Cervical Fusion Market Outlook:

Cervical Fusion Market size is valued at USD 7.2 billion in 2025 and is projected to reach USD 10.9 billion by the end of 2035, rising at a CAGR of 4.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cervical fusion is estimated at USD 7.5 billion.

The primary growth drivers in the market include an increasing patient pool due to aging populations and the rising prevalence of spinal disorders. The market operates within a complex global supply chain comprising raw materials, APIs, medical devices, and finished products. Titanium, PEEK polymers, bone grafts, and spinal instrumentation systems are some of the key components. These materials are sourced by manufacturers from various regions, and the most significant imports have been from the U.S., Germany, China, Singapore, and the Netherlands. As per a report by IBEF in July 2022, medical equipment imports into India grew from Rs. 4,569 crores (USD 572.0 million) to Rs. 40,649 crores (USD 5.08 billion) in 2021-22, wherein electronics and equipment accounted for the major share of imports.

Moreover, trade flow dynamics have a significant impact on the market, with Germany and South Korea being active exporting countries. As per a report by the International Trade Administration in August 2025, the medical device market in Germany is the largest in the world and accounts for about 44 billion USD. These strong export-level capabilities owe their origin to high manufacturing infrastructure and quality standards. Additionally, South Korea is taking good measures to increase its share by investing heavily in innovation and international collaborations. As per a report by the International Trade Administration in December 2023, the last 5 years have seen a substantial upsurge from 346 million USD to 658 million USD in imports of China-made medical devices to Korea.

Key Cervical Fusion Market Insights Summary:

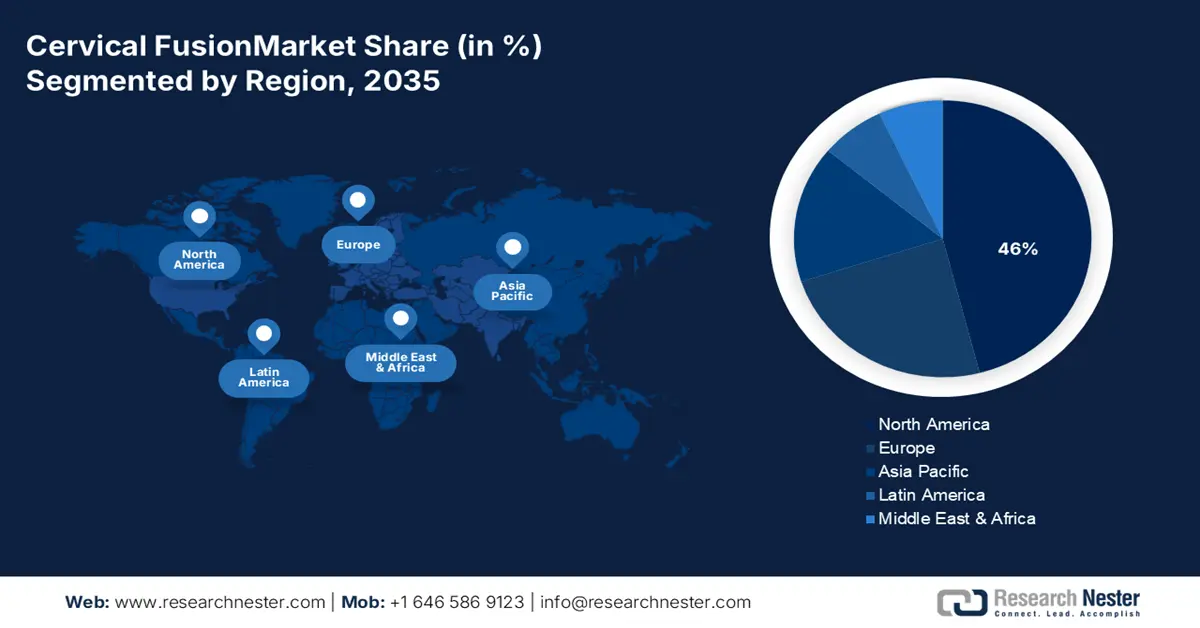

Regional Insights:

- The cervical fusion market in North America is projected to secure a 46% share by 2035 owing to advanced healthcare infrastructure and substantial funding for spinal research and innovation.

- Asia Pacific is anticipated to emerge as the fastest-growing region in the forecast period of 2026–2035, impelled by rapid population aging and rising incidence of spinal trauma and degenerative diseases.

Segment Insights:

- The metal implants segment in the Cervical Fusion Market is anticipated to account for a 61% market share by 2035, propelled by its superior biomechanical strength, corrosion resistance, and compatibility in spinal fixation.

- The minimally invasive surgery (MIS) segment is predicted to dominate by 2035, driven by reduced post-operative complications and faster patient recovery.

Key Growth Trends:

- Aging population and increased prevalence of spinal disorders

- Technological Advancements in Surgical Procedures

Major Challenges:

- Regulatory and compliance complexities

- High procedure costs and limited reimbursement

Key Players: Medtronic, DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, Globus Medical, NuVasive, B. Braun, Orthofix, Alphatec, RTI Surgical, K2M (Viscogliosi Brothers), Ulrich Medical, Joimax, LDR Medical, Medacta.

Global Cervical Fusion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 7.5 billion

- Projected Market Size: USD 10.9 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 1 October, 2025

Cervical Fusion Market - Growth Drivers and Challenges

Growth Drivers

- Aging population and increased prevalence of spinal disorders: The Aging population is one of the most important drivers in the takeover of the market. As people advance in age, degenerative spinal diseases such as cervical spondylosis and degenerative disc disease become more common, which, in turn, creates increased maturity for surgeries such as fusion of the cervical spine. For instance, as per a report by NLM in October 2022, adult spinal deformity (ASD) rates range from 2% to 32%, while ASD affects 68% of the elderly population. Elderly individuals with ASD are considered an unfortunate group affected by the disorder, which is growing due to the increase in life expectancy and demographic changes, and also because of better diagnosis of the disorder.

- Technological Advancements in Surgical Procedures: With the progress of surgical technologies, the outcome for cervical fusion procedures has become more favorable. Conventionally, pedicle screws intended for internal fixation are inserted manually, using landmarks and X-rays. However, an NLM report from September 2024 states that a misplaced screw occurs in about 17% to 40% of cases, due to which the risk of damage to nerves and blood vessels, compromise in spinal stability, and some other serious complications arise that most often require reoperation. In contrast, the arrival of robotic-assisted systems and navigation in market has made the placement of screws highly precise with minimal chances of errors, thus increasing patient safety and reducing recovery time.

- Rising healthcare expenditures and reimbursement policies: Physician expenditures for surgery for market have increased due to the availability. For instance, as per a report by the Government of India in January 2025, in India, health care expenditures of the current period were ₹7,89,760 crores (USD 94.5 billion), accounting for ₹1,14,701 crores (USD 13.7 billion) of capital expenses. This rise in public spending on health supports broader health infrastructure and increases surgical capacity in urban and rural hospitals. Once reimbursement coverage is widened by National Health Schemes, an increasing number of patients would opt for more advanced spinal procedures such as cervical fusion.

Multivariable Logistic Regression Clinical Study Analysis on Risk Factors for Fusion Following Laminectomy (2025)

|

Risk Factor |

Odds Ratio |

95% CI Lower |

95% CI Upper |

P Value |

|

Diabetes |

0.9 |

0.7 |

1.2 |

0.5 |

|

Tobacco |

1.1 |

0.8 |

1.4 |

0.2 |

|

Obesity |

1.4 |

1.1 |

1.9 |

<0.01 |

|

Male gender |

1.2 |

0.9 |

1.5 |

0.1 |

|

Age |

0.9 |

0.9 |

1.0 |

0.0 |

|

Elixhauser comorbidity index |

1.0 |

1.0 |

1.0 |

0.0 |

|

Osteoporosis |

0.9 |

0.6 |

1.5 |

0.9 |

Source: NLM

Challenges

- Regulatory and compliance complexities: The cervical fusion industry has to face stringent regulatory requirements, delaying both the approval of products and their entry into the market. Standards for medical device safety and efficacy differ across countries, thereby forcing one to comply with multiple standards if they wish to market their devices internationally. These complex regulatory issues increase costs and the time taken for developments. Another issue faced by manufacturers is the matter of post-market surveillance and reporting requirements, which require good resources to address and may be a heavy burden for smaller companies. Regulatory indecisiveness can also hinder the acceptance of innovations and reduce the invasion of new technologies by patients and providers.

- High procedure costs and limited reimbursement: The high pricing for cervical fusion surgeries and devices stands as a barrier to widespread adoption, particularly in developing economies. Irregular or limited reimbursement policies in some regions hamper patient access to these treatments. This essentially drags hospital budgets and interferes with patients' willingness to have surgery. Additionally, due to cost pressures, providers may elect to manage ailments conservatively, even when surgery may serve the patient well. For this very reason, the market is experiencing slow growth due to the affordability factor and reimbursement issues.

Cervical Fusion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 7.2 billion |

|

Forecast Year Market Size (2035) |

USD 10.9 billion |

|

Regional Scope |

|

Cervical Fusion Market Segmentation:

Implant Type Segment Analysis

The metal implants sub-segment under the implant type segment in the cervical fusion market is expected to maintain its dominance with a 61% market share in the forecast period due to its proven biomechanical strength and compatibility. Titanium and stainless-steel implants are usually employed in spinal fixation. Metal-based implants, due to their favorable outcomes in load-bearing environments, are the preferred ones for spinal fusion. As per a report by NLM in April 2025, the pooled standardized mean difference (SMD) was 2.5 for chromium and 2.0 for titanium, adjacent to higher metal ion levels pertaining to the implants. High corrosion resistance and osseointegration maintain their status as preferred ones among surgeons.

Method Segment Analysis

The minimally invasive surgery (MIS) sub-segment in the method segment is projected to dominate the cervical fusion market due to fewer incidences of post-operative morbidity and faster rates of recovery. MIS procedures are increasingly gaining acceptance largely because of reduced tissue disruption and shortened hospital stays. As per a report by NLM in September 2022, over the last eight years, an analysis of 9.8 million inpatient major operating room procedures showed that about 11.1% were MIS, whereas only 2.5% were robotic-assisted. In spinal procedures, MIS techniques are favored as they reduce blood loss and operative time, which is an attraction for both providers and patients. Other than this, the procedural advantages have long-established MIS as the preferred surgical approach.

End user Segment Analysis

The hospitals sub-segment in the end-user category of the cervical fusion market is likely to dominate due to high surgical volumes and the availability of advanced infrastructure for admitted patients. In the U.S., end user hospital facilities conduct the majority of cervical fusion procedures. As per a report by NLM in February 2022, The number of spinal surgeries increased 2.4 times over 15 years, and the proportion of elderly people has steadily risen each year, thereby emphasizing their central role in the hospital segment to deliver of highly complex interventions. Interaction does happen in multidisciplinary teams, and post-op care pathways are mostly hospital-based. This feature further elevates their status. The dominance of hospital settings is supported by advanced imaging, surgical navigation systems, and intensive care resources.

Our in-depth analysis of the global market includes the following segments:

|

Segment Category |

Sub-segments |

|

Surgery Type |

|

|

Implant Type |

|

|

Surgical Approach |

|

|

Method |

|

|

End user |

|

|

Fusion Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cervical Fusion Market - Regional Analysis

North America Market Insight

The cervical fusion market in North America is expected to hold the highest market share of 46% by the end of 2035, due to advanced healthcare infrastructure, a high prevalence of spinal disorders, and also increasing demand for minimally invasive surgical procedures. As per a report by Research America in September 2022, the federal government was financing 25% of medical and health R&D undertaken in the U.S. to the tune of USD 61.5 billion, with NIH alone accounting for 20% (USD 48.9 billion) of all such investments. Such huge funding leads to continuous innovation and development of new spinal surgical technologies, thereby further fueling the growth of the market in North America.

The cervical fusion market in the U.S. is experiencing growth due to several factors, such as the rising incidence of spinal ailments, surgical technological developments, and a growing aging population. In seeking effective ways of treating diseases such as degenerative disc disease and herniated discs, cervical fusion has been widely adopted. As per a report by the U.S. Bureau of Labour Statistics in August 2025, the following decades would see an annual average projection of 8,700 openings for surgical assistants and technologists. Besides, specialized surgical centers and well-trained healthcare professionals help boost market growth. All these factors together sustain the growth trajectory of the market across the U.S.

The cervical fusion industry in Canada is growing due to the aging of the population and an increased awareness and concern for spinal health, along with newer advances in medical technologies. As per a report by Statistics Canada in April 2025, persons aged 65 years and above in Canada numbered 8,108,467. This shifting demographic increases demand for spinal interventions, including cervical fusion, as age-related degenerative spinal conditions become common. Coupled with the ongoing investments in public healthcare infrastructure, Canada is perfectly positioned to meet increasing procedural volumes in this field.

Asia Pacific Market Insight

The cervical fusion market in the Asia Pacific is expected to hold the fastest-growing market by the end of 2035, as populations grow older in these major countries, and the incidence of spinal trauma and degenerative disease rises with concomitant healthcare expenditure, which is intertwined with medical infrastructure. As per a report by the U.S. Census Bureau in June 2022, an estimated 414 million Asian persons were above the age of 65, almost 20% greater than the total U.S. population. The older Asian population is expected to almost triple over the next four decades, signaling very promising demand ahead for spinal care.

The market in China is growing due to demographic transition with a shift towards aging, policy reforms in elderly care, and rising burdens from spinal disorders. According to a report by the People’s Republic of China, in October 2024, the population aged 60 and above in China reached nearly 297 million in 2023, accounting for 21.1 percent of the total, as the country is tackling the challenges of an aging society. This aging setup will translate into much demand for cervical fusion procedures, occasioned by common cervical spine degeneration in the older population. Also, further uplift into this market is the continued investment in China in the extension of orthopedic care and surgical infrastructures.

The cervical fusion market in India is growing due to rising spinal injury (back-drop accidents, falls) incidence, presence of high spinal pain conditions, and increasing access to surgical and diagnostic care. According to a report by NLM June 2025, patient acute care costs varied from USD 1,383.9 to USD 9,803 in India, a rather wide range due to hospital infrastructures and accessibility to special spinal care differing from region to region. However, affordability and accessibility are being gradually enhanced through extending government health care schemes and private hospital chains.

Countries for exporters and importers of medical instruments in 2023

|

Exporters (Country) |

Export Value (USD) |

Importers (Country) |

Import Value (USD) |

|

China |

12.3 billion |

China |

10.6 billion |

|

Japan |

7.2 billion |

Japan |

6.4 billion |

|

Malaysia |

2.7 billion |

India |

2.4 billion |

|

Israel |

2.5 billion |

South Korea |

2.3 billion |

|

Singapore |

2.4 billion |

Singapore |

2.2 billion |

|

South Korea |

2.2 billion |

Hong Kong |

1.6 billion |

Source: OEC

Europe Market Insight

The cervical fusion market in Europe is projected to continue to grow at a steady pace until the end of 2035, primarily due to an increase in the instances of spinal cord injuries and cervical lesions in the elderly, usual cases of back and neck pains, and increased expenditure for healthcare services focusing on musculoskeletal disorders. As per a report by NLM in June 2025, a single instance of spinal cord injury is believed to amount to a lifetime economic impact of around USD 2 to USD 4 billion within Europe. An escalating focus on spinal healthcare would cater to and increase the demand for new surgical interventions throughout the forecast period.

The market in the UK experiences growth due to the high number of spine fusion procedures when compared to other spinal surgeries, the aging population increasing the burden of degenerative cervical disorders, and investment in advanced surgical devices. The NHS has been continually investing in state-of-the-art surgical technologies and training to ensure better outcomes in patients undergoing spinal interventions. These activities will likely help drive the growth of the market in the UK. Government healthcare initiatives being undertaken to improve access to specialized spinal care are thus supporting the growing demand for cervical fusion procedures across the country.

The cervical fusion market in Germany is growing due to several conditions, high incidence of cervical spinal cord injuries, especially in the older age groups, high prevalence of back and neck pain among adults, and strong public hospital systems capable of performing advanced spinal surgeries. As per a report by the International Trade Administration in August 2025, with foreign sales amounting to USD 172 billion (EUR 159.4 billion), healthcare contributed 8.1%to Germany's total exports in 2023. With such a strong export scenario, Germany leading in medical technological innovations, including those related to spinal implants and surgical equipment used in cervical fusion.

German Medical Equipment Market (2022-2025) in billion USD

|

Category |

2022 |

2023 (e) |

2024 |

|

Total Exports |

27.1 |

30.0 |

31.0 |

|

Total Imports |

24.0 |

25.3 |

26.0 |

|

Imports from the U.S. |

5.2 |

5.6 |

6.0 |

|

Trade Surplus/Deficit |

-2.2 |

-0.7 |

-6.0 |

|

Exchange Rates |

1.0 |

1.0 |

1.0 |

Source: International Trade Administration

Key Cervical Fusion Market Players:

- Medtronic

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings

- Globus Medical

- NuVasive

- B. Braun

- Orthofix

- Alphatec

- RTI Surgical

- K2M (Viscogliosi Brothers)

- Ulrich Medical

- Joimax

- LDR Medical

- Medacta

The market for cervical fusion is marked by a moderately consolidated landscape, with leading companies holding significant shares. The market is dominated by Medtronic, DePuy Synthes, and Stryker, who have very large product portfolios to leverage for distribution around the world. These companies continue to maintain their competitive edge through mergers and acquisitions, technological advancements in robotic-assisted surgery, and minimally invasive techniques. Since healthcare access is increasing and, along with it, the demand for spinal procedures, the three big players are eyeing growth in emerging markets as well.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2024, Medtronic announced its new technologies to improve spine surgeries. The updates are part of Medtronic’s AiBLE spine surgery system, that uses obotics, navigation, imaging, and AI to help the doctors.

- In October 2022, Orthofix, a medical device company, announced its long-term research results from a U.S. study on its M6-C artificial cervical disc. M6-C disc is safe and works well for treating degenerative disc disease in the neck.

- Report ID: 8140

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cervical Fusion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.