Dynamic Random-Access Memory Market Outlook:

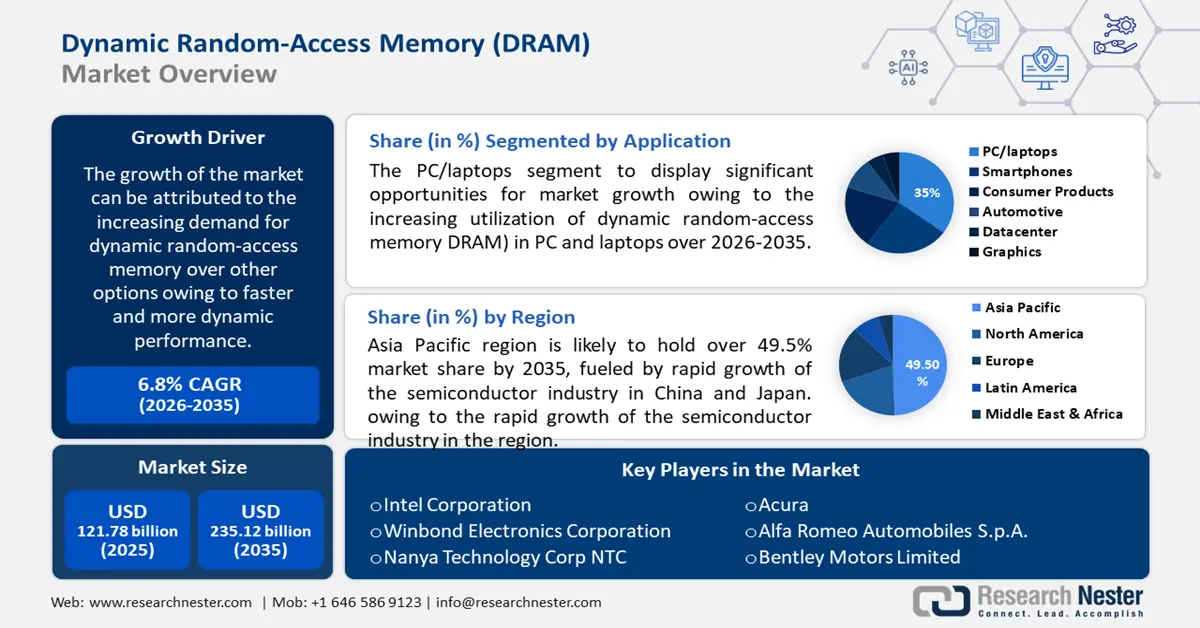

Dynamic Random-Access Memory Market size was valued at USD 121.78 billion in 2025 and is expected to reach USD 235.12 billion by 2035, expanding at around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dynamic random-access memory is evaluated at USD 129.23 billion.

The market growth is driven by increasing demand for dynamic random-access memory over other options owing to faster and more dynamic performance. Dynamic random-access memory is highly utilized in several applications such as smartphones, personal computers, and others which are estimated to hike the production volume of DRAM at a higher scale. For instance, in Taiwan alone, approximately 4 billion dynamic random-access memory were produced in 2021, up from 3 billion in 2018.

In addition, a dynamic random-access memory requires only one transistor. It also has a larger storage capacity compared to other options where it can store more data. Hence, increasing data traffic owing to several digital activities in each sector backed by the higher penetration of Internet services is expected to influence the market growth. For instance, in 2019, approximately 20 exabytes of data were generated per month across the globe. Additionally, increasing digitalization worldwide coupled with higher investment by the government and private organizations is also expected to expand the market size. As of 2023, global spending on services to support digitalization is expected to be around USD 2 trillion.

Key Dynamic Random-Access Memory (DRAM) Market Insights Summary:

Regional Highlights:

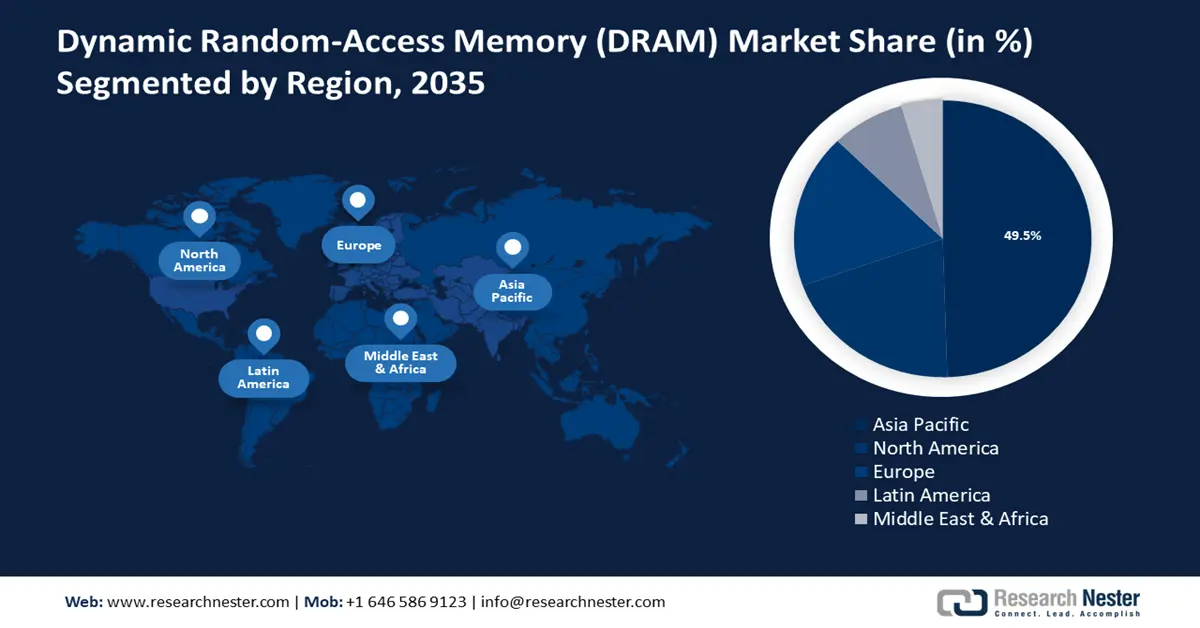

- Asia Pacific dynamic random-access memory (DRAM) market will hold around 49.5% share by 2035, fueled by rapid growth of the semiconductor industry in China and Japan, and rising production capacities of memory IC companies in the region.

- North America market will register lucrative growth from 2026 to 2035, driven by increasing manufacturing of DRAM chips backed by spiking demand for smartphones and personal laptops in the region.

Segment Insights:

- The pc/laptops segment in the dynamic random-access memory market is projected to secure the largest share by 2035, fueled by increasing DRAM usage in PCs and laptops due to faster performance and rising demand.

- The smartphone segment in the dynamic random-access memory market is anticipated to achieve lucrative growth during 2026-2035, driven by growing smartphone penetration and demand for high-speed mobile computing.

Key Growth Trends:

- Growing Manufacturing of Smartphones

- Rising Trend of Working from Home to Boost Market Growth

Major Challenges:

- High Cost of Design and Fabrication of DRAM

- Higher Power Consumption Compared to Others

Key Players: Micron Technology, Inc., Intel Corporation, Winbond Electronics Corporation, Nanya Technology Corp (NTC), United Microelectronics Corporation, Samsung Electronics Co., Ltd., Kingston Technology Company, Inc., Elpida Memory, Inc., Transcend Information, Inc., Etron Technology, Inc., Infineon Technologies.

Global Dynamic Random-Access Memory (DRAM) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 121.78 billion

- 2026 Market Size: USD 129.23 billion

- Projected Market Size: USD 235.12 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: South Korea, United States, China, Taiwan, Japan

- Emerging Countries: China, South Korea, Taiwan, India, Singapore

Last updated on : 8 September, 2025

Dynamic Random-Access Memory Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Manufacturing of Smartphones – The RAM provided in smartphones is called DRAM which is generally used as the main memory. Dynamic random-access memory is a vital part of modern smartphones. Hence, the growing utilization of smartphones is expected to drive market growth over the forecast period. For instance, in 2023, approximately 6 billion people were noticed to be using smartphones which was an increase from nearly 3 billion in 2016.

-

Rising Trend of Working from Home to Boost Market Growth – A surge in the work-from-home facility is noticed to hike the demand for personal laptops or computers since each employee requires a single device to work with. For instance, the process of working from home in America was observed to rise from approximately 4% in early 2019 to nearly 60% in 2020. Additionally, it was also observed that around 40% of employees across the globe can work from home.

-

Increasing Inclination of the Global Population towards Online Gaming – Owing to the increment in online gaming, the demand for smartphones and laptops with high performance is estimated to drive the growth of the market over the forecast period. for instance, as of 2019, there nearly 3 billion online gamers were estimated to live across the globe who has spent more than USD 140 billion on these games.

-

Growing Prevalence of E-Leaning - During the COVID-19 pandemic, the trend of e-learning was at its peak which is still growing owing to its countless benefits. For a better e-learning process, students and teachers are required to have at least a laptop or smartphone. Hence, the growing online classes are expected to hike the market growth over the forecast period. For instance, it was found that more than 80% of companies and 55% of students have used some type of e-learning platform.

Challenges

- High Cost of Design and Fabrication of DRAM - The designing process of DRAM is quite expensive since the manufacturing of dynamic random-access memory is quite complex. It consists of several tiny transistors and capacitors. To enhance its functionality, manufacturers are observed to require higher investment which is further expected to hamper the market growth over the forecast period.

- Higher Power Consumption Compared to Others

- Slower Performance than SRAM

Dynamic Random-Access Memory Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 121.78 billion |

|

Forecast Year Market Size (2035) |

USD 235.12 billion |

|

Regional Scope |

|

Dynamic Random-Access Memory Market Segmentation:

Application Segment Analysis

The PC/laptops segment is estimated to gain largest market share by 2035. due to increasing utilization of dynamic random-access memory (DRAM) in PC and laptops since it is faster than RAM backed by the upsurged demand for these electronics among the global population. Dynamic random-access memory (DRAM) is used in the main memory of the computer and each cell is made of a transistor and a capacitor within an integrated circuit. The demand for DRAM is escalated by the upsurged sales volume of personal computers since millionths of PCs are shipped globally every year. For instance, in 2022, more than 300 million units of personal computers were shipped worldwide backed by the higher IT device spending in a similar year which was expected to be around USD 700 billion in the similar year.

The smartphone segment in the dynamic random-access memory (DRAM) market is predicted to register lucrative CAGR during the forecast period, due to growing penetration of smartphones across the globe. There are several factors that are estimated to support the long-term growth of smartphones such as convenience to use for consumers. People use smartphones for several purposes from daily household work to financial activities, hence, a mobile phone is required to be fast which is possible through the utilization of dynamic random-access memory (DRAM). Furthermore, DRAM is an affordable option compared to others. Smartphones are one of the major applications of dynamic random-access memory since every type of query can be answered within seconds which is expected to boost the sales and manufacturing of smartphones.

Our in-depth analysis of the global market includes the following segments:

|

By Architecture |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dynamic Random-Access Memory Market Regional Analysis:

APAC Market Insights

Asia Pacific region is likely to hold over 49.5% market share by 2035, led by rapid growth of the semiconductor industry in China and Japan, and the rising production capacities of memory IC companies in the region. In addition, higher manufacturing of chip and electronic components and governmental support to regional vendors in countries namely China, India, Japan, South Korea, and Taiwan, will boost the market growth.

North American Market Insights

The North American dynamic random-access memory (DRAM) market is poised to register lucrative CAGR during the forecast period. The market growth is propelled by increasing manufacturing of DRAM chips in the region backed by spiking demand for smartphones and personal laptops in the region. In North America, a higher number of adults are involved in online gaming which is one of the major factors hiking the demand for personal computers in the region.

Dynamic Random-Access Memory Market Players:

- Micron Technology, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Intel Corporation

- Winbond Electronics Corporation

- Nanya Technology Corp (NTC)

- United Microelectronics Corporation

- Samsung Electronics Co., Ltd.

- Kingston Technology Company, Inc.

- Elpida Memory, Inc.

- Transcend Information, Inc.

- Etron Technology, Inc.

- Infineon Technologies

Recent Developments

-

Intel Corporation launched 4th Gen Intel Xeon Scalable processors that contain built-in accelerators. The processor is designed to enhance the performance of the fastest-growing workloads. It also has built-in accelerators of the CPU to improve the performance of artificial intelligence.

-

United Microelectronics Corporation merged its path with Infineon Technologies AG for the production of a 40nm eNVM Microcontroller. The production is expected to be accelerated to serve the rapidly expanding automotive industry.

- Report ID: 3460

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dynamic Random-Access Memory (DRAM) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.