ACL Reconstruction Market Outlook:

ACL Reconstruction Market size was USD 8.3 billion in 2025 and is anticipated to reach USD 15.1 billion by the end of 2035, increasing at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of ACL reconstruction is assessed at USD 8.8 billion.

The international market is driven by a rise in the cases of occupational injuries and sports-based trauma. According to an article published by NLM in November 2023, the yearly recorded ACL incidence in the U.S. is estimated to affect 1 in 3,500 people, and approximately 400,000 ACL-based reconstructions take place every year. Among athletes, the female-to-male ratio is reported to be 4.5:1, with female athletes intended to be affected at a young age in supporting legs, compared to kicking legs for males. However, to assess this condition, the Lachman test is the most suitable, with 94% specificity and 95% sensitivity, thereby suitable for the market’s upliftment.

Moreover, as per an article published by the Journal of Trauma and Injury in July 2022, a case-based review was conducted on sports-specific major traumas within 5 years, wherein 76% of cases constituted suitable recovery at the time of discharge. In addition, 19% catered to moderate disability, and the remaining 5% accounted for critical disability. Besides, the average hospital stay length ranges from 1 to 121 days, and the most critically injured body region accounted for 29.1% of limbs and 33% of spinal and vertebral injuries. Meanwhile, the National Health Service Hospital recorded 367,093 emergency department visits, owing to sports injuries, thus proliferating the market.

Key ACL Reconstruction Market Insights Summary:

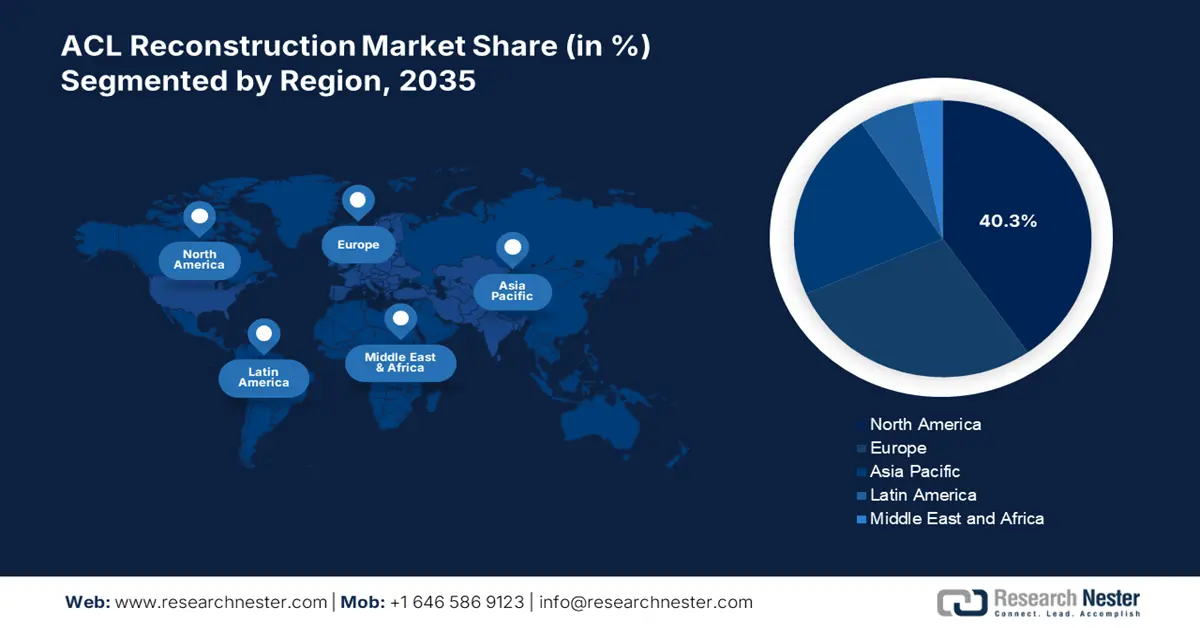

Regional Highlights:

- North America is expected to garner the highest share of 40.3% in the ACL reconstruction market by the end of 2035, driven by innovative surgical facilities, rising sports injury prevalence, and strong public healthcare funding.

- Asia Pacific is projected to emerge as the fastest growing region in the ACL reconstruction market during the forecast period, owing to increased accessibility to orthopedic surgeries, a surge in sports injuries, and strategic health and medical investments.

Segment Insights:

- The anatomic reconstruction segment is projected to garner the largest share of 68.7% by the end of 2035, propelled by its ability to restore individual joint anatomy and enhance long-term joint stability and function.

- The hospitals segment is anticipated to constitute the second-largest share during the projected duration, driven by the capacity to manage complex procedures, handle comorbidities, and provide wide-ranging perioperative care.

Key Growth Trends:

- Rise in healthcare and government expenditure

- Improvement in health and medical quality

Major Challenges:

- Increase in treatment expenses restricting government coverage

- Adoption and surgical training obstacles

Key Players: Stryker Corporation, Smith+Nephew plc, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., CONMED Corporation, B. Braun Melsungen AG, Olympus Corporation, DJO Global (Enovis), Karl Storz SE & Co. KG, Medtronic plc, MediCad Hectec GmbH, United Orthopedic Corporation, Aesculap Implant Systems, Parcus Medical LLC, Meril Life Sciences Pvt. Ltd., Osstem Implant Co., Ltd., Narang Medical Ltd., Austofix, Ideal Healthcare Sdn Bhd.

Global ACL Reconstruction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.5 billion

- 2026 Market Size: USD 17.8 billion

- Projected Market Size: USD 61.8 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: India, China, Australia, South Korea, Brazil

Last updated on : 29 September, 2025

ACL Reconstruction Market - Growth Drivers and Challenges

Growth Drivers

- Rise in healthcare and government expenditure: The aspect of Medicare spending on musculoskeletal procedures has deliberately increased, denoting a huge growth opportunity for the market globally. According to an article published by NLM in January 2023, the international number of prevalent musculoskeletal diseases has reached 1.3 billion, which has resulted in 121.3 thousand deaths, along with 138.7 million disability-adjusted life years. Besides, the healthcare spending for this disease in the U.S. has successfully reached USD 380.9 billion and €240 billion in Europe-based nations.

- Improvement in health and medical quality: The component of early ACL reconstruction, particularly for minimally invasive methods, has readily reduced hospitalization expenses, which positively impacts the market internationally. As per an article published by Health System Tracker in December 2024, the healthcare expenditure in the U.S. has effectively tripled to USD 4.9 trillion as of 2023, thereby denoting a 7.5% surge between 2022 and 2023, in comparison to 4.6% in 2022. Besides, the upliftment in overall health spending is also above the yearly rate, which is 4.1%, thus bolstering the market’s exposure.

- Expansion in the aging population and health accessibility: As per an article published by the World Health Organization in October 2024, 80% of elderly people will be residing in low- and middle-income nations by the end of 2050. Additionally, the world’s population will be more than 60 years old, which will double from 12% to 22% by 2050. Besides, as per the March 2024 NLM article, telehealth effectively constitutes an estimated 10% of overall outpatient clinic visits worldwide, which makes it a significant escalation in clinical services. Therefore, with all these factors, there is a massive growth opportunity for the market across different nations.

Increase Healthcare Spending Impacting the Market (2022)

|

Countries |

Per Capita Spending |

Increase % |

|

U.S. |

+USD 4,200 |

50% |

|

Germany |

+USD 3,300 |

69% |

|

New Zealand |

+USD 2,800 |

87% |

|

Korea |

+3.7% GDP |

61% |

|

Latvia |

+3.4% GDP |

63% |

|

Chile |

+2.0% GDP |

28% |

Source: OECD

Total Number of Sports and Recreational Equipment Tools Leading to Sports Injuries (2024)

|

Products |

Total Number |

|

Exercise Equipment |

564,845 |

|

Bicycles and Accessories |

454,008 |

|

Basketball |

385,777 |

|

Football |

318,243 |

|

Skateboards, Scooters, Hoverboards |

295,067 |

|

Soccer |

265,761 |

|

Playground Equipment |

231,245 |

|

Swimming Pool equipment |

182,344 |

Source: NSC Organization

Challenges

- Increase in treatment expenses restricting government coverage: The market caters to surgeries, which makes it highly and extremely expensive to be poorly affordable by the majority of patients across low-income nations. Besides, a considerable number of people are actually eligible to achieve complete coverage under Medicare, owing to strong capped reimbursement rates and eligibility criteria. Therefore, these stringent accessibility requirements demand that individuals to reduce procedural volumes for suppliers relying on public payer systems. Meanwhile, the aspect of cost-to-access disparity continues to be a significant gap, especially for producers of high-end fixation devices and biologic grafts.

- Adoption and surgical training obstacles: The presence of advanced devices frequently demands surgical techniques, which have necessitated wide-ranging training programs for surgeons. Hospitals are usually reluctant to bear the expenses of the training for diminished theater productivity, particularly during a surgeon’s learning curve. This has created an effective adoption gap, since even a reimbursed product will not be utilized if surgeons are not proficient enough, which in turn can cause a hindrance in the market. Besides, manufacturers need to invest heavily in cadaver laboratories, proctoring services, and training centers to represent a non-recoverable and substantial expense.

ACL Reconstruction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 8.3 billion |

|

Forecast Year Market Size (2035) |

USD 15.1 billion |

|

Regional Scope |

|

ACL Reconstruction Market Segmentation:

Procedure Type Segment Analysis

Anatomic reconstruction segment in the market is projected to garner the largest share of 68.7% by the end of 2035. The segment’s growth is highly attributed to its importance for restoring patients’ individual joint anatomy to enhance the long-lasting stability and function of joint health after injury. As per an article published by the MDPI in November 2022, there has been an evaluation of anatomical region, which includes 95.5% for the anterior maxilla, 97.5% for the posterior maxilla, 97.1% for the anterior mandible, and 98.9% for the posterior mandible, thereby making it suitable for the segment’s upliftment.

End user Segment Analysis

Hospitals segment in the market is anticipated to constitute the second-largest share during the projected duration. The segment’s upliftment is highly fueled by its leadership to effectively manage complicated procedures, handle comorbidities, and offer wide-ranging perioperative care. In addition, an increase in trauma incidences admitted through emergency departments, along with facilities to support inpatient accommodations, are also driving the segment’s exposure. However, the ultimate trend for the segment’s growth is the tactical shift of upfront ACL surgeries to ambulatory surgical centers for cost-effectiveness, thus suitable for boosting its importance in the overall market.

Graft Type Segment Analysis

Autografts segment in the market is projected to cater to the third-largest share by the end of the forecast duration. The segment’s development is highly driven by its aspect of utilizing patients’ tissue, diminishing the risk of disease transmission as well as immune rejection, and readily promotes rapid healing. As stated in the 2025 Biomedical Informatics article, a clinical study was conducted on 85 patients with the incorporation of 25% of autografts. These sites were demonstrated with the highest success rates, particularly 96.4% implant survival, which caters to the segment’s uplifting globally.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Procedure Type |

|

|

End user |

|

|

Graft Type |

|

|

Product Type |

|

|

Fixation Type |

|

|

Payment Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ACL Reconstruction Market - Regional Analysis

North America Market Insights

North America market is expected to garner the highest share of 40.3% by the end of 2035. The market’s upliftment in the region is highly attributed to the presence of innovative surgical facilities, an increase in the sports injury prevalence, and the existence of strong public healthcare funding. According to an article published by the CMS in June 2025, there has been an increase in Medicare expenditure by 8.1%, amounting to USD 1,029.8 billion as of 2023, while Medicaid services grew by 7.9% to USD 871.7 billion within the same year, making it suitable for the market’s growth.

The ACL reconstruction market in the U.S. is growing significantly, owing to the continuous rise in sports-based injuries, a surge in the aging population, and an increase in the availability of reimbursement services. As per an article published by NLM in June 2022, a total of 4,263 ACL reconstructions were performed in a clinical study, wherein 2.2%, which is 92, of patients were readily insured through Medicaid. In addition, 26 patients with this coverage demonstrated a compliance rate of 28.3%, thereby symbolizing the importance of insurance and reimbursement services in the country, which are positively impacting the market.

The ACL reconstruction market in Canada is also growing due to the presence of a single-payer healthcare system, an increase in provincial government expenditure to diminish backlogs, a focus on standardized procedures, and the adoption of affordable technologies. Besides, in June 2025, the government in Ontario made an investment of USD 155 million for two years and is poised to add 57 newest diagnostic centers and community surgical facilities to offer CT scans and MRI. This investment will assist 1.2 million people in the country to gain accessibility to publicly funded services rapidly. Besides, licenses will also be issued for 35 centers and will cater to almost 828,000 people within two years, thus suitable for the market’s upliftment.

Sports Injuries and Fatal Injuries in North America Impacting the Market

|

U.S. (2024) |

Canada (2022) |

|||

|

Injuries and Illnesses |

Female |

Male |

Fatal Injuries |

Total Incidences |

|

Overall injuries |

17 |

16 |

Road |

44 |

|

Athletes with injury |

9 (21.9%) |

10 (16.7%) |

Commute |

4 |

|

Overall illnesses |

6 |

7 |

Water |

3 |

|

Athletes with illnesses |

5 (12.2%) |

5 (8.3%) |

Rail |

2 |

|

Injury incidence per 1,000 |

48.2 |

31 |

Broadway |

1 |

Sources: NLM; Government of Canada

APAC Market Insights

Asia Pacific in the ACL reconstruction market is expected to emerge as the fastest-growing region during the projected duration. The market’s development in the region is highly driven by an increase in accessibility to orthopedic surgeries, a surge in sports injuries, and the presence of tactical health and medical investments. Besides, as stated in the July 2022 NLM article, the Ministry of Health in Indonesia has readily implemented a suitable rate for ACLR procedures within a range of IDR 9,586,400 TO 31,379,800 (USD 677 to USD 2,215), which is positively impacting the market in the overall region.

The ACL reconstruction market in China is gaining increased traction, owing to the presence of the National Medical Products Administration, increased government expenditures, enhanced focus on public orthopedic hospital upgradation, along with localized device production. As stated in an article published by Frontiers Organization in August 2023, a clinical study was conducted, wherein 73 patients from the country underwent successful ACLR. The study indicated non-contact injury as the ultimate type of ACL injury, constituting 84.9% of overall injuries. Besides, 75.35% of injuries occurred regularly during sports activities and 24.7% during military training, thus symbolizing the importance of the market in the country.

The ACL reconstruction market in India is also growing due to the existence of the government’s Ayushman Bharat scheme to effectively provide standard health and medical coverage, along with an upsurge in the patient population. According to an article published by the PIB in April 2025, the Pandit Deendayal Upadhyay National Welfare Fund for sportspersons has offered a one-time aid of ₹5 lakh and ₹5,000 as a monthly pension, along with ₹10 lakhs for medical assistance and injuries caused during sport-related competitions and training, thereby boosting the market’s exposure.

Europe Market Insights

Europe in the ACL reconstruction market is projected to steadily grow and develop by the end of the forecast timeline. The market’s growth in the region is highly fueled by aging demographics, a rise in injury rates, and government-based investments and funding for minimally invasive surgeries, along with an increase in the supply of MRI devices. Besides, countries such as Germany, France, Italy, the UK, and Spain are considered notable contributors to the market in the overall region. Meanwhile, the wide-ranging reimbursement programs under national health approaches have readily facilitated the rapid adoption of arthroscopic surgical equipment and graft fixation devices.

The ACL reconstruction market in Germany is gaining increased exposure, owing to a surge in funding for ACL reconstruction treatments, the presence of the Federal Ministry of Health for integrating sports medicine into national guidelines, and the increased conduct of procedural surgeries across ambulatory centers under public coverage. According to an article published by Germany Health in 2025, the expense of ACL reconstruction surgery in the country begins at EUR 10.5, followed by EUR 15.0 in Switzerland, EUR 11.8 in Austria, and EUR 8.5 in the Czech Republic, thereby denoting a huge growth opportunity for the overall market.

The ACL reconstruction market in France is also growing due to the aspect of increased focus on ambulatory surgery, the role of the National Authority for Health (HAS) for effectively evaluating the economic and clinical value, and significant government expenditure for health and medical services. As stated in the 2025 World Bank Data Organization report, the present health spending accounts for 11.8% of GDP, which readily contributes to the market’s growth in the country. Besides, the 2023 OECD data report indicated that the health spending in the country has reached EUR 4,200, catering to 12.3% of GDP, which is also bolstering the market.

MRI Machines 2023 Export and Import in Europe

|

Countries |

Export |

Import |

|

Germany |

USD 1.7 billion |

USD 762 million |

|

Netherlands |

USD 779 million |

USD 597 million |

|

UK |

USD 604 million |

USD 192 million |

|

France |

USD 143 million |

USD 332 million |

|

Poland |

USD 63 million |

USD 135 million |

|

Italy |

USD 37.4 million |

USD 158 million |

|

Hungary |

USD 34.5 million |

USD 32.1 million |

|

Switzerland |

USD 22.5 million |

USD 77 million |

Source: OEC

Key ACL Reconstruction Market Players:

- Arthrex, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Smith+Nephew plc

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings, Inc.

- CONMED Corporation

- B. Braun Melsungen AG

- Olympus Corporation

- DJO Global (Enovis)

- Karl Storz SE & Co. KG

- Medtronic plc

- MediCad Hectec GmbH

- United Orthopedic Corporation

- Aesculap Implant Systems

- Parcus Medical LLC

- Meril Life Sciences Pvt. Ltd.

- Osstem Implant Co., Ltd.

- Narang Medical Ltd.

- Austofix

- Ideal Healthcare Sdn Bhd

The international ACL reconstruction market is extremely competitive with the presence of top players. Organizations, such as Stryker, Arthrex, and Smith+Nephew, altogether account for a considerable share of the overall market. Additionally, these firms are readily driven by tactical mergers and acquisitions, advancement, and international expansion. For instance, Smith+Nephew has effectively focused on bio-integrative implants, while Arthrex has enhanced its production globally to successfully satisfy the growing demand in Asia and Europe. Meanwhile, companies in Asia, including Meril Life Sciences and Olympus, are deliberately gaining interest by offering cost-competitive offerings. The market is also driven by advancements in technology with robotic integration, AI-assisted surgical precision, and digital planning software.

Here is a list of key players operating in the global market:

Recent Developments

- In November 2024, Johnson & Johnson MedTech notified a significant commercial distribution-based deal in the U.S., with Responsive Arthroscopy Inc., with the intention to strengthen its sports platform by enhancing soft tissue portfolio.

- In April 2024, Miach Orthopaedics, Inc., declared the raising of USD 20 million in Series B extension, which will readily support clinical activities as well as commercial expansion for the BEAR Implant to aid almost 3,000 patients with ACL tears.

- Report ID: 4021

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ACL Reconstruction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.