Amphetamine Drugs Market Outlook:

Amphetamine Drugs Market size was valued at USD 11.8 billion in 2025 and is projected to reach USD 17.9 billion by the end of 2035, rising at a CAGR of 4.8% during the forecast period, 2026-2035. In 2026, the industry size of amphetamine drugs is assessed at USD 12.3 billion.

The global market is growing due to the rise of ADHD cases, increased diagnosis and awareness, and use in adults is also on the rise due to wider use in treating sleep disorders such as narcolepsy, newer drug formulations, and active investments by the pharma sector. There is an opportunity to tap into the growth of amphetamine drugs. As per a report by the CDC, November 2024, an estimated 7 million (11.4%) U.S. children aged 3 to 17 years have ever been diagnosed with ADHD. Typically, amphetamine drugs are dispensed for long periods for both public and private usage. The system works mainly on active pharmaceutical ingredients, which are mostly synthesized from amphetamine salts and then formulated into extended-release forms.

Pharmaceutical companies are investing heavily in extended-release and abuse-deterrent versions to improve efficacy and safety, which is increasing the global amphetamine drug market. Additionally, pricing and reimbursement policies (PPI) are playing a significant role in shaping market dynamics, especially in high-income regions such as the U.S. and Europe. As per a report by NLM in August 2024, specialty drugs now account for about 55% of all U.S. drug spending, double the share of a decade earlier, highlighting the growing economic effect of targeted therapies, such as amphetamines. Such a trend underscores the need for balanced regulation to ensure access, affordability, and innovation.

Key Amphetamine Drugs Market Insights Summary:

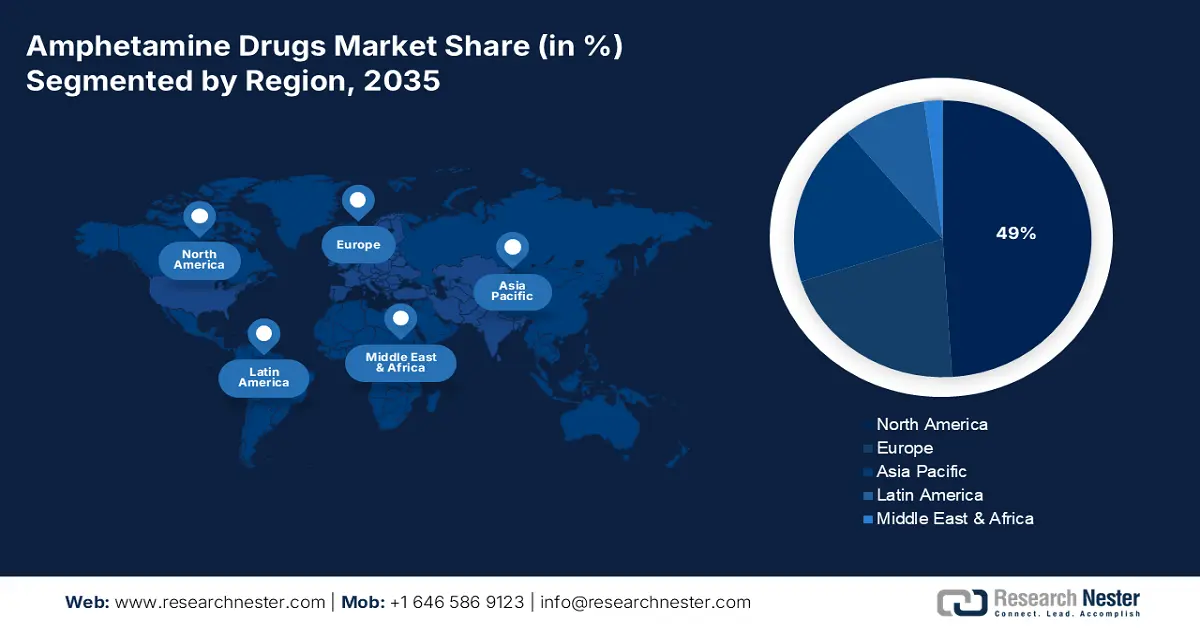

Regional Highlights:

- By 2035, North America is projected to command a 49% share of the Amphetamine Drugs Market, supported by intensified federal backing, accelerated approvals, and expanding domestic production capacity.

- Through 2026–2035, the Asia Pacific region is anticipated to emerge as the fastest-growing market, underpinned by tightening governmental controls on stimulant misuse and broader affordability initiatives.

Segment Insights:

- By 2035, the retail pharmacies sub-segment is expected to secure a 56% share in the Amphetamine Drugs Market, bolstered by their extensive accessibility and increasing digital integration enhancing patient adherence.

- Across 2026–2035, the ADHD sub-segment is projected to dominate the indication category as expanding diagnosis rates and heightened awareness amplify treatment uptake.

Key Growth Trends:

- Rising government spending via Medicare and Medicaid

- Healthcare quality improvement and early intervention

Major Challenges:

- Government price caps and cost containment policies

- Rising Concerns Over Misuse and Dependency

Key Players: Takeda Pharmaceutical (Japan), Novartis AG (Switzerland), Teva Pharmaceuticals (Israel/U.S.), Johnson & Johnson (U.S.), NeuroCare Pharma (India), Sun Pharma (India), Viatris (U.S.), Amneal Pharmaceuticals (U.S.), Shionogi & Co., Ltd. (Japan), Lupin Pharmaceuticals (India), Alkem Laboratories (India), Celltrion Healthcare (South Korea), Servier Laboratories (France), Pfizer Inc. (U.S.), GSK plc (UK).

Global Amphetamine Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.8 billion

- 2026 Market Size: USD 12.3 billion

- Projected Market Size: USD 17.9 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Australia, Italy

Last updated on : 24 September, 2025

Amphetamine Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Rising government spending via Medicare and Medicaid: The U.S. government spent a substantial amount of money on medications for ADHD, mainly amphetamines such as Adderall and Vyvanse, through programs such as Medicare, in 2023. This expenditure reflects the increased use of these drugs to treat ADHD, especially in the adult and elderly groups covered by federal health plans that is increasing the market. This rise impacts the rise in usage of older adults under Part D coverage. As per a report by NLM in February 2025, A total of 117,704 adults (26.6%) with ADHD received an ADHD medication prescription in the U.S. These figures focus on the growing demand for federal investment in ADHD management and expanding the scope of therapeutic access, both in the pediatric and adult populations.

- Healthcare quality improvement and early intervention: Clinicians strive to diagnose ADHD earlier in children, coupled with medication and behavioral therapy to maximize outcome optimization in the market. New tools, telehealth services, and streamlined protocols are being adopted to ensure patients receive the right treatment at the right time. According to the CDC in March 2024, during 2020-2022, 11.3% of children aged 5-17 years in the U.S. had ever been diagnosed with ADHD. Early diagnosis is complemented by constant investment in R&D for better formulations, abuse deterrence, and tailored delivery methods for advanced patient care.

- Growing acceptance of mental health treatment: One of the major drivers of growth in the market is the rising global acceptance of mental health care. As stigma continues to fade around disorders such as ADHD, more and more people are getting diagnosed and initiating treatment. Moving toward early intervention, the prescription line drugs, including amphetamines, are increasingly used. Schools, offices, and healthcare systems all weigh heavily on mental wellness, as treatment is carried out steadily. Thus, continued stimulation demand for well-accepted therapeutic agents further exacerbates general market growth of the market.

Broadening of Diagnostic Criteria Driving Growth in the Amphetamine Drugs Market

Changes in Diagnostic Determination for ADHD Between DSM-IV and DSM-5 (2022)

|

Criteria |

DSM-IV |

DSM-5 |

|

Number of symptoms required |

6 or more in either inattention or hyperactivity domains |

6 or more in either domain if <17 years old, OR 5 or more in either domain if >17 years old |

|

Age of symptom |

<7 years |

<12 years |

|

Impairments |

Onset of impairment <7 years |

Not required |

|

Pervasiveness |

Evidence of impairment in 2 or more settings |

Evidence of symptoms in 2 or more settings |

|

Autism exclusionary |

Yes |

No |

Source: NLM, September 2022

Challenges

- Government price caps and cost containment policies: Governments often enforce high pricing caps on manufacturers to reduce spending in national healthcare. This alternatively impacts manufacturers' profitability in market. In 2023, France made strict reimbursement ceilings on stimulant drugs and reduced commercial margins for amphetamine-based therapies. Takeda addressed this by implementing a tiered price plan that matched national reimbursement levels in collaboration with French health organizations. Further, this strategy has increased access to Elvanse, successfully demonstrating that the collaborative pricing frameworks can balance the market viability and affordability effectively.

- Rising Concerns Over Misuse and Dependency: Another major hurdle encountered in the amphetamine market lies in the matter of misuse, overprescription, and addiction. Basically, the more prescriptions given for amphetamine-based treatments such as Adderall and Vyvanse, the more non-medical usage abuses come into being, mostly by adolescents and young adults. Thus, they have faced more rigid regulatory scrutiny and tighter prescription monitoring in a few countries in amphetamine drug market. In many instances, providers must adhere to strict diagnostic criteria and follow risk mitigation strategies before treatment can be initiated. These worrisome issues may diminish confidence in prescribers and also be a restraint in market development, as regulators and public health agencies push for a more cautious use of stimulant medications.

Amphetamine Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 11.8 billion |

|

Forecast Year Market Size (2035) |

USD 17.9 billion |

|

Regional Scope |

|

Amphetamine Drugs Market Segmentation:

Distribution Channel Segment Analysis

The retail pharmacies sub-segment in the distribution channel segment of the market is expected to hold the highest market share of 56% within the forecast period, as they have widespread availability and maximum convenience for the patients. As per a report by NLM April 2022, prescription drug expenditures increased by 4.0% to 6.0%, while in hospitals and clinics, it increased by 7.0% to 9.0% and 3.0% to 5.0%, depicting their critical importance in drug circulation. Retail pharmacies offer a well-established system of drug circulation of prescription amphetamine medication with a stable drug supply. Also, the growing digital integration between retail pharmacies increases patient compliance as well as convenience.

Indication Segment Analysis

The ADHD sub-segment in the indication segment is expected to hold the highest market share within the forecast period due to growing diagnosis rates and awareness. Market growth is driven by such a large patient pool, especially of amphetamine-based stimulant drugs. ADHD is still the leading condition targeted by amphetamine drugs, with growing awareness among pediatric as well as adult populations. Enhanced screening technologies and public health measures have raised patient detection, creating treatment demand. According to a CDC report from November 2023, the proportion of current ADHD children on treatment differs considerably from state to state within the U.S., ranging from 58% to 92%.

Formulation Segment Analysis

The extended-release sub-segment in the formulation segment of the amphetamine pharmaceutical drug market is anticipated to hold the largest market share during the forecast period due to enhanced patient compliance and safety profiles. One-per-day dosing provided by extended-release products improves the patient's convenience and decreases the potential for missed doses. Extended-release products reduce the risk of abuse, a problem that is linked to immediate-release stimulants. The drugs possess more evenly distributed symptoms throughout the day with better overall treatment results. healthcare providers increasingly opt to prescribe extended-release amphetamines, especially to treat long-term conditions such as ADHD.

Our in-depth analysis of the global amphetamine drugs market includes the following segments:

|

Segment |

Subsegments |

|

Drug Type |

|

|

Indication |

|

|

Formulation |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amphetamine Drugs Market - Regional Analysis

North America Market Insights

The North America market is expected to hold the largest market share of 49% during the forecast period, driven by the presence of an effective support system from the government, high R&D activities, and a well-established healthcare facility. Federal organizations such as the NIH and CDC are actively sponsoring research and awareness campaigns for ADHD, leading to growing levels of diagnosis and treatment. The FDA has expedited approval for branded and generic amphetamine versions, and the DEA is in discussions with producers to end stimulant shortages by adjusting production quotas. Domestic manufacturing capacity is increasing, including FDA-approved plants producing amphetamine mixed salts, which provides an assured supply chain.

The amphetamine drugs market in the U.S. is growing due to government initiatives and research and development efforts. According to a report by the CDC in February 2024, in 2022, nearly 6 children out of 10 were reported to have had moderate or severe ADHD in the U.S. R&D will witness build-up in formulation research and development for amphetamine type drugs with an emphasis on extended release, top patient preference and doctor demand. At the same time, the United States Food and Drug Administration has enforced changes in approval processes for generic amphetamines, inducing competition and aiding gross market growth in amphetamine drug market.

The amphetamine drugs market in Canada is growing due to government programs such as the Scientific Research and Experimental Development (SR&ED) Tax Credit Program, which offers financing to firms that engage in research and development within the pharmaceutical industry. As per a report by CDA in November 2024, ADHD is a neurodevelopmental and neurologic disorder, which exists in 4% to 6% adults and 5% to 7% of children in Canada, therefore encouraging the amphetamine drug market. In addition, the federal government has been investing in healthcare infrastructure, expanding mental healthcare access, including treatment for such diseases as ADHD, which typically involves amphetamine medication.

Exporters and Importers of Pharmaceutical Products in 2023

|

Country |

Exports (USD) |

Imports (USD) |

|

U.S. |

100 billion |

170 billion |

|

Canada |

10.6 billion |

18 billion |

|

Mexico |

2.55 billion |

6.19 billion |

|

Costa Rica |

939 million |

758 million |

Source: OEC, September 2025

Asia Pacific Market Insights

The amphetamine drugs market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to several key factors. Governments in the region are stepping up efforts to curb the increasing prevalence of certain amphetamine-type stimulants. According to the United Nations Office on Drugs and Crime (UNODC), a major increase in methamphetamine seizures has occurred in South Asia, signaling that the synthetic drug trafficking menace is getting worse. Also, pricing strategies are purportedly getting affected in the region, considering that governments have taken up policies directed toward making the medicines more affordable and accessible to the masses that can increase the amphetamine drug market.

The amphetamine drugs market in China is growing as governments begin to regulate and criminalize the production of amphetamines, as well as with the emergence of pharmaceutical R&D efforts for better formulations. As per a report by NLM in July 2025, 42.2% of 12,376 children surveyed reported ADHD-related symptoms. In addition, China has been making efforts to improve healthcare infrastructure and accessibility, assisting in further adoption of diagnosis and treatment. Greater awareness and acceptance of mental health concerns are also behind the growing demand for amphetamine-based therapies in the country.

The amphetamine drugs market in India is growing due to increasing awareness of ADHD and associated healthcare infrastructure enhancement, and governmental supportive policies to increase mental health services all play their part. Governmental bodies such as the National Narcotics Control Bureau (NCB) also strive to clamp down on illegal production and trafficking of amphetamines and remain helpful through a stable legal supply. As per a report by UNICEF in September 2025, by 2022, the prevalence had increased nearly fivefold among children aged 5 to 9, 10 to 14, and 15 to 19 years. It is going to be enhanced to meet the growing domestic demands, both from public and private investment programs.

Europe Market Insights

The amphetamine drugs market in Europe is expected to grow steadily within the forecast period due to increasing demand for stimulant-based treatments, chiefly for attention-deficit/hyperactivity disorder (ADHD). Governments all over Europe are trying to enhance mental health services and create better access for diagnosis and treatment, jointly supporting the R&D of pharmaceutical formulations. Manufacturing capacities are being ramped up to meet the increasing demand for highly-quality amphetamine-based drugs. As per a report by the World Health Organization in 2022, 60% of adults and one in three children are obese in Europe, which increases the market.

The amphetamine drugs market in the UK is growing due to a steadily increasing diagnosis of adults with Attention-Deficit/Hyperactivity Disorder (ADHD). However, as per a report by ADDA in 2025, only about 1 in 9 UK adults with the condition have received a formal diagnosis, implying huge treatment and assessment gaps, signifying serious underdiagnosis, and unmet treatment needs. This gap has led to a surge in demand for diagnosis and medication, with prescriptions under the NHS for amphetamine and related stimulant drugs mushrooming sevenfold in the last ten years.

The amphetamine drugs market in Germany has been growing with an increase in recognition of ADHD in children and adults and with expansion in treatment options, most importantly, approval for adult use in Germany of lisdexamfetamine (Vyvanse) as of 2024, following the European trend to broaden indications for treatment. The approval of lisdexamfetamine (Vyvanse) for adult use in 2024 shows a major milestone in shifting and broadening the focus of treatment of adults. The healthcare authorities in Germany have also made improvements in reimbursement schemes and clinical guidelines to enable greater accessibility of stimulant medications through statutory health insurance.

Key Amphetamine Drugs Market Players:

- Takeda Pharmaceutical (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG (Switzerland)

- Teva Pharmaceuticals (Israel/U.S.)

- Johnson & Johnson (U.S.)

- NeuroCare Pharma (India)

- Sun Pharma (India)

- Viatris (U.S.)

- Amneal Pharmaceuticals (U.S.)

- Shionogi & Co., Ltd. (Japan)

- Lupin Pharmaceuticals (India)

- Alkem Laboratories (India)

- Celltrion Healthcare (South Korea)

- Servier Laboratories (France)

- Pfizer Inc. (U.S.)

- GSK plc (UK)

The global market is very competitive, with giants such as Takeda, Novartis, and Teva strutting on the stage. Growth in APAC, FDA ANDA approvals, and patent renewals are some of the strategic issues in question. South Korean and Indian players are ramping up the supply of low-level generics, with the U.S. market focusing more on extended-release and abuse-deterrent formulations. Hybrid treatment approaches are the direction to take in licensing, such as Takeda and the integration of digital therapy by Teva. Regional funding and public health reforms for mental health projects through countries such as Malaysia and Australia are helping to make the future market more fiercely competitive.

Here is a list of key players operating in the global market:

Recent Developments

- In January 2025, Granules India Limited announced that its U.S. subsidiary, Granules Pharmaceuticals, Inc. (GPI), had received final approval from the U.S. FDA to sell its generic version of Lisdexamfetamine Dimesylate Capsules.

- In October 2023, Otsuka Pharmaceutical Co., Ltd. and its U.S. part announced positive results from two major Phase 3 clinical trials of the new ADHD drug, Centanafadine, that works by affecting norepinephrine, dopamine, and serotonin.

- Report ID: 2527

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amphetamine Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.