AI in Food and Beverages Market Outlook:

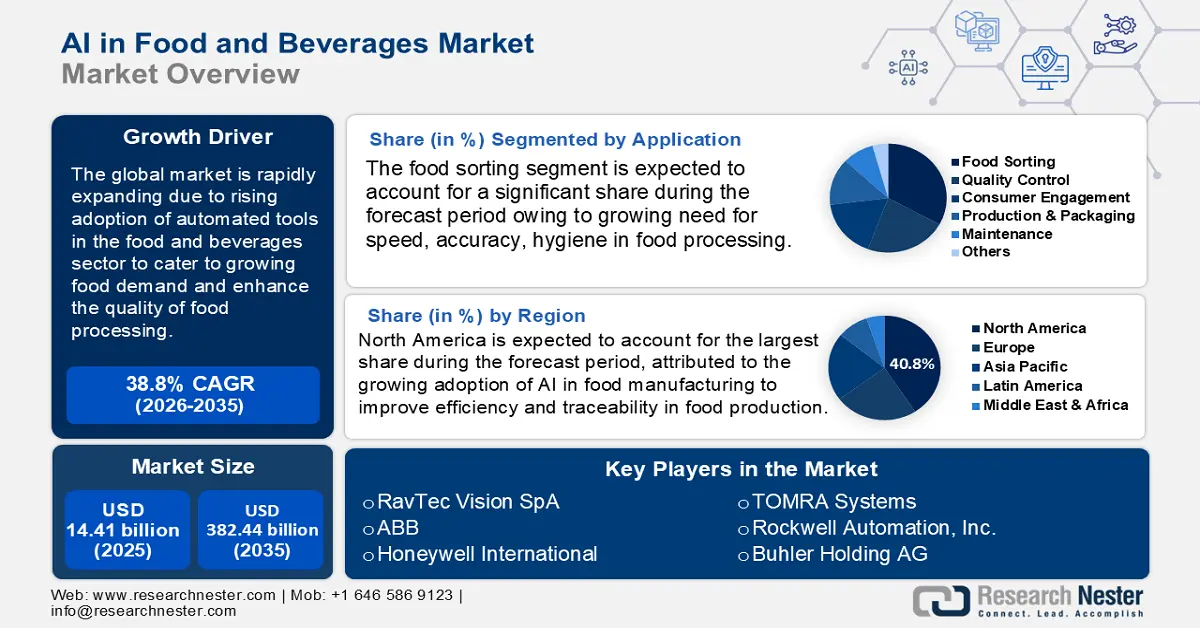

AI in Food and Beverages Market size was valued at USD 14.41 billion in 2025 and is expected to reach USD 382.44 billion by 2035, registering around 38.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of AI in food and beverages is assessed at USD 19.44 billion.

Globally, around 1.3 billion tons, which accounts for one-third of the total food prepared for human consumption, end up in landfills every year, as per the Food and Agriculture Organization (FAO). This underlying cause ranges from inefficient supply chain management, poor inventory planning, to a lack of cold storage management. Thus, integrating AI-driven food and beverage solutions into the food and beverage supply chain can provide a more precise data-driven approach to address these challenges. For instance, in December 2024, Trustwell announced the launch of a food product specification management solution, FoodLogiQ, and AI-driven real-time Embedded Analytics tools to streamline the food supply chain management. Moreover, it offers customizable templates, integrated workflows, and genesis foods integration, along with facility-level specification management to manage product specs efficiently and optimize the supply chain data.

Modern consumers, especially Gen Z and millennials, are drawn to personalized and unique taste experiences. They often prefer different flavors and are keen on experimenting with different brands and products. To cater to this, companies are leveraging AI to analyze vast databases from social media platforms, flavor ratings, and purchase behavior. With the help of AI, companies are able to create flavor profiles, aligning with emerging taste preferences. For instance, in September 2023, Coca-Cola launched Y3000 Zero Sugar, a limited-edition drink and human and AI co-created formulation, taking into consideration how fans envision the future through colors, emotions, flavors, and aspirations.

Key Artificial Intelligence (AI) In Food And Beverages Market Insights Summary:

Regional Highlights:

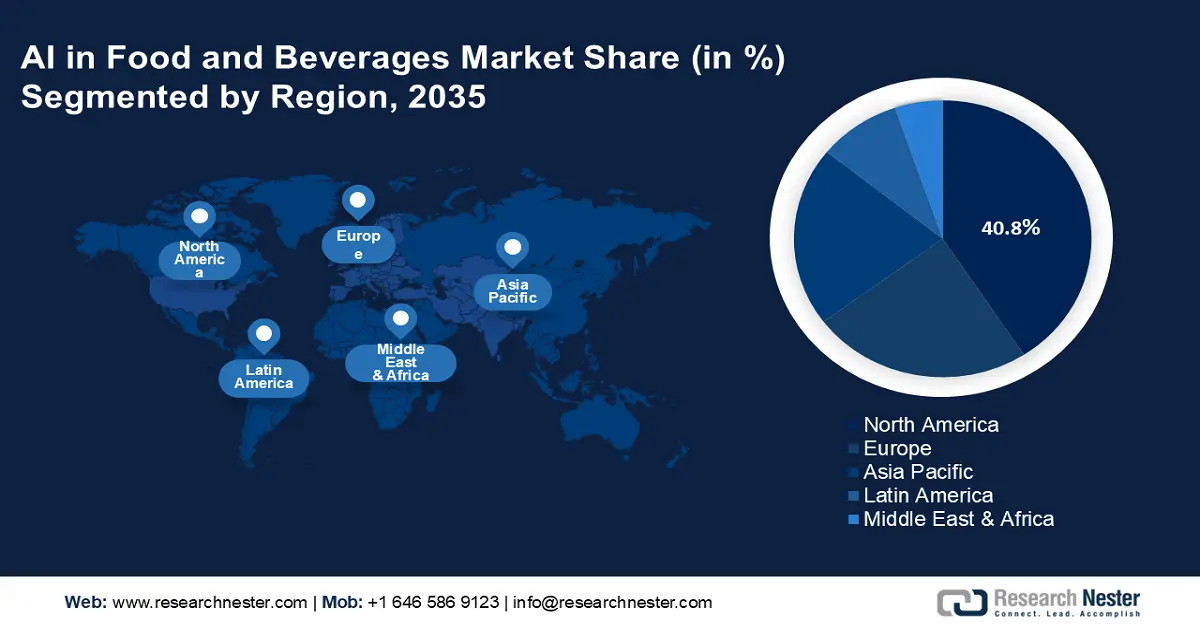

- North America AI in food and beverages market will hold around 40.8% share by 2035, driven by growing adoption of AI in food manufacturing for efficiency and traceability, and national initiatives to reduce food waste.

- Asia Pacific market will grow rapidly by 2035, driven by changing diets, high scope for product innovation, and AI-driven customization in food processes.

Segment Insights:

- The food sorting segment in the ai in food and beverages market is set for significant share by 2035, influenced by the growing need for speed, accuracy, and hygiene in food processing.

- The grocery segment in the ai in food and beverages market is set for rapid growth from 2026-2035, driven by the adoption of AI-based tools for demand forecasting, inventory optimization, and waste reduction.

Key Growth Trends:

- Use of AI to reduce F&B product launch risks

- Rising labor costs and shortage of skilled professionals

Major Challenges:

- High cost required for upgrading machines

Key Players: Rockwell Automation, Inc, Raytec Vision SpA, ABB Ltd, Honeywell International, Inc, Duravant LLC, TOMRA Systems.

Global Artificial Intelligence (AI) In Food And Beverages Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.41 billion

- 2026 Market Size: USD 19.44 billion

- Projected Market Size: USD 382.44 billion by 2035

- Growth Forecasts: 38.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

AI in Food and Beverages Market Growth Drivers and Challenges:

Growth Drivers

-

Use of AI to reduce F&B product launch risks: The continuous demand for different types of food and beverages across the globe encourages the food industry to develop novel products, meet consumer expectations, and achieve commercial success. Several companies are leveraging advanced AI tools and software to access predictive analysis and consumer feedback simulations, which can assist them in making data-driven decisions. One such product to reduce the risk of food and beverage product launch was the introduction of Launch AI by Nordic tech company, Cambri, in September 2023. This product is designed to provide companies with predictions and advice for new product developments (NPDs). Some of the key features of this product include predictive analysis, strategic recommendations, and collaborations with key industry players.

- Rising labor costs and shortage of skilled professionals: One of the biggest challenges that the food and beverages sector is currently facing is the escalating labor costs and a shortage of skilled professionals in services such as logistics, manufacturing, and customer services, where tasks are repetitive, time sensitive, and prone to errors. However, the use of AI and automation for these processes can help companies to stay resilient in the face of workforce instability. In April 2025, Mattson launched Chef Insights AI and ProtoThink Foodservice AI to address the challenges associated with labor shortage and the need for skilled professionals in the foodservice sector. These tools offer over 40 chef personas, each backed with decades of experience in several food service segments.

Challenges

-

High cost required for upgrading machines: Though automation in food processing and manufacturing enhances productivity and efficiency, the overall costs of these machines can he extraordinary. Apart from the high upfront investments required for AI infrastructure and tools, small and mid-sized companies and factories might face issues with the constant upgradation of software and hardware, cloud infrastructure, and hiring specialized talent for data science and machine learning tasks.

AI in Food and Beverages Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

38.8% |

|

Base Year Market Size (2025) |

USD 14.41 billion |

|

Forecast Year Market Size (2035) |

USD 382.44 billion |

|

Regional Scope |

|

AI in Food and Beverages Market Segmentation:

Application Segment Analysis

The food sorting segment is expected to account for a significant artificial intelligence (AI) in food and beverages market share between 2026 and 2035. This growth can be attributed to the growing need for speed, accuracy, and hygiene in food processing. The AI-powered sensors and software help to sort food items and beverages based on size, color, deformities, ripeness, or contamination. Several food and beverage industries are investing in AI-based models for sorting food to increase the yield and throughput, enhance product quality, and reduce food wastage. In January 2024, Tomra Solutions launched two revolutionary AI-powered sorting and grading solutions. The products are expected to make the production of fresh and processed foods more efficient.

End use Segment Analysis

The grocery segment is likely to register rapid revenue CAGR during the forecast period, owing to increasing adoption of AI-based tools and software for demand forecasting and inventory optimization, rising preference for customized products and services, and growing focus on waste reduction and sustainability. Moreover, as the labor costs are rising, many grocery stores are relying on automated machines and self-checkouts. These retailers are adopting AI-enabled smart carts, equipped with sensors and AI algorithms to assist customers with precise product information, personalized recommendations, and seamless checkout processes.

Our in-depth analysis of the global AI in Food and Beverages market includes the following segments:

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI in Food and Beverages Market Regional Analysis:

North America Market Insights

The AI in food and beverages market in North America is expected to account for the largest share of 40.8% during the forecast period, attributed to the growing adoption of AI in food manufacturing to improve efficiency and traceability in food production and logistics, and the presence of key manufacturers and food and beverage industry giants. National initiatives to reduce food waste also play a key role in supporting the adoption of AI in food manufacturing sector.

In the U.S., the market is rapidly expanding due to rising labor shortage, particularly in food processing, packaging, and food services. AI-powered robotics helps in automating repetitive kitchen and packaging tasks. To cater to this issue, in April 2025, Restaurant technology developer Qu launched a smarter kitchen. This product has unique features such as energy intelligence, predictive maintenance, remote equipment control, and AI-powered forecasting to optimize staffing levels and reduce food wastage.

APAC Market Insights

The APAC artificial intelligence (AI) in food and beverages market is likely to expand at a rapid pace in the coming years due to changing diets and food choices, high scope for product innovation, and AI-driven customization. Moreover, rising online grocery and food delivery services, high adoption of advanced tools and automation in food processes for better traceability, quality control and real-time monitoring are expected to fuel market growth going ahead. One of the notable investments in this sector is SoftBank Robotics Corp. and Yo-Kai Express’ initiative to take over autonomous cooking robots in Japan. The company announced that from April 2024, the company will take over the distribution of autonomous cooking robots under Cheffy’s name.

The market in India is expected to register robust growth during the forecast period, owing to rising demand for advanced tools to cater to the continuous food demand and enhance the efficiency of supply chain. Several food delivery partners such as Zomato and Swiggy are leveraging AI-driven recommendations to analyze customer behavior and offer them customized menu suggestions and promotions.

AI in Food and Beverages Market Players:

- Rockwell Automation, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Raytec Vision SpA

- ABB Ltd.

- Honeywell International, Inc.

- Duravant LLC

- TOMRA Systems

- GREEFA

- Sesotec GmbH

- Martec Of Whitwell Ltd.

- Buhler Holding AG

The AI in food and beverages market is highly competitive, comprising key players operating at global and regional levels. These key players are focused on investing in R&D activities and strategic alliances, such as product launches, mergers and acquisitions, license agreements, and joint ventures to cater to rising demand for food and beverages and changing consumer expectations. Here is a list of key players operating in the global market:

Recent Developments

- In January 2025, Agilitas announced the launch of its AI-first platform to transform the food and beverage formulation. The product consists of off-the-shelf LLMs such as Claude, OpenAI, and Llama, along with proprietary ingredients and formula datasets. As per the company, the platform can accelerate the production formulation by 100x.

- In October 2024, Symrise unveiled its predictive tool, Symvision AI, which enables food and beverage manufacturers to innovate their products, providing them with recent trends of flavors, ingredients and taste preferences.

- Report ID: 2033

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Artificial Intelligence (AI) In Food And Beverages Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.