Automotive NVH Materials Market Outlook:

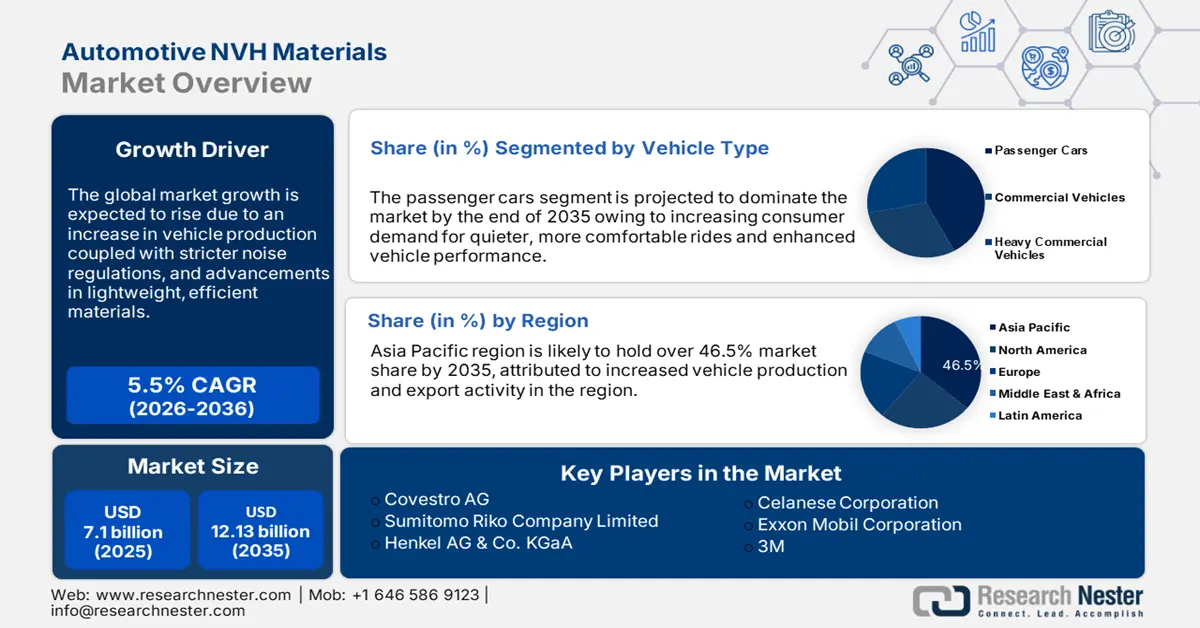

Automotive NVH Materials Market size was valued at USD 7.1 Billion in 2025 and is set to exceed USD 12.13 Billion by 2035, expanding at over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive NVH materials is estimated at USD 7.45 Billion.

The growth of the market can be attributed to the rapid growth in the automotive industry worldwide. For instance, the global automotive industry is expected to reach approximately USD 9 trillion by 2030. Further, the significantly rising production and use of heavy commercial vehicles is another key factor that is anticipated to fuel the market growth during the projected time frame.

In addition to these, factors that are believed to fuel the market growth of automotive NVH materials include the rising demand for these materials on the back of their outstanding properties including lightweight and comprising exceptional diesel, water, and oil resistance. Besides this, the increasing demand for hybrid and fuel-efficient vehicles is another major factor to drive the market expansion over the forecast period. For instance, approximately 280,500 hybrid and plug-in hybrid electric vehicles were sold in the United States between April and June 2022. Noise, vibration, and harshness in automobiles, especially in light vehicles, caused by structure-borne and air-borne noises, can be uncomfortable for passengers and reduce vehicle durability. Thus, the use of NVH reduction materials in vehicles assists in the elimination of such noises and the enhancement of ride quality. Moreover, with rapid urbanization, the demand for vehicles has increased considerably, which is also projected to boost the market growth over the projected time frame.

Key Automotive NVH Materials Market Insights Summary:

Regional Highlights:

- Asia Pacific automotive NVH materials market will dominate over 46.5% share by 2035, attributed to increased vehicle production and export activity in the region.

- North America market will register notable CAGR during 2026-2035, driven by rising EV adoption and increased automobile production.

Segment Insights:

- The insulation segment in the automotive nvh materials market is anticipated to achieve a notable CAGR over 2026-2035, fueled by rising demand for noise insulation solutions in automotive NVH applications.

- The passenger cars segment in the automotive NVH materials market is anticipated to hold the largest share by 2035, driven by the global rise in passenger car sales and production, supported by improving living standards and urbanization.

Key Growth Trends:

- Growth in Production of Heavy Vehicles

- Increased Demand and Production of Vehicles

Major Challenges:

- Stringent Government Rules Regarding Carbon Dioxide Emission

- Installation of Active Noise Cancellation Systems

Key Players: The Dow Chemical Company, Covestro AG, Sumitomo Riko Company Limited, Henkel AG & Co. KGaA, Celanese Corporation, Exxon Mobil Corporation, 3M, NVH KOREA INC., Huntsman International LLC, Solvay SA.

Global Automotive NVH Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.1 Billion

- 2026 Market Size: USD 7.45 Billion

- Projected Market Size: USD 12.13 Billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Automotive NVH Materials Market Growth Drivers and Challenges:

Growth Drivers

- Growth in Production of Heavy Vehicles – Heavy vehicles are being extensively produced owing to their benefits in transportation, driving for long kilometers, and many more. However, owing to its sturdy nature, heavy raw materials, and sturdy components, generate the need for automotive NVH materials for enhanced road performance. Thus, the increased production of heavy vehicles is expected to increase the utilization rate of global automotive NVH materials market in the forecast period. The latest report published in 2022 stated that the production of medium and heavy vehicles in North America increased by almost 5% over 2021.

- Increased Demand and Production of Vehicles – A surge in urbanization and increasing middle-class income resulted in an increased demand for vehicles that positively influenced the production of vehicles too. The latest reports released by the Organization of Motor Vehicle Manufacturers (OICA) stated that the global production of vehicles reached around 80 million units in 2021. That denotes a considerable rise from the year 2020, with 77 million vehicles.

- High Manufacturing Rate of Sports Cars – NVH materials are used extensively in luxury and sports cars, as required by the manufacturers. Therefore, the surging production of sports cars is another major factor that is anticipated to boost the global automotive NVH materials market over the forecast period. For instance, as per estimations, sports car sales are anticipated to reach more than 1,000.0K vehicles in the year 2027 across the globe.

- Growing Sales and Production of Electric Vehicles – For instance, in 2021, one out of every ten automobiles sold was an electric vehicle. Currently, there are more than 16 million electric vehicles on the road across the globe.

- Population Explosion with Middle Income - World Bank calculated the total population with middle income in the world to rose from 5.51 Billion in 2015 to 5.86 Billion in 2021.

Challenges

- Stringent Government Rules Regarding Carbon Dioxide Emission – An increased ratio of carbon emission has made the government of nations to impose strict regulations to lower it. Thus, several governments have taken steps by making rules to decrease carbon footprints. For instance, for model years 2023–2026 of passenger automobiles and light trucks, the Environmental Protection Agency of the U.S. (EPA) finalized new national greenhouse gas (GHG) emissions regulations in December 2021. The final guidelines would result in significant reductions in GHG emissions as well as other criterion pollutants.

- Installation of Active Noise Cancellation Systems

- Increase in Overall Vehicle Weight

Automotive NVH Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 7.1 Billion |

|

Forecast Year Market Size (2035) |

USD 12.13 Billion |

|

Regional Scope |

|

Automotive NVH Materials Market Segmentation:

Vehicle Type

The global automotive NVH materials market is segmented and analyzed for demand and supply by vehicle type into passenger cars, light commercial vehicles, heavy commercial vehicles, and others. Out of these segments, the passenger cars segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing sale, coupled with the surging production of passenger cars across the globe. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, 49 million new passenger cars were sold and 57 million passenger cars were produced throughout the world. Moreover, rising living standards in emerging nations, along with rapid urbanization is another significant factor that is projected to propel the market growth throughout the forecast period.

Application

The global automotive NVH materials market is also segmented and analyzed for demand and supply by application into absorption, insulation, and damping. Amongst these three segments, the absorption segment is expected to garner a significant share on the back of increasing utilization of acoustic absorption materials in the production of vehicles to minimize the transmission of noise. On the other hand, the insulation segment is projected to witness a notable growth rate during the forecast period, owing to the rising demand for insulation in NVH solutions.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive NVH Materials Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is likely to hold over 46.5% market share by 2035, attributed to increased vehicle production and export activity in the region. As per statistics released by the International Organization of Motor Vehicles, the total production of vehicles in the Asia Pacific expanded from the year 2020 with 44,276,549 units to 46,732,785 units in 2021. Similarly, the total sales in the region topped nearly 43,672,758 units in 2021, an upsurge from 40,322,544 in 2020. Further, the presence of major key players and leading exporters and importers of vehicles in the region is also expected to offer prominent opportunities for market growth in the forecast period. For instance, in 2021, China exported around 400,000 commercial vehicles and 2 million passenger vehicles.

North American Market Insights

Furthermore, the North America automotive NVH materials market is projected to display notable growth over the forecast period owing to the continuously surging automobile sector, coupled with increased production of vehicles in the region. For instance, in 2021, around 10 million vehicles were produced in the United States. In addition to this, the massive adoption of electric vehicles is another key factor that is anticipated to boost the market growth further throughout the forecast period in the region.

Automotive NVH Materials Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Covestro AG

- Sumitomo Riko Company Limited

- Henkel AG & Co. KGaA

- Celanese Corporation

- Exxon Mobil Corporation

- 3M

- NVH KOREA INC.

- Huntsman International LLC

- Solvay SA

Recent Developments

-

Celanese Corporation has decided to acquire a majority of DUPONT’S mobility and material business. The company will purchase a broad portfolio of engineered thermoplastics and elastomers, industry-renowned brands and intellectual property, global production assets, and a world-class organization.

-

Covestro AG along with SOL Kohlensäure has signed an agreement for biogenic carbon dioxide (COâ‚‚). This partnership is expected to help the company to switch to alternative raw materials.

- Report ID: 4495

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive NVH Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.