Disposable EEG Electrode Market Outlook:

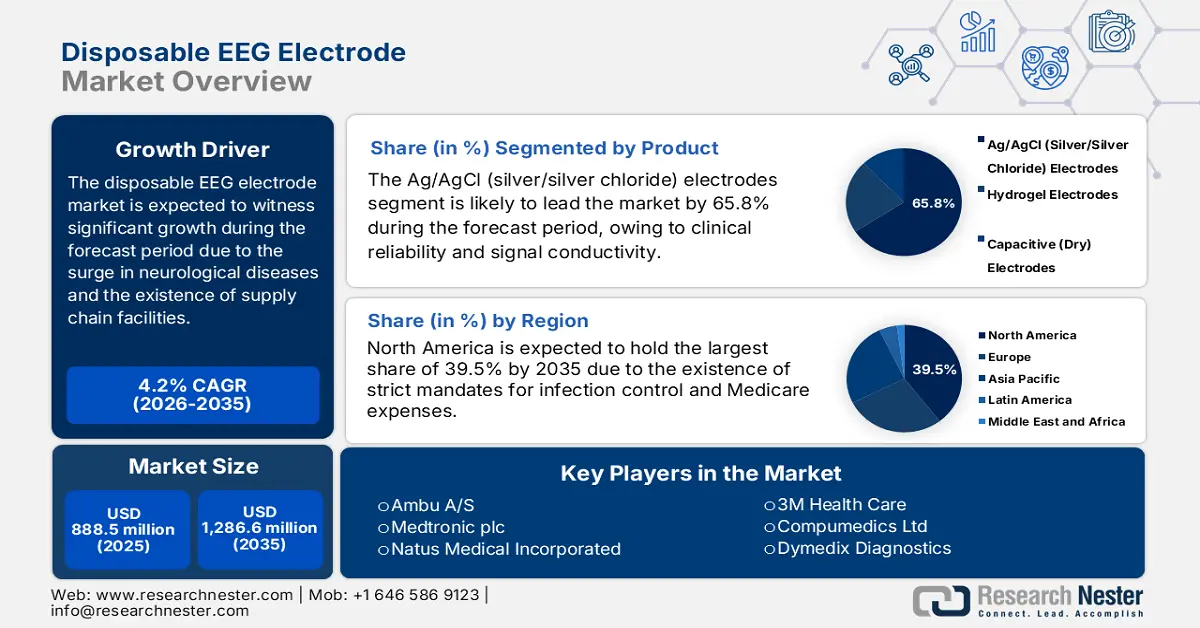

Disposable EEG Electrode Market size was USD 888.5 million in 2025 and is expected to reach USD 1,286.6 million by the end of 2035, increasing at a CAGR of 4.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of disposable EEG electrode is estimated at USD 925.8 million.

The international patient pool in the market is gradually expanding, owing to a rise in the occurrence of neurological disorders. As per a report published by the World Health Organization (WHO) in March 2024, over 3 billion people across different nations live with a neurological condition. In addition, over 80% of neurological deaths, along with health loss, take place across low- and middle-income nations. Besides, developed countries have almost 70 times more neurological professionals per 100,000 in comparison to developing nations. Therefore, with this prevalence, there is a massive growth opportunity for the market to gain increased exposure globally.

Moreover, the supply chain facility for the market includes raw material distribution, manufacturing, and procurement, especially for conductive polymers, silver chloride, and silver. Besides, as per a data report published by FRED in September 2025, the producer price index by industry for medical equipment and supplies manufacturing is 138.1% as of August 2025. This growth is readily subject to disruptions in the supply chain and volatility in silver prices. Meanwhile, the U.S. International Trade Commission (USITC) indicated that China effectively dominated raw material exports, which is also driving the market’s growth.

Key Disposable EEG Electrode Market Insights Summary:

Regional Highlights:

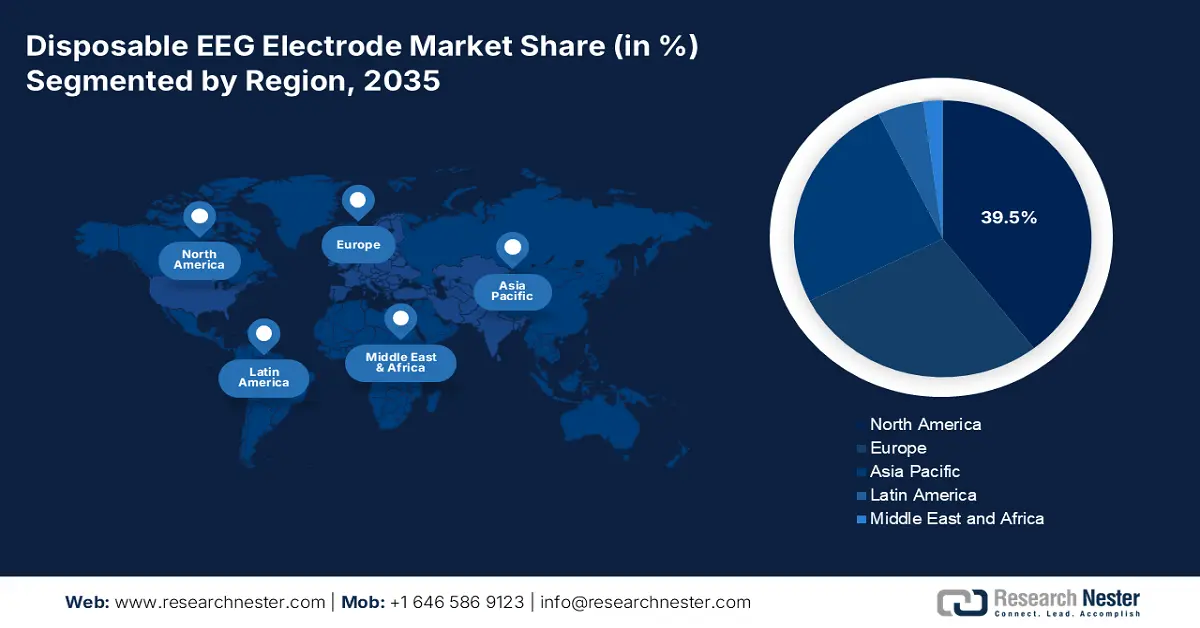

- North America market is predicted to command a 39.5% share by 2035 in the disposable EEG electrode market, owing to strict CDC infection control mandates and rising Medicare expenditure on EEG electrodes.

- Asia Pacific market is set to expand at the fastest pace through 2026-2035, impelled by growing healthcare infrastructure and the increasing prevalence of neurological disorders across China and India.

Segment Insights:

- The Ag/AgCl (silver/silver chloride) electrodes segment in the disposable EEG electrode market is projected to account for 65.8% share by 2035, propelled by clinical reliability and superior signal conductivity.

- The single-channel electrodes segment is anticipated to secure the second-largest share by 2035, supported by affordability, simplicity, and portability in varied EEG and tactile sensing applications.

Key Growth Trends:

- Company initiatives and product innovation

- Unmet requirements in emerging economies

Major Challenges:

- Regulatory delays in notable economies

- An increase in out-of-pocket costs for patients

Key Players: Medtronic plc, Natus Medical Incorporated, Ambu A/S, Rhythmlink International, Koninklijke Philips N.V., 3M Health Care, Compumedics Ltd, Dymedix Diagnostics, NeuroWave Systems Inc., Cadwell Industries Inc., Brain Products GmbH, Micromed S.p.A., Neurosoft, Bittium Biosignals Ltd, EMS Biomedical.

Global Disposable EEG Electrode Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 888.5 million

- 2026 Market Size: USD 925.8 million

- Projected Market Size: USD 1,286.6 million by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 1 October, 2025

Disposable EEG Electrode Market - Growth Drivers and Challenges

Growth Drivers

- Company initiatives and product innovation: Notable manufacturers are implementing material science and artificial intelligence (AI) to create differentiation in products, thereby denoting a positive impact on the market. according to an article published by NLM in July 2025, chronic coronary syndrome (CCS) has been readily observed as a relevant health issue, accounting for 197.2 million cases, along with 9.1 million deaths, thus denoting progression in health products. Besides, in April 2024, Medtronic plc declared latest innovation in AI for endoscopic care by introducing ColonPRO, thereby denoting a massive growth opportunity for the overall market.

- Unmet requirements in emerging economies: This is another growth factor that has effectively uplifted the market growth. As per an article published by the MDPI in January 2025, epileptic seizures tend to affect almost 1% of people internationally, and EEG is comprehensively utilized to diagnose them and effectively detect seizures. Therefore, to detect them, the 10–20 EEG cap system is extremely suitable, comprising a 73% sensitivity, while BTE channels utilization caters to a 68% sensitivity rate, thus creating an optimistic outlook of the overall market.

- Expansion in ambulatory and home-based care: This is extremely vital for the market globally, since it provides cost-effective, accessible, and convenient healthcare. This is effectively possible by focusing on chronic conditions and preventive services management outside of conventional hospital environments. As stated in the April 2024 NLM article, health system expenses for the home-based strategy per patient are accounted to be low, amounting to USD 19,598 in comparison to the clinic-based model, amounting to USD 20,007, thereby suitable for uplifting the overall market.

2025 Month-wise PPI for Surgical and Medical Instrument Manufacturing

|

Months |

PPI Rate |

|

January |

152.0% |

|

February |

151.9% |

|

March |

151.8% |

|

April |

151.3% |

|

May |

151.9% |

|

June |

151.9% |

|

July |

151.8% |

|

August |

151.8% |

Source: FRED

Challenges

- Regulatory delays in notable economies: The long-term monthly clearance duration, particularly in Brazil, has developed a huge gap in the market entry. Besides, the EU’s Medical Device Regulation (MDR) has resulted in small and medium enterprises (SMEs) abandoning electrode projects, owing to increased compliance expenses. Meanwhile, the FDA’s 2023 guidance on nanotechnology in electrodes has readily pressured a few organizations in the U.S. to reformulate products, adding months to create developmental cycles, thus negatively impacting the market.

- An increase in out-of-pocket costs for patients: Based on this issue, the majority of epilepsy patients across developing countries are finding it unsuitable to afford disposable EEGs, which has caused a hindrance in the market growth. In fact, the National Epilepsy Control Program in India usually covers only a small portion of electrode expenses, thereby leaving most patients with suitable accessibility. Besides, the presence of high-deductible health reforms in the U.S. pressurizes patients to initiate an increased purchase for each EEG, thereby leading to limitations in tests, which has negatively impacted the market.

Disposable EEG Electrode Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 888.5 million |

|

Forecast Year Market Size (2035) |

USD 1,286.6 million |

|

Regional Scope |

|

Disposable EEG Electrode Market Segmentation:

Product Segment Analysis

Based on the product, the Ag/AgCl (silver/silver chloride) electrodes segment in the market is projected to garner the highest share of 65.8% by the end of 2035. The segment’s upliftment is highly attributed to the aspect of clinical reliability as well as unmatched signal conductivity. According to an article published by NLM in July 2023, the stability of these electrodes utilizes open circuit potential (OCP) measurement, resulting in being stable for 300 seconds under 3 mKCl solution. Besides, the thickness deviation of each layer of the electrode from the targeted design thickness is within 0.5%, thereby suitable for uplifting the segment’s growth.

Usability Segment Analysis

Based on the usability, the single-channel electrodes segment in the market is expected to cater to the second-largest share during the projected timeline. The segment’s growth is highly driven by providing affordability, simplicity, and portability in different applications, including tactile sensing, as well as non-invasive EEG. As per an article published by AESNET Organization in December 2023, a clinical study was conducted on 251 patients, wherein they were monitored using EEG monitoring devices. The overall framework resulted in 100%, 89%, and 68% sensitivity rates, thus denoting the segment’s suitability.

End user Segment Analysis

Based on the end user, the hospitals segment in the market is anticipated to account for the third-largest share by the end of the predicted duration. The segment’s development is highly fueled by the existence of stringent infection control mandates as well as an increase in the occurrence of neurological cases. In this regard, the 2023 guideline of the CDC has effectively escalated the implementation by categorizing reusable EEG electrodes as high-risk for HAIs, which has prompted the majority of hospitals in the U.S. to switch to disposables. Besides, reimbursement support and operational efficiency are other benefits that positively impact the overall segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Usability |

|

|

End user |

|

|

Application |

|

|

Shape |

|

|

Form Factor |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable EEG Electrode Market - Regional Analysis

North America Market Insights

North America market is anticipated to garner the highest market share of 39.5% by the end of 2035. The U.S. is readily propelling the majority of the regional demand, which is driven by stringent CDC infection control mandates that have prompted hospitals to implement disposable electrodes. Besides, there has been an increase in Medicare expenditure on EEG electrodes, and meanwhile, generous funding provision has been initiated for neurotech research and development, such as AI-based electrodes. Therefore, all these factors are readily responsible for uplifting the market in the region.

The disposable EEG electrode market in the U.S. is significantly growing, effectively fueled by an expansion in Medicaid and Medicare, which are covering most of the hospital EEGs. According to an article published by the Milken Institute in 2022, BrightFocus Foundation provided USD 25.3 million in grants, along with a proactive portfolio, which includes more than 260 funded projects, further denoting a USD 65 million investment in research. Besides, as per the June 2025 CFG article, 48% of neurotech firms are present, which denotes a phenomenal neurotechnology landscape for the country.

The disposable EEG electrode market in Canada is also growing, readily attributed to the existence of provincial healthcare investments. In this regard, the 2025 Government of Canada indicated that it has offered a generous fund of USD 49,382 for in-house fabrication and development of a method for flex electrode arrays over the past 4 to 5 years. In addition, the government body has also initiated an additional fund of USD 25,000 for unveiling flexible dry electrodes for achieving electroencephalogram signals. Therefore, the offering of such investments has created a huge growth opportunity for the market in the country.

Neurology Research Funding in North America (2025)

|

Fund Organizations |

Month |

Amount |

|

America Board of Psychiatry and Neurology, Inc. |

July |

USD 100,000 |

|

Advanced Research+Invention Agency (ARIA) |

July |

£10,000,000 |

|

United States - Israel Binational Science Foundation (BSF) & National Multiple Sclerosis Society (NMSS) |

August |

USD 225,000 |

|

Brain Canada Foundation & Government of Canada |

August |

CAD 100,000 |

|

National Multiple Sclerosis Society (NMSS) |

August |

USD 180,000 |

|

Spastic Paraplegia Foundation |

August |

USD 150,000 |

Source: The George Washington University

APAC Market Insights

Asia Pacific market is considered the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by an expansion in healthcare infrastructure as well as a rise in the prevalence of neurological disorders. China is deliberately dominating the majority of the revenue share, while the market in India is also surging with support from administrative bodies to enhance EEG diagnostics. As per an article published by MDPI in July 2022, the region readily contributed at least 49.2% for the development of the latest investigations, pertaining to EEG with the utilization of machine learning techniques, thus suitable for the market’s exposure.

The disposable EEG electrode market in China is gaining increased traction in the region, which is readily attributed to strengthened healthcare accessibility and the presence of aggressive government investment. Besides, as per the 2023 Biogen annual report, in January 2024, Lecanemab, suitable for aiding Alzheimer’s disease effectively underwent Phase III clinical trial in the country. In addition, within the same month, the NMPA approved LEQEMBI in the country, with an expected launch date in the same year, thereby denoting a huge growth opportunity for the overall market, and eventually providing increased neurology-based solutions to patients.

The disposable EEG electrode market in India is also growing, and is poised to grab a generous portion of the region’s revenue by 2035. The Ayushman Bharat scheme in the country has readily made generous investments in terms of neurology and catered to rural clinics to combat access issues. In this regard, a data report has been published by the MOHFW Government in 2024, wherein the National Institute of Mental Health and Neuro Sciences released a fund of Rs. 603.4 crore (USD 68.4 million) in December 2024, of which Rs. 505.6 crore (USD 57.3 million) has been utilized. Therefore, with such generous funding allocation by the regional government, there is a massive opportunity for the market’s upliftment in the country.

Europe Market Insights

Europe market is expected to hold a considerable share by the end of the projected timeline. The market’s exposure in the region is effectively propelled by a rise in neurological disorder prevalence, the presence of stringent EU Medical Device Regulation (MDR) compliance, and a surge in the aging population. As per an article published by Seizure: Europe Journal of Epilepsy in August 2023, there exists a huge population of people with intellectual disabilities (PwID), amounting to an estimated 1.5 million in the UK. Additionally, the epilepsy prevalence in PwID is approximately 22.5%, thus suitable for bolstering the market in the region.

The disposable EEG electrode market in Germany is gaining increased exposure since it is dominating the region, based on the presence of strict regulations and strong healthcare facilities. As stated in the July 2023 DNDI Organization article, the German Federal Ministry of Education and Research (BMBF) awarded funds to non-profit organizations, amounting to EUR 50 million, to assist in progressing the research and development (R&D) for developing the latest tools for neglected diseases. This funding is projected to continue till 2028, which commenced from 2023 based on the continuous support of product development partnerships (PDPs).

The disposable EEG electrode market in the UK is significantly growing, which is readily supported by the NHS’s generous investment. According to a data report published by the NHS Confederation in August 2023, the Department of Health and Social Care has successfully received a generous funding of more than £180 billion. Besides, as of 2022, an estimated 1.6 million patient interactions has taken place with NHS services each day, while there exist 42 integrated care systems in the country, thus creating a huge growth opportunity for the overall market’s upliftment. This aspect of fund provision is extremely suitable for boosting the market and providing patients with standard care services.

Growth in Healthcare Expenditure in Europe (2022)

|

Countries |

Per Person Spending Growth |

Per Person Spending Average |

|

Germany |

4.2% |

£4,186.2 |

|

France |

2.8% |

£3,644.5 |

|

UK |

2.7% |

£3,005.0 |

|

Spain |

2.9% |

£2,369.1 |

Source: Health Organization UK

Key Disposable EEG Electrode Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Natus Medical Incorporated

- Ambu A/S

- Rhythmlink International

- Koninklijke Philips N.V.

- 3M Health Care

- Compumedics Ltd

- Dymedix Diagnostics

- NeuroWave Systems Inc.

- Cadwell Industries Inc.

- Brain Products GmbH

- Micromed S.p.A.

- Neurosoft

- Bittium Biosignals Ltd

- EMS Biomedical

The global disposable EEG electrode market is adversely united, with Medtronic accounting for the majority of the overall share, which is followed by Natus Medical, effectively constituting a considerable share. In addition, both these organizations are combinedly leading through AI-specific implementation, as well as pediatric specialization. Besides, companies in Europe, such as Ambu and Philips, with a moderate share, have readily focused on initiating telehealth compatibility, while Asia-based manufacturers, including Nihon Kohen and Omron, have successfully prioritized affordability and regulatory compliance. Meanwhile, regulatory partnership, research and development for sustainable materials, and emerging market extension are other suitable trends uplifting the disposable EEG electrode market.

Here is a list of key players operating in the global market:

Recent Developments

- In January 2025, Zeto, Inc. notified its recent successful closing of a USD 31 million funding round to effectively redefine the future of EEG brain monitoring and expand its operational and commercial teams.

- In November 2024, Nihon Kohden declared its successful acquisition of a 71.4% stake in NeuroAdvanced Corp. to effectively solidify its position as one of the industry leaders by combining its established expertise in EGE systems.

- Report ID: 7849

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable EEG Electrode Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.