CNC Machine Market Outlook:

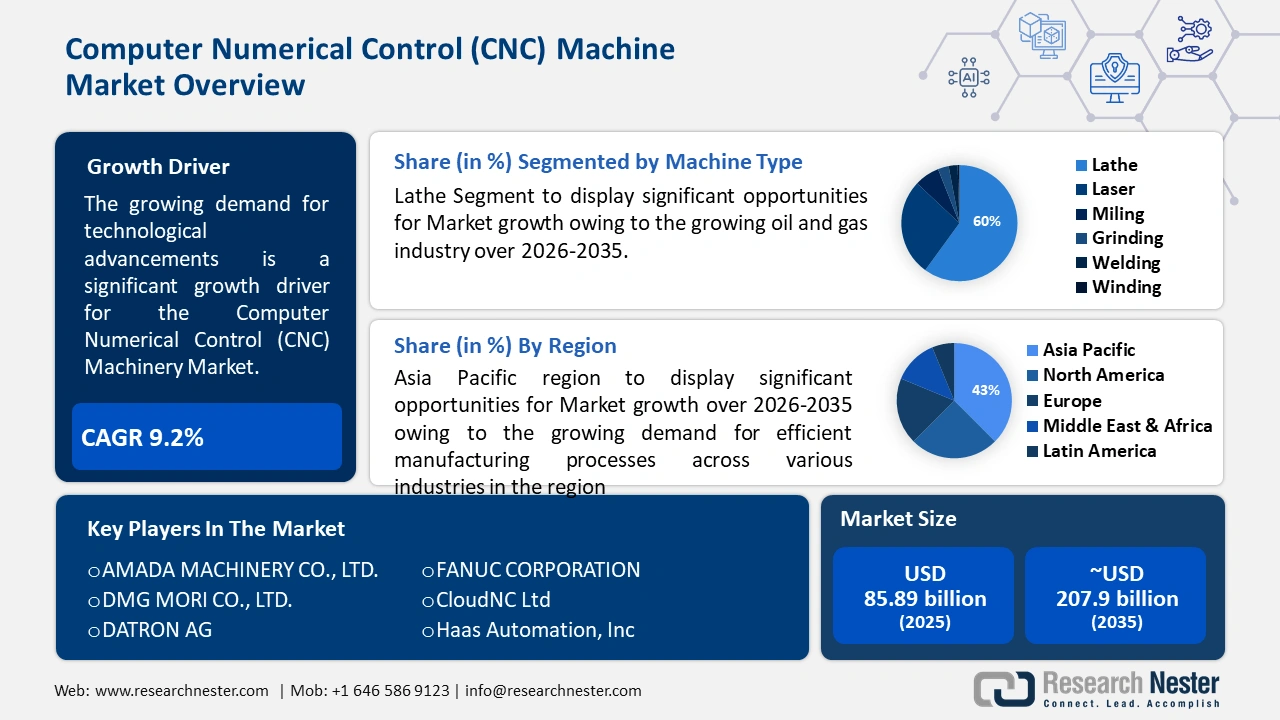

CNC Machine Market size was valued at USD 85.89 billion in 2025 and is set to exceed USD 207.09 billion by 2035, expanding at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of CNC machine is estimated at USD 93 billion.

The reason behind this growth is impelled by technological advancements as these machines are expected to be more sophisticated along with incorporating features such as multi-axis capabilities and the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technology. According to the Comp TIA IT Industry, about 22% of worldwide firms are aggressively pursuing the integration of Artificial Integration, while more than 33% of the firms are promoting the implementation of AI.

Furthermore, the growing demand for automation is increasing productivity as over 90% of businesses report a surge in automation demand, as it provides cutting expenses and satisfying the growing demand for complicated products, and manufacturers, and it also progressively implements automation technologies. These CNC machines are pretty accurate and do provide dependable production procedures.

Key Computer Numerical Control Machine Market Insights Summary:

Regional Highlights:

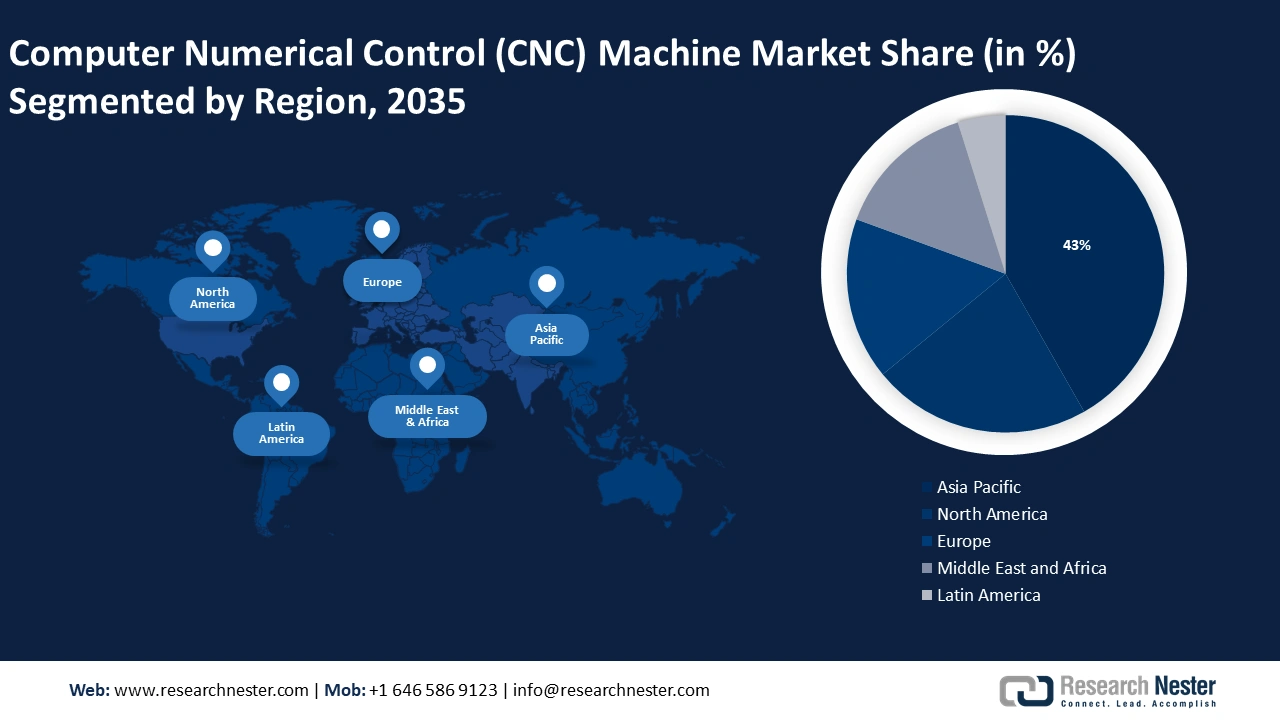

- Asia Pacific computer numerical control (cnc) machine market will hold more than 43% share by 2035, driven by the growing demand for efficient and precise manufacturing processes across industries such as electronics, aerospace, medical devices, and automotive.

Segment Insights:

- The lathe segment in the cnc machine market is expected to capture a 60% share by 2035, driven by the oil and gas sector’s need for precise machining tools for production and maintenance.

Key Growth Trends:

- Growth in the construction industry in 3D printing worldwide

- The shortage of competent workers and rising labor costs

Major Challenges:

- Exorbitant Initial Investment

- Involvement in complex technology increases the need for skilled operators.

Key Players: DMG MORI CO., LTD., General Technology Group Dalian Machine Tool Corp., YAMAZAKI MAZAK CORPORATION., DATRON AG, FANUC CORPORATION, CloudNC Ltd, Haas Automation, Inc, Hurco Companies, Inc.

Global Computer Numerical Control Machine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 85.89 billion

- 2026 Market Size: USD 93 billion

- Projected Market Size: USD 207.09 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Germany, United States, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

CNC Machine Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in the construction industry in 3D printing worldwide - Construction companies and firms are increasingly adopting 3D printing to produce custom-made parts and structures, as well as for prototyping and testing purposes. For instance, in 2019, a construction engineering firm Skanska partnered with Lough Borough University, UK, to promote the usage of 3D printing technology. These companies will be able to reduce their operational costs and time spent on manual construction, and this is expected to drive significant growth in the CNC machine market.

- The shortage of competent workers and rising labor costs: The use of CNC machines is mostly handled by the cost of labor, especially in industrialized sectors of the nations. CNC machines are proven to be a boon in the sector of skilled labor shortage that earlier prevailed.

- Rising Technological developments: The CNC machines are still in research and development with the help of new technologies like machine learning (ML) and artificial intelligence (AI). These developments are producing machines that are more capable of carrying out the toolpath commands faster, along with increased memory capacity, CPU speed, and bus communication rates.

Challenges

-

Exorbitant Initial Investment - Given the high initial cost of the machines, CNC technology requires a large investment since purchasing CNC machine tools requires a substantial upfront payment as they have extensive maintenance requirements.

- Involvement in complex technology increases the need for skilled operators.

- Shortage of skilled technicians in several regions may limit its adoption.

CNC Machine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 85.89 billion |

|

Forecast Year Market Size (2035) |

USD 207.09 billion |

|

Regional Scope |

|

CNC Machine Market Segmentation:

Machine Type Segment Analysis

The lathe segment in the CNC machine market is estimated to gain a robust revenue share of 60% in the coming years owing to the growing oil and gas industry. A significant portion of the energy industry and the world economy are dominated by the oil and natural gas sectors driven by changing energy consumption coupled with an increase in the focus on sustainable practices and investments in non-traditional energy sources. As per IEA's India Energy Outlook 2021, India's oil demand rises by almost 4 million barrels per day [mb/d) to reach 8.7 mb/d in 2040, the largest increase of any country. A CNC lathe is a device that revolves material around a stationary cutting tool and a central spindle, which is typically employed to accomplish or create exact circular forms that have an inner diameter (ID) and an outer diameter (OD). The oil and gas sector depends on a variety of CNC machining equipment such as lathe machines which allow for the precise and effective machining of lengthy workpieces. For the oil sector, CNC lathes are ideal as they can be employed for a variety of jobs involving the machining of plastic and metal, and the manufacture of complex equipment parts such as pumps, valves, and hydraulic cylinders. For this reason, CNC lathes are a necessary tool in the oil business to ensure proper dimensional tolerances, thread pipes, and machine shaft ends, and to assist in the production, maintenance, and repair of the equipment and infrastructure.

Application Segment Analysis

The industrial segment in the CNC machine market is set to garner a notable share shortly. To make intricate pieces, companies widely utilize CNC machines to eliminate superfluous metals from raw materials. These days, CNC machining is essential to the manufacturing industry to manage the machine tool's motion and command the operations of sophisticated equipment, such as mills, lathes, grinders, and other cutting instruments.

Our in-depth analysis of the global CNC machine market includes the following segments:

|

Machine Type |

|

|

End-Use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

CNC Machine Market Regional Analysis:

APAC Market Insights

The CNC machine market in Asia Pacific is predicted to account for the largest share of 43% by 2035 impelled by the growing demand for efficient and precise manufacturing processes across various industries like electronics, aerospace, medical devices, and automotive. The CNC Machines and their significant mass production are due to the ability to automate manufacturing processes, increase productivity, and hence downtime. The demand for CNC Machines is facing propelled expansion in this region due to the demand for medical devices, electric vehicles (EVs), telecom communication equipment, and semiconductor fabrication equipment.

North American Market Insights

The North American computer numerical control machine market is estimated to be the second largest, during the forecast timeframe led by the rising stipulation for precision machining, it is observed to be a key driver for the growth of CNC Machines in this region. The Market is constantly enhancing its efficiency, accuracy, and flexibility in the manufacturing process with the use of Automation. This expanding market and growth in the CNC Market is also due to the continuous innovations and focus on smart manufacturing solutions. This industry is adopting technologies like Artificial Intelligence (AI) to make indispensable tools that are required. The exponential sales in this CNC machine market are observed, because of the inexpensive raw materials and low operational costs.

CNC Machine Market Players:

- AMADA MACHINE CO., LTD.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DMG MORI CO., LTD.

- General Technology Group Dalian Machine Tool Corp.

- YAMAZAKI MAZAK CORPORATION.

- DATRON AG

- FANUC CORPORATION

- CloudNC Ltd

- Haas Automation, Inc

- Hurco Companies, Inc.

Recent Developments

- CloudNC Ltd. announced to increase in the size and capability of its CNC facility by adding additional machine from DMG Mori, to supply the extra capacity required for the increasing number of businesses relying on CloudNC to manufacture CNC parts in a cheap, efficient, and successful manner, and build an autonomous CNC facility that can be replicated and grown into a self-sufficient manufacturing ecosystem.

- DATRON, machines are designed to meet the requirements of 2D/3D milled parts, medical technology, micro drilling, the aerospace industry, micro molds, and many other applications, which are reliable partners for precise and efficient milling for your production.

- Report ID: 5889

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Computer Numerical Control Machine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.