Depth Filtration Market Outlook:

Depth Filtration Market size was valued at USD 3.2 billion in 2025 and is projected to reach USD 10.3 billion by the end of 2035, rising at a CAGR of 12.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of depth filtration is assessed at USD 3.6 billion.

The global market is driven by a growing patient pool requiring sterile pharmaceuticals, biologics, and plasma-derived therapies. The WHO report states that many people in North America rely on biologics for high-efficiency filtration. Further, the biologics drug approvals have expanded patient access to biosimilars and biologics. This resulted in the growth of depth filtration in varied drugs and API manufacturing, specifically within vaccine and monoclonal antibody production. As per the Food and Drug Administration guidance in 2024, 50 new drug approvals resulted in the fast adoption of biopharmaceutical drugs in the healthcare and, expanding the scope of the market demand.

The key raw materials required for the manufacturing of depth filtration include diatomaceous earth, perlite, and many more. As per the International Trade Administration report in October 2024, China is expected to invest $2.6 billion in special water pollution control projects, impacting the demand for depth filtration systems because many industrial, municipal, and pharmaceutical applications require high-purity water. Further, the assembly lines in major production hubs require robust quality control, validation, and regulatory-compliant practices, aided by FDA and AHRQ guidelines, to ensure the required output and reduce contamination risk.

Key Depth Filtration Market Insights Summary:

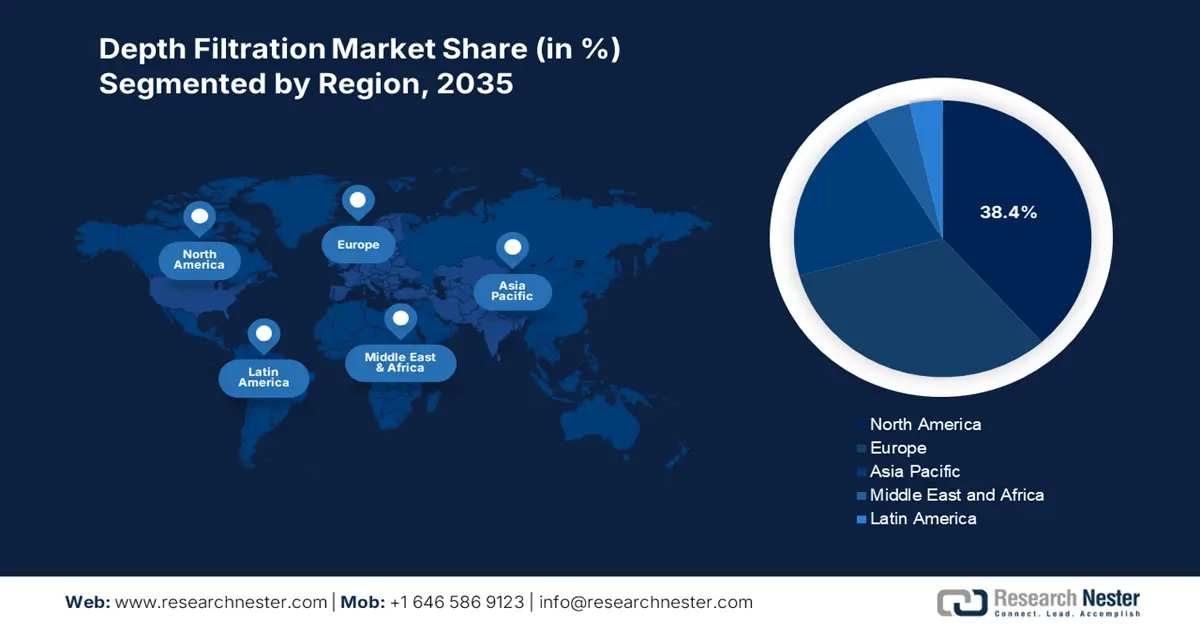

Regional Highlights:

- North America is anticipated to hold a 38.4% share by 2035 in the depth filtration market driven by strong biopharmaceutical demand and increasing federal support for advanced filtration technologies.

- Asia Pacific is expected to capture a 20.8% share by 2035 propelled by rising vaccine production, expanding biopharmaceutical manufacturing, and growing clinical trial activity.

Segment Insights:

- The pharmaceutical & biotechnology segment is projected to secure a 42.5% share of the depth filtration market by 2035 supported by rising biologics manufacturing and stringent purity requirements in vaccine and therapeutic production.

- The cartridge filters segment is expected to dominate by 2035 with the largest share value owing to its modular design, high particle retention capability, and suitability for sterile high-flow processing across industries.

Key Growth Trends:

- Technology innovations and advancements

- Expansion in the patient pool

Major Challenges:

- Patient affordability and reimbursement hurdles

Key Players: Danaher, Sartorius AG, 3M Company, Eaton Corporation, Parker Hannifin, Amazon Filters Ltd, Meissner Filtration, Graver Technologies, Porvair Filtration, Saint-Gobain, Cobetter Filtration, Donaldson Company, Thermo Fisher Scientific, MANN+HUMMEL, Ahlstrom-Munksjö, Toyo Roshi Kaisha, Clear Edge Filtration, Kimberly-Clark, Lydall Performance Materials.

Global Depth Filtration Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 2 September, 2025

Depth Filtration Market - Growth Drivers and Challenges

Growth Drivers

- Technology innovations and advancements: Top players are developing to enhance the filtration efficiency, decrease maintenance, and improve scalability. For example, Merck introduced a single-use reactor utilized to boost the antibody drug conjugate production. The technology has made the efficiency 70% higher compared to stainless steel or glass production. Further, technologies including multi-layer depth filters and embedded automation enhance the reliability of the process and reduce operating costs, allowing manufacturers to address increasing regulatory and quality requirements in healthcare markets worldwide.

- Expansion in the patient pool: The rising occurrence of chronic diseases requiring biologics is fueling the market. According to the Federal Ministry of Health, many patients in Germany are receiving biologic therapies, with usage increasing based on the autoimmune disorders, oncology, and rare diseases. The NLM report in October 2024 highlights that the biologics market is actively increasing at a growth rate of 11.7% and is expected to reach $ 679.03 billion by 2033 due to the rising demand for monoclonal antibodies, vaccines, or plasma-derived therapies, reflecting a steady annual increase. This expanding patient base necessitates scalable, high-efficiency filtration systems to maintain purity standards, reduce contamination risk, and ensure regulatory compliance.

- Government policies and implementation: The FDA guidance on manufacturing sterile biologics requires validated filtration stages for viral clearance and impurity removal. Adherence to it ensures product quality, lowers liability, and improves patient outcomes, leading pharma firms to invest in high-performance filtration systems. Likewise, EMA and WHO regulations compel strict validation during vaccine manufacturing. Regulatory imperatives induce the use of sophisticated depth filtration technologies that ensure consistent performance, lower chances of contamination, and facilitate quick market approvals.

Cost Comparison on Depth Filtration

|

Country |

CAPEX (estimate, USD range) |

OPEX (annual est., USD / year) |

Consumable Cost (index 1-5) |

Regulatory/Compliance (index 1-5) |

Rationale / Notes |

|

United States |

$150k-$400k |

$50k-$150k |

3 |

4 |

Higher labor & validation costs; strong regulatory (FDA) requirements and inspection costs. |

|

Germany |

$140k-$380k |

$45k-$130k |

3 |

4 |

High engineering quality & wage levels; EU/EMA regulatory compliance and stringent environmental rules. |

|

France |

$130k-$350k |

$40k-$120k |

3 |

4 |

EU/EMA compliance, moderate labor costs relative to Germany. |

|

Japan |

$150k-$420k |

$55k-$160k |

4 |

4 |

High precision manufacturing & wages; strong regulatory controls (PMDA). |

Depth Filtration Adoption by End use Industry

|

End use Industry |

Key Depth Filtration Trend (2022-2025) |

Market/Statistical Insight |

Source |

|

Pharmaceutical & Biotechnology |

Adoption of single-use and virus-retentive filters; integration with continuous bioprocessing |

72% of biologics manufacturing facilities in the U.S. adopted single-use filtration by 2023, improving throughput by 18% |

FDA.gov - Sterile Products Guidance, 2023 |

|

Food & Beverage |

High-throughput depth filtration for microbial control and particulate removal |

Filtration reduces microbial contamination by up to 90% in beverage production processes, according to USDA inspections in 2023 |

USDA.gov - FSIS, 2023 |

|

Water & Wastewater Treatment |

Depth filtration for virus, bacteria, and sediment removal; municipal and industrial applications |

Over 65% of U.S. municipal water treatment plants use depth filtration for virus removal; virus load decreased by 85% in treated water (EPA, 2023) |

EPA.gov - Water Quality & Treatment, 2023 |

|

Chemicals |

Filtration for particulate removal in industrial processes; improved product quality and reduced downtime |

Implementation of depth filtration in chemical manufacturing reduced particulate contamination by 78% and operational downtime by 12% (NIOSH, 2022) |

NIOSH.gov, 2022 |

Challenges

- Patient affordability and reimbursement hurdles: Access to the market often faces hurdles in the global market due to the high cost of the product. As per the report published by the National Health Policy of India, the biosimilar makers face financial constraints to afford premium filters. This creates a barrier to rate adoption rate and limits the growth of the market demand. The cost of the filter increased due to the high import tariff, as addressed by the World Health Organization and resulting in slow vaccine manufacturing. Patient face a high barrier to afford the drugs because of their raised cost. The reimbursement expansion rate is also rejected, which lowers the accessibility rate of the market.

Depth Filtration Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 3.2 billion |

|

Forecast Year Market Size (2035) |

USD 10.3 billion |

|

Regional Scope |

|

Depth Filtration Market Segmentation:

End use Segment Analysis

The pharmaceutical & biotechnology dominates the segment and is expected to hold the share value of 42.5% by 2035. The segment is led by the increasing requirement for bioprocessing and manufacturing of biologics. Depth filtration plays a key role in cell culture clarification, purification of protein, and viral clearance in vaccines and monoclonal antibodies. The Canada government report released in July 2025 depicts those rising investments in biologics research, with federal R&D expenditure on biomanufacturing, vaccine and therapeutics ecosystem exceeding $2.5B in 2025. On the other hand, the FDA also highlights the purity and safety standards in pharmaceutical production, driving the filtration systems.

Product Segment Analysis

The cartridge filters are expected to dominate in 2035 by holding the largest share value in the segment. The segment is fueled due to their modularity, scalability, and higher particle retention capacity. Their use of sterile filtration and high-flow production lines renders them indispensable in the pharma, food, and water treatment sectors. As stated by the U.S. Environmental Protection Agency (EPA) report in March 2024, advanced cartridge-based depth filtration enhances contaminant removal efficiency, removing microbial loads from water in excess of 99%. This is also economical for continuous processing, which is increasingly preferred by biomanufacturers.

Application Segment Analysis

Final product processing is dominating the application segment and is poised to hold a considerable share value by 2035. The segment is driven due to the role in ensuring the purity of the product before packaging. This involves removing the residual cell debris, contaminants, and impurities in the final stage of pharmaceuticals, beverages, and foods. The European Medicines Agencies necessitate a robust filtration method for sterile drug manufacturing, and improving safety and compliance. Further, the WHO highlights the vital role in producing safe vaccines and biologics, mainly in low-income regions.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Media Type |

|

|

Product |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Depth Filtration Market - Regional Analysis

North America Market Insights

North America dominated the global depth filtration market and is anticipated to hold a market share of 38.4% by 2035. The NIIMBL evidence in April 2024 announced an investment of USD 10 million in projects related to multiple novel technologies and workforce development projects based on biopharmaceuticals. According to the National Health Institution, cell and gene therapy growth is currently high in market demand in North America, which leverages the demand for depth filtration. Government supports to elevate the research and development in depth filtration to make innovations and demand market growth.

The U.S. market of depth filtration is currently dominating in North America. Rapid expansion of biopharma has created a significant demand for depth filtration. Expansion in Medicaid support ensured market accessibility and raised the scope of revenue accumulation for the concerned market. As per the KFF report in July 2025, Medicare spending expanded to USD 60.3 million in 2024, for people aged above 65, including filtration-based therapies, increasing patient access and expanding the market. The key trends, like single-use systems and viral filtration guidelines, pushed the market of depth filtration in the U.S.

Depth Filtration Government Spending

|

Country |

Category |

Data |

Year |

|

U.S. |

NIH |

$48 billion budget, including filtration-based research |

2025 |

|

Canada |

Federal government’s 2023 |

$344 billion total health spending including R&D in pharmaceuticals |

2023 |

Sources: NIH, CMA

Asia Pacific Market Insights

The depth filtration market of Asia Pacific is identified with the emerging region and is expected to hold a market share of 20.8% by 2035. The key driving factor of growth includes robust growth of biopharmaceutical usage in the healthcare sector and an increased number of vaccine productions. The EFPIA report in August 2022 states that the clinical trials in Asia has increased to 10% over the past decade, particularly in biopharmaceutical manufacturing and drug development including monoclonal antibodies (mAbs), vaccines, and cell & gene therapies. The government is exhibiting a sincere approach to support the growth of the depth filtration market. Fast urbanization and diagnosis led to an increased number of chronic disease burdens in the Asia Pacific.

The depth filtration market in China is expanding rapidly with the rise in biologics, vaccines, and plasma-derived medicines. Government support for advanced pharmaceutical manufacturing and biotech R&D highlights this growth. The 2025 China Power report illustrates that China allocated $54.6 billion on science and technology, which is 10.2% of its total budget. This funding also includes the research in single-use filtration, sterile manufacturing, and biologics manufacture, allowing domestic manufacturers to build capacity, increase efficiency, and comply with regulations within the fast-changing depth filtration industry.

Europe Market Insights

The Europe depth filtration market is experiencing sustained growth with rising demand for biologics, vaccines, and sterile advanced pharmaceuticals. The market is driven by increasing patient populations that are demanding cell and gene therapies, robust regulatory requirements for controlling contamination, and government funding in the production of pharmaceuticals. According to the vaccines Europe report in November 2024, the EU has spent close to €46.2bn on pharmaceuticals R&D. In addition, the worldwide R&D has a value of €143.6 billion in 2022, and Europe accounts for 32.2% of this investment. Germany, France, and the UK are the essential markets, as there is high use of single-use systems and advanced filtration modules in commercial production.

Germany is dominating the depth filtration market in Europe, and it is the largest medical biotechnology and diagnostics market. According to the GTAI report in 2025, Germany is the second strongest in biotech worldwide after the U.S. In 2022, the country saw a 19% boost in medical biotechnology R&D expenditures, aided by robust government programs through the Federal Ministry of Health (BMG) and EU initiatives. Germany spent more than EUR 6.3 billion in 2021 in the in vitro market, and it is stated that nearly 70% of clinical diagnoses are dependent on IVD. Further, the country will have a strong demand for biologics, robust infrastructure, and increasing adoption of bioprocessing and single-use filtration systems.

Key Depth Filtration Market Players:

- Merck KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danaher

- Sartorius AG

- 3M Company

- Eaton Corporation

- Parker Hannifin

- Amazon Filters Ltd

- Meissner Filtration

- Graver Technologies

- Porvair Filtration

- Saint-Gobain

- Cobetter Filtration

- Donaldson Company

- Thermo Fisher Scientific

- MANN+HUMMEL

- Ahlstrom-Munksjö

- Toyo Roshi Kaisha

- Clear Edge Filtration

- Kimberly-Clark

- Lydall Performance Materials

A highly competitive market is experienced within the depth filtration market and which is mainly dominated by companies like Merck, Sartorius, and many more. The key strategies implemented to gain a competitive edge include investment in research and development. Strategic acquisition and product portfolio expansion. Amazon Fitters in Europe have achieved traction through offering solutions that are cost-effective in nature. Switching to sustainable filter media is one of the competitive strategies that helped businesses develop product differentiation. The usage of single-use depth filtration systems by companies enabled them to achieve sustainability and scalability in the competitive market.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2025, Eaton introduced BECO Helix depth filter cartridges, which is a new approach to liquid filtration used to provide a double depth filtration effect, mainly in higher particle-holding capacity, and a longer service-life compared to other depth filter cartridges.

- In June 2025, Alioth has launched Alioth Alidep which is a Depth Filter Involved in China’s first 10,000L biosimilar production line. The depth filtration is mainly designed to overcome industrialization challenges in large-scale biopharmaceutical manufacturing.

- Report ID: 2628

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Depth Filtration Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.