Coumarin Market Outlook:

Coumarin Market size is valued at USD 129.1 billion in 2025 and is projected to reach USD 251.6 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of coumarin is estimated at USD 139 billion.

The international market is growing at a fast pace due to a combination of related supply-side and demand-side factors throughout the healthcare sector. Increased application of coumarin within the pharmaceutical sector, particularly as an active ingredient of anticoagulants and anti-inflammatory drugs, is driving demand across geographies such as North America, Europe, and the Asia Pacific. According to the U.S. Bureau of Labor Statistics report published inAugust 2025, U.S. import prices increased 0.4% in July after declining 0.1% in June. U.S. export prices increased 0.1% in July, after increasing 0.5% in June. Import prices declined 0.2% and export prices increased 2.2% during the past year. These minor adjustments indicate tough input costs for drug precursors, such as possibly coumarin, maintaining consistent supply and prices for healthcare manufacturers, absence of specific price indices for coumarin.

The market is influenced by the increasing number of patients in need of anti-inflammatory and anticoagulant therapies, which heavily rely on coumarin derivatives. The expanding prevalence of cardiovascular disease and long-term inflammatory disorders globally is driving the demand for efficient coumarin drugs. There is significant research and development (R&D) investment made in improving the efficacy and safety profile of coumarin drugs since pharmaceutical companies engage with academia to identify new drug therapies. This persistent R&D effort is supplemented by increasing healthcare spending and supportive regulatory structures, facilitating quicker clinical trials and market entry, thereby accelerating the adoption of coumarin in therapeutic use.

Key Coumarin Market Insights Summary:

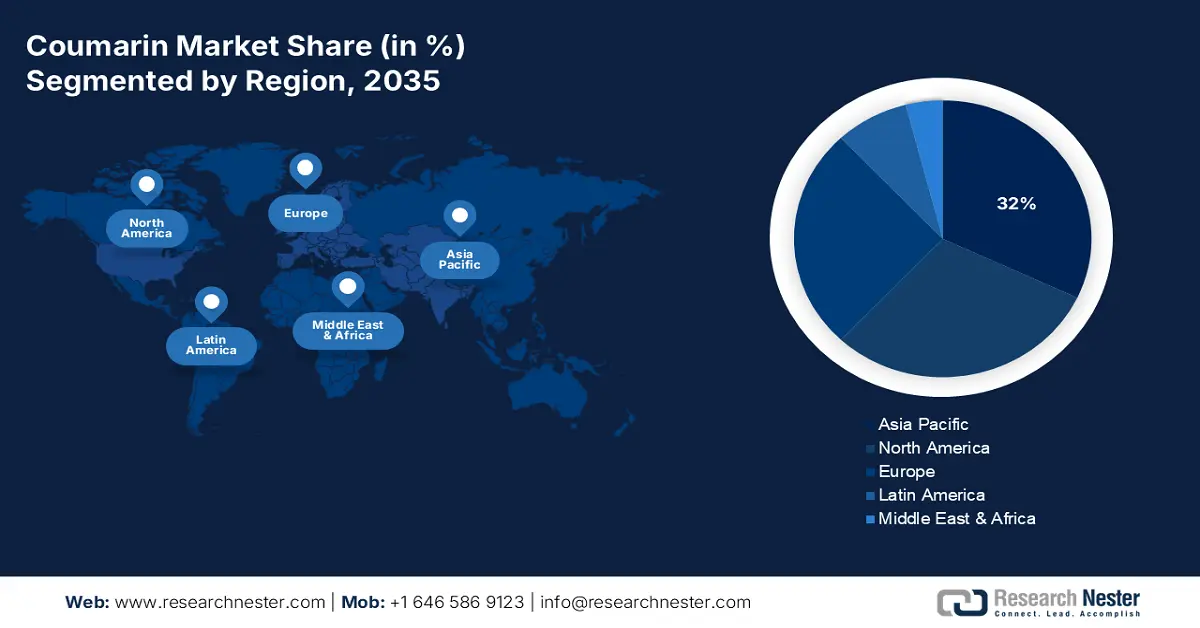

Regional Highlights:

- The Asia Pacific coumarin market is projected to hold the highest share 32% by 2035, driven by increasing pharmaceutical and cosmetic demand.

- The European is expected to be the fastest-growing region by 2035, impelled by strict regulations and rising demand for high-purity and eco-friendly products.

Segment Insights:

- Direct sales sub-segment is projected coumarin market to account for 46% share by 2035, propelled by strong connections between manufacturers and large industrial clients.

- Synthetic coumarins sub-segment is expected to hold the largest share by 2035, owing to their assured quality and scalable production.

Key Growth Trends:

- Enhanced safety regulations driving quality compliance

- Rising demand for natural product-based anticancer agents

Major Challenges:

- Regulatory complexity across jurisdictions

- Toxicological and public health concerns

Key Players: Givaudan S.A., Symrise AG, Firmenich International SA, International Flavors & Fragrances Inc. (IFF), Robertet Group, Sensient Technologies Corporation, Frutarom Industries Ltd., Kraton Polymers LLC, Privi Organics Ltd., Aarti Industries Ltd., Atul Ltd., Deepak Nitrite Ltd., Pidilite Industries Ltd., Globus Spirits Ltd., Sula Vineyards Ltd.

Global Coumarin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 129.1 billion

- 2026 Market Size: USD 139 billion

- Projected Market Size: USD 251.6 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 22 September, 2025

Coumarin Market - Growth Drivers and Challenges

Growth Drivers

- Enhanced safety regulations driving quality compliance: Increasing regulatory pressure is pushing pharmaceutical companies to improve quality compliance, especially for drugs such as coumarin derivatives that need strict safety and efficacy standards. Besides, based on the State of Pharmaceutical Quality, the agency is strengthening surveillance and compliance through more inspections, enforcement actions, and advanced oversight tools. This regulatory demand requires manufacturers to invest in better quality manufacturing processes and documentation, making improved quality compliance a key growth driver for the market in the future.

- Rising demand for natural product-based anticancer agents: Growing regulatory emphasis on dermal exposure to carcinogens is a key growth driver in the coumarin market. As pharmaceutical companies focus more on natural drugs, coumarins are promising structures in cancer drug discovery. As per a report published by the NIH in October 2023, 80% of approved anticancer drugs come from natural sources. Coumarins and their derivatives have many health benefits, including anti-inflammatory, antibacterial, antiviral, antioxidant, antithrombotic, anti-Alzheimer, and anticancer properties.

- Increasing consumer and regulatory scrutiny of dermal exposure: Increasing regulatory emphasis on dermal exposure to carcinogens drives the growth of the coumarin market. The regulators, such as the U.S. FDA, are gearing their initiatives toward reducing consumer exposure to dangerous chemicals that come under topical product formulations. In 2024, the FDA began applying standardized tests to identify asbestos in talc-based cosmetics, asbestos being a known carcinogen, essentially focusing on reducing the cancer risk posed by dermal exposure. With this regulatory pressure, manufacturers are now forced to give stronger emphasis on safety features and simplify their product formulations, which encourages an investment in forensic testing technologies for compliance.

Export and Import of Chemical Analysis Instruments for the Coumarin Market

Export and Import Values of Chemical Analysis Instruments (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

U.S. |

11.5 billion |

7.8 billion |

|

Germany |

8.6 billion |

4.7 billion |

|

China |

4.1 billion |

8.1 billion |

|

Japan |

5.6 billion |

1.7 billion |

|

Singapore |

4.0 billion |

2 billion |

|

UK |

2.6 billion |

1.9 billion |

|

Netherlands |

1.7 billion |

2.1 billion |

Source: OEC, August 2025

Healthcare spending of the countries per capita

Healthcare Spending Per Capita (2024)

|

Country |

Healthcare Costs per Capita |

|

U.S. |

USD 12,742 |

|

Switzerland |

USD 9,044 |

|

Germany |

USD 8,541 |

|

Netherlands |

USD 7,277 |

|

Sweden |

USD 7,009 |

|

Belgium |

USD 6,994 |

|

France |

USD 6,924 |

|

Average |

USD 6,850 |

|

Canada |

USD 6,845 |

|

Australia |

USD 6,807 |

|

Ireland |

USD 6,730 |

|

UK |

USD 5,867 |

|

Japan |

USD 5,424 |

|

Italy |

USD 4,736 |

Source: PGPF August 2024

Challenges

- Regulatory complexity across jurisdictions: Coumarin regulation varies significantly across regions, and manufacturers and exporters face a complex compliance environment. As a result, coumarin is often banned for human consumption in food-grade products in some places but allowed as a controlled substance in limited product categories in others. Navigating these differences requires constant reformulation, dual compliance strategies, and local testing, especially for companies exporting to markets with stricter cosmetic and food safety rules. This fragmentation reduces scale and slows down the time-to-market for coumarin-containing products.

- Toxicological and public health concerns: Despite its use in many industrial applications, coumarin continues to be under scrutiny for potential liver toxicities and allergic reactions, chiefly from long-term exposure via the dietary or dermal route. Most regulatory agencies stay on the cautious side, often considering coumarin an outright prohibited or restricted substance. This perception limits its use in any new pharmaceutical and food products and consequently worsens the situation by forcing companies to invest large sums in toxicology studies and safe-use documentation, which limits innovation in the coumarin market.

Coumarin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 129.1 billion |

|

Forecast Year Market Size (2035) |

USD 251.6 billion |

|

Regional Scope |

|

Coumarin Market Segmentation:

Distribution Channel Segment Analysis

The direct sales sub-segment is expected to hold the highest market share of 46% in the distribution channel segment in the coumarin market within the forecast period due to strong connections between manufacturers and large industrial clients. Direct sales ensure more customization and bulk supply, catering to special client needs. Direct sales enable easier communication and quicker response times, which are most critical in industries such as pharmaceuticals and healthcare. According to a report by the Direct Selling Association in August 2024, the U.S. direct selling industry hit USD 36.7 billion in retail sales in 2023 with 37.7 million customers, which is a testament to the significance of direct sales to the economy.

Type Segment Analysis

The synthetic coumarins sub-segment is expected to hold the highest market share in the type segment in the coumarin market within the forecast period due to their assured quality and price compared to natural sources. Synthetic production allows for scalability to meet rising demand. Synthetic production allows for scalability to meet rising demand, allowing for a stable supply for different applications. In the pharmaceutical sector, synthetic coumarins are utilized as they possess anticoagulant and anti-inflammatory properties, which aid in the management of diseases such as thrombosis and cardiovascular disease.

Application Segment Analysis

The fragrance and cosmetics sub-segment is expected to hold the highest market share in the application segment in the coumarin market within the forecast period due to an increased demand for natural and synthetic fragrances from consumers. Additionally, its antimicrobial and anti-inflammatory actions are responsible for skincare cosmetics encouraging healthy skin as well as soothing dermatoses, therefore driving its application in cosmeceuticals. Additionally, formulations of coumarin are increasingly being applied in medicated ointments and creams to bring about the healing of eczema and irritations of the skin.

Our in-depth analysis of the coumarin market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Source |

|

|

Form |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Coumarin Market - Regional Analysis

Asia Pacific Market Insights

The coumarin market in the Asia Pacific is expected to hold the highest market share within the forecast period, with the highest growth rate of 32% owing to increasing pharmaceutical and cosmetic demand, supported by improved manufacturing facilities and increasing healthcare investments. Besides, throughout the previous decade, the contribution of public spending towards overall health expenditure increased amongst every income group within the Asia Pacific region. As per a report by OECD, November 2022, lower-middle and lower-income countries, on the other hand, had a lower growth of 41.4% compared to upper-middle of 62.5% and high-income countries of 74.1%. The difference shows the growth prospect of healthcare access and coumarin demand within developing Asia-Pacific nations during the projection period.

The coumarin market in China is expected to grow steadily within the forecast period due to supportive government policies towards the pharmaceutical and chemical industries, domestic consumption, and export trade. As per a report by NLM in March 2025, China's regulatory system has 8 main laws, 24 administrative regulations, and 11 judicial interpretations that pertain to pharma alone. Expanding the horizon to broader rules traces 92 regulations, 171 administrative rules, and 44 court interpretations, emphasizing China's rigorous control and commitment to quality coumarin-type drug products. The strict regulatory system ensures market stability and growth within the projection period.

The coumarin market in India is expected to grow steadily within the forecast period due to growing awareness of natural scented components and growing investment in the herbal medicine and traditional medicine industries. As per a report by the Government of India, April 2025, the pharmaceutical export market in India has witnessed high growth, from ₹1,80,555 crore (USD 22.0 billion) in 2020 to 2021 to an estimated ₹2,19,439 crore (USD 26.7 billion) in 2023 to 2024, driven by high overseas demand and increasing manufacturing capacities. This growth is also driven by government assistance to pharmaceutical exports and increased focus on quality standards and regulatory demands in the healthcare sector.

Europe Market Insights

The coumarin market in Europe is expected to be the fastest-growing market within the forecast period due to strict regulations propelling the demand for high-purity coumarin and green, eco-friendly cosmetic products. Moreover, investments in pharmaceutical research with coumarin-based anticoagulants and anti-inflammatory drugs are increasing their applications within healthcare. Growing consumers' demand for natural and clean-label personal care products also drives market growth, with mature supply chains and sophisticated production technologies in the top European nations.

The coumarin market in the UK is expected to grow steadily within the forecast period due to growing consumer demand for high-quality personal care products and high-grade R&D emphasis in the pharmaceutical sector. As per a report by The Health Foundation in March 2023, the advantages of higher levels of R&D reach far beyond health out into the economy and there are approximately 66,000 people employed in the pharma industry in the UK, of which about half are employed in direct R&D of pharmaceuticals. This robust R&D workforce drives coumarin formulation development for therapeutic application at a brisk rate. Government support for the life sciences and the innovation centers also sustains the UK as a leading market for advanced pharmaceutical intermediates such as coumarin.

The coumarin market in Germany is expected to grow steadily within the forecast period due to the country’s dominance in chemical manufacturing and significant investments in sustainable procurement and green chemistry. The established pharma sector and strong regulatory framework in Germany also ensure the application of high-purity coumarin in pharma. Furthermore, the cosmeceutical and personal care products for natural ingredients remain on the rise, and Germany plays an essential role in the European coumarin market. Increasingly, growth is also fueled by highly export-oriented economies within Germany, wherein coumarin-derived intermediates are increasingly and more into high-end specialty chemicals and pharma supply chains across Europe as well as from outside.

North America Market Insights

The coumarin market in North America is expected to grow steadily within the forecast period due to rigorous regulatory systems that ensure quality and safety, as well as growing demand in the pharmaceutical and fragrance industries. Consumer demand for natural and clean-label products is also propelling the utilization of coumarin in personal care products. Additionally, long-term R&D and capacity investments by major industry players drive innovation and growth in the region. Additionally, a close rapport among regulatory bodies and industry players enables quicker approvals on products and cultivates sustainable production processes in the market.

The coumarin market in the U.S. is expected to grow steadily within the forecast period due to growing applications in over-the-counter drugs and cosmetics, driven by strong consumer expenditure. As per a report by Research America, January 2022, U.S. expenditure on medical and healthcare R&D was USD 245.1 billion over the past 5 years. This level of investment is an inducement for coumarin drug formulation and drug-delivery system innovation. Moreover, market scale-up by high-quality pharmaceutical organizations and openness of regulation encourage commercial scale-up of APIs from coumarin.

The coumarin market in Canada is expected to grow steadily within the forecast period due to growing development in the sector of natural cosmetics and initiatives taken by the government to promote safer use of materials in consumer products. According to a report by World Health Systems Facts in August 2025, approximately 55% of Canada's public health expenditures are flowing into physician and hospital services. The other 45% is divided equally between other categories such as public health, drugs, and long-term care. This even distribution is evidence of an established system to accommodate new therapeutic as well as cosmetic ingredients such as coumarin. Further, Canada's focus on regulation of clean labeling and product safety is in alignment with increased consumer demand for plant-based, non-toxic products.

Health Spending by Type of Sponsor in America (2022 and 2023)

|

U.S. |

Canada |

|||

|

Sponsor Type |

Share of Total Spending |

2022 Growth Rate |

Components |

Amount/Rate |

|

Federal Government |

33% |

1.0% |

Overall Health Spending |

USD 344 billion |

|

Households |

28% |

6.9% |

Per Person Expenditure |

USD 8,740 |

|

Private Businesses |

18% |

6.0% |

GDP |

12% |

|

State and Local Governments |

15% |

6.5% |

Hospital Spending |

26% |

|

Other Private Revenues |

6% |

- |

Drugs and Physicians |

14% |

Source: CMS December 2023; 2025 Canada Medical Association

Key Coumarin Market Players:

- Givaudan S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Symrise AG

- Firmenich International SA

- International Flavors & Fragrances Inc. (IFF)

- Robertet Group

- Sensient Technologies Corporation

- Frutarom Industries Ltd.

- Kraton Polymers LLC

- Privi Organics Ltd.

- Aarti Industries Ltd.

- Atul Ltd.

- Deepak Nitrite Ltd.

- Pidilite Industries Ltd.

- Globus Spirits Ltd.

- Sula Vineyards Ltd.

The global coumarin market is driven by a diverse range of manufacturers. Market leaders such as Givaudan S.A. and Symrise AG derive their strength from extensive product portfolios and global distribution networks. The giants remain poised to adopt continuous innovation and strategic acquisitions in the execution of their product portfolio. Japan-based companies such as Takasago International Corporation and Takeda Pharmaceutical company focus on research and development to produce novel coumarin derivatives to serve as pharmaceutical and healthcare products. This closure of competitive forces is the engine driving growth and innovation in the market.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2024, BASF Aroma Ingredients launched L-Menthol FCC rPCF, its first aroma product with a 10% to15% reduced carbon footprint. Certified by TÜV Rheinland, BASF plans to expand its sustainable rPCF portfolio to help customers meet Scope 3 carbon targets.

- In August 2022, Biosynth Carbosynth diversified into enzymes, over 70 industrial enzymes from Eucodis Bioscience of Austria, serving the pharmaceutical, food, cosmetic, and bioremediation fields. The range includes lipases, peroxidases, and others, available in free and immobilized forms.

- In June 2025, Ono Pharmaceutical Co., Ltd., along with Bristol-Myers Squibb K.K., received the approval of Ono’s anti-PD-1 antibody, Opdivo Intravenous Infusion, as well as BMSKK’s anti-CTLA-4 antibody, Yervoy Injection, in Japan, to aid unresectable hepatocellular carcinoma (HCC).

- Report ID: 5393

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Coumarin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.