Demineralized Allografts Market Outlook:

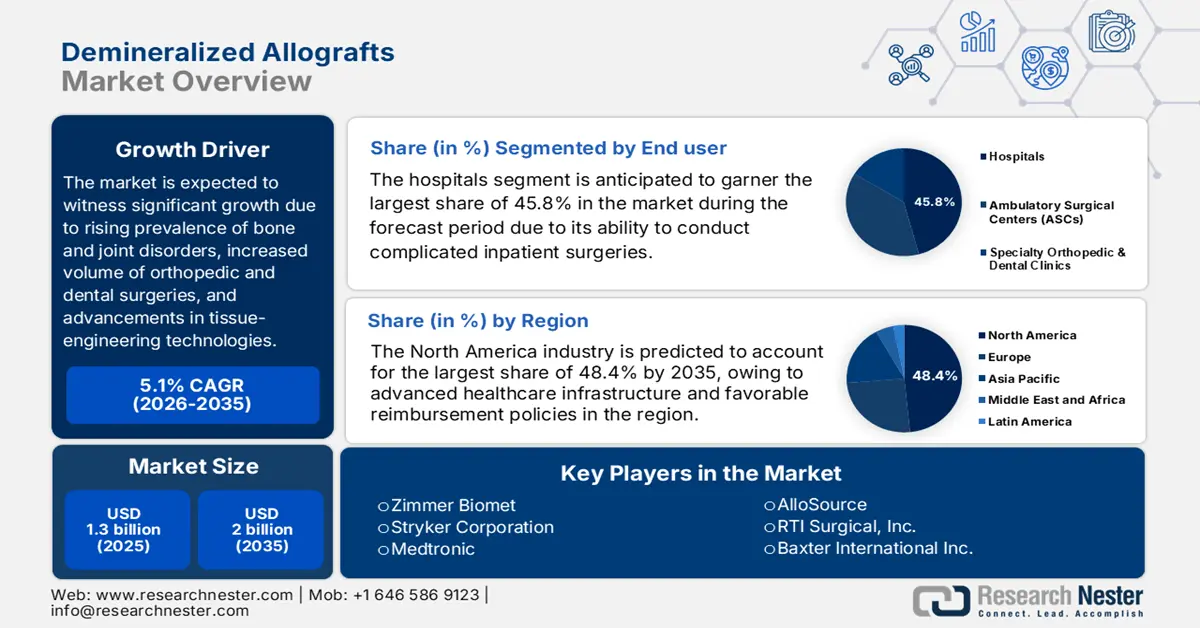

Demineralized Allografts Market size was over USD 1.3 billion in 2025 and is estimated to reach USD 2 billion by the end of 2035, expanding at a CAGR of 5.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of demineralized allografts is estimated at USD 1.4 billion.

The patient pool of the demineralized allografts market is gradually expanding owing to the rising aging demographics and increasing occurrence of musculoskeletal disorders. According to the report published by the Centers for Disease Control and Prevention in June 2024, almost 53 million adults in the U.S. are affected by arthritis, which is a key driving factor for orthopedic bone grafts. In addition, the July 2022 World Health Organization article stated that an estimated 1.7 billion individuals across all nations are readily suffering from musculoskeletal conditions, in turn creating a sustained demand for demineralized bone matrix products.

Moreover, the worldwide market of demineralized allografts comprises a credible supply chain with multiple stages, including tissue procurement, processing, and distribution. In this context, the July 2025 NLM article indicated that there exist more than 100,000 patients on the national organ transplant waiting list. In addition, micropolitan and rural zones effectively supply 9.7% and 7.2% of donors, despite 10.7% and 8.5% of total deaths. On the other hand, according to a data report published by the Federal Reserve Bank of St. Louis in September 2025, the producer price index of medical and surgical instruments was 151.8, which denoted a steep rise year-over-year (YoY), owing to an increase in sterilization and high processing expenses.

Historical Data for Medical and Surgical Instruments PPI

|

Years |

Price Index |

|

2014 |

132.8 |

|

2015 |

134.8 |

|

2016 |

137.0 |

|

2017 |

137.0 |

|

2018 |

137.2 |

|

2019 |

137.2 |

|

2020 |

138.4 |

|

2021 |

138.8 |

|

2022 |

143.3 |

|

2023 |

146.0 |

|

2024 |

149.6 |

Source: Federal Reserve Bank of St. Louis

Key Demineralized Allografts Market Insights Summary:

Regional Insights:

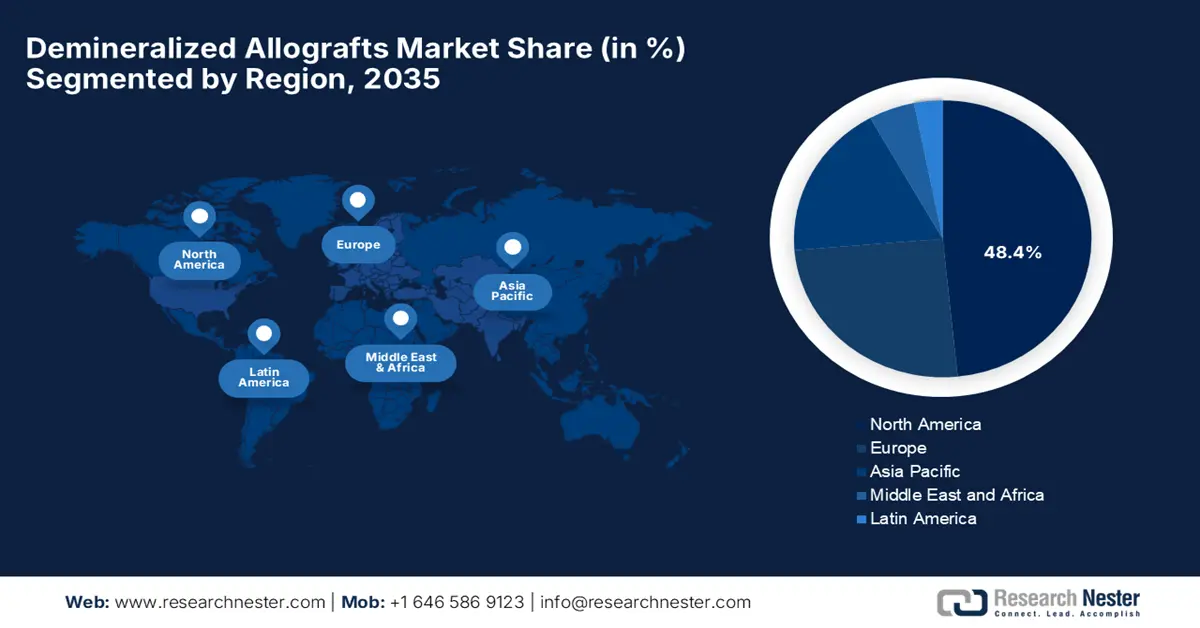

- By 2035, North America is projected to secure a 48.4% share in the demineralized allografts market, uplifted by advanced healthcare infrastructure and supportive reimbursement frameworks.

- Asia Pacific is anticipated to command a rapidly increasing share by 2035, underpinned by aging populations, rising trauma cases, and government-backed healthcare modernization.

Segment Insights:

- The hospitals segment in the demineralized allografts market is forecast to attain a 45.8% share by 2035, supported by its critical role in complex inpatient surgeries requiring DBM.

- The spinal fusion segment is poised to secure the second-highest share by 2035, propelled by its pivotal function in stabilizing the spine and the rising success rates of fusion procedures.

Key Growth Trends:

- Cost savings and value-based care

- Unmet demands in emerging economies

Major Challenges:

- Administrative delays in key markets

- Lack of adequate awareness

Key Players: Medtronic plc (Ireland), Stryker Corporation (U.S.), Zimmer Biomet Holdings, Inc. (U.S.), MTF Biologics (U.S.), AlloSource (U.S.), RTI Surgical, Inc. (U.S.), Baxter International Inc. (U.S.), Nuvasive, Inc. (U.S.), Integra LifeSciences Holdings Corporation (U.S.), Smith & Nephew plc (U.K.), Arthrex, Inc. (U.S.), Lattice Biologics Ltd. (U.S.), Aziyo Biologics, Inc. (U.S.), LifeNet Health (U.S.), J-TEC (Japan Tissue Engineering Co., Ltd.) (Japan), Osiris Corporation (a part of Smith & Nephew) (U.S.), Orthofix Medical Inc. (U.S.), Cook Medical Inc. (U.S.), Seikagaku Corporation (Japan), B. Braun Melsungen AG (Germany).

Global Demineralized Allografts Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.4 billion

- Projected Market Size: USD 2 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Malaysia, Australia

Last updated on : 3 November, 2025

Demineralized Allografts Market - Growth Drivers and Challenges

Growth Drivers

- Cost savings and value-based care: The enhanced quality of care offered by the market accelerates the consistent progress. Exemplifying this, a study was conducted by AHRQ in 2022, which found that utilizing demineralized bone matrix allografts in early-stage orthopedic procedures significantly reduced hospitalization expenses. In this regard, the December 2024 the Joint Commission Journal on Quality and Patient Safety article denoted that approximately surgical site infection (SSI) affects 2% to 4% of patients undergoing surgical procedures in the U.S. Therefore, hospitals are shifting towards outpatient procedures to cut down the costs further, denoting a prolific market opportunity.

- Unmet demands in emerging economies: This is yet another factor that has effectively uplifted the demineralized allografts market growth. According to an article published by NLM in February 2023, deceased‐donor liver transplantation (DDLT) has emerged as the most suitable treatment option, along with living donor liver transplantation, constituting 10% to 20% of liver transplants in Japan. Besides, the March 2022 NLM indicated that allografts are the most commercial and successful bone grafts, holding 57% of the present bone graft market. Additionally, collaborations with Asia-based tissue banks, such as Korea’s KODA, are projected to reduce import reliance and propel business in these nations.

- Increase in craniomaxillofacial and dental applications: Demineralized allografts are increasingly utilized as a gold-standard bone graft material in sinus lifts, ridge preservation after tooth extraction, and in periodontal bone defects for dental implants. Besides, the National Institute of Dental and Craniofacial Research (NIDCR) highlighted the severe demand for effective bone grafting materials in oral regeneration to deliberately support millions of dental implant procedures every year, thereby making it suitable for boosting the market internationally.

Challenges

- Administrative delays in key markets: The delays caused by the regulatory frameworks create a major hurdle in the demineralized allografts market, hampering the product’s market entry. As evidence, in Japan, PMDA necessitates a year to 1.5 years for the DBM approvals, whereas it's only half a year in the U.S. However, to combat this, Stryker successfully fast-tracked approvals by aligning with the U.S. FDA’s 510 (k) pathway that reduced the launch timelines, thus skyrocketing the market’s demand across different countries.

- Lack of adequate awareness: This is yet another factor negatively impacting the overall growth of the market across different nations. In this regard, the NHC reported that in China, rural hospitals utilize demineralized bone matrix (DBM) in eligible cases owing to the lack of skilled professionals in this sector. However, Smith+Nephew addressed this challenge by effectively offering training to the majority of surgeons through the government-funded workshops, which created a huge growth opportunity for the overall market globally.

Demineralized Allografts Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 2 billion |

|

Regional Scope |

|

Demineralized Allografts Market Segmentation:

End user Segment Analysis

The hospitals segment in the demineralized allografts market is anticipated to garner the highest share of 45.8% by the end of 2035. The segment’s upliftment is highly attributed to its central role in conducting complicated inpatient surgeries that need DBM, including major joint reconstructions and spinal fusions. Hospitals possess the required facility, innovative operating rooms, and specialized surgical teams to effectively manage these procedures. Besides, suitable reimbursement policies for inpatient care under systems, such as Medicare in the U.S., readily consolidate the leading market share.

Application Segment Analysis

The spinal fusion segment in the market is expected to account for the second-highest share during the predicted period. The segment’s growth is fueled by its importance in sterilizing the spine by joining more than two vertebrae permanently to correct and diminish deformities. According to an article published by NLM in July 2024, the overall fusion success rate of bridging bone is 98.9% and fusion success is 97.9% within 2 years, while it is 98.5% and 98.1% within a year. Besides, there has been a yearly increase in lumbar spinal fusion, which is 138%, particularly for patients aged more than 65 years, thus suitable for the segment’s growth.

Form Segment Analysis

The putty segment in the demineralized allografts market is predicted to cater to the third-highest share by the end of the forecast duration. The segment’s development is highly driven by its clinical versatility and superior handling characteristics. In addition, its moldable consistency permits surgeons to effectively contour the graft, with the objective of lifting irregular and complex bone defects, thus ensuring optimal contact with the host bone, which is crucial for osteogenesis promotion. Therefore, this ease-of-use, which is combined with suitable retention at the surgical site, makes it preferable for requiring applications, such as craniomaxillofacial surgery as well as spinal fusion.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Application |

|

|

Form |

|

|

Type |

|

|

Delivery Mode |

|

|

Anatomy |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Demineralized Allografts Market - Regional Analysis

North America Market Insights

North America market is projected to account for the largest share of 48.4% by the end of 2035. The market’s upliftment in the region is fueled by its advanced healthcare infrastructure and favorable reimbursement policies. The U.S. FDA’s 2023 data showcased that the adoption of gamma-irradiated DBM products represented the majority of the market in the region. The landscape also benefits from established tissue bank networks with AATB-accredited facilities, ensuring a stable supply. Furthermore, the products combined with DBM and stem cells are gaining traction, thereby suitable for boosting the overall market.

The U.S. dominates the North America’s demineralized allografts market owing to the Medicare’s 2024 ambulatory surgical center coverage expansion as per the CMS report. According to an article published by NLM in January 2025, 18,577,953 trauma and orthopaedic surgery procedures have been performed in the country. Besides, the orthopaedic impact sector in the country is valued at USD 43.1 billion as of 2022, which is further projected to surge to USD 64.2 billion by the end of 2030. Furthermore, Medicaid granted generous funding to underprivileged populations, thus denoting a standard market development.

Canada is portraying steady growth in the regional market, and the progress is effectively attributed to its federal and provincial healthcare investments. Exemplifying the same, Ontario’s Ministry of Health in June 2025 stated that it increased the spending, with an estimated USD 99,495,400 as of 2025 and USD 98,573,700 by the Ministry Administration Program. Besides, according to the October 2025 Government of Canada article, the prescription drug spending for public drug plans increased by 7.4% between 2022 and 2023, amounting to USD 14.1 billion, thus reinforcing the country’s dependence in this sector.

Ministry Program Investments in Canada (2025)

|

Program Name |

2024-2025 Estimate (USD) |

2025-2026 Estimated (USD) |

Differentiation |

Actual 2023-2024 Estimate (USD) |

|

Health Policy and Research Program |

1,279,028,300 |

1,557,266,800 |

278,238,500 |

1,219,980,815 |

|

Ontario Health Insurance Program |

29,091,138,700 |

28,513,471,200 |

577,667,500 |

25,856,609,076 |

|

Population and Public Health Program |

1,533,815,200 |

1,694,654,600 |

160,839,400 |

1,780,023,052 |

|

Provincial Programs and Stewardship |

4,329,506,000 |

2,925,650,200 |

1,403,855,800 |

2,918,619,907 |

|

Health Services and Programs |

37,654,655,200 |

40,437,136,700 |

2,782,481,500 |

37,934,616,447 |

Source: Ontario

APAC Market Insights

Asia Pacific is likely to emerge as the fastest-growing region in the demineralized allografts market during the projected period. The aging populations, rising trauma cases, and government-backed healthcare modernization are collectively fueling the region’s accelerated upliftment in this sector. China leads the market, followed by Japan, which assigned the majority of its healthcare budget towards allografts. Besides, the countries South Korea and Malaysia are emphasizing tax incentives and domestic production mandates to reduce import reliance, highlighting the region’s position in the global landscape.

China is augmenting its dominance in the regional market with its massive government investments and domestic production capabilities. According to an article published by Frost & Sullivan in September 2023, the aging population in the country is rapidly increasing at a 5.9% growth rate, and people more than 65 years of age accounted for 209.8 million as of 2022. In addition, the overall population is expected to reach 243.3 million by the end of 2026, along with 273.2 million by the end of 2030, denoting a 3.8% and 2.9% growth rate, thus suitable for uplifting the market’s demand.

Historical Growth in China’s Aging Population

|

Years |

Population Growth (million) |

|

2018 |

166.6 |

|

2019 |

176.0 |

|

2020 |

190.6 |

|

2021 |

200.6 |

|

2022 |

209.8 |

|

2023 |

218.7 |

|

2024 |

227.2 |

|

2025 |

235.4 |

|

2026 |

243.3 |

|

2027 |

251.0 |

|

2028 |

258.6 |

|

2029 |

265.9 |

|

2030 |

273.2 |

Source: Frost & Sullivan

India is also gaining increased traction in the demineralized allografts market owing to its substantial government funding and rising procedural volumes. As per a data report published by the PIB in August 2024, the country’s bio-economy has increased by 13 times over the past 10 years, from USD 10 billion as of 2014 to more than USD 130 billion in 2024. This is further projected to increase to USD 300 billion by the end of 2030. Besides, according to the October 2024 NLM article, the country’s National Health Policy (NHP) has positively impacted the public health spending, with an increase from 0.9% to 1.6% of the domestic GDP as of 2022, thus suitable for bolstering the overall market.

Europe Market Insights

Europe in the demineralized allografts market is expanding at a rapid pace to capture steady growth during the forecast timeline. This is backed by rising aging populations and advanced orthopedic care. EMA states that the adoption of demineralized bone matrix in spinal fusion and dental grafts is positioning Germany and France at the forefront of the region’s development in this sector. On the other hand, the region’s Health Data Space initiative made a generous investment in biologics R&D, including hybrid allografts, to spur innovation, thus creating a prolific market opportunity.

Germany is reinforcing its position as the dominant player in the regional market, fueled by the strong consumer base and shift towards outpatient care. The country witnesses an expansion of orthopedic interventions with the Federal Joint Committee reporting yearly bone graft procedures, primarily spinal fusion and knee revisions. According to an article published by NLM in August 2023, a survey-based clinical study was conducted on 198 people in the country’s university hospital. This resulted in the utilization of alloplastic devices by 61% of the participants, 41% to 45% agreed with xenografts, and 87% agreed with the artificial material adoption.

France market is vigorously progressing as a result of regulated market access and cost optimization initiatives. Besides, in 2024, HAS reported that its pricing framework-imposed price reductions in terms of imported allografts, which also offers standard reimbursement rates for in-country produced DBM. On the other hand, the November 2024 Monaco Life article denoted that the success rate of dental implants in the country is 97%, thus denoting a growing focus of France on effective healthcare.

Key Demineralized Allografts Market Players:

- Medtronic plc (Ireland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation (U.S.)

- Zimmer Biomet Holdings, Inc. (U.S.)

- MTF Biologics (U.S.)

- AlloSource (U.S.)

- RTI Surgical, Inc. (U.S.)

- Baxter International Inc. (U.S.)

- Nuvasive, Inc. (U.S.)

- Integra LifeSciences Holdings Corporation (U.S.)

- Smith & Nephew plc (U.K.)

- Arthrex, Inc. (U.S.)

- Lattice Biologics Ltd. (U.S.)

- Aziyo Biologics, Inc. (U.S.)

- LifeNet Health (U.S.)

- J-TEC (Japan Tissue Engineering Co., Ltd.) (Japan)

- Osiris Corporation (a part of Smith & Nephew) (U.S.)

- Orthofix Medical Inc. (U.S.)

- Cook Medical Inc. (U.S.)

- Seikagaku Corporation (Japan)

- B. Braun Melsungen AG (Germany)

- Medtronic plc is one of the international leaders in the medical device industry, providing a wide-ranging portfolio of demineralized bone matrices, initially through its biologic and spine division. Its effective market contribution originates from integrated solutions and an extended distribution network. Besides, as per its 2024 annual report, the company spent USD 2.7 billion in research and development, serving more than 79 million patients, and over 150 operations in countries.

- Stryker Corporation is considered the dominating force in the orthobiologics market, with a strong portfolio of DBM products under brands such as Magnifuse and Allograft Bio-Matrix. The organization readily strengthens its market position through tactical acquisitions of biologic firms and increased focus on advanced and surgeon-based formulations for joint, trauma, and spine reconstruction.

- Zimmer Biomet Holdings, Inc. is one of the notable key players with a robust presence in the DBM market, providing products, such as Grafton Demineralized Bone Matrix. The organization has leveraged its wide-ranging footprint in orthopedics to offer combined bone grafting solutions that are often utilized for spine implants and joint replacement. According to its 2024 annual report, published in February 2025, its sales in the U.S. amounted to USD 4,439 and USD 3,240 internationally. Besides, in terms of knees, the sales were USD 3,174, USD 1,999 for hips, USD 1,866 for S.E.T., and USD 640 for other products.

- MTF Biologics is the world’s largest non-profit tissue bank, along with being a critical supplier of high-quality donor tissue by offering foundational raw materials for different DBM products in the market. Its effective contribution is crucial to the overall supply chain, deliberately serving both as a key partner and direct DBM distributor.

- AlloSource is one of the leading non-profit providers of DBM and cellular allografts, readily distributing a wide array of products, such as AlloWrap and AlloFuse. The company plays an essential role in advancing the field through its effective investment in ensuring allograft research and its standard commitment to supply high-volume grafts for different surgical applications.

Here is a list of key players operating in the global market:

The global demineralized allografts market is extremely consolidated, with Zimmer Biomet, Stryker, and Medtronic controlling the maximum revenue share. The U.S.-based pioneers are dominating this market with vertically integrated tissue banks and hybrid product innovation. Meanwhile, the Europe-based players, such as Smith+Nephew, focus on cost-optimized DBM strips for ambulatory surgical centers. Furthermore, in July 2024, Dentsply Sirona introduced the newly enhanced Symbios Allograft mineralized and demineralized line of regenerative solutions. This has been designed for a comprehensive range of dental implant and surgical needs, which assist in promoting bone formation, stability, and volume for long-lasting results, which is suitable for bolstering the market.

Corporate Landscape of the market:

Recent Developments

- In October 2025, Spineheart and BIOBank announced their tactical partnership for spine surgery in Switzerland as well as in France, wherein Spineheart will promote BIOBank’s portfolio, with increased focus on BIOBank Synergy.

- In October 2025, Tonix Pharmaceuticals Holding Corp. declared that the first patient has been successfully dosed with arginine-vasopressin deficiency (AVP-D), which is a rare endocrine disorder associated with oxytocin deficiency and adverse mental health results.

- In August 2024, LifeNet Health notified the U.S. launch of PliaFX Pal, which is considered a versatile bone allograft created in collaboration with Johnson & Johnson MedTech. It readily combines mineralized bone chips with moldable demineralized fibers and allows surgeons to cater to defects and voids in trauma procedures and orthopedic spine.

- Report ID: 7874

- Published Date: Nov 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Demineralized Allografts Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.