Blood Culture Tests Market Outlook:

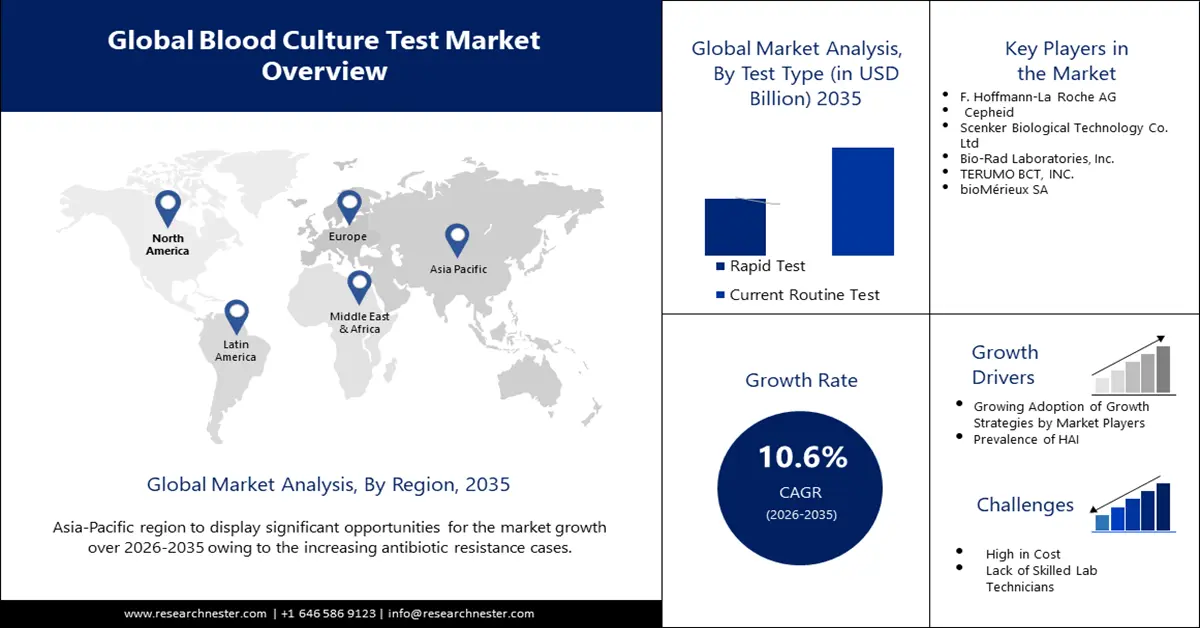

Blood Culture Tests Market size was valued at USD 6.83 billion in 2025 and is set to exceed USD 18.71 billion by 2035, expanding at over 10.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blood culture tests is estimated at USD 7.48 billion.

Nosocomial infections are a major problem that requires global attention. A group of infections called HAIs are infections that the patient did not have before being admitted to the hospital. HAIs occur when a patient arrives at the hospital or 48 to 72 hours after admission. It doesn't even exist during waiting time. Currently, these diseases have become a serious problem for both medical institutions and the public, requiring increased medication and testing, prolonging treatment periods, and placing an unnecessary financial burden on patients and medical institutions. As a result, the demand for blood culture testing to investigate infectious diseases and the demand for blood culture testing market is increasing. According to a study by the Centers for Disease Control and Prevention, about 1 in 31 hospitalized patients in the United States suffers from a healthcare-associated infection.

Antibiotics are drugs used to prevent and treat infectious diseases in humans, animals, and plants. These include antibiotics, antiviral drugs, antifungal drugs, and antiparasitic drugs. Antibiotics and other antimicrobial drugs lose their effectiveness due to drug resistance, making infections difficult or impossible to treat and increasing the risk of disease transmission, serious illness, disability, and death. Blood culture tests are primarily used to detect microbial resistance. Most of the bacteria isolated from blood cultures were found to be multidrug-resistant, especially to first- and second-line antibiotics. Thus, growing cases of antimicrobial resistance are set to drive market growth in the upcoming period.

Key Blood Culture Tests Market Insights Summary:

Regional Highlights:

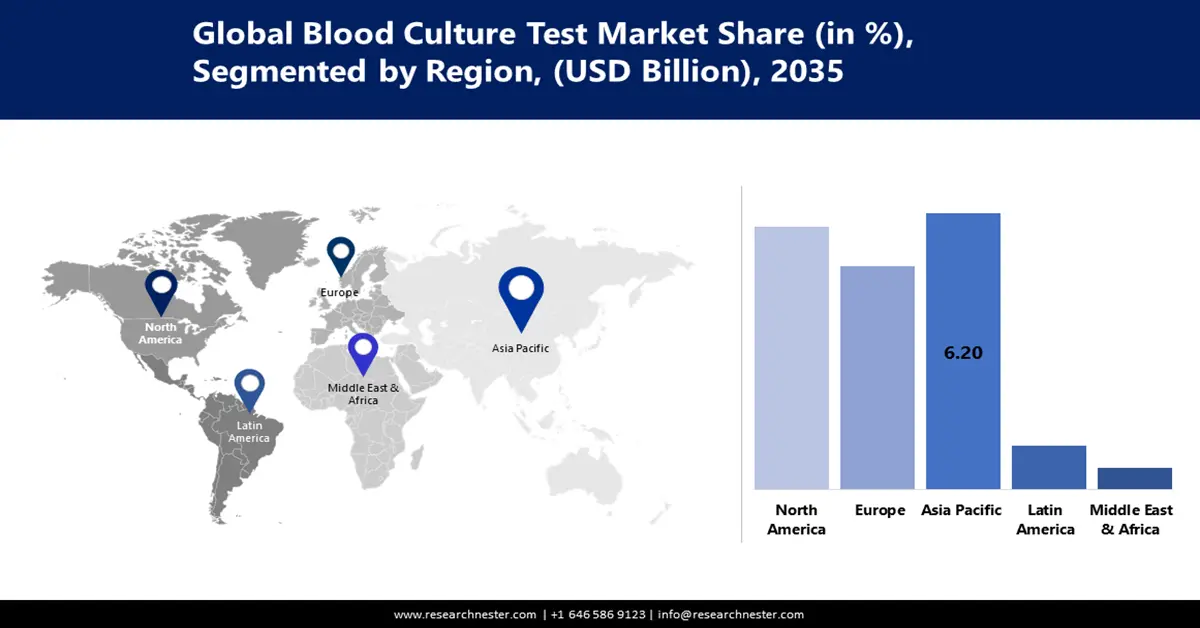

- Asia Pacific blood culture tests market will secure around 33% share by 2035, driven by the rising importance of blood cultures in combating antibiotic resistance, particularly in South Asia.

- North America market will achieve a 31% share by 2035, driven by increasing demand for antimicrobial susceptibility testing.

Segment Insights:

- The phenotypic ast segment in the blood culture tests market is forecasted to capture a 72% share by 2035, driven by increased demand to determine antibiotic effectiveness and higher incidence of sepsis.

- The current routine test segment in the blood culture tests market is projected to secure a 64% share by 2035, attributed to routine blood tests enabling monitoring of health and infection diagnosis.

Key Growth Trends:

- Growth Strategies Integration by Market Players

- Blood Culture Out Space Solid Media Culture Plates

Major Challenges:

- Lack of Skilled Laboratory Technicians

- High Cost of Test is Set to Pose Limitation on the Market Growth in the Upcoming Period

Key Players: F. Hoffmann-La Roche AG, Cepheid, Scenker Biological Technology Co., Ltd, Bio-Rad Laboratories, Inc., TERUMO BCT, INC., bioMérieux SA.

Global Blood Culture Tests Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.83 billion

- 2026 Market Size: USD 7.48 billion

- Projected Market Size: USD 18.71 billion by 2035

- Growth Forecasts: 10.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Blood Culture Tests Market Growth Drivers and Challenges:

Growth Drivers

- Growth Strategies Integration by Market Players - Growth strategies include new product launches, mergers and acquisitions, obtaining investment from prominent companies to provide consumers with innovative and safe products, strengthening our product offerings, expanding our customer base, and expanding our market reach. This includes strengthening our presence and expanding our geographic footprint. We are currently seeing an increasing trend in the market towards these strategies. In March 2023, BARDA and BioFire Defense, LLC partnered to advance the development of Specific Diagnostics' SPECIFIC Reveal Rapid AST system. The platform is designed to test for antibiotic susceptibility in a rapid and modular manner, providing phenotypic results from positive blood cultures or isolates in an average of just 5.5 hours. Thus, growing number of growth strategies introduced by market players is significantly driving the expansion of the market in the estimated timeframe.

- Blood Culture Out Space Solid Media Culture Plates - The requirement for a lengthy culture period on solid media has been considered a limitation of MALDI-TOF, as it delays time to patient diagnosis. By comparison, nucleic acids isolated directly from biological samples can be subjected to molecular techniques such as polymerase chain reaction (PCR) and do not require additional incubation time. The concentration of host proteins also contributes to the bacterially attributed and masked spectral information, making it impossible to analyze microorganisms using MALDI-TOF directly from biological samples such as blood or urine.

Challenges

- Lack of Skilled Laboratory Technicians - It is well known that lab-based diagnostic tests are the most important volume activity of the medical industry. In almost all cases, patients who visit a healthcare establishment are treated with clinical laboratory tests. Despite the growing demand for skilled workers in the laboratory sector, there is a severe shortage of them.

- False Positive Results of the Test are Expected to Hamper the Market Growth in the Forecast Period

- High Cost of Test is Set to Pose Limitation on the Market Growth in the Upcoming Period

Blood Culture Tests Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.6% |

|

Base Year Market Size (2025) |

USD 6.83 billion |

|

Forecast Year Market Size (2035) |

USD 18.71 billion |

|

Regional Scope |

|

Blood Culture Tests Market Segmentation:

Analysis Segment Analysis

The phenotypic AST segment share in the blood culture tests market is anticipated to surpass 72% by 2035. The growth of this segment is due to the increased demand for blood culture tests with a view to determining whether or not antibiotics are effective in preventing bacteria, thus providing physicians with vital information on appropriate antibiotic treatment options. The demand for phenotypic AST is also increasing due to an increased incidence of conditions such as sepsis. For example, sepsis is a potentially fatal disease that occurs when the body's response to an infection causes tissue and organ damage as defined by WHO. Although it is difficult to determine the true global epidemiological burden of sepsis, recent scientific papers estimate that an estimated 49 million people worldwide suffer from sepsis each year, and a total of 11 million people die from sepsis.

Test Type Segment Analysis

Blood culture tests market from the current routine test segment is predicted to hold the largest share of 64% during the forecast period. One of the most important methods to monitor overall physical well-being is regular blood tests or a culture test. It may be able to understand the body changes over time and allow it to make informed decisions about health by being tested regularly. In order to diagnose infections and control the presence of germs in the blood, blood culture testing is commonly used.

Our in-depth analysis of the global blood culture tests market includes the following segments:

|

Test Type |

|

|

Analysis |

|

|

Product |

|

|

Method |

|

|

Technology |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Culture Tests Market Regional Analysis:

APAC Market Insights

The blood culture tests market share in Asia Pacific is estimated to cross more than 33% by 2035. Blood culture is currently the accepted method of diagnosis for possible bacteremia in the region. If bacteremia is suspected in a majority of high-income countries, blood cultures are often provided to patients with fever. Nevertheless, when working under resource constraints, physicians may decide to give patients direct treatment due to a lack of or limited laboratory capacities. In the present era of increasing antibiotic resistance, particularly in South Asia, blood cultures are becoming a more important tool to help identify the best course of therapy and promote effective management.

North American Market Insights

The blood culture tests market in the North American region is set to grow substantially by reaching 31% share by the end of 2035. Rising demand for antimicrobial susceptibility testing awaits the blood culture testing market in the region. The most effective treatment for patients with bloodstream infections depends largely on the rapid identification of blood culture isolates and the conclusions of his AST. The importance of blood cultures is highlighted in the area by the fact that empiric antibiotic dosing is often inappropriate, leading to increased morbidity and mortality, prolonged hospital stays, and associated healthcare costs. Additionally, in September 2023, FDA issued a regulation entitled “Antibiotic Susceptibility Testing System Devices – Updates to Breakpoints in Device Labeling,” effective immediately.

Blood Culture Tests Market Players:

- Becton, Dickinson and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche AG

- Cepheid

- Scenker Biological Technology Co., Ltd

- Bio-Rad Laboratories, Inc.

- TERUMO BCT, INC.

- bioMérieux SA

- Accelerate Diagnostics, Inc.

- DiaSorin S.p.A.

Recent Developments

- In 2023, Roche announced that it has strengthened its research and innovation efforts by expanding its partnership with Janssen Biotech to develop companion diagnostics for targeted therapies. With the latest agreement expansion, Roche and Janssen intend to increase opportunities to collaborate on precision medicine projects including a variety of companion diagnostic technologies such as immunohistochemistry, digital pathology, next generation sequencing, polymerase chain reaction and immunoassays.

- In August 2023, Thermo Fisher Scientific announced that it had acquired CorEvitas, LLC from Audax Private Equity for USD 912.5 million. CorEvitas is a leading provider of regulatoryally validated, realworld evidence for approved medical treatments and therapy.

- Report ID: 4851

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Culture Tests Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.