Aluminum Phosphide Market Outlook:

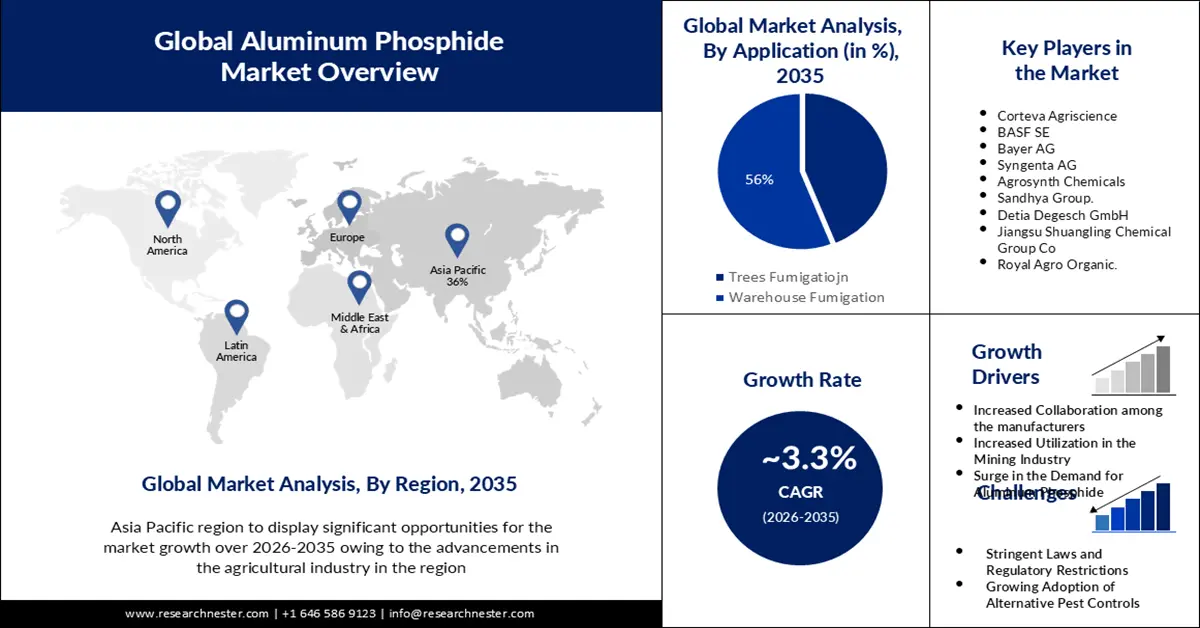

Aluminum Phosphide Market size was over USD 192.03 million in 2025 and is anticipated to cross USD 265.69 million by 2035, growing at more than 3.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aluminum phosphide is assessed at USD 197.73 million.

The rising need for pesticides as a result of rising food prices will fuel the market for aluminum phosphide. As per a report, the global pesticide consumption in 2021 was close to 3.54 million metric tons.

In light of population increase, insect resistance, and climate change, there is a growing need for crop protection chemicals to improve agricultural productivity and food security. Also, technological breakthroughs and advancements in the agriculture sector are other aspects that contribute to the growth of market.

The use of aluminum phosphide for pest control in metropolitan settings has increased as a result of urban sprawl. To maintain safe and hygienic surroundings, there is an increasing demand for efficient pest control solutions as more structures and facilities are built.

Aluminum phosphide is predicted to see a rise in demand due to its use in a variety of public health applications and structural fumigations, including private residences, businesses, and public buildings.

Key Aluminum Phosphide Market Insights Summary:

Regional Highlights:

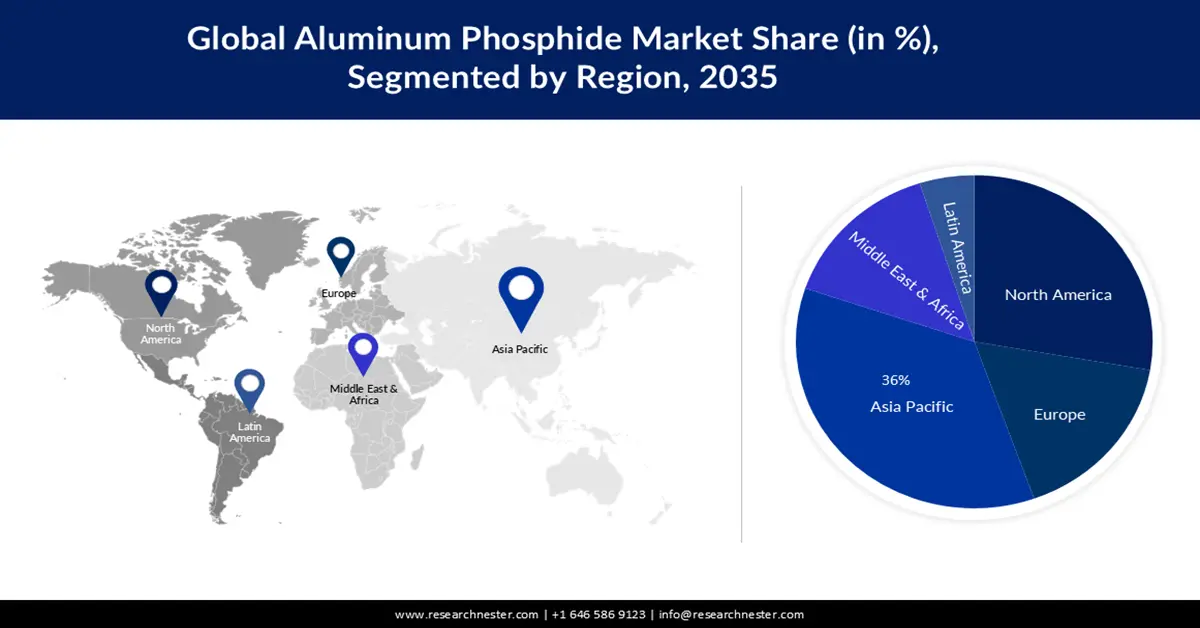

- Asia Pacific is anticipated to secure a 36% share by 2035 in the aluminum phosphide market, attributed to rising investments from major corporations in emerging economies and continued advancements in the agricultural sector.

- North America is projected to capture a 28% share by 2035, underpinned by technological improvements and the escalating need for pesticides in the region.

Segment Insights:

- The warehouse fumigation segment in the aluminum phosphide market is expected to command a 56% share by 2035, sustained by increasing fumigation practices across grain bins, silos, and warehouse facilities.

- The pesticides segment is forecasted to hold a 46% share by 2035, bolstered by the rising requirement for effective pest control solutions in agriculture.

Key Growth Trends:

- Increased collaboration among the manufacturers

- Increased utilization in the mining industry

Major Challenges:

- Stringent laws and regulatory restrictions

- Environmental regulations may hamper market growth

Key Players: Teramerra Inc., Corteva Agriscience, BASF SE, Bayer AG, Syngenta AG, Vinipul Inorganics Pvt. Ltd., Sandhya Group., Detia Degesch GmbH, Ava Chemicals Pvt. Ltd., Royal Agro Organic Pvt. Ltd.

Global Aluminum Phosphide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 192.03 million

- 2026 Market Size: USD 197.73 million

- Projected Market Size: USD 265.69 million by 2035

- Growth Forecasts: 3.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Turkey

Last updated on : 27 November, 2025

Aluminum Phosphide Market - Growth Drivers and Challenges

Growth Drivers

- Increased collaboration among the manufacturers - Establishing strategic alliances and collaborations with other agriculture-related businesses can aid in the development of new products and technologies, client acquisition, and market share growth.

For instance, crop protection solutions, and Syngenta Crop Protection, one of the top agriculture companies globally.

According to Syngenta, pheromones have been used as a pest control tool in agriculture for more than 30 years. Indonesia, the third-largest rice producer and one of the world's major rice consumers, will be the first country to use this breakthrough in rice. Therefore, the growing collaborations between the companies are accelerating the growth of the aluminum phosphide market. - Increased utilization in the mining industry - The most common method for removing gold and silver from ores is cyanide leaching, which uses aluminum phosphate as a reducing agent. This approach has several benefits from using aluminum phosphate, including excellent selectivity, high efficiency, and low cost. Aluminum phosphate is becoming increasingly in demand as a reducing agent with gold and silver.

Manufacturers of aluminum phosphate now have the chance to enter new markets and create specific goods for the mining sector. The creation of novel formulations based on aluminum phosphate has the potential to improve the efficacy and safety of the extraction process for gold and silver, hence generating fresh prospects for market expansion.

Challenges

- Stringent laws and regulatory restrictions - When aluminum phosphide comes into touch with moisture, it releases extremely poisonous gas. Both people and animals are in serious health danger from this. In numerous jurisdictions, the chemical is categorized as a pesticide with restricted usage, necessitating rigorous adherence to safety protocols to reduce exposure.

Many nations have tight laws and limits on aluminum phosphide because of its toxicity. Its use may be restricted by regulations governing its handling, application, storage, and disposal; noncompliance may have legal ramifications. Pests can become resistant to fumigants, such as AIP. Over time, this resistance may lessen the compound's effectiveness, requiring the creation and application of substitute pest control techniques. - Growing adoption of alternative pest controls such as biological controls may impede the growth of the market.

- Environmental regulations may hamper market growth

Aluminum Phosphide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.3% |

|

Base Year Market Size (2025) |

USD 192.03 million |

|

Forecast Year Market Size (2035) |

USD 265.69 million |

|

Regional Scope |

|

Aluminum Phosphide Market Segmentation:

Application Segment Analysis

The warehouse fumigation segment in the aluminum phosphide market is estimated to hold the largest share of 56% during the projection period. Grain bins, silos, and warehouses are among the storage structures where fumigation is frequently used to manage pests.

It is frequently used in agriculture and food processing to keep rodents and insects away from stored goods like grains, seeds, and other items. Warehouses offer a contained area where fumigants, such as aluminum phosphide, can be effectively used to control pests.

Because of how well this strategy works for handling huge quantities of stored products, it is frequently adopted. Additionally, to safeguard human health, agriculture, and the environment, several nations have stringent pest management laws. To achieve these requirements, fumigation is frequently necessary. Therefore, altogether these factors are escalating the growth of the warehouse fumigation segment.

End-use Segment Analysis

The aluminum phosphide market for the pesticides segment is expected to hold a share of 46% during the projected period. The growing demand for effective pest control solutions in agriculture is accelerating the growth of the segment.

In addition to this, the growing consumption of pesticides is propelling the growth of the segment. As per a report, it is predicted that global agricultural pesticide consumption will rise slightly, from around 4.3 million metric tons in 2023 to a value of approximately 4.41 million metric tons in 2027.

Moreover, integrated pest management (IPM) is becoming increasingly popular since it provides a more environmentally responsible and sustainable method of controlling pests. Furthermore, growing awareness of crop protection chemicals and the increasing number of pests and insects in warehouses and other crop storage rooms as a result of biotic and abiotic causes are propelling the market growth in the pesticides segment.

Our in-depth analysis of the global aluminum phosphide market includes the following segments:

|

Form |

|

|

Application |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Phosphide Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 36% by 2035. The market is expanding due to several factors, including the rise in major corporations' investments in emerging countries, and advancements in the agricultural industry.

The Asia Pacific region is expected to lead the market in the next ten years due to notable advancements in the domain of food security. Grain storage facilities are being planned for countries such as China, Vietnam, India, and the Philippines.

For instance, according to the world’s largest food grain storage program in India, a godown with a 2000-ton capacity will be built in each block as part of this plan. Through the cooperative sector, the program seeks to increase India's foodgrain storage capacity by 700 million tonnes.

Furthermore, the market expansion can contribute to the growing agricultural industry in the region. These factors are bolstering the market growth in the region.

North American Market Insights

The North American aluminum phosphide market is poised to hold a share of 28% by the end of 2035. The market is expected to grow in the upcoming years due to advancements in technology and a rise in the need for pesticides in the region.

Further, the high demand for semiconductors paved the way for the market. For instance, sales of semiconductors worldwide reached USD 574.1 billion in 2022, a 3.3% rise from 2021. Also, greater prospects for market expansion are being created by the major corporations' increased investments in grain storage facilities.

The agricultural research and development industry will grow as a result of increased efforts and financial support by the governments in the region.

Aluminum Phosphide Market Players:

- Teramerra Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Corteva Agriscience

- BASF SE

- Bayer AG

- Syngenta AG

- Vinipul Inorganics Pvt. Ltd.

- Sandhya Group.

- Detia Degesch GmbH

- Ava Chemicals Pvt. Ltd.

- Royal Agro Organic Pvt. Ltd.

Recent Developments

- Terramera with the debut of its newest product is thrilled to offer producers in the US, both conventional and organic, a single treatment that manages disease, mites, and insects. SOCORO is a potent new tool for row crop growers that may be used in a program rotation, as a tank mix partner, or as a standalone. Specifically designed to target troublesome pests in important commodity crops like cereals, legumes, and oil seeds, SOCORO can be administered in foliar or in the furrow.

- Corteva Agriscience announced the new brand name for its newest herbicide – BexoveldTM in May 2023 from its extensive innovation pipeline. With the help of the active component, cereal farmers will have an additional weapon for managing broadleaf weeds. Subject to regulatory assessments, Corteva plans to introduce Bexoveld in North America in 2028 and Europe in 2030.

- Report ID: 5692

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Phosphide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.