Disposable Curved Cutting Stapler Market Outlook:

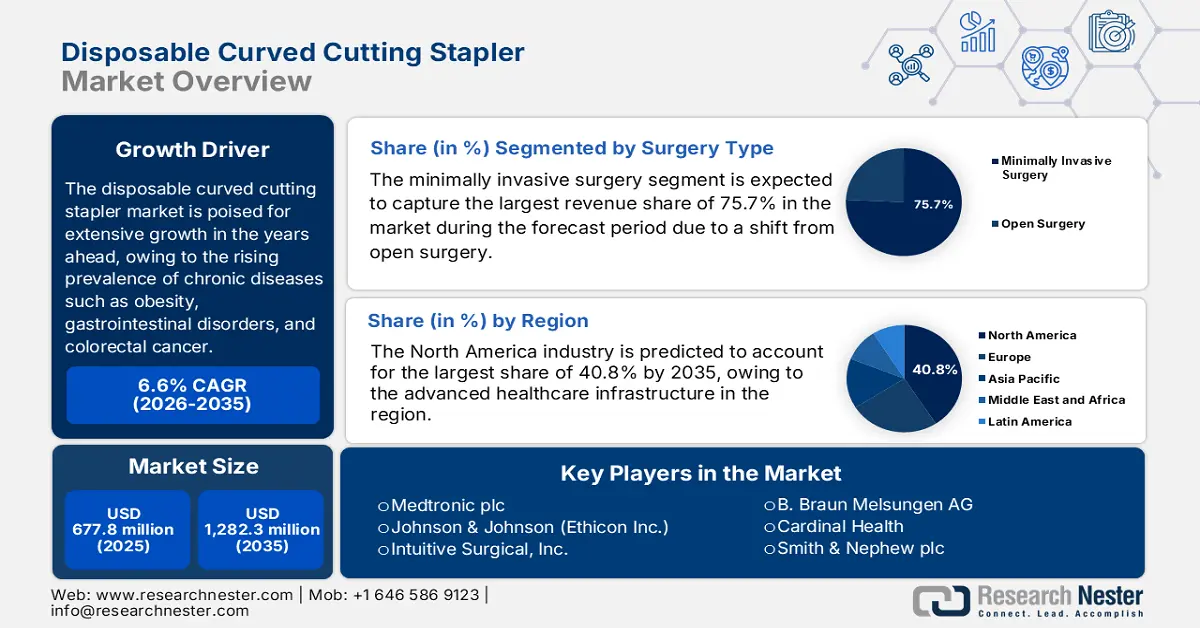

Disposable Curved Cutting Stapler Market size was valued at USD 677.8 million in 2025 and is projected to reach USD 1,282.3 million by the end of 2035, rising at a CAGR of 6.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of disposable curved cutting stapler is estimated at USD 720.6 million.

The market is poised for extensive growth in the years ahead, owing to the rising prevalence of chronic diseases such as obesity, gastrointestinal disorders, and colorectal cancer. Testifying this in September 2023, AGA Journal reported that digestive diseases accounted for 7.3 billion cases in a year and 2.8 billion prevalent cases across all nations, resulting in 8 million deaths and 277 million disability-adjusted life years lost, hence denoting a positive market outlook.

Furthermore, the market is expected to sustain steady growth owing to the rise in procedural volumes coupled with greater emphasis on safety, efficiency, and patient outcomes. Therefore, a 2024 study in Arq Bras Cir Dig evaluated the costs associated with laparoscopic bariatric surgeries, such as Roux-en-Y gastric bypass (RYGB) and vertical gastrectomy (VG), in a span of three years, wherein 177 surgeries were performed. It found that SUS reimbursed R$6,145.00 for RYGB and R$4,095.00 for VG, while actual hospital costs reached R$10,799.23 and R$10,207.53, respectively.

Key Disposable Curved Cutting Stapler Market Insights Summary:

Regional Insights:

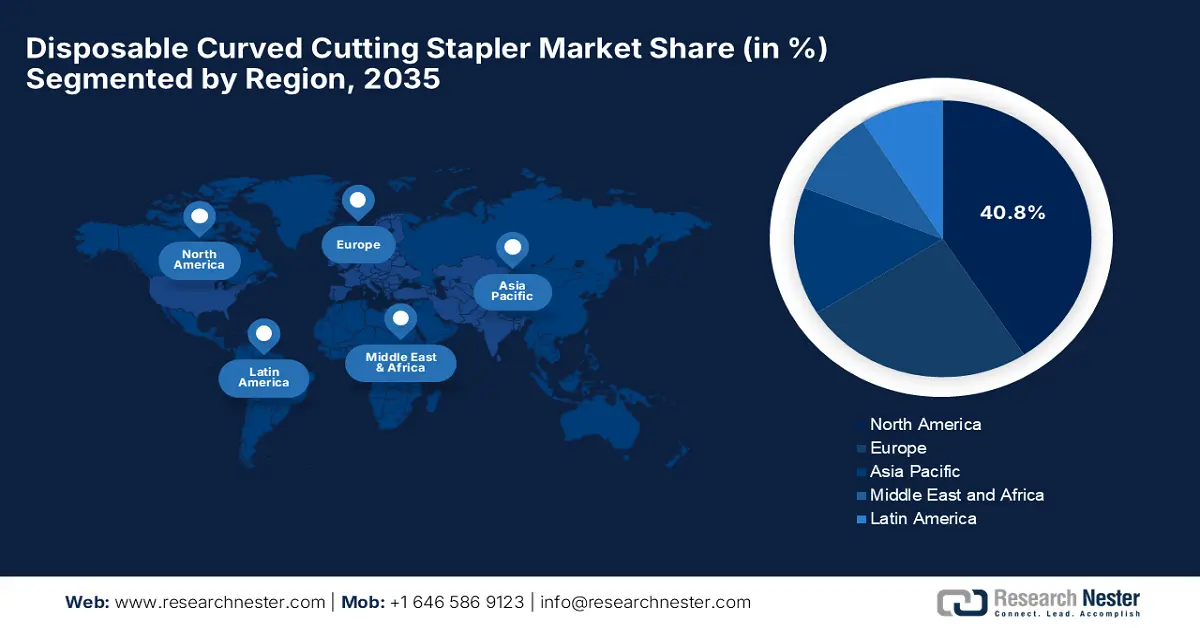

- North America is set to dominate the Disposable Curved Cutting Stapler Market with a 40.8% revenue share by 2035, spurred by the progressive integration of AI-enabled and robotic-assisted stapling technologies.

- The Asia Pacific region is anticipated to record the fastest growth through 2026–2035, supported by healthcare modernization initiatives and the growing number of surgical procedures.

Segment Insights:

- The minimally invasive surgery segment in the Disposable Curved Cutting Stapler Market is projected to hold a dominant 75.7% revenue share by 2035, propelled by the global transition from open surgery to minimally invasive techniques.

- The hospitals segment is expected to capture a 65.3% share by 2035, fueled by their pivotal role in performing complex surgeries and housing advanced medical infrastructure.

Key Growth Trends:

- Amplifying surgical rates

- Technological advances in stapler design

Major Challenges:

- Increased out-of-pocket expenses

- Supply chain vulnerabilities

Key Players: Medtronic plc, Johnson & Johnson (Ethicon Inc.), Intuitive Surgical, Inc., B. Braun Melsungen AG, Cardinal Health, Smith & Nephew plc, CONMED Corporation, LIVSMED Inc., Meril Life Sciences Pvt. Ltd., Fujifilm Holdings Corporation, Olympus Corporation, Purple Surgical International Ltd., Welfare Medical Ltd., Grena Ltd., Victor Medical Instruments Co., Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Teleflex Incorporated, Stryker Corporation, Integra LifeSciences, 3M Company.

Global Disposable Curved Cutting Stapler Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 677.8 million

- 2026 Market Size: USD 720.6 million

- Projected Market Size: USD 1,282.3 million by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 30 September, 2025

Disposable Curved Cutting Stapler Market - Growth Drivers and Challenges

Growth Drivers

- Amplifying surgical rates: There has been a rise in surgical procedures owing to the rising instances of diseases such as colorectal cancer, obesity, gastrointestinal disorders, and other chronic conditions. This can be evidenced from the report published by the National Institute of Health in January 2024, which stated that the surgical rate in India was observed to be 1,385.28 surgeries per 100,000 people, wherein the major surgeries accounted for 355.94 per 100,000 in a year, denoting the strong necessity for curved cutting staplers.

- Technological advances in stapler design: The innovations in terms of better materials, improved ergonomics, and enhanced safety are fostering a huge consumer base for the market. For instance, in December 2021, Intuitive reported that it received FDA clearance for its 8 mm SureForm 30 Curved-Tip Stapler, which is the first robotic stapler with 120-degree articulation and SmartFire technology and enables better visibility in general, thoracic, gynecologic, urologic, and pediatric surgeries.

- Expanding healthcare infrastructure: As nations across the world are readily making investments in the healthcare sector, a larger number of hospitals and surgical centers are being inaugurated and updated. In June 2023, VishwaRaj Hospital reported that it had inaugurated its Department of Bariatric and Metabolic Surgery and successfully performed its first bariatric surgery, an advanced laparoscopic sleeve gastrectomy on a 130 kg female patient, underscoring the necessity for curved cutting staplers.

Global Projections and Economic Impact of Obesity by 2035

|

Category |

Value / Projection |

|

The global population will be overweight/obese by 2035 |

51% (Over 4 billion people) |

|

The global population will be obese by 2035 |

1 in 4 people (~2 billion) |

|

Global economic impact of overweight/obesity by 2035 |

USD 4.32 trillion annually (~3% of global GDP) |

|

Comparison to the COVID-19 economic impact |

Comparable to the 2020 global economic losses |

|

Childhood obesity (boys) by 2035 |

208 million (100% increase from 2020) |

|

Childhood obesity (girls) by 2035 |

175 million (125% increase from 2020) |

|

Adults living with obesity by 2035 |

Over 1.5 billion |

|

Children living with obesity by 2035 |

Nearly 400 million |

|

Economic impact in low/lower-middle income countries (2035) |

Over USD 370 billion annually |

|

Region with the highest GDP impact |

Americas (3.7% of GDP) |

|

Region with the highest total economic cost |

Western Pacific (USD 1.56 trillion) |

Source: World Obesity Atlas 2023

Key Developments Indicating Revenue Opportunities in the Disposable Curved Cutting Stapler Market

|

Year |

Event / Initiative |

Company Name |

Revenue Opportunity for Manufacturers |

|

2025 |

Launch of Bariatric Surgery & Medical Weight Loss Clinic by CommonSpirit |

CommonSpirit Health |

Increased demand for bariatric surgical tools |

|

2025-2029 |

USD 55 billion investment, including new manufacturing facilities |

Johnson & Johnson |

Boost in local production capacity and demand for advanced surgical systems and components |

|

2022 |

Titan SGS stapler launch and early Series B funding completion |

Standard Bariatrics |

Validated demand for specialized staplers in bariatric surgery; opens market for innovative stapling tech |

Source: Company Official Press Releases

Challenges

- Increased out-of-pocket expenses: The aspect of cost-effectiveness remains a severe barrier, especially for economies with limited insurance coverage. Regardless of all the clinical benefits offered by these products, their higher costs when compared to reusables cause a major challenge for the global disposable curved cutting stapler market. Also, patients in low and middle-income nations often bear a huge cost burden, making the devices less accessible there, by limiting market expansion.

- Supply chain vulnerabilities: This is yet another factor negatively influencing the disposable curved cutting stapler market. These disruptions, which are caused by geopolitical tensions coupled with transportation delays, can severely impact the availability of these materials and components. Additionally, shortages in raw materials, owing to the manufacturing bottlenecks, may lead to potential supply gaps in this field.

Disposable Curved Cutting Stapler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 677.8 million |

|

Forecast Year Market Size (2035) |

USD 1,282.3 million |

|

Regional Scope |

|

Disposable Curved Cutting Stapler Market Segmentation:

Surgery Type Segment Analysis

The minimally invasive surgery segment is expected to capture the largest revenue share of 75.7% in the disposable curved cutting stapler market during the forecast period. The shift from open surgery to MIS is the primary fueling factor of this segment’s dominance. Most of the prominent organizations are promoting minimally invasive procedures owing to the presence of their documented benefits, which include reduced infection rates, shorter hospital stays, and faster recovery. Furthermore, these staplers are engineered especially for the maneuverability and precision required in laparoscopic and robotic-assisted surgeries, hence denoting a positive segment scope.

End user Segment Analysis

In terms of the end-user hospitals segment, it is likely to attain a share of 65.3% in the disposable curved cutting stapler market by the end of 2035. The growth in the segment originates from their role as the primary centers for conducting complex surgical procedures, advanced infrastructure, and the key point of care for the largest patient population. Besides, the government health portals across the world are significantly tracking surgical procedure volumes within these settings, thereby encouraging the provision of best-in-class services.

Application Segment Analysis

The bariatric surgery segment is predicted to capture a lucrative share of 25.5% in the disposable curved cutting stapler market during the discussed timeframe. The global burden of obesity is the key factor behind this leadership, necessitating procedures such as sleeve gastrectomy. Testifying, this ASMBS reported that in 2023, the total number of bariatric surgeries in the U.S. reached 270,000, wherein the most commonly performed procedure was sleeve gastrectomy, accounting for 154,000 surgeries, denoting the presence of strong demand.

Our in-depth analysis of the disposable curved cutting stapler market includes the following segments:

|

Segments |

Subsegments |

|

Surgery Type |

|

|

End user |

|

|

Application |

|

|

Usability |

|

|

Cartridge Size |

|

|

Staple Height |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Curved Cutting Stapler Market - Regional Analysis

North America Market Insights

North America is readily dominating the international disposable curved cutting stapler market with a projected 40.8% revenue share by the end of 2035. The progressive robotic implementation provides the U.S.-based manufacturers, such as Medtronic, with a wide range of advantages with AI-driven staplers, diminishing complexities in clinical trials. In April 2025, CMR Surgical reported that it secured USD 200 million to expand its Versius Surgical Robotic System, which will positively influence the disposable curved cutting stapler market, as tools like these are essential for surgeries supported by robotic platforms.

The U.S. is a major contributor to progress in the regional disposable curved cutting stapler market, backed by robust healthcare infrastructure and ongoing technological advancements in laparoscopic and robotic-assisted surgeries. In May 2024, Ethicon reported that it had successfully launched the ECHELON LINEAR Cutter in the U.S., which is the first linear cutter to combine 3D-Stapling Technology and Gripping Surface Technology. Also, the product demonstrated 47% fewer staple line leaks, aiming to reduce surgical risks, especially in colorectal procedures.

The disposable curved cutting stapler market in Canada is gaining increased traction owing to the presence of publicly funded healthcare systems and increasing investments in surgical technology upgrades across major provinces in the country. For instance, in March 2022, the country’s federal government announced a one-time USD 2 billion funding boost to provinces and territories to reduce COVID-19-related surgical backlogs and accelerate hundreds of thousands of additional surgeries. Besides, this funding complements earlier healthcare transfers and aims to enhance timely access to surgical care, and will boost demand for surgical consumables, including disposable curved cutting staplers.

Annual Bariatric Surgery Volumes in the U.S. (2021-2023)

|

Procedure |

2021 |

2022 |

2023 |

|

Sleeve |

151,680 |

162,560 |

154,000 |

|

RYGB |

61,190 |

63,920 |

63,132 |

|

Band |

2,270 |

2,070 |

1,982 |

|

BPD-DS |

1,280 |

1,310 |

1,334 |

|

Revision |

20,520 |

21,690 |

22,037 |

|

SADI |

5,380 |

6,070 |

6,281 |

|

OAGB |

2,180 |

2,560 |

2,644 |

|

Other |

1,250 |

1,230 |

1,211 |

|

ESG |

4,220 |

4,700 |

4,600 |

|

Balloon |

4,020 |

4,080 |

4,136 |

|

Total |

254,890 |

270,190 |

270,000 |

Source: ASMBS

APAC Market Insights

The Asia Pacific region is anticipated to represent the fastest growth in the disposable curved cutting stapler market share by the end of the forecast period. The market’s upliftment in the region is attributed to a rise in healthcare modernization, along with an increase in surgical volumes. China is dominating the region, which is driven by its government support for single-use surgical devices and systems. Therefore, based on all these factors, the market has a huge opportunity for development in the region.

The disposable curved cutting stapler market in China is gaining increased traction since it is propelled by the aspect of administrative-based investment and continued efforts from key firms to introduce novel technologies in this field. In March 2025, Surgsci reported that it received official medical device registration in the country for its Powered Endoscopic Cutter Stapler, which features advanced ultra-hydrophilic titanium alloy staples that reduce bacterial adhesion and inflammation, and nano-scale ultrafine titanium grain technology.

The disposable curved cutting stapler market in India is gradually increasing based on government assistance, as well as expansion in private hospital chains. For instance, in February 2025, Rela Hospital in Chennai inaugurated the country’s first Centre for Intestinal Rehabilitation and Nutrition Support, which is aimed at providing comprehensive medical, surgical, and nutritional therapies for rare intestinal failures and complex gastrointestinal disorders, hence making it suitable for standard market growth.

Europe Market Insights

Europe in the disposable curved cutting stapler market is expected to account for a considerable share by the end of the forecast duration. The market’s upliftment in the region is readily propelled by the existence of EU regulations that favor single-use devices and an upsurge in aging demographics that require surgical implementations. In July 2025, Intuitive announced that its fifth-generation da Vinci 5 Surgical System had received CE mark approval, enabling its use across the region for minimally invasive endoscopic procedures in adult and pediatric patients.

Germany holds a strong position in the regional disposable curved cutting stapler market, facilitated by the heightened surgical volumes and government efforts to enhance healthcare in the country. In this regard, the country’s Federal Ministry of Health has approved the Transformation Fund, allocating up to €50 billion over 10 years starting in 2026 to modernize hospital infrastructure. The fund aims to support high-quality, centralized inpatient care, with €25 billion from the Health Fund and matching contributions from federal states as well.

The U.K. in the disposable curved cutting stapler market is growing at a steady pace, backed by increasing demand for minimally invasive surgical procedures and advancements in surgical technologies. Besides, hospitals and surgical centers are adopting these staplers due to their precision, ease of use, and ability to reduce operation time and postoperative complications, providing an encouraging opportunity for players in this field. Meanwhile, ongoing innovations in design and material quality also contribute to the enhanced performance, hence denoting a positive market outlook.

Trends in Bariatric and Endoluminal Procedures in Europe

|

Procedure Type |

2020 |

2021 |

|

Sleeve Gastrectomy (SG) |

63,666 |

79,499 |

|

Roux-en-Y Gastric Bypass (RYGB) |

42,918 |

53,918 |

|

One Anastomosis Gastric Bypass (OAGB) |

15,633 |

29,475 |

|

Biliopancreatic Diversion (BPD) |

835 |

1,245 |

|

Adjustable Gastric Banding (AGB) |

3,013 |

2,942 |

|

Other Surgical Operations |

7,281 |

5,313 |

|

Intragastric Balloons |

2,900 |

5,301 |

|

Other Endoluminal Procedures |

338 |

778 |

|

Total |

136,584 |

183,736 |

Source: NIH

Key Disposable Curved Cutting Stapler Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson (Ethicon Inc.)

- Intuitive Surgical, Inc.

- B. Braun Melsungen AG

- Cardinal Health

- Smith & Nephew plc

- CONMED Corporation

- LIVSMED Inc.

- Meril Life Sciences Pvt. Ltd.

- Fujifilm Holdings Corporation

- Olympus Corporation

- Purple Surgical International Ltd.

- Welfare Medical Ltd.

- Grena Ltd.

- Victor Medical Instruments Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Teleflex Incorporated

- Stryker Corporation

- Integra LifeSciences

- 3M Company

The global disposable curved cutting stapler market is extremely consolidated, dominated by the multinational pioneers such as Medtronic and Johnson & Johnson (Ethicon), collectively holding the majority of the revenue share. The dominance of is effectively fueled by extensive R&D investments, robust product portfolios with advanced articulating and reinforced staplers. On the other hand, these key players are also introducing staplers for robot-assisted procedures, thereby facilitating a steady cash influx in this field.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In June 2025, Johnson & Johnson MedTech announced the launch of the ETHICON 4000 Stapler in the U.S., which comprises proprietary 3D Stapling Technology and enhanced Gripping Surface Technology to improve tissue management and minimize surgical leaks and bleeding.

- In September 2024, Intuitive Surgical received the U.S. FDA’s acceptance for the 8mm SureForm 30 Curved-Tip Stapler and related reloads (K241638) as substantially equivalent to legally marketed predicate devices, allowing the company to market it under general controls.

- Report ID: 7841

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.