Allergy Immunotherapy Market Outlook:

Allergy Immunotherapy Market size was over USD 4 billion in 2025 and is estimated to reach USD 6 billion by the end of 2035, exhibiting a CAGR of 4.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of allergy immunotherapy is assessed at 4.1 billion.

The demand for the market is growing on account of the increasing incidence of allergic diseases globally. According to the January 2023 CDC report, almost 25.7% of the U.S. population indicated they had a history of seasonal allergies in 2021. Additionally, the NLM article in July 2023 states that 50 million U.S. people are affected by allergic rhinitis, and 20 to 30 million are affected by asthma, causing allergy component. This further creates a heightened awareness among both healthcare professionals and patients, intensifying the therapeutic demand.

Furthermore, the supply chain for the products in allergy immunotherapy comprises raw material sourcing, active pharmaceutical ingredients, biologic manufacturing, and medical device development, such as injection devices for subcutaneous immunotherapy. These APIs and vaccines are imported from regions with substantial manufacturing capabilities. In this context, import-export activities from the CEIC data in 2023 demonstrated a lucrative increase in import activities that with U.S. imports of pharmaceutical products reported at USD 90,202,040.529 in December 2023.

Key Allergy Immunotherapy Market Insights Summary:

Regional Insights:

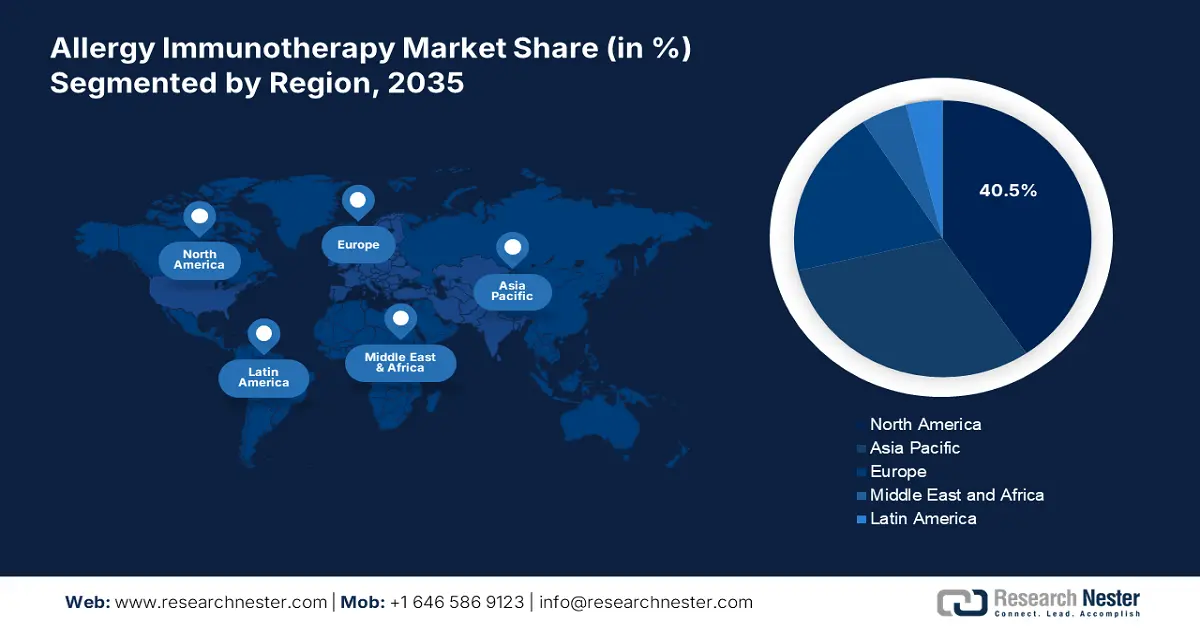

- By 2035, North America is projected to capture over 40.5% share of the Allergy Immunotherapy Market, underpinned by its expanding patient base, heightened awareness, and strong governmental funding initiatives.

- Europe is expected to register substantial growth by 2035, supported by high allergy prevalence, advanced healthcare infrastructure, and harmonized EMA-driven regulatory approvals.

Segment Insights:

- The allergic rhinitis segment is projected to command 71.9% share by 2035 in the Allergy Immunotherapy Market, supported by the escalating prevalence of allergic rhinitis and the growing shift toward advanced modalities such as SCIT and SLIT.

- The subcutaneous immunotherapy segment is anticipated to secure the highest share by 2035, bolstered by its proven efficacy in managing severe allergic conditions and expanding healthcare accessibility.

Key Growth Trends:

- Government funding activities

- Advancements in personalized medicine

Major Challenges:

- Uneven market access

Key Players: ALK-Abelló,Stallergenes Greer,Merck KGaA,Aimmune Therapeutics,HAL Allergy Group,Biomay AG,DBV Technologies,Allergy Therapeutics,Leti Pharma,WOLW Pharma,Abbott Laboratories,Novartis AG,GlaxoSmithKline plc,Johnson & Johnson,Sanofi,Torii Pharmaceutical Co., Ltd.,Shionogi & Co., Ltd.,Mitsubishi Tanabe Pharma,ALK-Abelló Japan K.K.,Nippon Zenyaku Kogyo

Global Allergy Immunotherapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4 billion

- 2026 Market Size: 4.1 billion

- Projected Market Size: USD 6 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries – United States, Germany, China, United Kingdom, Japan

- Emerging Countries – India, South Korea, Brazil, Mexico, Australia

Last updated on : 12 September, 2025

Allergy Immunotherapy Market - Growth Drivers and Challenges

Growth Drivers

- Government funding activities: One of the major factors driving growth in the allergy immunotherapy sector is the increasing funding from government and public healthcare initiatives. According to the Research Gate report released in April 2021, allergy immunotherapy costs range from USD 748 to USD 849, with many claims exceeding USD 1,000. Additionally, the regulatory frameworks, such as the U.S. FDA, support with needed approvals in supporting the development of innovative immunotherapy products, enabling greater affordability for treatments.

- Advancements in personalized medicine: Another major factor driving growth in the allergy immunotherapy market is the innovative and personalized therapeutic measures. This ability to customize the management relying on the patient's medical profile has created immense awareness due to its higher efficacy and low side effects. As per the NLM report in November 2024, allergy immunotherapy demonstrates significantly improved effectiveness compared to traditional methods, with effectiveness improvements of approximately 30%. This global shift is expected to improve patient outcomes and boost the market demand.

- Increasing disease incidence: The allergy immunotherapy is increasing global incidence of allergic rhinitis and asthma, due to urbanization, air pollution, and climate change prolonging pollen seasons. Many people are impacted in North America and Europe alone. For instance, more than 40% of pediatric patients have allergic rhinitis and develop symptoms before 6years, giving AIT access to a huge and expanding treatable patient base, based on the frontiers article in April 2022. This superior prevalence guarantees a stable and increasing baseline need for subcutaneous (SCIT) and sublingual (SLIT) immunotherapy treatments.

Percentage of Allergy Dragonized in Adults in 2021

|

Allergy Type |

Percentage |

|

Any Allergic Condition |

31.8 |

|

Seasonal Allergy |

25.7 |

|

Eczema |

7.3 |

|

Food Allergy |

6.2 |

Source: CDC January 2023

Challenge

- Uneven market access: One of the major challenges posed by the market is the uneven market access, particularly in the emerging regions. This is mainly influenced by expensive therapeutic costs associated with allergic immunotherapy and a lack of public awareness, which makes it difficult for the products to reach the targeted group of patients. Additionally, the products from allergy immunotherapy are often unavailable in the rural areas of developing regions due to their high costs and low insurance subsidies, thereby hindering market upliftment.

Allergy Immunotherapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 4 billion |

|

Forecast Year Market Size (2035) |

USD 6 billion |

|

Regional Scope |

|

Allergy Immunotherapy Market Segmentation:

Allergy Type Segment Analysis

Based on the allergy type, the allergic rhinitis segment is projected to account for a lucrative share of 71.9% in the allergy immunotherapy market during the forecast period. The dominance of the segment is attributable to the rising occurrence of allergic rhinitis across the world, which significantly contributes to the market expansion. The NLM report in July 2023 depicts that 30% of the general population are affected by allergic disease. Additionally, the push for advanced treatments such as subcutaneous immunotherapy, sublingual immunotherapy in rhinitis treatment is inspiring the global pharma leaders to invest in such therapeutic measures, driving the adoption of immunotherapy for rhinitis.

Treatment Type Segment Analysis

Based on treatment type, the subcutaneous immunotherapy segment is expected to garner the highest share by the end of 2035. The dominance of the segment is attributable to its capability to offer reliable solutions for severe allergies and develop resistance against allergens. According to the CDC report in January 2023, 1 in 5 children in the U.S. have seasonal allergy, and asthma. The subcutaneous immunotherapy demonstrated exceptional positive outcomes in treating conditions such as allergic rhinitis, asthma, and other allergic conditions. This is the evidence for a wider scope fueled by increasing healthcare access, well-established conventions, and proven efficacy of this element as a reliable solution.

Formulation Type Segment Analysis

Tablet dominates the form type segment used in sublingual immunotherapy and are preferred for patient compliance and convenience. CDC reports depicts increased home-administered treatment of allergic diseases owing to fewer clinic visit requirements over injections. Government-supported research underscores tablets’ safety and efficacy, which have enhanced patient acceptance and market expansion. FDA approvals of several SLIT tablet products for allergic rhinitis are a key factor driving growing adoption levels throughout the U.S. and North America healthcare systems.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Allergy Type |

|

|

Treatment Type |

|

|

Distribution Channel |

|

|

Formulation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Allergy Immunotherapy Market - Regional Analysis

North America Market Insights

The North America allergy immunotherapy market is anticipated to account for more than 40.5% of the global market share by the end of 2035. The dominance of the region is attributable to a large patient pool and strong support from the country’s government, which is with their funding initiatives. Additionally, the increased awareness about the allergic conditions of immunotherapy and the advancements in sublingual immunotherapy are significantly contributing to the market growth in the region. Furthermore, the growing adoption of personalized medicine and favourable reimbursement policies are shaping market expansion.

The allergic immunotherapy market in the U.S. is driven by rising disease prevalence, and private sector investments in the medical industry. For instance, based on the CDC report in January 2023, 1 in 3 adults and more than 1 in 4 children in the U.S. reported having a seasonal allergy. Moreover, 6% of adults and children have a food allergy, showcasing the demand in the market. Hence, such factors are expected to support the market progression during the forecast period with enhanced treatment access.

Allergy Types and their Prevalences

|

Allergy Type |

U.S. Prevalence |

Canada Prevalence |

|

Allergic Rhinitis |

24 million |

20% of general population |

|

Food Allergy (Children) |

1 in 13 |

3 million |

|

Food Allergy (Adults) |

1 in 10 |

3% to 4% of population |

|

Allergic Asthma |

24.9 million |

250,000 |

Sources: ACAAI, AACI Journal, Food Allergy Canada, Canada Government, NLM October 2023

APAC Market Insights

The allergy immunotherapy market is the fastest-growing market in the Asia-Pacific region and is experiencing significant growth, driven by increasing prevalence of allergic diseases, rising healthcare expenditure, and government-associated initiatives in countries such as Japan, China, India, South Korea, and Malaysia. Additionally, the rapid urbanization is creating a large patient pool owing to the increased pollution, which creates a heightened awareness of healthcare access in the region. The region’s market is projected to grow steadily with support from governments to drive further growth.

China is a global leader in the market, which is exceptionally supported by increasing instances of allergic diseases in the country. As per the NLM article in November 2022, nearly 250 million people in China are affected by allergic rhinitis. Furthermore, as the population increases, the demand for management strategies also expands rapidly. Those factors strengthen the domestic production of allergy immunotherapy products in the country, positioning China as a key leader in the Asia Pacific.

Europe Market Insights

The allergy immunotherapy market in Europe is expanding rapidly and is dominated by high disease prevalence, advanced healthcare systems, and robust government support. The major drivers are the mass adoption of both subcutaneous (SCIT) and sublingual (SLIT) therapies, facilitated by solid national reimbursement systems in Germany and France. One notable trend is the convergence of regulatory approvals within the European Union, which is enabled by the European Medicines Agency (EMA) that expedites market access for novel AIT products. In addition, rising patient awareness, supplemented by clinical guidelines that support the use of AIT as a disease-modifying treatment, is driving demand.

Germany is projected to hold the largest revenue share in Europe by 2035. The region is dominated by its strong statutory health insurance system, which provides high coverage and timely reimbursement for both SCIT and SLIT therapies, ensuring high patient access. According to the NLM report in July 2023, 15% of the adult population and 10% of children are suffering from allergic rhinitis. In addition, the nation's large patient base, high diagnostic rates, and dense network of specialized allergologists cement its market leadership even further.

Key Allergy Immunotherapy Market Players:

- ALK-Abelló

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stallergenes Greer

- Merck KGaA

- Aimmune Therapeutics

- HAL Allergy Group

- Biomay AG

- DBV Technologies

- Allergy Therapeutics

- Leti Pharma

- WOLW Pharma

- Abbott Laboratories

- Novartis AG

- GlaxoSmithKline plc

- Johnson & Johnson

- Sanofi

- Torii Pharmaceutical Co., Ltd.

- Shionogi & Co., Ltd.

- Mitsubishi Tanabe Pharma

- ALK-Abelló Japan K.K.

- Nippon Zenyaku Kogyo

The competitive landscape of the allergy immunotherapy industry is inspiring the global players to expand their market share. Companies involved in the emerging markets of the U.S., such as Thermo Fisher Scientific and Regeneron Pharmaceuticals, are leveraging advanced injectable treatments. While other key players, including ALK-Abelló and Stallergenes Greer, are dominating the industry with sublingual and subcutaneous treatments. This is further dragging the interest in conducting research activities and bringing innovation in the field, especially for biologics and immunotherapies targeting severe allergic reactions.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2025, ALK announced the European regulatory filing for ITULAZAX, which is a tablet for tree pollen sublingual allergy immunotherapy. The tablet is used to treat young children and adolescents aged five to 17.

- In February 2024, Novartis announced the FDA approval for Xolair which is used to reduce the allergic reactions among children and adults. The product is used for people have more than one food allergy.

- Report ID: 3769

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Allergy Immunotherapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.