Blastomycosis Treatment Market Outlook:

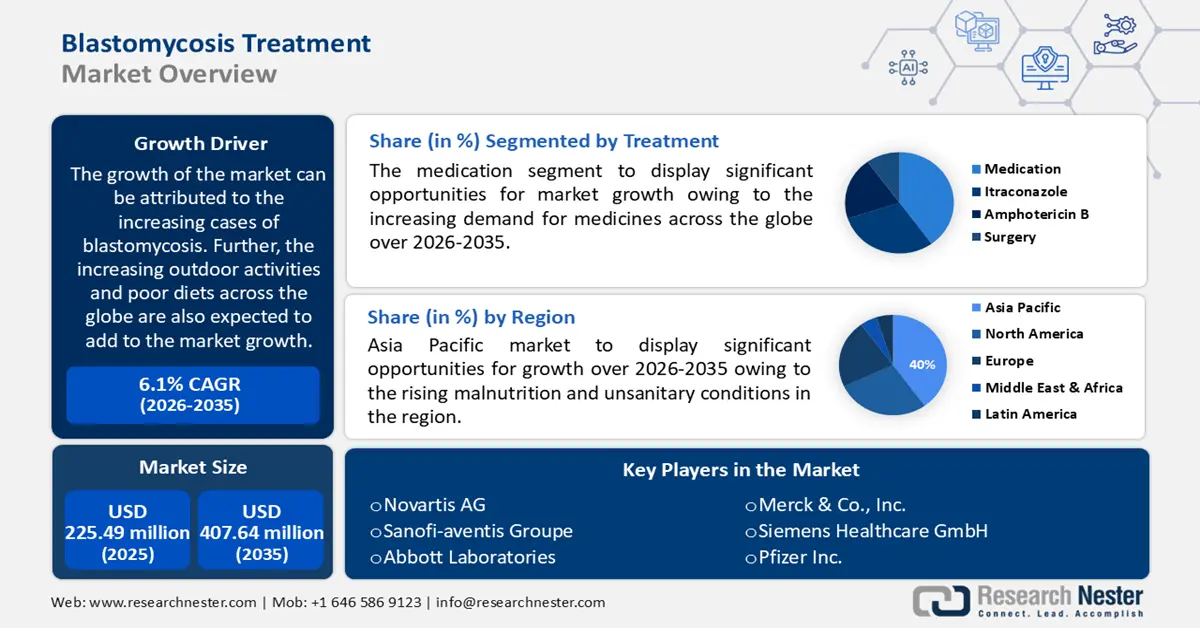

Blastomycosis Treatment Market size was valued at USD 225.49 million in 2025 and is likely to cross USD 407.64 million by 2035, registering more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blastomycosis treatment is assessed at USD 237.87 million.

The growth of the market can be attributed to the increasing cases of blastomycosis. Further, the increasing outdoor activities and poor diets across the globe are also expected to add to the market growth. For instance, the majority of blastomycosis cases are linked to exposure to soil-borne fungus in the summer. As of 2021, more than 80 cases of blastomycosis infections were reported in Minnesota.

In addition to these, factors that are believed to fuel the market growth of blastomycosis treatment include the rise in poor lifestyles. For instance, urban living contributes to dietary issues including the use of fast food and unhealthy meals, which results in a poor immune system. A weak immune system is more likely to get infected with blastomycosis and other diseases, which in turn is predicted to present the potential for market expansion over the projected period.

Key Blastomycosis Treatment Market Insights Summary:

Regional Highlights:

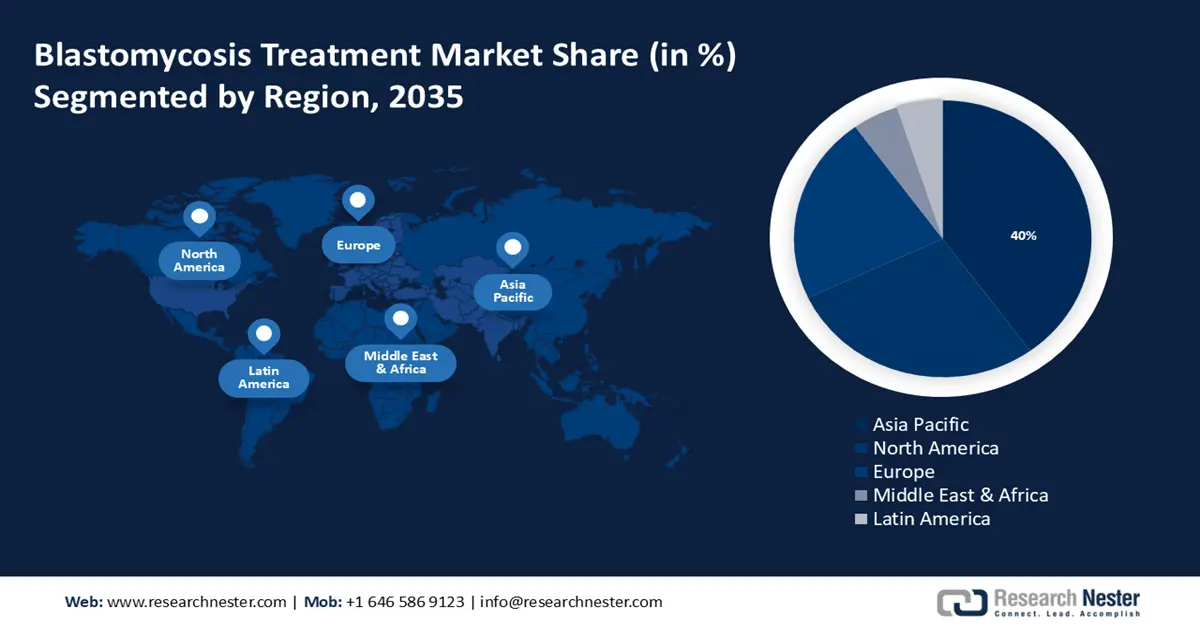

- Asia Pacific blastomycosis treatment market will hold around 40% share by 2035, fueled by rising malnutrition, unsanitary conditions, and a growing healthcare sector.

- North America market will register the highest CAGR during 2026-2035, attributed to the increased frequency of fungal infections, especially in the US and Canada.

Segment Insights:

- The hospital segment in the blastomycosis treatment market is expected to maintain a significant share by 2035, driven by the convenience of hospital-based treatment and access to prescription antifungal drugs.

- The medication segment in the blastomycosis treatment market is set to hold the largest share by 2035, influenced by the increasing demand for antifungal medications like itraconazole and amphotericin B.

Key Growth Trends:

- Growing Population of Immunocompromised Patients

- Rising Geriatric Population

Major Challenges:

- Diagnoses of Blastomycosis can be Challenging

- Growing Availability of Generic Medicines in the Market

Key Players: Emcure Pharmaceuticals Limited, Viatris Inc., Hindustan Antibiotics Limited, Sun Pharmaceutical Industries Ltd., Novartis AG, Sanofi-aventis Groupe, Abbott Laboratories, Merck & Co., Inc., Siemens Healthcare GmbH, Pfizer Inc.

Global Blastomycosis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 225.49 million

- 2026 Market Size: USD 237.87 million

- Projected Market Size: USD 407.64 million by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Blastomycosis Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Population of Immunocompromised Patients – On account of the increasing immunodeficiencies, and malnutrition the market is expected to expand more in the upcoming years. Further, patients with weakened immune systems are more vulnerable to bacterial, fungal, viral, and parasitic illnesses. According to estimates, there are over 9 million immunocompromised individuals in the US, which is more than 3% of the total population.

-

Rising Geriatric Population – The elderly population is more prone to fungal infections owing to a weakened immune system is estimated to drive market growth. As of 2050, the number of individuals over 60 in the world is expected increase by over 2 billion.

-

Increasing Health Care Spending – According to the most recent expenditure data, U.S. health care spending increased by over 2% in 2021. It is predicted that this boom would continue over the forecast period.

-

Growing Prevalence of Malnutrition – It is expected that rising poverty is anticipated to drive the incidence of malnutrition which is further expected to propel the market growth. The World Health Organization (WHO) estimates that undernutrition accounts for over 45% of child mortality in low- and middle-income countries.

Challenges

-

Diagnoses of Blastomycosis can be Challenging - The increasing concern amongst individuals for the difficulty associated with the diagnosis is one of the major factors predicted to slow down the market growth. For instance, the position of radiographic findings in pulmonary blastomycosis might vary, which can result in an inaccurate diagnosis.

-

Growing Availability of Generic Medicines in the Market

-

Exorbitant Cost of Treatment

Blastomycosis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 225.49 million |

|

Forecast Year Market Size (2035) |

USD 407.64 million |

|

Regional Scope |

|

Blastomycosis Treatment Market Segmentation:

Treatment Segment Analysis

The global blastomycosis treatment market is segmented and analyzed for demand and supply by treatment into medication (itraconazole, amphotericin B, and others), and surgery. Out of the two, the medication segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing demand for medicines across the globe. Medical treatment for blastomycosis is done with antifungal drugs which often last for at least six months. Doctors commonly utilize itraconazole to treat mild to moderate blastomycosis, which is given 200 mg orally once or twice a day and is considered an effective treatment for immunocompetent people. Amphotericin B is generally advised for severe blastomycosis in the lungs or infections that have progressed to other body regions. Moreover, it is the only medication authorized to treat blastomycosis in expectant women. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years. Also, The growth of the segment can be attributed to the growing spending for medicines across the globe. In the United States, total prescription medication spending increased by more than 4% in 2019.

End-user Segment Analysis

The global blastomycosis treatment market is also segmented and analyzed for demand and supply by end-user into hospital, pharmacy, and others. Amongst these three segments, the hospital segment is expected to garner a significant share. Patients suffering from blastomycosis often visit hospitals for treatment, and it’s easier and more convenient for them to take follow-ups to check for reinfection by the fungus. In addition, the diagnosis of the disease must be identified with a high level of clinical suspicion, which is not possible at home. Further, most blastomycosis patients require therapy with prescription antifungal drugs, which are easily available in hospitals, all these factors are expected to boost the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Anatomy |

|

|

By Treatment |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blastomycosis Treatment Market Regional Analysis:

APAC MMarket Insights

Asia Pacific industry is predicted to dominate majority revenue share of 40% by 2035. The growth of the market can be attributed to rising malnutrition and unsanitary conditions in this region. For instance, India continues to have one of the highest rates of child malnutrition worldwide. Malnutrition may result from an energy shortfall or a lack of certain micronutrients, it alters the immune system in several ways by raising virus sensitivity and suppressing immunological responses. Poor immunity as a result makes a person more susceptible to illnesses such as blastomycosis, which in turn is expected lead to an increase in demand for treatments of such illnesses in the region. In addition, the region's expanding healthcare industry and economic growth are also anticipated to boost the market growth during the forecast period. Over 3 million children in India are undernourished, with more than half of them classified as seriously undernourished.

North American Market Insights

The North American blastomycosis treatment market, amongst the market in all the other regions, is projected to grow with the highest CAGR during the forecast period. The growth of the market can be attributed majorly to the increased frequency of various fungal infections including blastomycosis. For instance, the majority of instances take place in Canada and the US. Moreover, Wisconsin possibly has the highest prevalence of blastomycosis of any state, which has increased the need for treatment in the region. Further, these fungi have spread more widely throughout the United States as a result of several causes, such as travel-related exposure, anthropogenic climate change, and changing land development methods. In addition, the increasing concern towards health is also anticipated to boost the market growth during the forecast period. According to the statistics provided by the U.S. Centers for Disease Control and Prevention (CDC), the prevalence of blastomycosis varies by location and can reach over 20 cases per 100,000 people in various areas of the United States.

Europe Market Insights

Europe region is projected to observe substantial growth through 2035. The growth of the market can be attributed majorly to the increasingly sedentary lifestyle of individuals in this region. For instance, the EU has a high prevalence of sedentary lifestyles, which is mostly owing to the rising consumption of unhealthy foods. Consumption of unhealthy food leads to various nutritional deficiencies in the body. Moreover, the deficiency may impair the immune system, increasing the risk of blastomycosis among the local population, which is anticipated to boost market growth during the forecast period in this region.

Blastomycosis Treatment Market Players:

- Emcure Pharmaceuticals Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Viatris Inc.

- Hindustan Antibiotics Limited

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- Sanofi-aventis Groupe

- Abbott Laboratories

- Merck & Co., Inc.

- Siemens Healthcare GmbH

- Pfizer Inc.

Recent Developments

-

Viatris Inc. acquired Oyster Point Pharma and Famy Life Sciences, to establish a franchise for ophthalmology.

-

Sun Pharmaceutical Industries Ltd. obtained US FDA clearance for Amphotericin B injection. Further, Amphotericin B is an antifungal drug used to treat leishmaniasis and severe fungal infections, such as mucormycosis, aspergillosis, blastomycosis, candidiasis, coccidioidomycosis, and cryptococcosis.

- Report ID: 3667

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blastomycosis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.