Antibiotics Market Outlook:

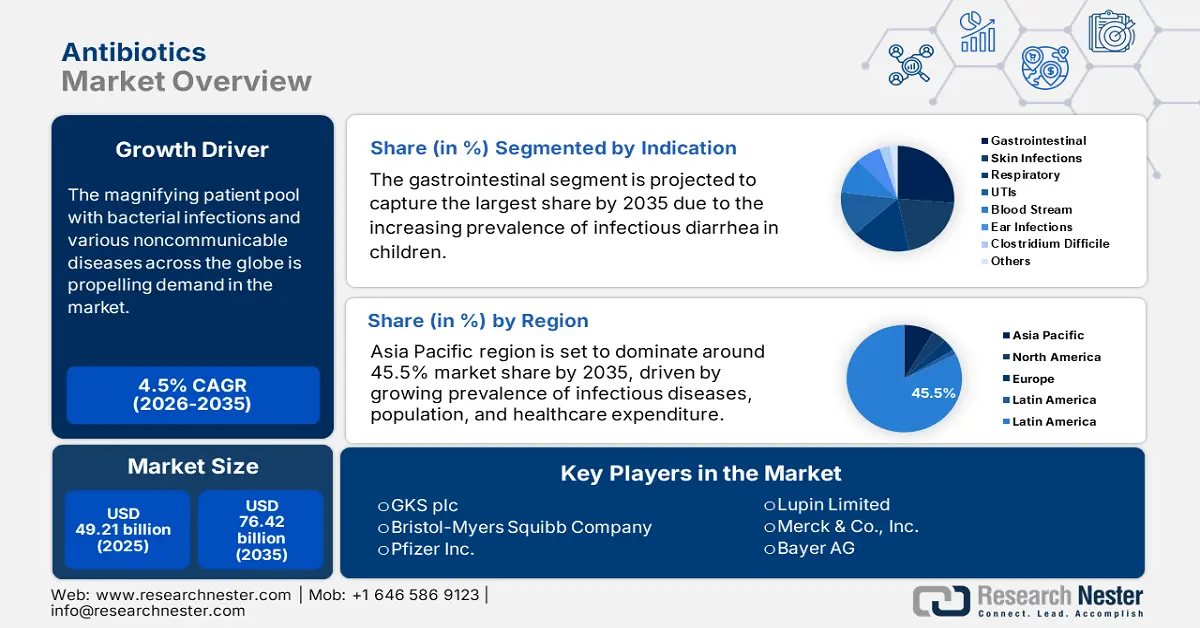

Antibiotics Market size was over USD 49.21 billion in 2025 and is anticipated to cross USD 76.42 billion by 2035, growing at more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antibiotics is assessed at USD 51.2 billion.

The growth of the market is primarily attributed to the worldwide growing prevalence of various communicable diseases, such as TB, HIV, and others. As per the World Health Organization (WHO) statistics, in 2020, an estimated 1.5 million (UI 1.0 to 2.0 million) people were infected with HIV for the first time. This brought the global HIV population to 38.4 million people by 2021.

Antibiotics are antibacterial compounds that are active against bacteria. It is the most common type of antibacterial agent used to treat bacterial infections. Antibiotic medications are commonly used to treat and prevent such infections. They either kill or inhibit bacterial growth. Such factor is leading up the growing consumption of various types of antibiotics across the globe. For instance, global antibiotic consumption rates surged by 47% between 2000 and 2018 (from 9.8 to 14.3 defined daily doses (DDD) per 1000 people per day).

Key Antibiotics Market Insights Summary:

Regional Highlights:

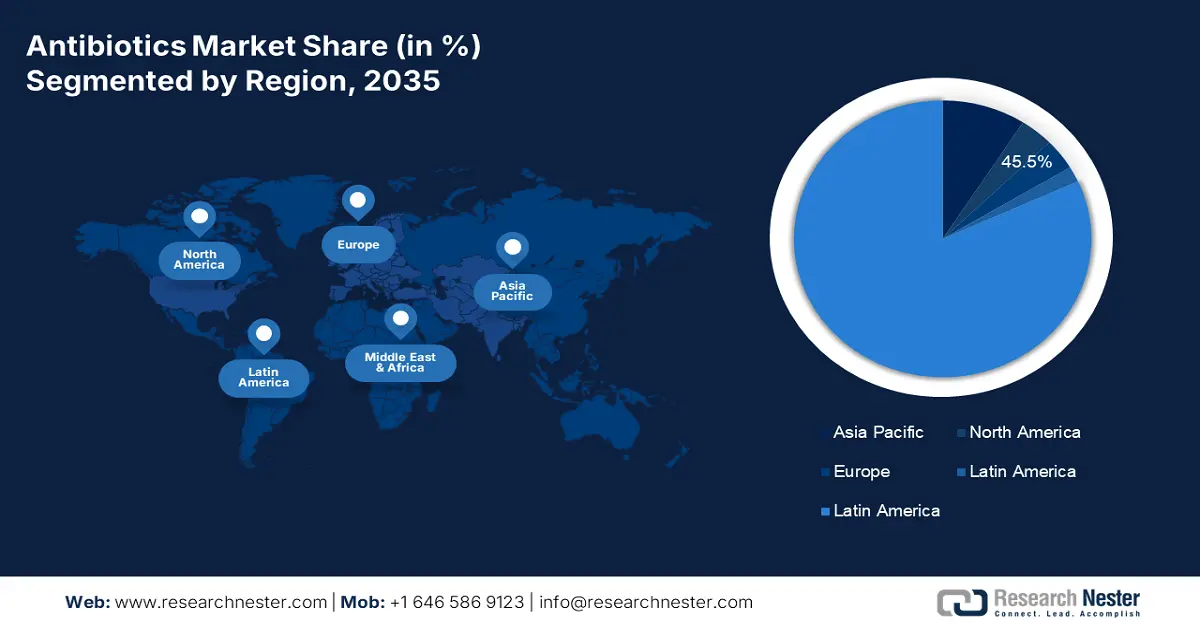

- The Asia Pacific antibiotics market is predicted to capture 45.5% share by 2035, driven by growing prevalence of infectious diseases, population, and healthcare expenditure.

Segment Insights:

- The gastrointestinal segment in the antibiotics market is expected to experience significant growth over the forecast period 2026-2035, influenced by the high global prevalence of acute infectious diarrhea in children.

Key Growth Trends:

- Surge in Drug Combinations Over Mono-Therapy

- Escalation in Urinary Tract Infections (UTIs)

Major Challenges:

- Side Effects Associated with Antibiotics

- Stringent Regulatory Procedures

Key Players: F. Hoffmann-La Roche Ltd., GlaxoSmithKline plc, Bristol-Myers Squibb Company, Teva Pharmaceuticals Industries Ltd., Pfizer Inc., Abbott Laboratories, Merck & Co., Inc., Lupin Limited, Melinta Therapeutics, LLC, Bayer AG.

Global Antibiotics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 49.21 billion

- 2026 Market Size: USD 51.2 billion

- Projected Market Size: USD 76.42 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Italy, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Antibiotics Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Respiratory Diseases - The respiratory system is a group of organs that regulates breathing. The lungs are the system's main organ, and it also consists of the pharynx, larynx, trachea, nasal tube, oral cavity, pharynx, and bronchi and bronchioles. Respiratory diseases are one of the leading causes of death worldwide. These diseases need a preferred dose of antibiotics to control the further spread of bacteria. Therefore, growing prevalence of respiratory diseases is fueling up the antibiotics market growth. As per the World Health Organization statistics, globally, nearly 262 million individuals have been suffering from asthma.

- Surge in Drug Combinations Over Mono-Therapy – It was observed in a clinical study that a database for antifungal therapy has nearly 5,517 medicines in 8,129 combinations that have been evaluated against 240 strains, yielding 491,126 samples.

- Escalation in Urinary Tract Infections (UTIs) – For instance, every year, more than 8 million patients with urinary tract infections (UTIs) seek medical treatment. About 61% of women and 13% of men are predicted to get at least one UTI in their lives.

- Boost in Global Burden of Bacterial Skin Diseases – Globally, the age-standardized estimated incidence of bacterial skin diseases was reached around 161 million for males and 133 million for females in 2019.

- Growing Number of Older-Aged Population - According to the statistics of World Health Organization, the global population of people aged 60 and up is projected to increase from 1 billion in 2020 to 1.4 billion by 2030.

Challenges

- Side Effects Associated with Antibiotics - Antibiotic side effects can include allergic reactions and severe, sometimes fatal diarrhea brought on by the bacterium Clostridium difficile (C. diff). Additionally, antibiotics may conflict with other medications.

- Stringent Regulatory Procedures

- Escalation in Antibiotic Resistance

Antibiotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 49.21 billion |

|

Forecast Year Market Size (2035) |

USD 76.42 billion |

|

Regional Scope |

|

Antibiotics Market Segmentation:

Indication Segment Analysis

The global antibiotics market is segmented and analyzed for demand and supply by indication into skin infections, respiratory, gastrointestinal, UTIs, blood stream, clostridium difficile, ear infections, and others. Out of these, the gastrointestinal segment is projected to significantly grow over the forecast period on the back of increasing prevalence of acute infectious diarrhea in children across the globe. For instance, acute infectious diarrhea is one of the most serious conditions in the world and is accountable for 1 million to 2.5 million deaths per year. Globally, more than 2 to 5 billion kids are affected every year.

Our in-depth analysis of the global market includes the following segments:

|

By Drug Class |

|

|

By Drug Origin |

|

|

By Spectrum of Activity |

|

|

By Indication |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antibiotics Market Regional Analysis:

APAC Market Insights

Asia Pacific region is set to dominate around 45.5% market share by 2035, driven by growing prevalence of infectious diseases, population, and healthcare expenditure. For instance, around 4.2 billion people, or 61% of the world's population, reside in the Asia Pacific region.

Antibiotics Market Players:

- F. Hoffmann-La Roche Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc

- Bristol-Myers Squibb Company

- Teva Pharmaceuticals Industries Ltd.

- Pfizer Inc.

- Abbott Laboratories

- Merck & Co., Inc.

- Lupin Limited

- Melinta Therapeutics, LLC

- Bayer AG

Recent Developments

-

GlaxoSmithKline plc and Spero Therapeutics have announced an exclusive license agreement for tebipenem pivoxil hydrobromide (tebipenem HBr), a late-stage antibiotic that is anticipated to be used to treat complex urinary tract infections. Its 3rd phase clinical trial is estimated to start in 2023.

-

Teva Pharmaceuticals Industries Ltd. announced the launch of its 250 mg and 500 mg strength generic Erythromycin tablets as a therapeutic equivalent to Arbor Pharmaceuticals' reference listed drug (RLD) Erythromycin Tablets. A variety of bacterial infections and rheumatic fever attacks are projected to be treated with these tablets in patients allergic to penicillin.

- Report ID: 4465

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antibiotics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.