Distributed Energy Generation Market Outlook:

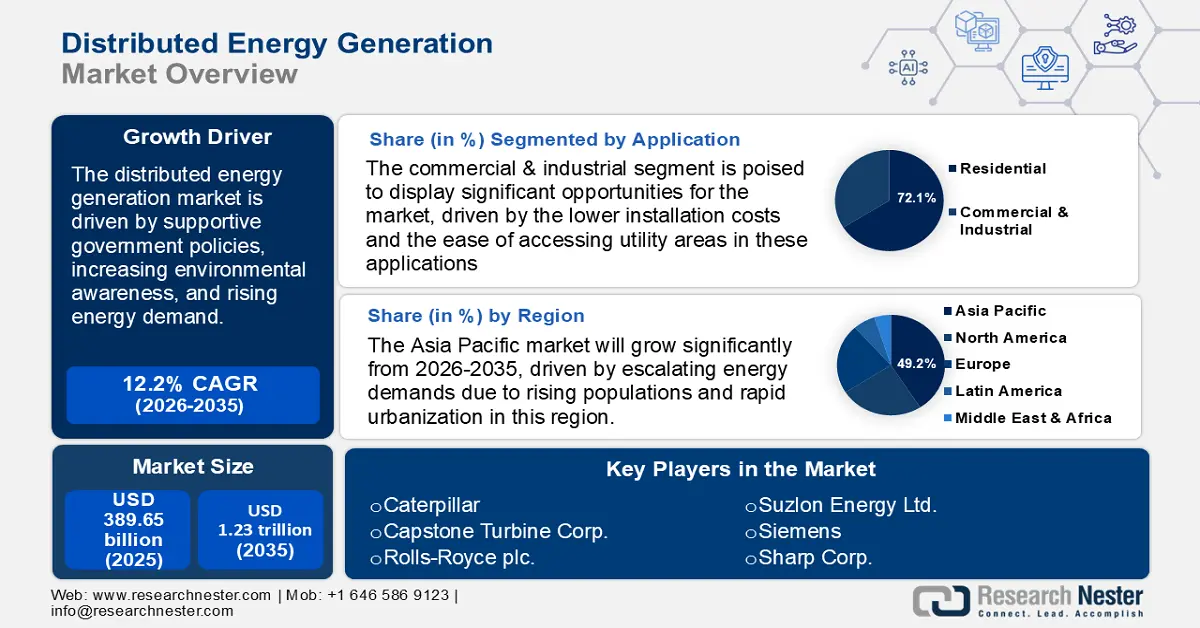

Distributed Energy Generation Market size was valued at USD 389.65 billion in 2025 and is likely to cross USD 1.23 trillion by 2035, expanding at more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of distributed energy generation is assessed at USD 432.43 billion.

The distributed energy generation market is experiencing significant growth, highly driven by supportive government policies, increasing environmental awareness, and rising energy demand. Government initiatives such as feed-in tariffs in North America and Asia Pacific boost the adoption of DEG systems across residential, industrial, and commercial sectors. These systems provide flexibility by operating both on-grid and off-grid, based on applications and location.

In the U.S., policies such as the Production Tax Credit (PTC) and Investment Tax Credit (ITC) have been implemented the DEG technologies since the early days. For instance, the ITC has prominently promoted solar PV installations across the U.S. The ITC facilitates homeowners and businesses deducting a significant percentage of the cost of installing a solar energy system from their federal taxes. For the system installed between 2022 and 2032, the tax credit is set at 30%. This financial incentive has minimized the upfront cost associated with solar system installations, thus making renewables more accessible and fostering growth in this sector.

The rising global emphasis on clean energy and the cost benefits of DEG systems are significantly propelling distributed energy generation market growth. DEG technologies such as solar PV and wind turbines facilitate localized power production, minimizing transmission losses and improving energy security. Notably, the reduced costs of solar PV systems have made them more accessible for residential and commercial use. For instance, community solar projects in the U.S. encourage households to install rooftop panels to gain benefits from shared solar installations, leading to minimized CO2 emissions and saving energy costs.

In North America, the regulatory enhancements are further accelerating DEG adoption. In Canada, improvements in provincial renewable energy policies have enabled the implementation of DEG technologies. Rooftop solar PV systems in both commercial and residential sectors bolster the significant growth of the distributed energy generation market. Canada has reduced electricity-related carbon emissions by nearly 60% in barely two decades. This shift not only boosts sustainable energy practices but also offers economic benefits to consumers via electricity bills and tax incentives.

Key Distributed Energy Generation Market Insights Summary:

Regional Highlights:

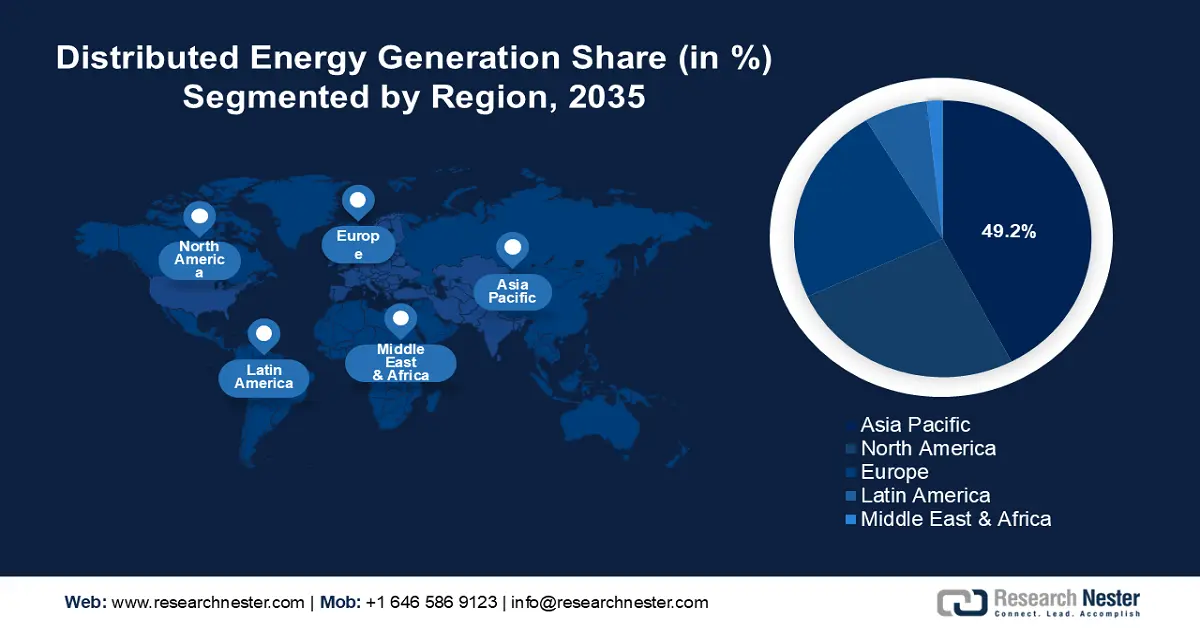

- Asia Pacific leads the Distributed Energy Generation Market with a 49.2% share, propelled by escalating energy demands due to rising populations and rapid urbanization, driving growth through 2026–2035.

- North America's distributed energy generation market is poised for the fastest growth by 2035, fueled by wind and solar tech improvements and favorable incentives.

Segment Insights:

- The Commercial & Industrial segment is projected to capture 72.1% market share by 2035, driven by lower installation costs and favorable policies supporting renewable energy adoption.

- The Fuel Cell segment is expected to achieve substantial growth from 2026-2035, propelled by superior energy efficiency and near-zero emissions.

Key Growth Trends:

- Increase in research and development investments

- Increase in demand for decentralized power generation

Major Challenges:

- Land use constraints

- Cost of fuel cell batteries

- Key Players: Capstone Turbine Corp., Caterpillar, Ballard Power Systems Inc., Doosan Heavy Industries & Construction, Rolls-Royce plc, Suzlon Energy Ltd..

Global Distributed Energy Generation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 389.65 billion

- 2026 Market Size: USD 432.43 billion

- Projected Market Size: USD 1.23 trillion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 12 August, 2025

Distributed Energy Generation Market Growth Drivers and Challenges:

Growth Drivers

- Increase in research and development investments: The increasing energy demand, government incentives, environmental concerns, and innovation in fuel cell technology drive the increase in research and development in the DEG market. Countries such as the U.S., UK, China, Germany, and Japan lead this distributed energy generation market, concentrating on applications such as fuel cell-powered vehicles, unmanned aerial vehicles (UAVs), and portable power generation units. For instance, the U.S. Department of Energy has attained a 50% decline in fuel cell costs, thus improving the economic viability of these technologies.

Additionally, China's contemporary Amperex Technology Co. (CATL)has prominently raised its investments in Germany by implementing its first overseas battery production facility in Thuringia, aiming to attain a generation capacity of 8 GWh. Furthermore, CATL has engaged in R&D facilities by joining the BattLife project with the Battery Innovation and Technology Center (BITC), to explore enhanced battery technologies and contribute to Germany's green energy initiatives. Underscoring a commitment to global fuel cell enhancement. These investments, coupled with a global emphasis on clean energy, are propelling the expansion of fuel cell applications in DEG.

- Increase in demand for decentralized power generation: The grid stability concerns climatic changes, and the requirement for energy security drive the increase in demand for decentralized power generation. Increasing renewable energy adoption, reduced wind and solar costs, the requirement for resilience against power outages, and regulatory support further accelerate the shift towards localized, sustainable energy solutions.

Technologies such as combined heat and power (CHP) units, wind turbines, and PV systems are at the forefront of this transition, offering localized energy production that minimizes reliance on centralized grids. For instance, the U.S. Environmental Protection Agency's Solar for All program aims to expand access to affordable, resilient solar energy for low-income and disadvantaged communities. According to the EPA, the average low-income household benefiting from the Solar for All program will experience approximately USD 400 in annual savings on their electricity bills. These community solar projects in the U.S. enable residents to benefit from shared solar installations, offering cost savings and contributing to reduced carbon emissions.

Additionally, the improvements in natural gas technologies and the declining costs of renewable systems have enabled their widespread adoption. This shift not only boosts environmental sustainability but also improves energy security by developing more resilient and adaptive power infrastructure. As decentralized energy systems become more prevalent, they play a crucial role in modernizing the energy landscape to meet rising demands.

Challenges

- Land use constraints: Restricted usage of land poses significant challenges to the expansion of the distributed energy generation market, especially for utility-scale solar power projects. These installations need vast land areas to attain efficiency, restricting their deployment in regions with high population density or competing land uses. Factors such as solar radiation availability and environmental effects on biodiversity further limit site selection. Large solar farms can change ecosystems and disrupt wildlife habitats. As a result, balancing energy expansion with sustainable land management remains crucial for future growth. Innovations like agrivoltaics and floating solar farms help to mitigate these land use challenges.

- Cost of fuel cell batteries: The demand for reliable energy storage has surged, especially for off-grid and grid stabilization applications. However, the high cost of fuel cell batteries remains a significant challenge for the growth of the distributed energy generation market. Despite the enhancement in the technologies, lithium-ion batteries and fuel cell systems still need expensive materials such as platinum catalyst, which further increases the production costs. Additionally, the infrastructure restrictions and the difficulties of large-scale implementation stop widespread adoption. Key players in the distributed energy generation market have to navigate these scalability and cost issues to improve market competitiveness. Continuous research, technological innovations, and government incentives are critical to enhancing the affordability and efficiency of fuel cell batteries.

Distributed Energy Generation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 389.65 billion |

|

Forecast Year Market Size (2035) |

USD 1.23 trillion |

|

Regional Scope |

|

Distributed Energy Generation Market Segmentation:

Application (Residential, Commercial, and Industrial)

The commercial & industrial sectors are expected to dominate the distributed energy generation market, accounting for over 72.1% of installations. This trend is attributed to the lower installation costs and the ease of accessing utility areas in these applications. Globally, governments are implementing policies to bolster renewable technologies in these sectors due to their benefits, including improved efficiency, enhanced energy security, minimized emissions, and greater resilience compared to traditional power generation methods.

Large-scale solar PV systems are increasingly used in industrial settings to meet substantial energy needs, while smaller PV units are suitable for commercial applications. According to the U.S. Department of Energy’s Better Buildings Initiative, a solar PV system can be installed onsite to offer renewable power for facility electrical loads, including industrial processes. Deploying solar PV in industrial applications is cost-effective and aligns with organizational environmental goals and regulations. Additionally, the U.S. Energy Information Administration (EIA) reports that small-scale distributed solar PV systems, such as those found on residential and commercial rooftops, have grown significantly over the past several years, highlighting their suitability for commercial and residential applications.

Technology (Wind Turbine, Solar Photovoltaic, Reciprocating Engines, Fuel Cells, Gas and Steam Turbine)

The fuel cell segment is expected to lead the distributed energy generation market by holding a substantial share. Fuel cells provide numerous benefits over conventional technologies, including their higher efficiencies and lower emission levels. They convert chemical energy directly into electrical energy, attaining efficiency up to 60%. For instance, ClearEdge Power’s fuel cells operate at 42% electrical efficiency and can reach up to 90% overall efficiency with full heat recovery, depending on the application.

Additionally, hydrogen fuel cells emit only water, producing zero carbon dioxide and air pollutants, thereby addressing critical climate challenges. Similarly, the UTC Power PureCell® System 400 fuel cells deliver 42% electrical efficiency and, with effective heat recovery, can reach an overall system efficiency of up to 90%. These high efficiency levels are attained by converting chemical energy directly into electrical energy and using the byproduct heat, thereby improving the system’s total energy output. These attributes make fuel cells a compelling choice for clean and efficient energy generation.

Our in-depth analysis of the global distributed energy generation market includes the following segments:

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Distributed Energy Generation Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific in distributed energy generation market is expected to capture over 49.2% revenue share by 2035. This leadership position is driven by escalating energy demands due to rising populations and rapid urbanization in countries such as India, China, Indonesia, and Malaysia. Particularly, China sees significant demand concentrated in its urban centers, fueled by increasingly disposable income levels.

One notable instance of distributed energy generation is the 19-megawatt peak (MWp) rooftop solar project completed by EDP Renewables (EDPR) in Anhui province. Constructed on the rooftop of a major consumer electronics manufacturing facility, this installation comprises approximately 35,000 solar panels and is projected to generate more than 22 GWh of electricity annually. This initiative aligns with China’s goal of achieving net-zero carbon emissions during the forecast period. And reflects the country’s growth in renewable energy capacity, with 87 GW of solar added in 2022, 58% of which was from distributed generation.

Similarly, rooftop systems, microgrids, and biomass projects drive the distributed energy generation market growth in India. Incentives like PM-KUSUM and net metering policies support solar expansion. DEG improves energy access, minimizes grid dependency, and bolsters sustainability across urban and rural areas.

North America Market Analysis

North America has rapidly emerged as a fast-growing distributed energy generation market, driven by enhancements in wind and solar technologies. Wind turbines hold the largest share, particularly in the region with strong wind resources, such as the Midwest and Texas. However, solar PV is the fastest-growing segment, fueled by declining costs, supportive policies, and innovative business models such as solar leasing and third-party ownership.

Programs such as the U.S. Investment Tax Credit (ITC) and Canada’s Net Metering regulations encourage widespread adoption. For instance, California’s distributed solar initiatives have enabled over 1.5 million rooftop installations, reducing grid dependency and carbon emissions. As DEG solutions expand, North America is anticipated to improve energy resilience, lower electricity costs, and contribute to emission reduction goals.

Continued investment in renewable energy infrastructure will further accelerate the transition to a decentralized power grid. For instance, California Public Utilities Commission’s (CPUC) Self-Generation Incentive Program (SGIP) offers incentives to support new, existing, and emerging distributed energy resources. Furthermore, SGIP offers rebates for qualifying distributed energy systems installed on the customer's side of the utility meter.

Key Distributed Energy Generation Market Players:

- Vestas Wind Systems A/S

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Capstone Turbine Corp.

- Caterpillar

- Ballard Power Systems Inc.

- Doosan Heavy Industries & Construction

- Rolls-Royce plc.

- Suzlon Energy Ltd.

- General Electric

- Siemens

- Schneider Electric

- ENERCON GmbH

- Sharp Corp.

- First Solar

- Mitsubishi Electric Corp.

- Toyota Turbine and Systems Inc.

Leading key players in the distributed energy generation market drive growth through technological innovation, strategic partnerships, and large-scale renewable energy projects. Companies invest in enhanced solar, wind, and fuel cell technologies while leveraging digital solutions and microgrids to enhance energy efficiency, grid stability, and sustainability worldwide.

Recent Developments

- In June 2022, Cairn Oil & Gas revealed plans to transition its Mangala pipeline to solar energy. The company aims to implement solar rooftop photovoltaic systems across all 36 AGIs by the year 2025.

- In June 2022, the infrastructure investment division of Philippine billionaire Enrique Razon revealed its intention to build the largest solar power facility in the world, collaborating with an increasing number of local firms engaged in renewable energy development.

- Report ID: 7500

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.