Multiple Sclerosis Drug Market Outlook:

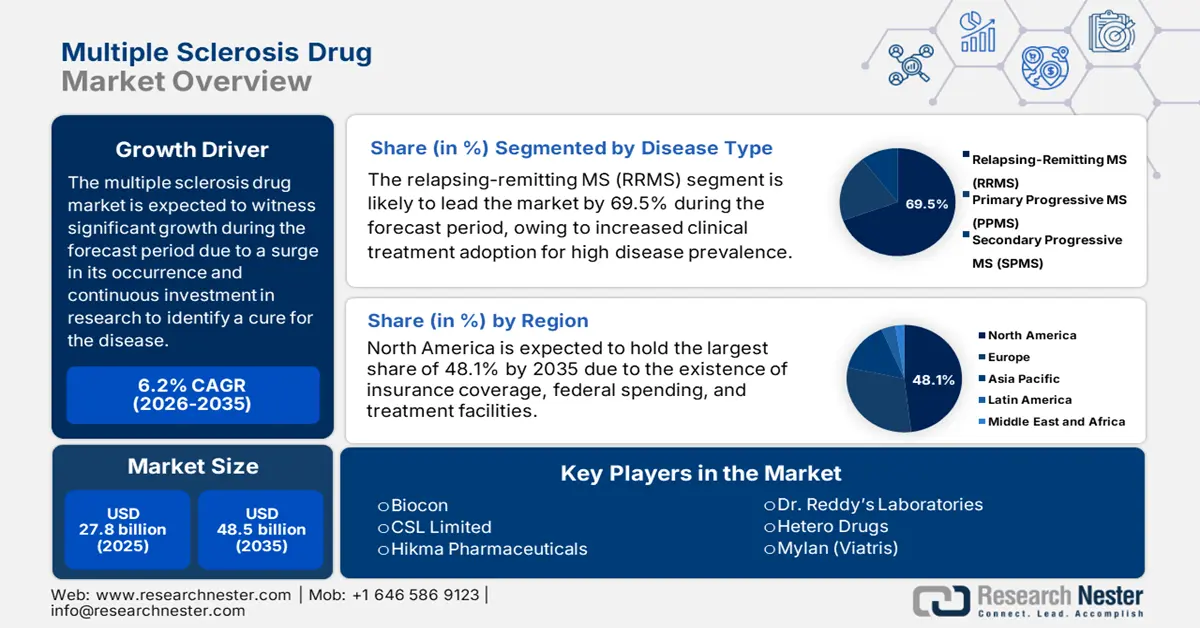

Multiple Sclerosis Drug Market size was USD 27.8 billion in 2025 and is expected to reach USD 48.5 billion by the end of 2035, increasing at a CAGR of 6.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of multiple sclerosis drug is estimated at USD 29.3 billion.

The international patient pool in the multiple sclerosis (MS) drug market is significantly exceeding the 2.8 million mark, with an estimated 1 million cases recorded in the U.S., as stated by the National Multiple Sclerosis Society (NMSS). Additionally, the occurrence rate is increasing gradually from 5% to 7% annually, which is attributed to environmental factors and improved diagnostics. Additionally, the World Health Organization (WHO) has estimated that over 1.8 million people globally are thought to have MS. Therefore, all these factors are creating a positive impact on the overall market across different nations.

Moreover, current trends in the multiple sclerosis (MS) drug market reflect a lot of change in drug development, treatment options and aware of patient care. One specified trend is the increased use of biologic therapies. Monoclonal antibodies have become an important part of disease-modifying therapies (DMTs) for MS, including Ocrevus (ocrelizumab) and Tysabri (natalizumab). These biologics can target specific molecules that are involved in the immune attack of the central nervous system, which helps to define the pathogenesis of the disease. In addition to the biologics, we already have oral drugs like Gilenya and Tecfidera, which are something that is growing in popularity. Another trend is the increased effort concerning the progressive forms of MS. Progressive forms of MS have been much more difficult to treat. Ocrevus, of course, now has the approval for primary progressive MS, which is significant in establishing disease-modifying therapies.

Key Multiple Sclerosis Drug Market Insights Summary:

Regional Insights:

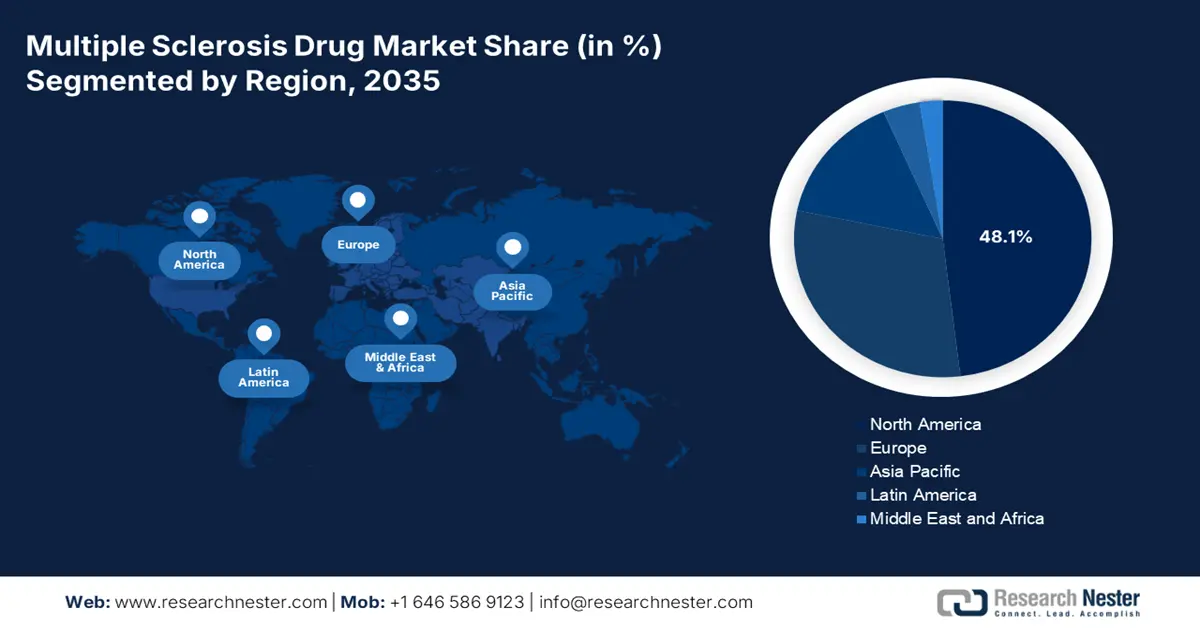

- By 2035, North America is anticipated to secure a leading 48.1% share in the multiple sclerosis drug market, supported by broad Medicaid–Medicare accessibility, expanding telemedicine reach, and accelerated FDA approvals.

- Asia Pacific is set to capture a 15.2% share by 2035, as regional growth is bolstered by strengthened healthcare policies, rising diagnosis volumes, and increasing biosimilar integration.

Segment Insights:

- By 2035, the relapsing-remitting MS (RRMS) segment is expected to hold a dominant 69.5% share in the multiple sclerosis drug market, elevated by higher treatment integration rates and increasing global prevalence.

- During 2026–2035, the monoclonal antibodies segment is anticipated to maintain a substantial 40.5% share, reinforced by its strong impact on slowing disability progression and optimizing relapse prevention.

Key Growth Trends:

- Healthcare cost savings and early intervention

- Increase in disease and diagnosis

Major Challenges:

- Increased gaps in patient cost-effectiveness

- Resistance to biosimilars

Key Players: Roche, Novartis, Biogen, Merck KGaA, Sanofi, Teva Pharmaceutical, Bristol-Myers Squibb, Pfizer, Mylan (Viatris), Dr. Reddy’s Laboratories, Hetero Drugs, Biocon, Celltrion, CSL Limited, Hikma Pharmaceuticals

Global Multiple Sclerosis Drug Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.8 billion

- 2026 Market Size: USD 29.3 billion

- Projected Market Size: USD 48.5 billion by 2035

- Growth Forecasts: 6.2 % CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Saudi Arabia, Singapore

Last updated on : 19 August, 2025

Multiple Sclerosis Drug Market - Growth Drivers and Challenges

Growth Drivers

- Healthcare cost savings and early intervention: The aspect of early treatment in the market has been clinically and economically proven to be impactful. Patients are less likely to experience relapses, will have less disability, and reduced hospitalizations when treatment is started early in the disease course. This will lead to substantial savings from the health care system. In addition, Governments and insurance companies have realized that by investing in early treatments for MS, the biologic drugs will cost less over the lifetime of the patient as they will have better outcomes and are less reliant on acute care. With health economics studies continuing to support those conclusions, there will be increasing appreciation for early-stage treatment by both the pharmaceutical industry and health systems across the world.

- Increase in disease and diagnosis: With increased awareness of the disease, as well as the advancement of diagnostic tools, patients are being diagnosed with MS at earlier points in the disease process. The importance of such diagnoses is highlighted to clinicians that there are persons who can safely commence early medications known to alter the course of the disease, suppress disability progression, and lessen the severity of relapses. In addition, the increase in the number of cases diagnosed in countries with developing health care systems will expand the total pool of noted MS patients.

- Transition toward generics and biosimilars: The existence of biosimilars and generics is effectively reshaping the market by reducing expenses. Besides, education-based campaigns have highlighted that comparative results can escalate upgradation, thus denoting an optimistic outlook for the overall market growth across different countries. The move towards generics and biosimilars is a main factor for the growth of the Multiple Sclerosis (MS) drug market because they will increase access and affordability for more patients. The biosimilars will allow the patient the same practice and efficacy as the original biologics, while helping make treatment more affordable and accessible to our healthcare systems.

Challenges

- Increased gaps in patient cost-effectiveness: Increased expenses develop treatment barriers across different nations, which causes a hindrance in the market internationally. Likewise, the public health system in Brazil effectively covers only first-line interferons, thereby leaving behind 65,000 patients without the need for modernized DMTs. Besides, manufacturers experience risky choices for maintaining limited accessibility and premium pricing, thus negatively impacting the overall market globally.

- Resistance to biosimilars: This is another challenge that the market is witnessing internationally. The market, despite comprising potential savings, stakeholders are deliberately resisting the biosimilar integration. Therefore, this resistance readily increases healthcare expenses every year, while safeguarding brand manufacturers from extreme competition.

Multiple Sclerosis Drug Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 27.8 billion |

|

Forecast Year Market Size (2035) |

USD 48.5 billion |

|

Regional Scope |

|

Multiple Sclerosis Drug Market Segmentation:

Disease Type Segment Analysis

The relapsing-remitting MS (RRMS) segment is projected to dominate the market, with the highest share of 69.5% by the end of 2035. The segment’s growth is highly fueled by an increase in the treatment integration rates, as well as an upsurge in the prevalence globally. This segment is considered the most common MS subtype, and therefore, RRMS patients demand constant disease-based therapies to prevent delayed progression and relapses. In addition, the segment’s upliftment is also driven by cutting-edge monoclonal antibodies, such as Roche’s Ocrevus, along with oral therapy, thus demonstrating reduction in relapse during clinical studies.

Drug Class Segment Analysis

Monoclonal antibodies segment is expected to hold the second-largest market share of 40.5% during the forecast period. The segment’s growth is effectively driven by managing disability progression, along with superior efficiency in relapse prevention. Besides, the segment also propels from stretched dosage intervals, constituting half a year for Ocrevus, and robust payer coverage.

Route of Administration Segment Analysis

The oral segment market is anticipated to account for the third-largest share of 33.7% by the end of the forecast timeline. This particular therapy is positively uplifting the overall market, owing to convenience and superior patient adherence, with the inclusion of notable agents, such as Biogen's Vumerity. In addition, the segment readily benefits from an expansion in Medicare Part D coverage. Besides, advanced oral BTK inhibitors, such as Merck’s evobrutinib, provide targeted immunomodulation with regular dosage, thereby suitable for the overall segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Disease Type |

|

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multiple Sclerosis Drug Market - Regional Analysis

North America Market Insights

North America market is anticipated to be the dominating region, with a projected highest share of 48.1% by the end of 2035. The market’s growth in the region is subject to the U.S., readily driving the majority of the demand, further backed by a strong presence of Medicaid and Medicare coverage, along with an increase in treatment implementation rates. Besides, an expansion in telemedicine across rural areas, biosimilar adoption diminishing expenses, and the FDA’s fast track approvals are other drivers positively impacting the overall market in the region.

U.S. market is significantly growing, highly fueled by an increase in the treatment services, along with Medicaid and Medicare coverage. Additionally, Medicare Part B expenditure for monoclonal antibodies also surged, thus effectively uplifting the overall market in the country.

The multiple sclerosis drug market in Canada is also projected to grow at a rate of 6.1%, which is propelled by provincial DMT subsidies and the presence of universal health and medical coverage. Besides, Ontario’s Exceptional Access Program provides complete coverage of high-efficiency DMT expenses. Furthermore, biosimilar switching policies, indigenous health disparities, and early treatment initiation are other key trends that are skyrocketing the market in the country.

APAC Market Insights

Asia Pacific in the multiple sclerosis drug market is considered the fastest-growing region, with an expected share of 15.2% during the forecast period. The market’s development in the region is fueled by an increase in government healthcare policies, biosimilar implementation, and a surge in diagnosis volumes. China is positively impacting the region, owing to the 2023 reforms by the National Medical Products Administration (NMPA) for escalating 7 notable DMT acceptances. India is following closely through the presence of localized generics and Ayushman Bharat coverage. Then there is a generous investment by South Korea for conducting neuroprotection, while Malaysia expanded hospital and pharma collaborations, thus suitable for market upliftment in the region.

The multiple sclerosis drug market in China is gaining increased exposure with a projected revenue share of 30.5% within the forecast duration, effectively propelled by administrative policies and enhanced diagnostic rates. Together, healthcare reforms and government initiatives have been central to many aspects of the MS drug market in China. The Chinese government has made significant advancements in health care and health care funding in recent years. Moreover, there have been policy changes that improve access to treatments for chronic diseases, including MS. Healthcare insurance reforms expanded coverage for a wider variety of medications, including DMTs for MS, which gives more patients access to expensive biologics.

The multiple sclerosis drug market in India is also simultaneously growing by an expected 15% of the regional share, which is propelled by administrative policies and generic manufacturing. The Indian administration has shown sustained attention toward enhancing access to healthcare for chronic diseases like multiple sclerosis (MS). Through healthcare reforms and government-funded programs, affordable access to disease-modifying therapies (DMTs) is coming to a larger patient base. India’s National Health Policy and Ayushman Bharat (National Health Protection Scheme) are pushing for more cheap drugs for all diseases, including MS. It enables affordable access to expensive MS drugs.

Europe Market Insights

Europe is expected to hold a considerable market share of 30.2% by the end of the forecast period, catering to a 5.7% growth rate, highly fueled by biosimilar implementation as well as the increased prevalence of the disease. Germany is deliberately leading in the region, which is further driven by AMNOG pricing policies, along with an increase in the yearly growth in demand. This is followed by the UK allocating substantial part of its healthcare budget for MS therapies.

The multiple sclerosis drug market in Germany is dominating the region, with a 35% revenue share, which is propelled by an increase in biosimilar adoption and the existence of a value-specific AMNOG pricing system. Besides, the Federal Ministry of Health made the provision of a generous fund that has prioritized early high-efficiency DMTs such as Kesimpta and Ocrevus. Meanwhile, the EMA’s PRIME scheme has accelerated acceptances for 7 neuroprotection therapies between 2023 and 2025, including Merck’s evobrutinib, thus creating an optimistic outlook for the overall market.

The multiple sclerosis drug market in the UK is also growing, with a projected 25% of the region’s MS drug revenue, effectively backed by the NHS universal coverage, as well as NICE’s advanced DMT acceptances. Awareness of MS has increased within the UK population and healthcare professionals over the last few years. This is leading to earlier, more accurate diagnoses of MS. Clinicians now have accepted diagnostic approaches and technology, which means MS can be diagnosed at earlier points in the disease, where there will be a benefit to early intervention with treatments. Early intervention is likely to support long-term preventative care of MS, it is also expected to benefit treatment adherence to a routine medication.

Key Multiple Sclerosis Drug Market Players:

- Roche

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis

- Biogen

- Merck KGaA

- Sanofi

- Teva Pharmaceutical

- Bristol-Myers Squibb

- Pfizer

- Mylan (Viatris)

- Dr. Reddy’s Laboratories

- Hetero Drugs

- Biocon

- Celltrion

- CSL Limited

- Hikma Pharmaceuticals

The international market is extremely unified, with the presence of notable key players, such as Biogen, Novartis, and Roche, collectively dominating with 65% of the market share through oral DMTs and monoclonal antibodies. These companies have readily implemented tactical initiatives, including transition to neuroprotection and approved administrative products. For instance, Biogen witnessed a sudden shift towards neuroprotection with USD 1.1 billion in research and development-based investment. Besides, Novartis’s Kesimpta gained 23% of the share with self-administered convenience, while Roche’s Ocrevus achieved 27% of the share through pediatric acceptances and expanded dosage, thus suitable for the market development.

Here is a list of key players operating in the global market:

Recent Developments

- In April 202o, Novartis AG declared that it achieved the FDA acceptance for Kesimpta, which is an ofatumumab, suitable as a first-line monotherapy for RMS, which can expand its market by more than 30,500 patients in the U.S. market.

- In May 2025, Zydus Lifesciences received approval from the USFDA to market Glatiramer Acetate Injection, a generic equivalent of Copaxone, for treating relapsing forms of Multiple Sclerosis. The product, developed with Chemi S.p.A., is manufactured in Europe and meets a market where annual sales in the USA are USD 719 million. This approval demonstrates Zydus' commitment to offering different therapeutic options in the marketplace.

- Report ID: 1986

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Multiple Sclerosis Drug Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.