Anti-Aging Drugs Market Outlook:

Anti-Aging Drugs Market size was valued at USD 52.27 billion in 2025 and is projected to reach USD 101.87 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of anti-aging drugs is estimated at USD 55.88 billion.

The anti-aging drugs market is aided by a rising patient population, mainly among people above the age of 65. According to the World Health Organization, the global population aged 60 and above is projected to increase to 2.1 billion by 2050. This shift is rising the clinical demand for therapeutic interventions overcoming the age-related chronic conditions, including neurodegeneration, metabolic diseases, and cardiovascular dysfunction, where senolytic and NAD+ modulators are providing therapeutic potential. On the supply chain side, the anti-aging drugs and their active pharmaceutical ingredients are actively increasing. Therapies related to anti-aging, including NAD+ precursors, rely on synthetic vitamins and some intermediates imported from East Asia, mainly in South Korea and China.

The anti-aging drugs market is clearly changing fast due to scientific advancement and consumer shifts. Meanwhile, billionaire venture capital is rapidly changing the market along with AI drug discovery. There are also advances in research on senolytics and gene therapies to reverse/repair age-related cellular degeneration. In the consumer market, both NAD+ infusions and NAD+ supplements are surging in wellness-type and among celebrity groups, with longer efficacy data not yet available. Overall, AI and biomarker assessments are enabling new data-driven, personalized interventions to measure & slow biological aging. Finally, on a geographical basis, growth in the Asia-Pacific region is accelerating with a rapid increase in research funding combined with an accelerating e-commerce distribution.

Key Anti-Aging Drugs Market Insights Summary:

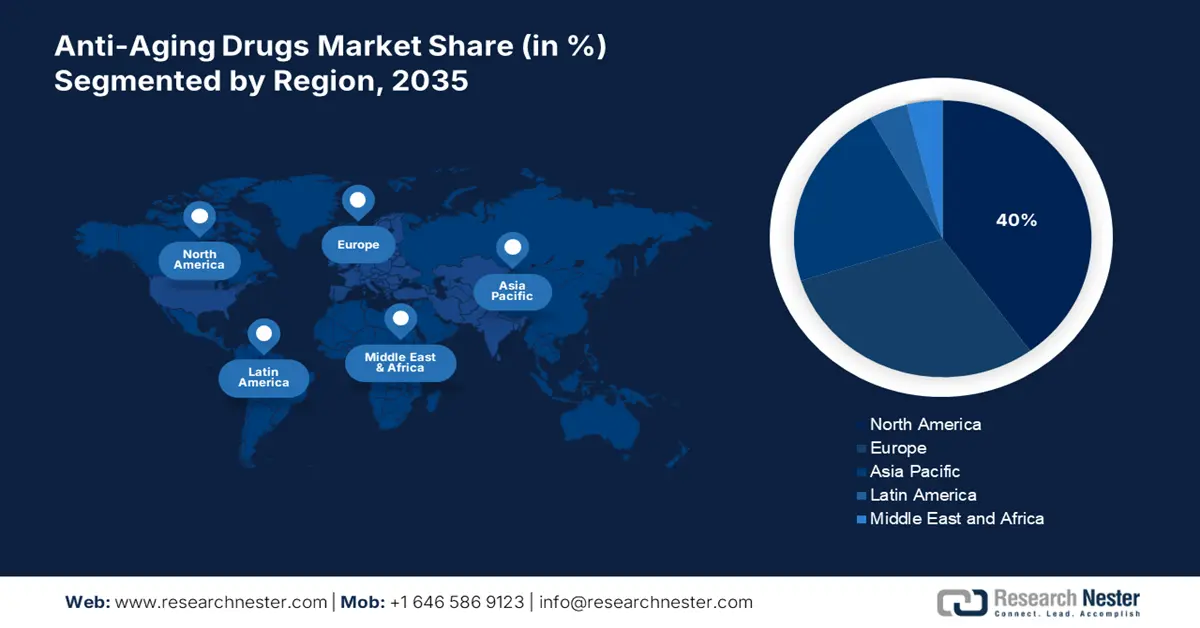

Regional Highlights:

- North America is projected to hold a 40% share in the anti-aging drugs market by 2035, driven by high federal healthcare expenditures, rising R&D intensity, supportive reimbursement systems, and advanced clinical infrastructure.

- Asia-Pacific is expected to be the fastest-growing region with a 21.8% share by 2035, fueled by improving life expectancy, urbanization, growing healthcare spending, and government support for anti-aging clinical trials and regional production.

Segment Insights:

- In the drug class segment, senolytics are forecast to secure the largest share of 32.8% by 2035, propelled by their potential to target senescent cells and retard age-related diseases.

- Within the mechanism of action segment, cellular senescence modulators are set to hold a 21.9% share by 2035, reinforced by their influence on biological aging pathways and preclinical evidence supporting regenerative capacity.

Key Growth Trends:

- Increase in patient volume and disease occurrence

- Manufacturers' strategies and innovations

Major Challenges:

- WHO guidelines limiting new therapies

- Consumer skepticism & misinformation

Key Players: L’Oréal S.A. (Active Cosmetics Division), Johnson & Johnson, Pfizer Inc., Bayer AG, GlaxoSmithKline (GSK), Novartis AG, Amorepacific Corporation, Rejuvenate Bio, Eisai Co., Ltd., Dr. Reddy's Laboratories, Calico Life Sciences (Alphabet Inc.), Evolus, Inc., Medytox, Inc., CSL Limited, Hims & Hers Health, Inc., Lupin Limited, Biocon Biologics, Forest Biosciences, Chugai Pharmaceutical Co., Ltd. (Roche Subsidiary).

Global Anti-Aging Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

Largest region: North America (40% share by 2035)

Fastest growing region: Asia-Pacific

Dominating countries: United states, Germany, Japan, United Kingdom, France

Emerging countries: China, South Korea, Italy, India, Australia

Last updated on : 11 September, 2025

Anti-Aging Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Increase in patient volume and disease occurrence: As per the Centers for Disease Control and Prevention, one in four persons (45 and older) report caring for someone with a cognitive impairment, and one in ten report experiencing deteriorating memory loss (also known as cognitive decline). Age-associated comorbidities, including sarcopenia, cognitive impairment, and cardiovascular decline, directly drive the demand for anti-aging drugs. This demographic trend highlights a long-term growth path for the industry, especially in public health programs focused on aging in certain geographies.

- Manufacturers' strategies and innovations: Major pharmaceutical companies are investing in next-gen biologics and small molecules, focusing on aging mechanisms. In April 2021, BioAge Labs introduced BGE-117, which is an inhibitor of hypoxia-inducible factor (HIF) for muscle maintenance in older patients, which is now in Phase 2 trials. Strategic partnerships, such as Juvenescence with AI drug discovery companies, are also an example of a pipeline acceleration trend. These initiatives represent a shift from cosmetic anti-aging to disease-modifying treatments, increasing the addressable anti-aging drugs market.

- Expansion of reimbursement and market penetration: Medicaid programs in 2024 have included certain anti-aging substances such as metformin and rapamycin analogs on chronic disease management formularies. Such policy reform increases access and drives prescription volumes. Germany's G-BA included NAD+ precursors for cognitive impairment in national reimbursement policies. Increased formulary inclusion across payers supports provider prescribing confidence as well as lowers out-of-pocket costs, ultimately promoting broader drug adoption.

Challenges

- WHO guidelines limiting new therapies: New anti-aging drugs often do not fall under the WHO's International Classification of Diseases (ICD-11), which prevents them from official disease recognition. In 2023, Unity Biotechnology's senotherapeutics did not meet the criteria for WHO code assignment, reducing the opportunities in government procurement. This keeps governments from adding such medicines to public health programs and disincentivizes the institutional uptake. Without ICD-11 coding, anti-aging drugs are not included in reimbursement systems and health insurance coding systems, which considerably limits anti-aging drugs market penetration. This regulatory uncertainty is a disadvantage in hospital formularies from taking such treatments, delaying widespread clinical integration.

- Consumer skepticism & misinformation: The anti-aging industry is usually muddied by hype and misrepresented claims, especially about supplements and wellness-type products. The distinction between legitimate drugs that have been proven scientifically and those that are nonsense fads can be foggy enough that consumers fail to make the distinction. This ultimately destroys trust and leaves individuals with a very skeptical eye towards any new therapies.

Global Share of Population Aged 65 and Above by Country and Region

|

Region / Country |

% of Population Age 65+ |

|

Japan |

28% |

|

Italy |

23% |

|

Finland |

~22% |

|

Portugal |

~22% |

|

Greece |

~22% |

|

Southern Europe (avg.) |

21% |

|

China |

12% |

|

United States |

16% |

|

India |

6% |

|

Nigeria |

3% |

Anti-Aging Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 52.27 billion |

|

Forecast Year Market Size (2035) |

USD 101.87 billion |

|

Regional Scope |

|

Anti-Aging Drugs Market Segmentation:

Drug Class Segment Analysis

Senolytics dominate the drug class segment and are projected to hold a share value of 32.8% by 2035. The segment is targeting senescent cell-killing drugs, and these drugs have the potential to retard age-related diseases such as osteoarthritis, fibrosis, and neurodegeneration. Senolytics such as Dasatinib and Quercetin are under Phase II/III clinical trials. Their capacity to regulate the inflammatory SASP is supported by preclinical data and growing regulatory traction. Senolytics are one of the most studied categories in longevity science. The expanding base of evidential support will propel their clinical development and anti-aging drugs market entry much faster than other emerging drug classes.

Mechanism of Action Segment Analysis

In the mechanism of action segment, cellular senescence modulators lead the segment and are likely to hold the share value of 21.9% by 2035. The segment is gaining traction as it influences the pathways related to biological aging. As per the NIA report, these interventions reduce the frailty and enhance the murine model’s regenerative capacity. The rising pool of NIH is supported by research in senescence biomarkers and intervention mechanisms, offering a strong foundation for drug development. These therapies further overcome the root cellular processes by providing higher patient compliance and long-term therapeutic value.

Distribution Channel Segment Analysis

Online pharmacies are expected to account for 19.6% of the anti-aging drugs market by 2035. The segment is driven by the increasing direct-to-consumer models and the trend towards more affordable longevity products. Further, FDA-regulated telehealth platforms have provided a secure online prescribing and distribution of anti-aging drugs, surging the digital health infrastructure. Online pharmacies provide a convenient option for consumers to buy anti-aging medications and supplements without setting foot into any pharmacy or health store. It is also advantageous because consumers can review and compare the products and prices from the comfort of their home.

Our in-depth analysis of the anti-aging drugs market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Mechanism of Action |

|

|

Distribution Channel |

|

|

Application |

|

|

Age Group |

|

|

Route of Administration |

|

|

Trade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-Aging Drugs Market - Regional Analysis

North America Market Insights

North America is dominating the anti-aging drugs market and is poised to hold a share of 40% at a CAGR of 13.8% by 2035. The region is driven by high federal healthcare expenditures, rising R&D intensity, and strong reimbursement systems. The U.S. Centers for Medicare & Medicaid Services forecast predicts that in 2023, U.S. health care spending increased by 7.5% to USD 4.9 trillion, or USD 14,570 per person. The region also benefits from advanced clinical infrastructure, increasing geriatric populations, and increasing direct-to-consumer digital pharmaceutical platforms. The area has supportive reimbursement plans, many clinical trials, and regulatory agencies that support new technologies and innovations. Additionally, longevity companies, increased awareness of anti-aging therapies, and positive consumer perceptions make North America the center of the global anti-aging drugs market.

Demographic trends, increased research investment, and more reimbursement coverage have created a healthy U.S. anti-aging drugs market. The U.S. remains the global leader in research and development and continues to garner significant funding from both government and private developments in developing senolytics, NAD+ booster therapies, and genetic therapies. Venture capitalists, billionaire-sponsored longevity companies, and pharma companies are all investing in preventative medicine. The convergence of these factors creates a potent ecosystem where the U.S. will be the primary engine of growth in the anti-aging drugs space.

The marketplace for anti-aging drugs in Canada is steadily increasing due to multiple factors related to demographic change, healthcare infrastructure, and consumers who are willing and able to embrace these therapies. Canada's robust healthcare system and a government that encourages the adoption of more advanced medications. Canadians are also habituated to having the healthcare system open to many options for dealing with the aging process. In addition, as middle-aged and elderly Canadians have greater access to disposable income as well as growing health awareness regarding their health, adoption is likely.

APAC Market Insights

The Asia-Pacific is the fastest-growing region in the anti-aging drugs market and is anticipated to hold a share of 21.8% at a CAGR of 15.2% by 2035. The region is witnessing strong growth, led by improving life expectancy, urbanization, and growing healthcare spending. Countries such as Japan, South Korea, and China are fueling the region by government prioritization of healthy aging and consumer awareness. Government policies are promoting public-private collaborations for drugs related to anti-aging clinical trials, drug approvals, and regional production to minimize import reliance. Further, key policy guidelines and budget shifts are transforming the region and driving the commercialization of anti-aging treatments via hospital, retail, and e-commerce distribution channels.

The anti-aging drugs market in India has a strong positive growth trend due to the resurgence of a middle-class population, increased disposable income, and increasing awareness of preventive health. India has one of the largest populations of young adults becoming middle-aged adults which will create future demand for longevity solutions. India is seeing major growth in the pharmaceutical and biotechnology industries, with the added bonus of cheaper manufacturing and clinical trials. Finally, due to the e-commerce boom, anti-aging pharmaceuticals and supplements are also extremely more accessible for semi-urban and urban populations.

China is expanding rapidly due to an aging population. China has a robust pharmaceutical industry along with considerable investments in research and development (R&D), clinical studies, and artificial intelligence-supported drug discovery for age related diseases. The rise in spending of the health-aware middle-class population base and rapid uptick in technology usage is leading to demands for the solutions for the population's needs. Of equal relevance are the highly developed e-commerce ecosystems in China that assist in ensuring that anti-aging drugs are reasonably accessible to everyone.

Europe Market Insights

The anti-aging drugs market in Europe is expected to hold a share of 30.1% at a CAGR of 13% by 2035. The region is driven by the growth in an aging population, greater health awareness, and strong investment in personal and regenerative medicine. As per the European Medicines Agency (EMA) and health.ec.europa.eu report, an increase in EU-wide funding has accelerated innovation in anti-aging treatments such as senolytics, peptide treatments, and hormone regulators. The regulatory convergence under the European Health Data Space (EHDS) has facilitated greater data interoperability to boost clinical trials and market approvals. The region is projected to enhance the technology integration with digital health technologies by 2034, including AI-driven biomarker analysis, which will further enhance the efficiency of drug development.

Germany in the anti-aging drugs market is anticipated to hold a revenue share of 23.8% by 2035. The country has one of the world's oldest populations, which represents a growing consumer market for anti-aging therapies. This is supporting the demand for pharmaceutical products, senolytics, NAD+ boosters, as well as regenerative medicine. With some of the leading biotech and pharmaceutical companies actively engaged in exploring longevity and regenerative medicine, Germany's strong R&D capabilities, public-private innovation schemes, and direct collaboration with academia have positioned it well to commercialise anti-aging drugs.

France is expected to capture a substantial revenue share of the anti-aging drugs market by 2035 as a result of its large elderly population, strong health care system, and increasing focus on preventive medicine. France provides universal health care to its citizens and invests a high amount of money annually basis on the health of their citizens. Accordingly, they provide access to innovative but potentially costly therapeutics such as senolytics, NAD+ boosters, and genetic therapies. France also has an active pharmaceutical and biotechnology ecosystem that has programs exploring longevity. As consumers continue to be more health-conscious and willing to spend money on anti-aging, either through prescription drugs or wellness products, France is positioned to capitalize considerably on the regional anti-aging drugs market.

Key Anti-Aging Drugs Market Players:

- AbbVie Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- L’Oréal S.A. (Active Cosmetics Division)

- Johnson & Johnson

- Pfizer Inc.

- Bayer AG

- GlaxoSmithKline (GSK)

- Novartis AG

- Amorepacific Corporation

- Rejuvenate Bio

- Eisai Co., Ltd.

- Dr. Reddy's Laboratories

- Calico Life Sciences (Alphabet Inc.)

- Evolus, Inc.

- Medytox, Inc.

- CSL Limited

- Hims & Hers Health, Inc.

- Lupin Limited

- Biocon Biologics

- Forest Biosciences

- Chugai Pharmaceutical Co., Ltd. (Roche Subsidiary)

The anti-aging drugs market is very competitive and is driven by the key pharmaceutical, cosmeceutical, and biotech players. Firms such as AbbVie, Novartis, and GSK are actively investing in cellular rejuvenation, NAD+ pathway modulation, and senolytics. Strategic partnerships, including Pfizer’s collaboration with biotech startups and investments by Alphabet’s Calico, further fuel the R&D innovation. Companies in Asia are increasing in both modern and traditional bioactive compounds. Companies in India are aiming for biosimilar-related aging therapies to broaden access with cost effective therapies.

Here is a list of key players operating in the anti-aging drugs market:

Recent Developments

- In February 2025, according to a study published by researchers from two partner institutions and artificial intelligence (AI) drug developer Insilico Medicine, its lead candidate ISM001-055 is the first to exhibit anti-aging properties. Through the inhibition of many aging processes, ISM001-055 was demonstrated to have reduced cellular senescence, indicating its potential as a senomorphic medication. A class of medications known as senomorphics targets the senescence-associated secretory phenotype (SASP) of senescent cells, which are thought to contribute to aging and age-related disorders.

- In July 2023, a group of Harvard Medical School researchers have discovered a set of medications that can stop the aging process in as little as seven days. Three distinct medications were given to the mice in the study: growth hormone, metformin, and a substance that activates the AMPK enzyme. Aged muscles, liver tissue, and other organs were rejuvenated as a result of the treatment.

- Report ID: 375

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-Aging Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.