Anticoagulants Market Outlook:

Anticoagulants Market size was valued at USD 39.85 billion in 2025 and is expected to reach USD 93.48 billion by 2035, registering around 8.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anticoagulants is evaluated at USD 43.04 billion.

These blood thinners are widely prescribed to patients, who are highly prone to developing cardiovascular diseases (CVDs). The contribution of these drugs in preventing strokes, heart attacks, and deep vein thrombosis (DVT) is driving demand for them. Thus, the magnifying population of such residents all over the world is fueling the anticoagulants market. According to the World Heart Federation, CVD took over 20.5 million lives worldwide in 2021, accounting for 33.3% of the total death incidences across the globe. Thus, various healthcare organizations are increasingly investing in solutions that can decrease the rate of mortality and improve quality of life.

Further, the rising prevalence of clotting disorders, such as deep vein thrombosis, pulmonary embolism, and atrial fibrillation, is one of the major reasons behind its significant use. The worldwide business of this medicine is booming, as a result of its wide utility in treating chronic conditions in older adults, particularly during surgical interventions. This is pushing various pharmaceutical marketplaces to fetch reliable supply channels for large-scale medicine production. In this regard, OEC reported that the global trade of therapeutic heparin, an injectable anticoagulant, was valued at USD 4.6 billion in 2023. This showcases the steady flow of business in this category.

Import-Export Dataset for Therapeutic Heparin (2023)

|

Country |

Import (USD, million) |

Export (USD, million) |

|

U.S. |

402.0 |

682.0 |

|

Singapore |

536.0 |

631.0 |

|

France |

915.0 |

605.0 |

|

Spain |

363.0 |

376.0 |

Source: 2023 OEC Report

Key Anticoagulants Market Insights Summary:

Regional Highlights:

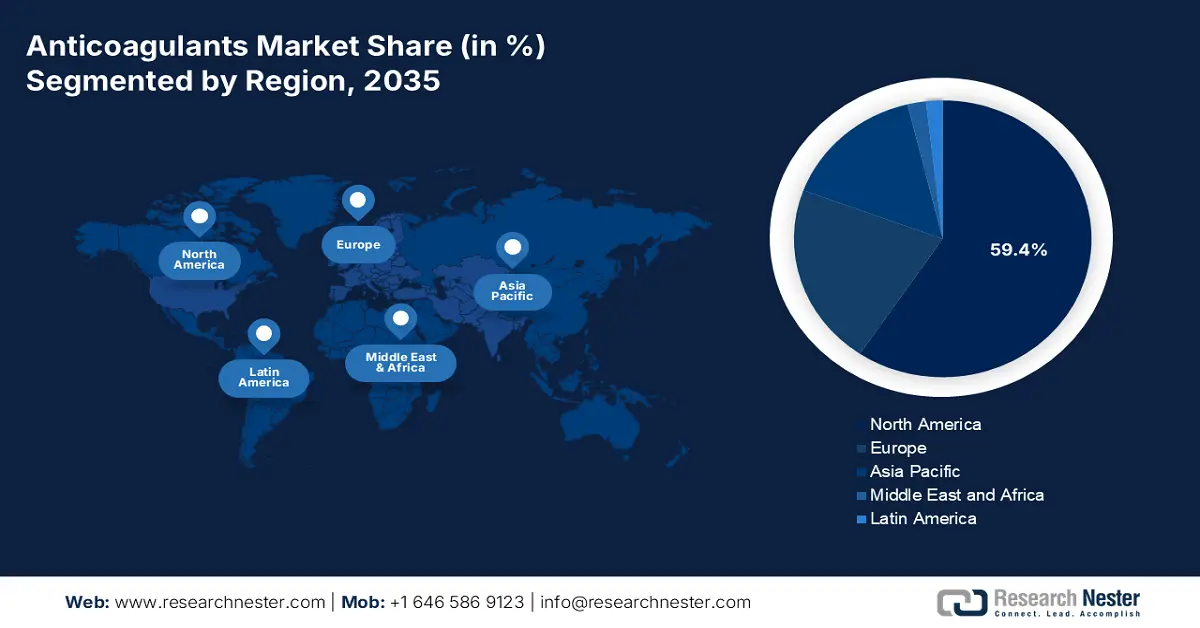

- North America commands a 59.4% share of the Anticoagulants Market, driven by well-established medical infrastructure and large patient pools with heart diseases, supporting sustained growth through 2026–2035.

- The Anticoagulants Market in Asia Pacific is projected to experience the fastest growth by 2035, attributed to heightened cardiovascular mortality and pharmaceutical advancements.

Segment Insights:

- The Pulmonary Embolism segment is forecasted to capture 77.6% market share by 2035, propelled by the high prevalence and mortality rates associated with pulmonary embolism.

Key Growth Trends:

- Growing awareness about early intervention

- Improved drug actions and effectiveness

Major Challenges:

- Frequent adverse events and adherence concerns

- Competition with generic and safer alternatives

- Key Players: Johnson & Johnson, Bristol-Myers Squibb Company, Bayer AG, Boehringer Ingelheim GmbH, Aspen Holdings, GlaxoSmithKline Plc, Pfizer Inc., Sanofi S.A., Portola Pharmaceuticals.

Global Anticoagulants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.85 billion

- 2026 Market Size: USD 43.04 billion

- Projected Market Size: USD 93.48 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (59.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Anticoagulants Market Growth Drivers and Challenges:

Growth Drivers

- Growing awareness about early intervention: The wide adoption in the anticoagulants market is majorly increasing for the therapeutic use of these drugs in blood clot prevention. There is a heightened risk of life-threatening fatalities from heart attack and stroke in COVID-19 Patients, which pushes professionals to prescribe blood thinning medicines. According to the American Heart Association report, published in September 2022, after 27-49 weeks of the first COVID diagnosis, the risk of arterial clots has been found to show a 30.0% increment. These clots in veins further result in developing deep vein thrombosis and pulmonary embolism. Such findings help people to be prepared for prior prevention, creating a new era of business in this field.

- Improved drug actions and effectiveness: Continuous pharmaceutical advances are introducing new path administrations, offering faster action and convenient intake. For instance, in July 2022, Apotex launched oral blood thinner, APO-Apixaban tablets, as an accessible alternative to Eliquis in Canada. The product line contains a range of dose amounts and packaging sizes: available in 2.5 mg & 5 mg tablets and 60, 180 & 500 BTL packaging variations. These innovations are further bolstering the anticoagulants market by attracting a wider base of consumers, expanding product availability, and availing diverse options.

Challenges

- Frequent adverse events and adherence concerns: Novel drugs, available in the anticoagulants market often carry a risk of heavy bleeding. The critical issue between efficacy and safety creates hesitation among both consumers and healthcare professionals in prescribing these medicines. In addition, the necessity of consistent patient adherence to dosing schedules requires regular monitoring, which may hinder long-term use and wide adoption due to additional expenses.

- Competition with generic and safer alternatives: Patent expiration and history of side-effects conjugately impact profitability in the anticoagulants market. The entry of generic versions into the distribution channels results in price erosion and brand-value reduction. On the other hand, the dosing complexity and monitoring cost may shift consumer loyalty toward these therapeutics, as they opt for safer and simpler alternatives, diluting the interest in further research.

Anticoagulants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 39.85 billion |

|

Forecast Year Market Size (2035) |

USD 93.48 billion |

|

Regional Scope |

|

Anticoagulants Market Segmentation:

Indicated Disease (Pulmonary Embolism (PE), Deep Vein Thrombosis (DVT), Atrial Fibrillation, Heart Attacks, Others)

Pulmonary embolism (PE) segment is expected to hold anticoagulants market share of more than 77.6% by 2035. There is a close association of this disease with deep vein thrombosis (DVT), which is a highly occurrent cause of demise across the globe. According to an NLM article, published in January 2023, the rate of reappearance was concluded to be as high as 25.0% worldwide, where the rate of mortality among residents with pulmonary embolism is 12.0%. On the other hand, PE prevalence was found to be 11.0% in acute exacerbation of chronic obstructive pulmonary disease (AECOPD) patients, as per a 2022 Frontiers study. These figures indicate a large and continuously growing consumer base for this segment, embarking on its strong dominance.

Region-wise Prevalence of PE (2022)

|

Region |

Prevalence (in %) |

|

Europe |

12.0 |

|

South-East Asia |

2.0 |

|

Western Pacific |

7.0 |

|

Eastern Mediterranean |

16.0 |

Source: 2022 Frontiers Article

Administration Route (Oral, Injectable)

Based on administration routes, the oral segment is predicted to capture a noteworthy share in the anticoagulants market throughout the forecasted timeframe. This form of AC medicines encompasses a wide spectrum of advantages over injectables, such as ease of consumption and fewer dietary restrictions. These features make direct oral administration the primary segment of interest and an attractive aspect for drug producers. According to an NLM article, the solid oral medicine industry was estimated to be at USD 550.0 million in 2022. It also stated that 46.0% of the total FDA-approved modalities and applications were in the form of oral immediate-release products. Furthermore, recent discoveries in formulations and delivery systems are evolving efficacies of this route of administration.

Our in-depth analysis of the global anticoagulants market includes the following segments:

|

Indicated Disease |

|

|

Administration Route |

|

|

Drug Class |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anticoagulants Market Regional Analysis:

North America Market Analysis

North America in anticoagulants market is projected to capture over 59.4% revenue share by 2035. Well-versed and established medical infrastructure across this region is assuring easy access to these medications. This testifies to the growing demand and consumer engagement in this sector. This attracts foreign AC producers to engage their resources. For instance, in October 2022, Tiefenbacher Pharmaceuticals introduced an affordable and high-quality generic version of a blood thinner, Apixaban, in Canada. This OTC drug is highly effective in preventing DVT, PE, and VTE. In addition, the presence of large patient pools of heart failure (HF), CVD, and AF is fueling its proprietorship.

The U.S. anticoagulants market is ensuring a profitable business environment for both domestic and international leaders. In support of government initiatives and efforts to make life-saving treatment more publicly accessible, the field is achieving broad product reach. For instance, in August 2024, the U.S. Department of Health and Human Services established a Maximum Fair Price (MFP) for ELIQUIS (apixaban) under the terms of the Inflation Reduction Act (IRA). The upgraded payers’ pricing allocated Medicare coverage of USD 231.0 MFP over 30 days of ELIQUIS dosage. This government initiative also showcased a strong reimbursement policy, supporting wide adoption.

Canada presents a heightened demand in the anticoagulants market due to the rising occurrence of HF. Nationwide events of this condition require a consistent supply of blood thinners, fostering a reliable distribution channel for global leaders. Additionally, in May 2022, the Ministry of Health invested USD 5.0 million to establish a pan-Canadian national heart failure research network, bringing innovation to this field. Thus, companies are notably contributing to the improvement of the availability of this merchandise.

APAC Market Statistics

Asia Pacific is poised to register the fastest growth in the anticoagulants market over the forecasted timeline. This region’s progress is driven by two major factors such as heightened CVD mortality and pharmaceutical advancements. Particularly, the academic efforts to improve outcomes, in combating the omicron crisis, are encouraging more healthcare professionals to prescribe these medicines and drug developers to bring innovation in this sector. For instance, in January 2025, Glenmark Pharmaceuticals introduced a generic anticoagulant injectable emulsion of Phytonadione, available in 10 mg/mL single-dose vials.

India is emerging as a great hub for innovators to improve availability in the anticoagulants market. Various local pharmacology producers are now focusing on diversifying the existing product range by discovering new generic and oral alternatives. For instance, in August 2024, Alembic Pharmaceuticals achieved a milestone in commercializing its 110 mg Dabigatran Etexilate Capsules by attaining Abbreviated New Drug Application (ANDA) clearance from the FDA. This orally administrated treatment is indicated to treat DVT and PE, which usually occur after hip replacement surgeries. Such recognition inspires other pharmaceutical giants to invest in this cohort.

China is internationally leading as one of the biggest manufacturers and developers in the anticoagulants market. This is testified by the global trade of related essentials that originated from this country. In this regard, OEC reported that China occupied the 1st rank in exporting heparin slats, which are clinically used to prevent blood clots, with a value of USD 795.0 million in 2023. In addition, the rising occurrence of pulmonary embolism across the country is creating a surge in this field. For instance, in 2021, the National Hospital Quality Monitoring System (HQMS) observed 200,112 new and 14,123 death incidences in 5101 hospitals in China. It showcases incidence and mortality rates of 14.19 per 100,000 and 1.00 per 100,000 respectively.

Key Anticoagulants Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Bayer AG

- Boehringer Ingelheim GmbH

- Aspen Holdings

- GlaxoSmithKline Plc

- Pfizer Inc.

- Sanofi S.A.

- Portola Pharmaceuticals

- Cadrenal Therapeutics, Inc.

- Roche Holding AG

Considering the sudden boost in the anticoagulants market during the COVID-19 pandemic, consistent R&D activity is noticed among key players. They are putting efforts into improving generic availability to ensure optimum public access to treatment for related disorders. In addition, their innovations were also focused on bringing effective solutions for younger residents. For instance, in December 2021, Janssen Pharmaceutical Companies received approval from the FDA to market its oral VTE preventive and curative solution, XARELTO (rivaroxaban), for newborns and children aged up to 18 years. Similarly, in June 2021, Boehringer Ingelheim attained FDA clearance for VTE patients, aged between 3 months and 12 years. Such key players are:

Recent Developments

- In August 2024, Cadrenal Therapeutics released an announcement of developing a new-generation vitamin K antagonist (VKA), tecarfarin, to prevent blood clotting in cases of implanted cardiac devices or CVD. The oral and reversible blood thinning component was sent for clinical trials to be evaluated for use in lifelong anticoagulation (AC).

- In February 2024, Roche launched three new coagulation tests for oral Factor Xa inhibitors: apixaban, edoxaban, and rivaroxaban. This evaluation assists clinicians with making informed decisions while prescribing direct oral anticoagulants in countries that have given it CE mark clearance.

- Report ID: 7409

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anticoagulants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.