Efinaconazole Market Outlook:

Efinaconazole Market size was USD 1.8 billion in 2025 and is anticipated to reach USD 4.1 billion by the end of 2035, increasing at a CAGR of 9.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of efinaconazole is estimated at USD 1.9 billion.

The international market is effectively propelled by a combination of economic, technological, and demographic factors. Besides, the worldwide aging population is also a fundamental driver, since onychomycosis incidence effectively increases with age and directly expands the patient pool. According to an article published by NLM in January 2022, onychomycosis transmission is extremely common in households and accounts for 44% to 47%, with almost one individual affected. Besides, this fungal infection is estimated at almost 6.5% among the population in Canada, and it is considered to be responsible for nearly 50% of overall nail diseases globally.

Moreover, as per the August 2025 BLS Government data report, the producer price index has eventually edged down for final demand to 0.1%, which denotes an optimistic outlook for the efinzconazole market internationally. Besides, final demand prices readily advanced 0.7% in July and 0.1% in June, while the index eventually increased by 2.6% for a year, all of which effectively caters to the market’s upliftment across different nations. This rise is deliberately attributed to an increase in the expenses regarding raw materials, logistics, labor, and antifungal API production. Therefore, this highlights the enhanced demand for incorporating a wide-ranging pricing model that balances cost-effectiveness with sustainable market accessibility.

Key Efinaconazole Market Insights Summary:

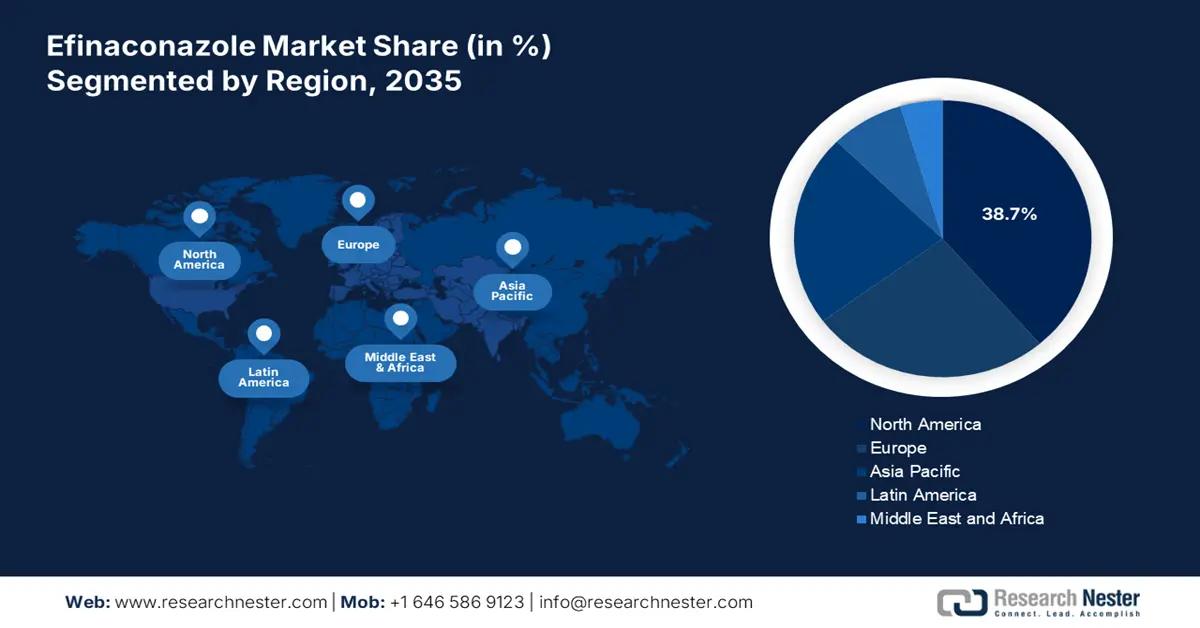

Regional Highlights:

- North America is projected to lead the efinaconazole market with a 38.7% share by 2035, supported by high onychomycosis prevalence, advanced healthcare infrastructure, regulatory efficiency, and increasing diabetic population.

- Asia Pacific is anticipated to be the fastest-growing region through the forecast period, propelled by rapid healthcare modernization, favorable government initiatives, and rising preference for non-invasive therapeutic solutions.

Segment Insights:

- The topical solution segment is projected to dominate the efinaconazole market with a 98.3% share by 2035, driven by regulatory preference, patient convenience, and proven clinical efficacy of topical-based formulations.

- The onychomycosis segment is anticipated to secure the second-largest share by 2035, fueled by the high prevalence of dermatophyte infections and the growing need for effective treatments addressing pain and functional limitations.

Key Growth Trends:

- Increase in personal and public spending

- Surge in R&D-based activities and investments

Major Challenges:

- Expensive and elongated compliance process

- Restrictions in intervention and timely diagnosis

Key Players: Pfizer Inc., Novartis AG, Bausch Health Companies, Glenmark Pharmaceuticals, Taro Pharmaceutical Industries, Mylan NV (Viatris), Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, Teva Pharmaceutical Industries, Perrigo Company, Almirall, LEO Pharma, Hikma Pharmaceuticals, Lupin Limited, Strides Pharma Science, CSPC Pharmaceutical Group, Hanmi Pharmaceutical, Pharmaniaga Berhad

Global Efinaconazole Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 4.1 billion by 2035

- Growth Forecasts: 9.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: India, China, South Korea, Singapore, Australia

Last updated on : 1 October, 2025

Efinaconazole Market - Growth Drivers and Challenges

Growth Drivers

- Increase in personal and public spending: The aspect of a surge in government healthcare spending, along with an expansion in insurance coverage, is one of the primary growth drivers for the market. According to an article published by the CMS in 2023, the healthcare spending in the U.S. has successfully reached USD 4.9 trillion, denoting an increase by 7.5% as of 2023, in comparison to 4.6% in 2022. Besides, the health industry’s economy share in the same year was 17.6%, which is also responsible for uplifting the overall market across different nations.

- Surge in R&D-based activities and investments: The market is readily being bolstered by effective investments in research and drug development (RDD). As per an article published by America Society for Microbiology in May 2024, the organization has urged to increase funding for the NIH to USD 51.3 billion by the end of 2025. In addition, USD 7.1 billion has also been proposed for the National Institute of Allergy and Infectious Diseases (NIAID) within NIH. This effectively includes USD 608 million for conducting suitable research, which is deliberately uplifting the market internationally.

- Advancements in diagnostic techniques: These are extremely essential for the efinaconazole market to effectively ensure earlier and appropriate disease detection, resulting in optimized treatment outcomes, diminished healthcare expenses, and personalized medicine. According to the October 2022 NLM article, 5% of overall patients cater to 50% of total expenses in the healthcare sector, along with an increase in chronic conditions demanding continuous treatment has successfully increased. Besides, the application of machine learning is yet another technological advancement in diagnosis, which is readily boosting the market’s exposure.

Fungal Nail Infection Driving the Efinaconazole Market Globally (2025)

|

Components |

Incidence/ Rate |

|

Global population affected |

4% to 6% |

|

Age |

1/5th of people aged more than 60 years and over ½ of people aged more than 70 years |

|

Onychomycosis causation |

60% to 90% of infection |

|

Candida albicans |

10% to 20% of onychomycosis |

|

Non-dermatophyte moulds |

105 of overall mail infections |

Source: BPAC Organization

Challenges

-

Expensive and elongated compliance process: The aspect of an expensive and time-consuming process associated with achieving approval from a strict administrative framework is gradually slowing the introduction of the latest products in the efinaconazole market globally. For instance, the Pharmaceuticals and Medical Devices Agency (PMDA) has caused a delay in product approval, which has caused a hindrance in the overall market. Likewise, there has been an extension in the DCGI’s mandate for local clinical trials, particularly in India, by almost 2 years. However, Glenmark overcame this challenge by effectively leveraging WHO-based API suppliers.

- Restrictions in intervention and timely diagnosis: The widespread misdiagnosis and underreporting of onychomycosis is other major issue in the international efinaconazole market. Based on this, there have been strong cases, wherein diagnosis has been wrongly dismissed as cosmetic issues. This, in turn, has eventually resulted in infections and restricted the opportunity for therapeutics to display their potential in aiding the connected ailments effectively. However, Bausch Health addressed this issue by successfully collaborating with LabCorp to implement PCR testing with prescriptions, thus bolstering appropriate diagnosis rates.

Efinaconazole Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 4.1 billion |

|

Regional Scope |

|

Efinaconazole Market Segmentation:

Formulation Segment Analysis

Based on formulation, the topical solution segment in the efinaconazole market is projected to readily dominate, with the highest share of 98.3% by the end of 2035. The segment’s growth is highly attributed to the aspect of regulatory preference, as well as clinically proven efficiency. According to an article published by Biomaterials in November 2023, topical-based drugs are extremely preferred by patients, owing to their convenience and cost-effectiveness, based on which the FDA has readily cleared two oral drugs, which cost approximately 3% of the average injectable biologics, thus suitable for the segment’s growth.

Application Segment Analysis

Based on application, the onychomycosis segment in the efinaconazole market is predicted to garner the second-highest share during the projected timeline. The segment’s growth is highly driven by its significance in negatively impacting quality of life, leading to pain, physical discomfort, and functional limitations that tend to impair regular activities. According to an article published by NLM in January 2024, the most frequent cause of this condition is dermatophytes, which are recognized in 90% of toenails, as well as 50% of fingernails. Besides, Candida albicans incidences cater to 2% of onychomycosis, thus deliberately impacting the overall segment’s upliftment.

Distribution Channel Segment Analysis

Based on the distribution channel, the retail pharmacies segment in the efinaconazole market is expected to account for the third-highest share by the end of the forecast duration. The segment’s development is highly subject to its pivotal role as the ultimate access point for prescription-based pharmaceuticals. Besides, for efinaconazole, which frequently requires continuous and regular usage, the wide-ranging and convenient availability, along with established patient-pharmacist relationships, provide maximum chains, along with independent community pharmacies, which are unparalleled. Meanwhile, its strong facility readily permits effective administration of prescription fulfillment under a complex benefit manager, thus boosting the segment globally.

Our in-depth analysis of the efinaconazole market includes the following segments:

|

Segment |

Subsegments |

|

Formulation |

|

|

Application |

|

|

End user |

|

|

Distribution Channel |

|

|

Patient Demographics |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Efinaconazole Market - Regional Analysis

North America Market Insights

North America in the efinaconazole market is predicted to garner the highest share of 38.7% by the end of 2035. The market’s exposure in the region is highly driven by an increase in the prevalence of onychomycosis, the presence of robust health and medical facilities, regulatory agility, strong payer support, a surge in the diabetic population, and technological innovation. According to an article published by NLM in September 2024, a clinical study was conducted on 710,541 patients to ensure molecular diagnostic laboratory evaluation of their toenails. It was demonstrated that 54.3% of T. rubum was the most common pathogen, followed by 6.5% of T. mentagrophytes, 7.0% of Aspergillus, and 4.5% of Fusarium, thus increasing the market’s demand.

The efinaconazole market in the U.S. is growing significantly, owing to the existence of Medicaid and Medicare support, FDA-based administrative reforms, robust funding for conductive research, progressive drug formulations, an upsurge in healthcare spending and coverage, along with public health strategies. As per the September 2022 Research America data report, the medical and health R&D in the country has reached USD 245.1 billion over the past five years, with state government spending USD 2.1 billion on health, followed by voluntary health associations providing USD 3.0 billion, thus suitable for the market’s upliftment.

The efinaconazole market in Canada is also growing due to the aspect of federal healthcare funding, an expansion in provincial health programs, inclusion of provincial formularies, collaborative initiatives between industry and government, public awareness campaigns, and increased emphasis on topical therapies. As stated in the 2025 Canada Medical Association article, the federal government readily contributes through the Canada Health Transfer to assist territories and provinces pay for healthcare, which amounts to USD 49.4 billion between 2023 and 2024. This represents almost 22% of territories and provinces' spending on healthcare, which positively impacts the overall market.

Microscopes 2023 Export and Import in North America

|

Countries |

Export |

Import |

|

U.S. |

USD 236 million |

USD 606 million |

|

Canada |

USD 21.5 million |

USD 65.9 million |

|

Mexico |

USD 1.0 million |

USD 39 million |

|

Costa Rica |

USD 180,000 |

USD 10.6 million |

|

Guatemala |

USD 104,000 |

USD 1.8 million |

|

Panama |

USD 12,300 |

USD 1.8 million |

Source: OEC

APAC Market Insights

Asia Pacific in the efinaconazole market is predicted to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by rapid modernization in healthcare, an increase in the aging population, sudden lifestyle shifts, cost-effective government-based approaches, increased preference for non-invasive treatments, and generous investments in R&D. As per the January 2022 APCTT article, polices, such as the Digital India programme has initiated a USD 1 trillion digital economy in 2025, followed by Singapore’s SG Digital and Australia’s AUD 1.2 billion Digital Transformation Strategy, are contributing towards the region’s overall health advancements.

The efinaconazole market in China is gaining increased traction, owing to government-based pricing and generic push, expansion in urban healthcare accessibility, a rise in government expenditure, the presence of a massive patient base, and the availability of infectious disease control policies. As per the September 2024 NLM article, there has been a continuous surge in the country’s public financial health resources from 141.8 billion yuan to 2,254.2 billion yuan as of 2023. In addition, during this period, the healthcare industry also peaked at 47.5%, thereby denoting an optimistic outlook for the overall market.

The efinaconazole market in India is also growing due to an expansion in public health expenditure, increased disease burden, government-based patient programs, proliferation in generic drugs, and rising awareness and educational programs. As stated in the June 2022 Frontiers Organization article, infectious diseases are predominant in the country, with more than 33% of the population readily suffering. Besides, these diseases are effectively prevalent among patients with marginalized characters and residing in rural locations, within the age group between 0 and 14 years, thus enhancing the market’s demand.

Healthcare Expenditure in Asia Pacific (2022)

|

Countries |

% Of GDP |

|

Australia |

9.9 |

|

China |

5.3 |

|

Cambodia |

4.7 |

|

India |

3.3 |

|

Indonesia |

2.6 |

|

Japan |

11.4 |

|

Korea |

9.8 |

|

Malaysia |

3.9 |

Source: World Bank Group

Europe Market Insights

Europe in the efinaconazole market is expected to account for a considerable share by the end of the projected duration. The market’s development in the region is highly driven by an increase in public and private healthcare expenditure, growth in R&D investments, a surge in aging demographics, the presence of government health strategies, and rising awareness, as well as early intervention. According to the February 2025 Impact Global Health Organization data report, the region’s neglected disease-based R&D funding has successfully generated €3.8 trillion, of which the Europe Union is readily responsible for €1.6 trillion, thereby suitable for uplifting the market.

The efinaconazole market in Germany is gaining increased exposure, owing to the presence of robust government investment, an increase in patient identification rates, affordable regulatory mandates, clinical efficiency, and pharmaceutical efficiency. As per the November 2023 Monarch article, the statutory health insurance (SHI) is considered the most common health insurance type in the country, effectively covering more than 85% of the population. This policy is readily financed by contributions initiated from employers and employees, covering medical devices, outpatient and inpatient care, dental care, and medications.

The efinaconazole market in the UK is also growing due to an expansion in the NHS budget, policy-based market growth, effective focus on preventive care, the presence of a balance between personal and public spending, and suitable healthcare infrastructure. As per an article published by NLM in July 2025, the healthcare and medical spending is projected to grow by 2.8% by the end of 2025 and 2029. In addition, the aspect of capital investment has readily focused on technology, equipment, and new buildings, all of which are expected to grow by 1% within a year, thereby creating an optimistic outlook for the overall market.

Key Efinaconazole Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Bausch Health Companies

- Glenmark Pharmaceuticals

- Taro Pharmaceutical Industries

- Mylan NV (Viatris)

- Sun Pharmaceutical Industries

- Dr. Reddy’s Laboratories

- Teva Pharmaceutical Industries

- Perrigo Company

- Almirall

- LEO Pharma

- Hikma Pharmaceuticals

- Lupin Limited

- Strides Pharma Science

- CSPC Pharmaceutical Group

- Hanmi Pharmaceutical

- Pharmaniaga Berhad

The global efinaconazole market is extremely consolidated, with the presence of notable organizations, such as Novartis and Pfizer. These players are readily leading the commercial dynamic through brand-based solutions, which include Jubila. Besides, companies in Africa and Asia, such as Sun Pharma and Glenmark, are successfully competing with low-cost generics provision, as has been stated by the National Pharmaceutical Pricing Authority (NPPA). Meanwhile, organizations based in Japan are deliberately focusing on spray formulations to make administrations appear to be more convenient for the rising aging population, thus suitable for uplifting the market internationally.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, Biocomposites declared that it has readily undertaken a minor share in InfectoTest GmbH, which readily develops advanced point-of-care systems, suitable for effectively diagnosing infectious diseases.

- In May 2024, Turn Therapeutics introduced its first-ever public investment campaign to successfully fund clinical studies for its FDA-approved antimicrobial ointment for two potential new drug indications, including moderate to severe eczema and onychomycosis, or toenail fungus.

- In May 2022, Almirall S.A. declared the filing for the administrative submission for efinaconazole, which is a triazole antifungal compound indicated for aiding mild-to-moderate fungal infection of the nail in adults and children, particularly in Germany and Italy.

- Report ID: 7845

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Efinaconazole Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.