Cutaneous Radiation Injury Treatment Market Outlook:

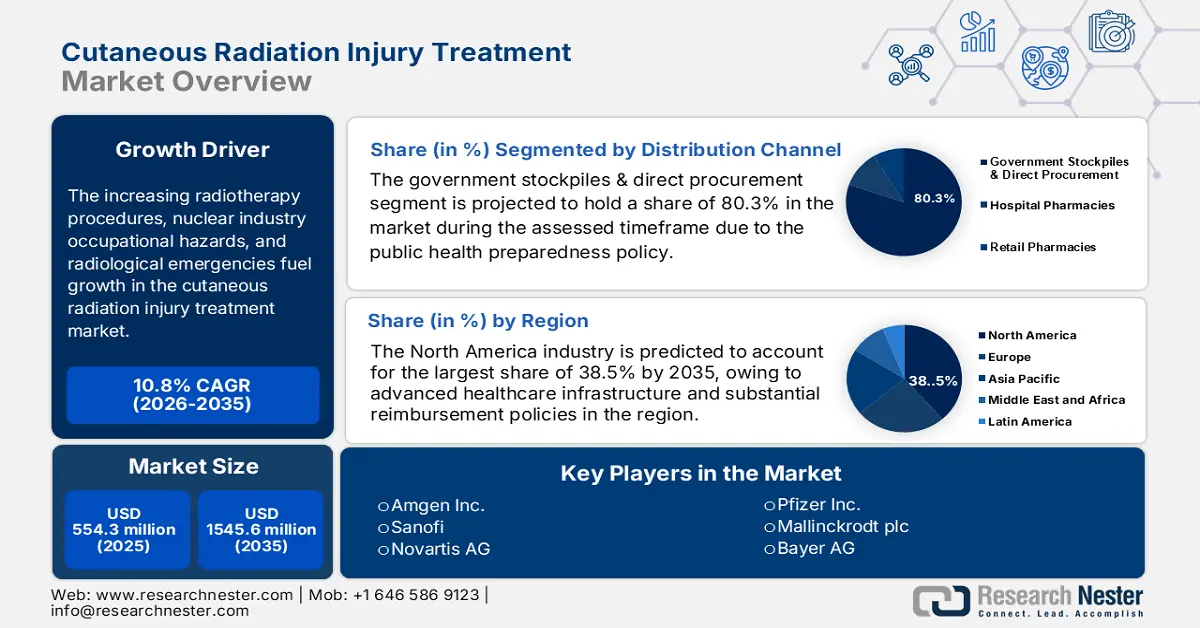

Cutaneous Radiation Injury Treatment Market size was valued at USD 554.3 million in 2025 and is projected to reach USD 1545.6 million by the end of 2035, rising at a CAGR of 10.8% during the forecast period 2026 to 2035. In 2026, the industry size of cutaneous radiation injury treatment is assessed at USD 614.1 million.

The increasing radiotherapy procedures, nuclear industry occupational hazards, and radiological emergencies create a reliable consumer base for the market. In this context, the NLM study in June 2022 stated that about 90% to 95% of patients undergo radiotherapy, out of which 85% experience moderate to severe radiation dermatitis. In addition, the World Nuclear News in September 2025 states that there are over 417 nuclear reactors across all nations, which further increases occupational exposure risks.

Federal investment in research, development, and deployment (RDD) is fueled by the NIH, HHS, and BARDA. NIST in October 2024 has granted USD 1.5 million for regenerative medicine standards-related workforce development. Additionally, trade dynamics are dominated by high import dependency for APIs and critical starting materials, which is exposed in FDA drug shortage reports. For example, to counter this, U.S. government contracts typically include Buy American provisions or finance on-shoring projects for key drug production in order to insure the supply chain against global trade interruptions.

Key Cutaneous Radiation Injury Treatment Market Insights Summary:

Regional Highlights:

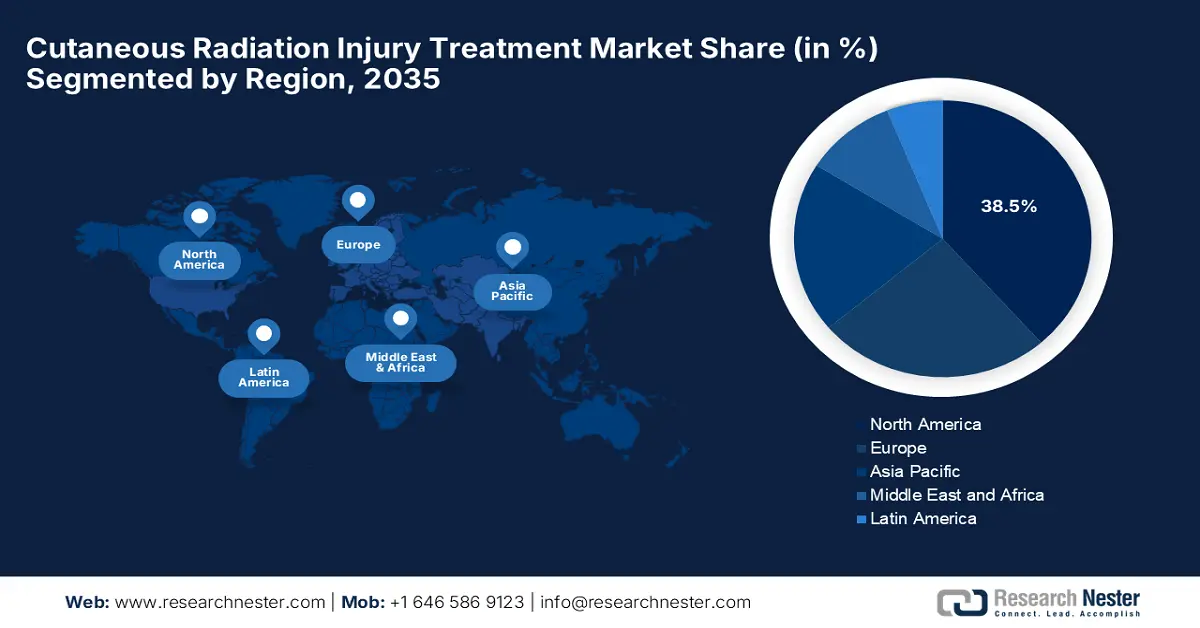

- By 2035, North America is projected to secure a 38.5% share of the Cutaneous Radiation Injury Treatment Market, attributed to advanced healthcare infrastructure and substantial reimbursement policies.

- The Asia Pacific region is set to grow at a 6.5% CAGR from 2026–2035, propelled by rising radiotherapy adoption, nuclear energy expansion, and government-backed programs.

Segment Insights:

- By 2035, the Government stockpiles & direct procurement segment is expected to capture 80.3% share of the Cutaneous Radiation Injury Treatment Market, underpinned by public health preparedness policy.

- The Pharmaceuticals segment is projected to command the largest share by 2035, bolstered by the critical role of specialized drugs addressing complex radiation pathophysiology.

Key Growth Trends:

- Value-based care and financial benefits

- Patient pool and disease prevalence

Major Challenges:

- Price caps and reimbursement barriers

- Robust regulatory pathways

Key Players: Amgen Inc., Sanofi, Novartis AG, Pfizer Inc., Mallinckrodt plc, Bayer AG, Mylan N.V. (part of Viatris), Teva Pharmaceutical Industries Ltd., Rakuten Medical, Inc., Humanigen, Inc., Partner Therapeutics, Inc., Shield Therapeutics PLC, Celltrion Inc., Daiichi Sankyo Company, Limited, CSL Limited, Sun Pharmaceutical Industries Ltd., Lupin Limited, Hikma Pharmaceuticals PLC, Biogen Inc., Duopharma Biotech Berhad.

Global Cutaneous Radiation Injury Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 554.3 million

- 2026 Market Size: USD 614.1 million

- Projected Market Size: USD 1545.6 million by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 15 October, 2025

Cutaneous Radiation Injury Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Value-based care and financial benefits: The validations gained through numerous clinical studies have readily fostered growth in the cutaneous radiation injury treatment market. In this context, the study by AHRQ in 2022 found that early intervention with CRI significantly reduced hospitalizations thereby saves U.S. healthcare expenditure in a span of two years. Besides the Germany’s Institute for Quality and Efficiency in Healthcare also recommends topical growth factor therapies as cost-effective solutions for moderate CRI cases, thus suitable for standard market development.

- Patient pool and disease prevalence: Increased cancer incidence is one of the drivers that require the treatment of cutaneous radiation injury. According to the NLM research in August 2023, 7 million patients receive radiotherapy globally and the majority of them have skin injury. Higher cancer survivorship and increased application of radiation therapy are the drivers of the larger patient pool. Prophylactic and therapeutic demand in North America is propelled by exposure-related accidents and scheduled medical procedures. Growing awareness among clinicians and patients regarding early treatment to prevent severe skin necrosis further fuels market uptake, ensuring that hospitals and burn centers remain primary end users.

- Strategic public-private alliances: Firms are increasingly making use of alliances with government institutions for sharing the cost and risk of development. One good example is the alliance between the BARDA and Partner Therapeutics to ensure the availability of Leukine (sargramostim) for the Strategic National Stockpile. These collaborations are one major strategy utilized by manufacturers for coping with the high-risk, high-cost development setting and accessing markets in case of successful product approval.

Summary of Clinical Trials on Cutaneous Radiation Injury Treatment

|

Trial ID |

Intervention/Treatment |

Condition |

Patient Population |

Status (as of 2025) |

|

NCT04995328 |

"Radiation Care" gel application |

Radiation-induced skin injury |

Breast cancer & head and neck cancer patients |

Active, recruiting |

|

- |

TP508 (Thrombin Peptide) |

Mitigation of radiodermatitis |

Radiation exposure patients |

Preclinical/early clinical |

|

- |

Granexin gel (aCT1 peptide) |

Radiation dermatitis treatment |

Patients with radiation dermatitis |

Late-stage human trials |

|

- |

Nor Leu 3-A (Angiotensin analog) |

Radiation-induced skin healing |

Severe radiation injury patients |

Preclinical/early clinical |

Source: Clinical Trials September 2023, NLM January 2022

Challenges

- Price caps and reimbursement barriers: This aspect demonstrates a major issue in the market, delaying the manufacturer's profitability. In this regard, strict price ceilings imposed by Germany’s AMNOG system hinder players' interest in investing in this sector. However, in 2023, Smith & Nephew addressed this by collaborating with France’s HAS, thereby securing a broader market access for its PICO 7 dressing. Furthermore, cutaneous radiation injury treatments are completely reimbursed under the U.S. Medicare system owing to its exacerbated costs.

- Robust regulatory pathways: The manufacturers have to deal with the Animal Rule problem in which human efficacy studies are unacceptable. The U.S. FDA demands strong data from animal models for approval, a cumbersome and expensive process. Neupogen approval for Acute Radiation Syndrome, for instance, involved large-scale studies coordinated by the National Institute of Allergy and Infectious Diseases (NIAID). This route requires a huge initial investment without a certain return on the commercial side, setting a high entry barrier for any but the most highly capitalized firms.

Cutaneous Radiation Injury Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 554.3 million |

|

Forecast Year Market Size (2035) |

USD 1545.6 million |

|

Regional Scope |

|

Cutaneous Radiation Injury Treatment Market Segmentation:

Distribution Channel Segment Analysis

Government stockpiles & direct procurement is dominating the segment and is poised to hold the share value of 80.3% by 2035. The segment is driven by the public health preparedness policy, not commercial demand. As per the Health Information and Quality Authority report in November 2023, all the countries are actively managing their stockpiles as they are rotating their stocks and maintaining the waste below 0.5% of the total stockpile products to avoid wastages. This strategy makes the market almost entirely dependent on federal budgeting and procurement cycles, bypassing traditional commercial distribution.

Product Segment Analysis

The pharmaceuticals lead the product segment and is expected to hold the largest share by 2035. The segment is driven due to the critical role of specialized drugs that address the complex pathophysiology of radiation damage. The pharma industry is rising rapidly and the Department of Pharmaceuticals report in September 2024 states that India Pharmaceutical Industry is the 3rd largest industry in the world accounting 10% of global production volume. This robust manufacturing base expands the R&D ecosystem position India to research, produce and supply advanced formulations for cutaneous radiation injury management globally.

Route of Administration Segment Analysis

The parenteral or injectables dominate the segment and has the biggest share in the segment. This is because of the necessity of immediate systemic action in a mass casualty situation. Therapies for the most urgent components of radiation injury, including hematopoietic syndrome and internal contamination, need intravenous or subcutaneous administration for effectiveness and quick recovery. The National Institutes of Health emphasizes that important countermeasures such as cytokines, antibiotics, and certain decorporation agents are designed to be injected to facilitate immediate bioavailability, and therefore, this is the critical route of administration for first-line emergency care.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Product |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

End user |

|

|

Radiation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cutaneous Radiation Injury Treatment Market - Regional Analysis

North America Market Insights

North America is dominating the market and is projected to capture the largest share of 38.5% by 2035. The region benefits from an advanced healthcare infrastructure and substantial reimbursement policies. According to the U.S. Department of Health & Human Services, agencies like the Biomedical Advanced Research and Development Authority provide a significant funding for the development and procurement of medical countermeasures, including treatments for radiation exposure. Furthermore, telemedicine adoption is anticipated to grow post-radiation follow-ups, thereby denoting a positive market outlook.

The U.S. is the dominating player in the market, highly fueled by the military and oncology demand. As per the NLM study in March 2022, almost 650,000 cancer patients in the U.S. undergo radiotherapy and they experience skin injuries and need to undertake cutaneous radiation injury treatment. Various researches on stem cell therapies and hydrogel system are conducted to cure the skin injuries related to radiation. The presence of key market players and their innovative strategies positions the U.S. as the global hotspot in this field.

Canada represents exceptional growth in the cutaneous radiation injury treatment market, owing to the federal and provincial allocations. Testifying this the CMA report in October 2022 stated that Canada spends more than USD 300 million on healthcare, including emergency preparedness and radiation incident management. Besides Public Health Agency of Canada prioritizes stockpiling silver dressings, whereas Alberta’s tele-radiotherapy program cuts rural disparities, providing a prolific market opportunity. These coordinated federal and provincial initiatives are surging nationwide adoption of advanced cutaneous radiation injury treatments, solidifying Canada’s position as a key growth market.

APAC Market Insights

Asia Pacific market is likely to exhibit the fastest growth at a CAGR of 6.5% from 2026 to 2035. The growing radiotherapy adoption, nuclear energy expansion, and government-backed programs are key factors propelling this progress. Governments across this region are proactively contributing to this expansion with a collective goal to enhance healthcare services and encourage innovation. Besides KIRAM's advances in stem cell therapies on the other hand Malaysia’s Nuclear Agency focuses on emergency response training, thus suitable for standard market growth.

China is augmenting its dominant position in the cutaneous radiation injury treatment market, grabbing a significant regional share on account of government-backed R&D and radiotherapy demand. As evidence, the Royal Society of Chemistry study published in December 2023 states that hydrogel based treatment on wound has achieved an exception efficiency in minimizing the growth of bacteria by 99%. Besides, the country is a manufacturing hub of APIs, effectively supported by the production of topical agents and biologics. Furthermore, the Healthy China 2030 initiative prioritizes nuclear emergency preparedness for CRI dressings and systemic therapies.

India is propagating in the regional cutaneous radiation injury treatment market, effectively driven by generic drug production and expanding radiotherapy access. In this regard, the PRS Legislative Research for 2025 to 2026 has stated that the Rs 99,859 crore was allocated by the Ministry for healthcare budget, which is expected to rise by 11% in the next year. Besides the CDSCO-EMA collaboration in 2024, has accelerated the approvals for CRI generics, benefiting million patients. The National Cancer Grid aims to bridge this by doubling CRI treatment centers. In addition, Mylan NV reduced prices by emphasizing domestic API manufacturing and reinforcing the country’s position in the worldwide landscape.

Europe Market Insights

Europe is expected to retain its position as the second-largest stakeholder in the global market owing to the rising demand for radiotherapy, nuclear safety protocols, and nationwide healthcare initiatives. The funding grants also contribute to standard development with the EU’s Health Data Space investing in cutaneous radiation injury research & development, as stated by EC 2024 data. Also, the EMA fast-tracked CRI therapies in 2024, thus attracting both national and international players to invest in this sector.

Germany leads the Europe’s market with significant revenue share, mainly driven by substantial healthcare spending and a vast patient base. The Federal Ministry of Health and the Robert Koch Institute are key bodies responsible for stockpiling and response planning. Besides the Destatis report in April 2022 depicts that there is a rise of 81% in skin cancer due to high radiation. Furthermore, the domestic players, such as Siemens Healthineers, lead in terms of innovation with IoT-enabled CRI monitors.

The U.K. is demonstrating strong growth in the regional cutaneous radiation injury treatment market. Market demand is defined by the maintenance of the UK's national stockpile of medical countermeasures. According to a UK government review of health emergency preparedness, funding for these capabilities has been prioritized, with a significant portion of the dedicated health security budget allocated to procuring and replenishing CRI treatments to ensure national resilience. Therefore, all of these factors appreciably amplify financial outputs from this sector.

Key Cutaneous Radiation Injury Treatment Market Players:

- Amgen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi

- Novartis AG

- Pfizer Inc.

- Mallinckrodt plc

- Bayer AG

- Mylan N.V. (part of Viatris)

- Teva Pharmaceutical Industries Ltd.

- Rakuten Medical, Inc.

- Humanigen, Inc.

- Partner Therapeutics, Inc.

- Shield Therapeutics PLC

- Celltrion Inc.

- Daiichi Sankyo Company, Limited

- CSL Limited

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Hikma Pharmaceuticals PLC

- Biogen Inc.

- Duopharma Biotech Berhad

The cutaneous radiation injury treatment market is extensively concentrated, with the leading pioneers, 3M, Smith & Nephew, Amgen, Mölnlycke, and ConvaTec controlling the maximum revenue share. These players undertake numerous strategies to secure their market positions, such as production differentiation emphasized by 3M, Smith & Nephew with the FDA and CE-approved dressings. In addition, the biologic expansion is at a boom with Amgen’s Kineret targeting severe CRI to gain more sales by the end of 2026. Furthermore, the emerging firms such as PolyNovo and Toray are readily investing in nanotech dressings for radiation burns.

Top players in this landscape are listed below:

Recent Developments

- In October 2025, Soligenix, Inc. has announced its achievement on the important safety milestone in its confirmatory Phase 3 Clinical Trial of HyBryte for the treatment of cutaneous T-Cell Lymphoma.

- In August 2025, IAEA has launched a stem cell project which is used to enhance the healing for patients suffering from radiation damage in their skin that is more painful and the healing process is too long.

- Report ID: 4154

- Published Date: Oct 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cutaneous Radiation Injury Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.