Disposable Wound Management Products Market Outlook:

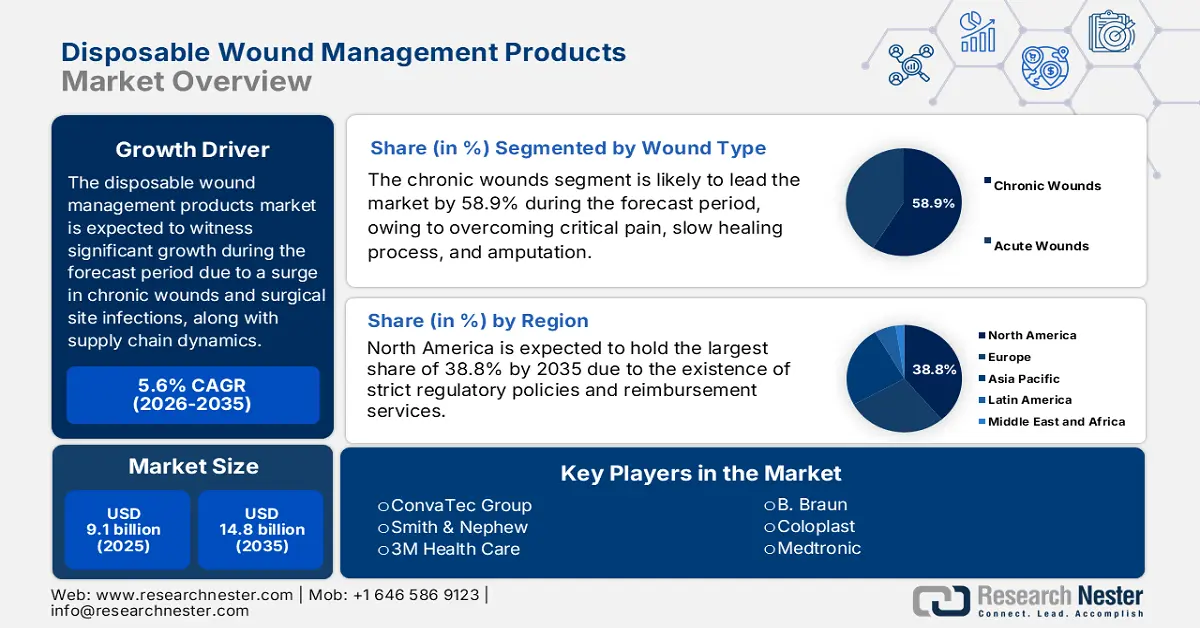

Disposable Wound Management Products Market size was USD 9.1 billion in 2025 and is expected to reach USD 14.8 billion by the end of 2035, increasing at a CAGR of 5.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of disposable wound management products is assessed at USD 9.6 billion.

The international patient pool in the market is expanding rapidly, highly attributed to an increase in chronic wound cases, particularly surgical wounds, pressure ulcers, and diabetic ulcers. According to an article published by the CDC in January 2025, the overall number of unintentional injury deaths accounts for 222,698 cases, along with 66.5 deaths per 100,000 population, and ranks in third position in terms of death rank. Besides, the March 2023 NLM article denoted that the international surgical site infection incidence accounts for 2.5% of overall infections, thereby creating an optimistic outlook for the overall market across different nations.

Moreover, the global trade facility plays a crucial role in the market, with the U.S., China, and Germany being key exporters of wound care raw materials. According to a data report published by the OEC in August 2025, the overall export valuation of medical dressings with adhesive layer is USD 5.2 million as of 2023, with Malaysia being the top exporter for USD 1.3 million. Additionally, the import valuation has been USD 13 million, with China being the topmost importer for USD 6.2 million. Besides, Thailand has emerged to be the fastest-growing market, with a valuation of over USD 554,000 between 2022 and 2023, thus denoting a huge growth opportunity for the overall market.

Key Disposable Wound Management Products Market Insights Summary:

Regional Highlights:

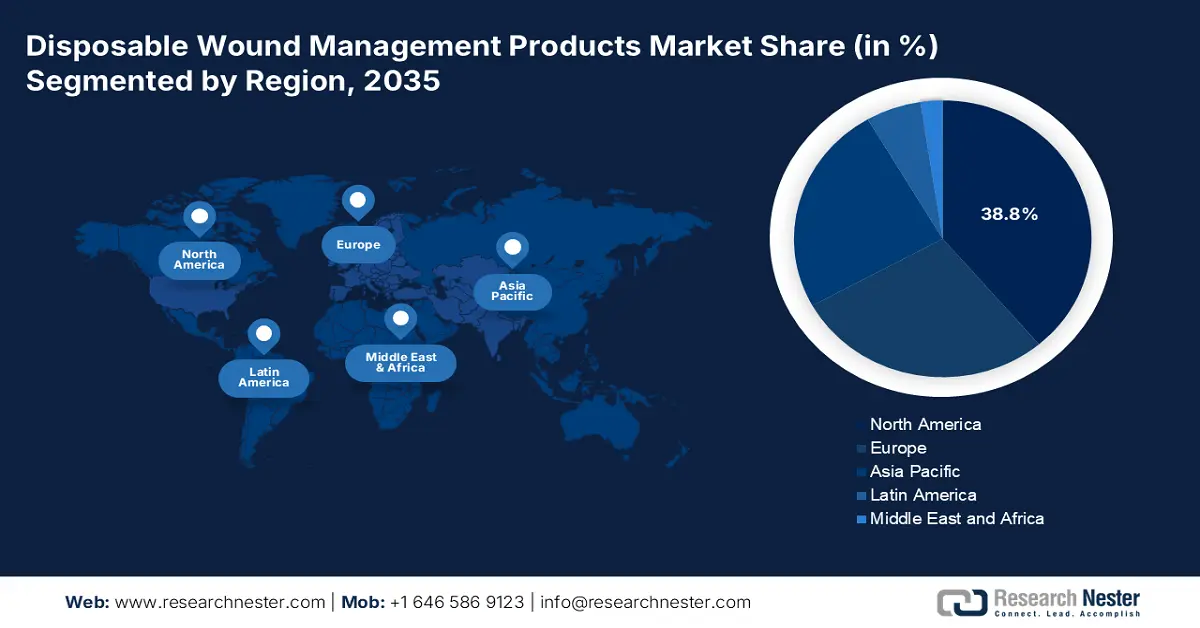

- The North America Disposable Wound Management Products Market is anticipated to command the largest share of 38.8% by 2035, impelled by the expansion of Medicare coverage and the strong presence of provincial healthcare systems.

- The Asia Pacific region is projected to be the fastest-growing during 2026–2035, bolstered by increased government healthcare investments, an aging population, and the rising prevalence of chronic wounds.

Segment Insights:

- The chronic wounds segment in the Disposable Wound Management Products Market is projected to hold a dominant 58.9% share by 2035, propelled by the increasing need for effective management of slow-healing wounds that heighten risks of complications such as pain, amputation, and infections.

- The advanced wound dressings segment is anticipated to secure the second-largest share by 2035, supported by wider reimbursement coverage and superior clinical outcomes enhancing adoption rates.

Key Growth Trends:

- Growth in personal and government spending

- Investments in supply chain and manufacturing

Major Challenges:

- Barriers in government and reimbursement price controls

- Delays in regulations and compliance expenses

Key Players: 3M Health Care, Smith & Nephew, ConvaTec Group, Mölnlycke Health Care, Medtronic, B. Braun, Coloplast, Cardinal Health, Baxter International, Integra LifeSciences, Hollister Incorporated, Medline Industries, Derma Sciences (Acquired by Integra), Hartmann Group, Lohmann & Rauscher.

Global Disposable Wound Management Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.1 billion

- 2026 Market Size: USD 9.6 billion

- Projected Market Size: USD 14.8 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 1 October, 2025

Disposable Wound Management Products Market - Growth Drivers and Challenges

Growth Drivers

- Growth in personal and government spending: The healthcare budget is positively influencing the market demand globally. In this regard, the December 2024 Health Affairs Organization article stated that the healthcare expenditure in the U.S. has successfully reached USD 4.9 trillion, deriving an increase by 7.5% as of 2023, which surged from 4.6% back in 2022. Besides, in 2023, there has also been an increase in the insured population share by 92.5% since enrollment in public health insurance upsurged at a robust rate, with both Medicare and private health insurance expanding effectively.

- Investments in supply chain and manufacturing: The existence of domestic production incentives is readily reshaping supply chain facilities in the market. As per an article published by the FDA Government in November 2023, there has been a proposed rule for wound dressings, along with liquid wound washes, which resulted in yearly cost savings ranging from USD 1.1 million to USD 6.3 million at a 3% discount, along with USD 1.1 million to USD 6.4 million at a 7% discount rate. Besides, in the upcoming 10 years, the proposed rule will cater to USD 24.5 million at 3% and USD 19.0 million at 7%, thus driving the overall market growth.

- An increase in surgical procedures: This increase is inevitably crucial for the international public health since they have the ability to combat premature deaths, along with disabilities from conditions, such as cardiovascular diseases, cancer, and trauma, thereby suitable for boosting the market. As stated in the October 2024 NIH article, there has been a global increase in surgeries by 3.4%. This readily includes 34.9 million surgical as well as nonsurgical procedures, effectively conducted by plastic surgeons as of 2023. Besides, more than 15.8 million surgical and 19.1 million nonsurgical procedures have been performed globally, which is uplifting the overall market.

Injuries Aspects Driving the Disposable Wound Management Products Market (2025)

|

Components |

Incidence Rate |

|

Morbidity (over 18 years) |

5.9% in 3 months |

|

Physician office visits |

57.5 million |

|

Emergency department visits |

43.5 million |

|

Injury Deaths |

300,900 (89.8 per 100,000) |

|

Poison deaths |

109,522 (32.7 per 100,000) |

|

Motor vehicle deaths |

43,273 (12.9 per 100,000) |

|

All firearm deaths |

46,728 (14.0 per 100,000) |

|

Drug Poisoning |

105,007 (31.4 per 100,000) |

Source: CDC

Suture Materials, Sterile Surgical, and Dental Goods 2023 Export and Import

|

Countries |

Export |

Import |

|

U.S. |

USD 1.5 billion |

USD 625 million |

|

Austria |

USD 487 million |

- |

|

Belgium |

USD 442 million |

USD 854 million |

|

Germany |

- |

USD 511 million |

Source: OEC

Challenges

- Barriers in government and reimbursement price controls: The market is currently witnessing risks from regulatory-based, stringent pricing controls and reimbursement policies. For instance, strict health technology assessments along with price caps, particularly in Europe, are rapidly restricting market accessibility. Similarly, the IQWiG in Germany readily needs proven cost-effectiveness, especially for reimbursement clearance, which tends to delay innovative product incorporation, in comparison to the U.S. market. Besides, the presence of the Medicaid system in the U.S. effectively covers limited beneficiaries for wound care products, thereby creating disparities in the overall market.

- Delays in regulations and compliance expenses: The administrative landscape has emerged as complicated for the market, with diversifying requirements for pivotal markets. The purpose is to provide suitable cost and time to product launches, which has caused a negative impact on the market’s development. Based on this, the EU Medical Device Regulation (MDR) has readily optimized the compliance expenses, thus pressuring small manufacturers to readily abandon the market, particularly in Europe. Meanwhile, key players are presently initiating investments generously to successfully achieve the CE mark, thereby negatively impacting the market.

Disposable Wound Management Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 9.1 billion |

|

Forecast Year Market Size (2035) |

USD 14.8 billion |

|

Regional Scope |

|

Disposable Wound Management Products Market Segmentation:

Wound Type Segment Analysis

The chronic wounds segment in the disposable management products market is anticipated to garner the largest share of 58.9% by the end of 2035. The segment’s growth is highly attributed to effectively managing the slow healing process, which leads to increased risk of critical complications, such as significant pain, amputation, sepsis, and life-threatening infections. According to the March 2024 AJDHS article, chronic wounds affect an estimated 2.2 per 1,000 people, and are readily growing since the population is gradually aging, thus making them suitable for enhancing the market’s demand.

Product Segment Analysis

The advanced wound dressings segment in the market is expected to account for the second-largest share during the projected duration. The segment’s upliftment is highly fueled by an expansion in reimbursement coverage, along with superior clinical results. This category deliberately includes alginate, foam, and hydrocolloid dressings, which have successfully escalated the implementation rate. As per the January 2025 NLM article, a clinical study was conducted on 927 patients, and the utilization of advanced dressings lowered the surgical site infection, resulting in a 0.5 risk ratio and 95% confidence intervals, thereby boosting the segment’s growth.

End user Segment Analysis

The hospitals segment in the disposable wound management products market is predicted to cater to the third-largest share by the end of the forecast timeline. The segment’s development is highly driven by its crucial role as primary facilities for conducting acute and complicated medical care, which includes inpatient treatment, surgeries, and emergency services for chronic wounds. Besides, an increase in the patient volume, along with strict infection control protocols, has readily necessitated extended usage of innovative and conventional wound care products. Meanwhile, the sudden shift towards value-specific care and focus on reduced hospital infections is further fueling the adoption of advanced disposable products.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Wound Type |

|

|

Product |

|

|

End user |

|

|

Distribution Channel |

|

|

Material |

|

|

Levels of Exudate |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Wound Management Products Market - Regional Analysis

North America Market Insights

North America market is projected to hold the largest share of 38.8% by the end of 2035. The market’s growth in the region is highly subject to an expansion in Medicare for effectively providing advanced wound care products coverage. In addition, the presence of provincial healthcare systems is also uplifting the market’s exposure in the overall region. According to an article published by The Foot in September 2022, it has been estimated that 67% of amputations in the U.S. is directly related to diabetes, which caters to the increasing demand for the market.

The disposable wound management products market in the U.S. is significantly growing, highly driven by the chronic wound occurrence and an expansion in Medicaid and Medicare. As per an article published by NLM in October 2023, chronic wounds readily affect 10.5 million of the country’s Medicare beneficiaries, and also impact the quality of life for almost 2.5% of the overall population. However, to combat this, the U.S. Centers for Medicare and Medicaid Services successfully restricted the utilization of tissue products, cellular, and skin substitute grafts, thus suitable for the market’s growth in the country.

The disposable wound management products market in Canada is gradually increasing, effectively driven by provincial healthcare investments. In this regard, as per the March 2024 Government of Canada article, the Minister of Health declared compulsory Canada Health Transfer (CHT) deductions, amounting to more than USD 79 million, which caters to patients' charges as of 2022 for medical services. Besides, Newfoundland, Quebec, Ontario, Alberta, British Columbia, and Labrador achieved deduction-based reimbursements of more than USD 90 million, thus bolstering the market’s exposure.

Diabetic Foot Ulcer (DFU) Expense in North America (2022)

|

Countries |

Sample Size |

Cost |

|

U.S. |

400,000 |

USD 3,999 to USD 6,278 |

|

U.S. |

- |

USD 33,000 |

|

U.S. |

112 (non DFU) |

USD 941.8 to USD 278.6 |

|

Canada |

27,878 |

USD 26,000 |

|

Canada |

25,597 |

USD 21,371 |

Source: The Foot

APAC Market Insights

The disposable wound management products market in the Asia Pacific is anticipated to emerge as the fastest-growing region between 2025 and 2037. The market’s development in the region is highly attributed to government healthcare investments, a rise in the aging population, and a surge in chronic wounds. Besides, China is effectively dominating the region’s upliftment, which is driven by NMPA’s escalated acceptances for innovative dressings, along with a surge in annual government expenditure. Meanwhile, India’s market is also accelerating with support from administrative bodies for wound care services for the majority of patients.

The disposable wound management products market in China is gaining increased traction and is effectively fueled by government-based modernization and the fast implementation of progressive therapies. According to an article published by NLM in September 2024, the overall health spending in the country has surged from 85,327.4 billion yuan, denoting a 203% increase, while the government-based health and medical expenditure has readily upsurged by USD 15,608.9 billion yuan, denoting a 185% increase, which in turn is suitable for effectively bolstering the market in the country.

The disposable wound management products market in India is also expected to grow, owing to the presence of government initiatives for providing advanced dressings, along with generous investments. In this regard, the March 2025 PIB Government report declared that the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) increased the government health spending from 29.0% to 48%, while declined out-of-pocket expenses from 62.6% to 39.4%, which resulted in savings of more than Rs. 1.2 lakh crore (USD 14.3 billion). In addition, the organization made an expansion in providing free treatment advantages of almost Rs. 5 lakh (USD 5,692) every year to nearly 6 crore (60 million) senior citizens, thus denoting a huge growth opportunity for the market.

Europe Market Insights

Europe market is expected to hold a considerable share during the forecast timeline. The market’s growth in the region is propelled by EU-based healthcare reforms, an increase in the aging population, and rare wound occurrences. Germany is gradually leading the region with an increase in health and medical spending, which is effectively supported by reimbursement policies, particularly for wound care. Besides, the UK is also followed by due to the existence of the NHS, offering a generous budget for ensuring wound management, thus creating an optimistic outlook for the overall market in the region.

The disposable wound management products market in Germany is gaining increased exposure, which is effectively fueled by an increase in chronic wound prevalence as well as the presence of strong reimbursement policies. The Federal Joint Committee (G-BA) has mandated evidence-specific wound care, particularly for foam and antimicrobial products. Besides, as stated in the April 2025 NCBI article, 3.3 million insured people reside in the country, thereby making it more suitable for the market to continuously grow and cater to standard services required for managing wound care services.

The disposable wound management products market in the UK is also growing due to the aspect of cost-effective NHS mandates, along with NICE guidelines demanding innovative dressings for chronic wounds, resulting in suitable savings, particularly in low hospital accommodations. According to an article published by the NLM in July 2025, there will be an upsurge in the country’s health and medical expenditure by 2.8% by the end of 2025 and between 2028 and 2029. In addition to this, there will be capital investments for technology, new buildings, and equipment, which will also grow by 1% within a year, thus suitable for uplifting the market in the country.

2022 Healthcare Expenditure in Europe

|

Countries |

€ million |

€ per inhabitant |

PPS per inhabitant |

% of GDP |

|

Germany |

488,677 |

5,832 |

5,317 |

12.6 |

|

Spain |

17,562 |

1,683 |

1,986 |

8.5 |

|

France |

313,574 |

4,607 |

4,302 |

11.9 |

|

Italy |

175,719 |

2,978 |

2,945 |

9.0 |

|

Hungary |

11,297 |

1,171 |

1,867 |

6.7 |

|

Austria |

49,897 |

5,518 |

4,751 |

11.2 |

Source: Eurostat

Key Disposable Wound Management Products Market Players:

- 3M Health Care

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smith & Nephew

- ConvaTec Group

- Mölnlycke Health Care

- Medtronic

- B. Braun

- Coloplast

- Cardinal Health

- Baxter International

- Integra LifeSciences

- Hollister Incorporated

- Medline Industries

- Derma Sciences (Acquired by Integra)

- Hartmann Group

- Lohmann & Rauscher

The global market is effectively modest, and is readily dominated by organizations, including 3M, Smith & Nephew, and ConvaTec, all of which combinedly cater to a majority of the market share. Besides, notable approaches, such as emerging markets, product innovation, and mergers and acquisitions, are deliberately accounting for the market’s development internationally. For instance, the FDA has successfully approved 3M’s artificial intelligence-based Tegaderm dressings in 2023, and within the same year, Smith & Nephew introduced PICO single-use NPWT. Meanwhile, as of 2022, ConvaTec’s generous acquisition of Triad Life Sciences resulted in expanding its bioactive dressings, making it suitable for the overall market growth.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2025, SOLASCURE Ltd notified that the U.S. FDA has effectively granted the fast-track designation for its investigational Aurase Wound Gel, which is suitable for aiding patients with calciphylaxis ulcers.

- In March 2025, Mölnlycke declared that it has successfully signed a strategic agreement to effectively achieve P.G.F. Industry Solutions GmbH and consolidate its position as one of the global leaders in wound care.

- In December 2024, Niterra Ventures Company deepened its commitment by partnering with Neoplas Med GmbH to ensure advancements in healthcare innovation globally by readily investing USD 18 million to make a revolution in wound care services.

- Report ID: 7848

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Wound Management Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.