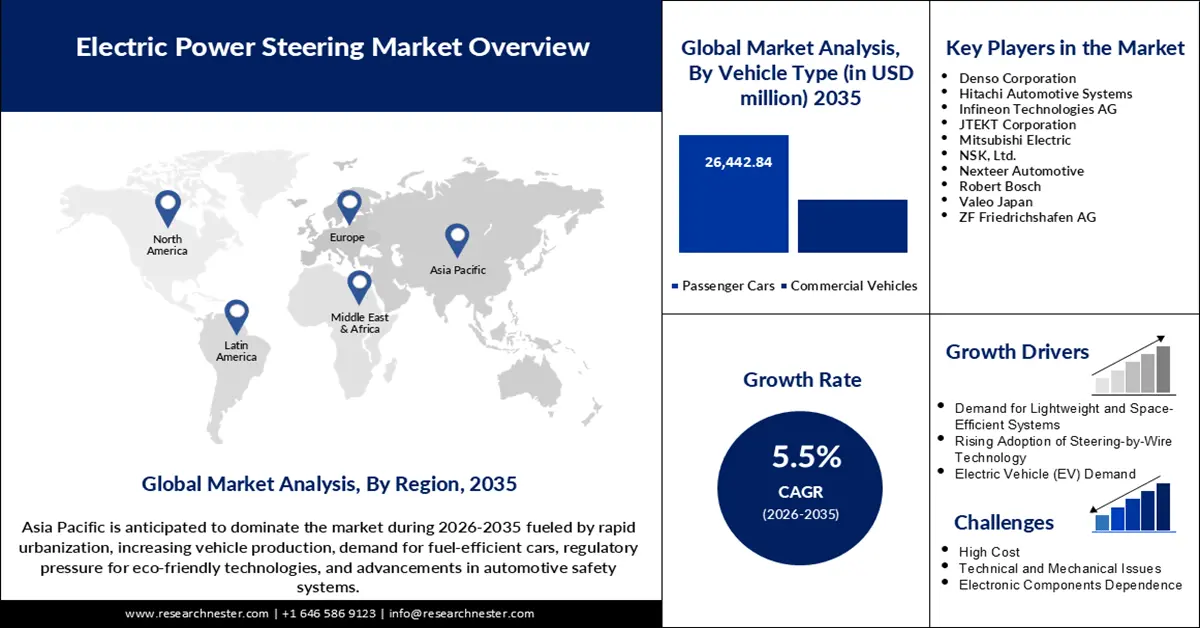

Electric Power Steering Market size was over USD 29.23 billion in 2025 and is projected to reach USD 49.93 billion by 2035, growing at around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of electric power steering is evaluated at USD 30.68 billion.

The electric power steering market remains on an upward trend as car manufacturers focus on fuel efficiency, car autonomy, and a cleaner environment. EPS systems reduce the use of hydraulic systems for steering, which are replaced by electric assisted systems that are more efficient in terms of power consumption. This has led to governments across the globe promoting lightweight vehicle technologies to achieve better fuel efficiency, which in turn has led to a faster adoption of EPS by manufacturers. Further, by-wire steering solutions that are a part of the Advanced Driver Assistance Systems (ADAS) market are emerging. In January 2025, ZF and Rane Group made a strategic move by launching EPS technology in India. Such moves caters to the increasing demand for enhanced steering systems in both the passenger and commercial vehicle markets in the country.

Stringent emission standards are significantly influencing the electric power steering market growth, as governments work to curb emissions and fuel consumption. According to the International Energy Agency (IEA), the overall sales of electric vehicles (EVs) increased from 2022 to 2023 by 3.5 million units, which is an annual growth of 35%, and thus, driving the demand for EPS in EVs and hybrid vehicles. Governments have also introduced measures such as the European Union Green Deal that seeks to reduce emissions by 45% in heavy-duty vehicles by 2030. Such goals put pressure on car makers to focus on energy-efficient parts, making EPS an essential solution to achieve such goals.

Key Electric Power Steering Market Insights Summary:

Regional Highlights:

- Asia Pacific electric power steering market will dominate more than 58.70% share by 2035, driven by rising population, growing sales of EVs, and adoption of advanced driver assistance systems.

- North America market will exhibit significant growth during the forecast timeline, attributed to rising demand for ADAS, EVs, and safety-compliant steering systems.

Segment Insights:

- The passenger cars segment in the electric power steering market is projected to secure a 67.70% share by 2035, driven by demand for comfortable, efficient mobility, including electric models.

- The steering rack/column segment in the electric power steering market is anticipated to achieve significant growth during 2026-2035, driven by the expansion of EPS in newer vehicle models and demand for accurate steering.

Key Growth Trends:

- Rising demand for electric and hybrid vehicles

- Integration of ADAS in modern vehicles

Major Challenges:

- Steering system complexity and self-driving cars

- Supply chain disruptions and component availability

Key Players: Denso Corporation, Hitachi Automotive Systems, Infineon Technologies AG, JTEKT Corporation, Mitsubishi Electric, NSK, Ltd., Nexteer Automotive, Robert Bosch, Valeo Japan, ZF Friedrichshafen AG.

Global Electric Power Steering Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.23 billion

- 2026 Market Size: USD 30.68 billion

- Projected Market Size: USD 49.93 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (58.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Electric Power Steering Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for electric and hybrid vehicles: Electric and hybrid cars rely on components that help regulate and manage power in a way that does not hinder performance. EPS fulfills this need by minimizing the energy losses commonly experienced in hydraulic systems. In November 2024, ZF Automotive Technology increased its EPS production in China, which proves that local car makers are eager to adopt electronically assisted steering for the largest electric vehicle market in the world. This strategic expansion also fits into the customers’ desire for precision steering and low maintenance. In this context, EPS is a crucial factor for automakers to offer both sustainable and high-performance vehicles for consumers.

- Integration of ADAS in modern vehicles: As ADAS functions such as lane-keeping assist and automatic emergency steering demand precise electronic inputs, EPS systems are well placed to deliver. For instance, the Partnership for Analytics Research in Traffic Safety (PARTS) revealed that 10 out of 14 ADAS features had more than 50% market uptake by 2023. This fact highlights the need for high-performance steering solutions that would be able to respond in a matter of milliseconds. The increasing popularity of ADAS also improves safety and increases the need for EPS technologies that can interact with onboard sensors and control modules.

- Weight reduction and fuel efficiency: Another advantage of EPS is that it plays a major role in weight reduction due to the absence of the hydraulic fluid reservoir and other associated parts. According to the U.S. Department of Energy, reducing the weight of a vehicle by 10% is likely to result in fuel economy gains of between 6% and 8%. This is a plus for both the car manufacturers and the car users who are in most cases conscious of the amount of emission and the running cost. For this reason, EPS is gradually replacing hydraulic steering to reduce fuel consumption in conformity with current trends. These trends reveal how EPS can contribute to providing more environmentally friendly transportation.

Challenges

- Steering system complexity and self-driving cars: Although EPS is beneficial, implementing steer-by-wire systems for fully autonomous vehicles cannot be an easy task. Self-driving systems are very complex and need high levels of redundancy and safety measures, hence the need for software and hardware integration. Steer-by-wire, a system that eliminates mechanical linkages with electrical and electronic systems, has functional safety requirements. This has made development timelines more complicated. However, industry players agree that EPS can be used to facilitate the evolution of the driving process to the next level of automation.

- Supply chain disruptions and component availability: Some of the challenges that affected EPS production include the global semiconductor shortage and logistics disruptions. High precision sensors and control units are essential for steering performance, which becomes a challenge for the supply chain. This has led to the adoption of local sourcing and vertical integration strategies by companies to avoid reliance on a single supplier. While some of these factors may be improving in some areas, the ability to gain a stable supply of electronic components continues to be a key concern for EPS manufacturers seeking to achieve sustained growth.

Electric Power Steering Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 29.23 billion |

|

Forecast Year Market Size (2035) |

USD 49.93 billion |

|

Regional Scope |

|

Electric Power Steering Market Segmentation:

Component Segment Analysis

Steering rack/column segment is anticipated to capture over 34.6% electric power steering market share by 2030, due to the expansion of EPS in the newer models of vehicles. The steering rack is a critical component in EPS systems because it is responsible for the conversion of force produced by the motor into the required vehicular movement. In January 2025, Nexteer Automotive launched a new production line for EPS in China, which reflects the global trend towards the advanced steering mechanisms. Due to this expansion, Nexteer will be able to provide a large market of customers who require highly accurate steering systems that enhance vehicle stability.

Vehicle Type Segment Analysis

By the end of 2030, passenger cars segment is predicted to hold over 67.7% electric power steering market share owing to the growing demand for comfortable and efficient mobility. This segment includes sedans, SUVs, and electric models, all of which can take advantage of the fuel-saving attributes and improved ride quality of EPS systems. In November 2023, Mahindra & Mahindra announced that it had entered into a strategic partnership with Valeo for electric drivetrains and EPS solutions in its Born Electric passenger vehicles. These collaborations demonstrate the increasing focus on the overall vehicle system that coordinates power demands and driver comfort.

Our in-depth analysis of the global electric power steering market includes the following segments:

|

Type |

|

|

Component |

|

|

Vehicle Type |

|

|

Vehicle Propulsion Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electric Power Steering Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in electric power steering market is likely to account for more than 58.7% revenue share by the end of 2030, owing to the rapidly growing population, sales of electric vehicles, and advanced driver assistance system vehicles. Developing nations such as China and India are already moving towards the implementation of the advanced steering system to enhance fuel economy, control, and safety of the drivers.

The demand for sophisticated automotive technologies in India has led to a major development in the Indian automotive steering industry. For instance, in January 2025, ZF entered into a partnership with Rane Steering Systems which allows Rane Steering Systems to incorporate ZF’s rack drive EPS technologies to meet the growing demand for lightweight and high-performance steering systems for passenger and commercial vehicles. Such partnerships are likely to further enhance India shift towards intelligent mobility solutions, driving the market expansion.

China continues to play a key role in the electric power steering market, where manufacturers are working on increasing production capabilities to cater to the increasing demand. For example, Nexteer Automotive invested in a new manufacturing and testing facility in Changshu, Jiangsu Province in January 2025 to support its advanced steering systems production. Such investment is in line with the automotive electrification plan in China and strengthens the country’s role as a center for EPS technology advancement.

North America Market Insights

North America region is set to witness significant growth till 2035, due to the growing need for ADAS, EVs, and safety-compliant steering systems. Manufacturers are focusing on the development of energy-efficient steering systems for the purpose of improving the cars’ performance and at the same time minimizing emission levels. The trend towards autonomous driving is also contributing to the increased popularity of electric power steering (EPS) as manufacturers incorporate steer-by-wire technologies into new vehicles.

Rising automotive alliances with software companies are anticipated to propel the growth of the electric power steering market in the U.S. In October 2024, Volkswagen collaborated with Ansys software to create new and improved EPS solutions with improved simulation functions in the United States. This approach is aimed at enhancing the steering responsiveness in the new-generation vehicles, enhancing safety, and achieving precise handling. Through real-time modeling, Volkswagen seeks to increase predictive performance in electric and self-driving vehicles and strengthen EPS as an element of future mobility.

The electric power steering market in Canada is also expanding due to the increasing investments by car makers and their components suppliers in safety conformant steering systems. As the government of Canada is actively promoting the use of electric vehicles, domestic producers of automotive components are aiming at lightweight and energy-saving steering solutions. In November 2024, Linamar Corporation revealed that it had plans to expand its EPS manufacturing plant in Ontario as part of its strategic response to the increasing electric power steering market for electric and hybrid automobiles.

Electric Power Steering Market Players:

- Denso Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hitachi Automotive Systems

- Infineon Technologies AG

- JTEKT Corporation

- Mitsubishi Electric

- NSK, Ltd.

- Nexteer Automotive

- Robert Bosch

- Valeo Japan

- ZF Friedrichshafen AG

The electric power steering market is highly competitive, with key players focusing on technological innovation, regional expansion, and strategic collaborations. Leading companies in the industry include Denso Corporation, Hitachi Automotive Systems, Infineon Technologies AG, JTEKT Corporation, Mitsubishi Electric, NSK Ltd., Nexteer Automotive, Robert Bosch, Valeo Japan, and ZF Friedrichshafen AG. These companies are actively expanding their production capabilities to cater to the growing global demand for EPS systems.

The positive competition outlook has remained a major factor impacting on the advancement of the electric power steering market. For instance, in January 2025, ZF Friedrichshafen AG signed a major deal to provide brake-by-wire and EPS systems to a multinational Original Equipment Manufacturer (OEM). This development points to the fact that there is an increasing use of integrated by-wire technologies in the automotive sector. Due to these factors, EPS is gradually becoming an important element in the further development of vehicle steering and automation, influencing the demand during the forecast period.

Here are some leading companies in the electric power steering market:

Recent Developments

- In December 2024, Bosch announced the expansion of electric steering production in Hungary, with an investment of USD 117 million, supported by USD 27 million in state funding. The expansion reflects the growing demand for EPS systems across Europe markets.

- In October 2024, Nissan launched the 2025 Nissan Murano, featuring advanced design upgrades and enhanced performance. The EPS system has been integrated to improve handling and damping sensitivity, available with intelligent all-wheel drive or front-wheel drive, reinforcing EPS adoption in the automotive sector.

- In August 2024, Nexteer Automotive introduced mPEPS, expanding its modular and cost-effective EPS portfolio, including Dual-Pinion and Single-Pinion systems. The system enhances scalability, shortens development cycles, and increases component reuse, while offering low NVH (noise, vibration, and harshness) levels and advanced safety features.

- Report ID: 4791

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electric Power Steering Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.