Aliphatic Solvents Market Outlook:

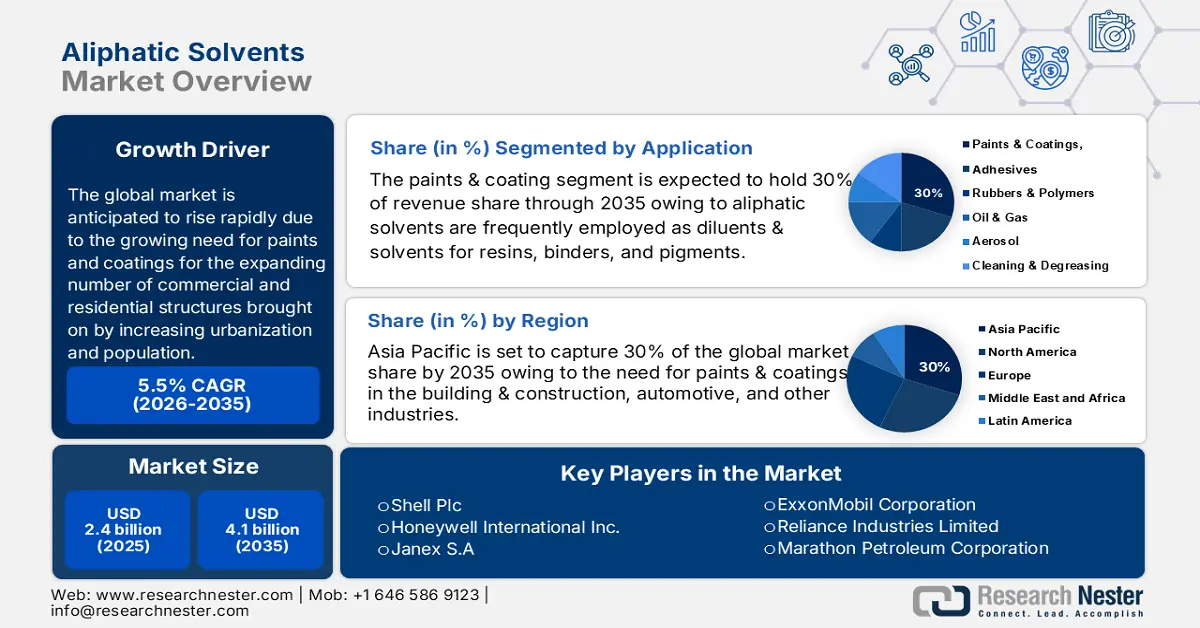

Aliphatic Solvents Market size was over USD 2.4 billion in 2025 and is poised to exceed USD 4.1 billion by 2035, growing at over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aliphatic solvents is evaluated at USD 2.52 billion.

The market growth is due to growing need for paints and coatings for the expanding number of commercial and residential structures brought on by increasing urbanization and population. Approximately 52% of the coatings manufactured globally are used for both the upkeep and decoration of newly constructed and pre-existing structures, such as public buildings, factories & residences, and public buildings. Moreover, approximately 35% of the coatings are applied to industrial objects for protection or decoration. Furthermore, increasing focus on sustainability and the growing demand for environmentally friendly solvents would drive the development of new and creative aliphatic solvents in the next years.

Key Aliphatic Solvents Market Insights Summary:

Regional Highlights:

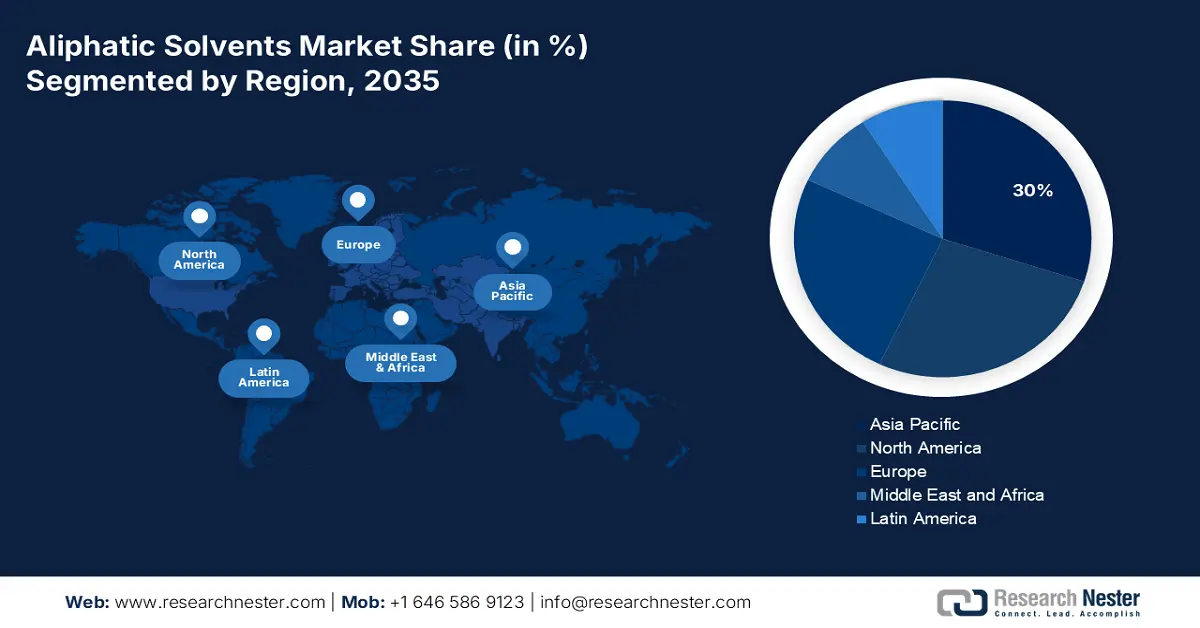

- Asia Pacific aliphatic solvents market is poised to capture 30% share by 2035, driven by rising demand from automotive and construction industries in China.

- North America market will secure 27% share by 2035, driven by demand for eco-friendly solvents and infrastructure development.

Segment Insights:

- The paints & coatings segment in the aliphatic solvents market is expected to experience substantial growth during 2026-2035, driven by construction demand and preference for low-VOC coatings.

- The mineral spirits segment in the aliphatic solvents market is projected to maintain a 25% share by 2035, fueled by widespread use in paints, cleaning products, and coatings.

Key Growth Trends:

- Expanding Rubber Sector Will Increase Need for Aliphatic Solvents

- Turpentine Substitution with Mineral Spirits

Major Challenges:

- Expanding Rubber Sector Will Increase Need for Aliphatic Solvents

- Turpentine Substitution with Mineral Spirits

Key Players: Chevron, Corporation, ExxonMobil Corporation, Reliance Industries Limited, Marathon Petroleum Corporation, E.I. Du Pont De Nemours and Company, PJSC Lukoil Oil Company, Valero Energy Corporation, Shell Plc, Honeywell International Inc., Janex S.A.

Global Aliphatic Solvents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 billion

- 2026 Market Size: USD 2.52 billion

- Projected Market Size: USD 4.1 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 8 September, 2025

Aliphatic Solvents Market Growth Drivers and Challenges:

Growth Drivers

- Expanding Rubber Sector Will Increase Need for Aliphatic Solvents- The availability of turpentine alternatives, such as mineral spirits, broadens the range of aliphatic solvents available, and the use of aliphatic hydrocarbon solvents is one of the major factors propelling the global aliphatic solvents market. Rubber is manufactured with the use of aliphatic solvents. The solvents's adhesive qualities, which also soften and clean each rubber layer, keep the tire's components together. Safety and performance are enhanced by this. Global rubber production reached 13.8 million tons in 2021, according to WRIO. Rubber demand is predicted to rise as a result of the expanding shoe, automotive, and other industries. The need for aliphatic solvents is increasing as a result of large producers of rubber products moving to recyclable raw materials in response to global concerns about sustainability.

- Turpentine Substitution with Mineral Spirits- Although it is commonly utilized in the art industry, turpentine is known to generate toxic fumes and have a pungent smell. Similar to turpentine, mineral spirits are aliphatic solvents that carry out the same task without emitting any smells or fumes. Human skin, eyes, mucous membranes, and upper respiratory tracts are all irritated by nicotine. It can affect the central nervous system, gastrointestinal system, and urinary tract in addition to causing skin sensitization. These are the main causes of the substitution of mineral spirits for turpentine, which is anticipated to increase the aliphatic solvents market demand for aliphatic solvents.

- Growing Utilization of Organic Solvents and Technological Advancements- The key market participants will have a plethora of opportunities owing to the latest equipment, cutting-edge technologies, and the deployment of new systems. Furthermore, the market for aliphatic solvents will continue to develop in the future due to the growing regulatory pressure regarding the usage of organic solvents. Additionally, the growing need from developing and underdeveloped nations would present a chance for the aliphatic solvents market for aliphatic solvents to expand.

Challenges

- Negative Consequences and a Transition to Greener Substitutes to Hinder Development- Employees who work with solvents in the production of aliphatic solvents and thinners often come into contact with them, which can be detrimental to their respiratory and neurological systems. Because of the strict laws governing the use of solvents, producers of aliphatic solvents and thinners are now interested in using organic solvents as a substitute.

- The aliphatic solvents market is expected to develop more slowly due to the growing demand from makers of adhesives, paints & coatings, cosmetics, medications, and eco-friendly solvents such glycerol, ethanol, ethyl acetate, and d-limonene.

- Since aliphatic solvents are made from petroleum, their production and consumption will be negatively impacted by rising crude oil prices.

Aliphatic Solvents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 2.4 billion |

|

Forecast Year Market Size (2035) |

USD 4.1 billion |

|

Regional Scope |

|

Aliphatic Solvents Market Segmentation:

Application Segment Analysis

Based on application, paint & coatings segment in the aliphatic solvents market is anticipated to hold 30% of the revenue share by 2035. In the paint and coatings industry, aliphatic solvents are frequently employed as diluents & solvents for resins, binders, and pigments. The rise of the construction industry, the need for high-performance coatings, and the trend toward low-VOC coatings are driving the need for aliphatic solvents in the paint & coatings sector. Cleaning and degreasing are two other significant uses for aliphatic solvents, especially in the industrial and automotive sectors. The growing demand for aliphatic solvents as thinners and diluents in paints and coatings is a result of the expanding building and construction sector. Processors employ these solvents as cleaning and degreasing chemicals in addition to construction adhesives, paints, and coatings that are specifically designed for the construction sector. According to estimates, between 27,000 and 50,000 new homes will be produced in the UK year starting in 2018, expanding the aliphatic solvents market potential.

Type Segment Analysis

Based on type, mineral sprits segment in the aliphatic solvents market is predicted to hold largest revenue share of about 25% during the forecast period. With the greatest market share, mineral spirits are the most often used aliphatic solvents. Mineral spirits are multipurpose solvents that are frequently used in ink, paints and coatings, and cleaning products. Although their market shares are smaller than that of mineral spirits, other aliphatic hydrocarbon solvents and thinners, such as painter's naphtha, varnish makers' naphtha, hexane, and heptane, also hold sizable market shares.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aliphatic Solvents Market Regional Analysis:

APAC Market Insights

Aliphatic solvents market share in Asia Pacific region is anticipated to exceed 30% by 2035. The majority of the world's demand for aliphatic solvents is currently met by the Asia Pacific region because of the need for paints & coatings in the building & construction, automotive, and other industries. China is the world's largest vehicle producer, and the country's market continues to be the key driver of aliphatic solvents growth. It is anticipated that China's robust chemical manufacturing industry and massive public and private infrastructure development will operate as the primary growth drivers for rising consumption across the country. With yearly chemical exports valued at over USD 72 billion, China is the aliphatic solvents market leader in this sector. In addition, as of 2020, China's domestic chemical consumption was valued at USD 1.77 trillion.

North American Market Insights

Aliphatic solvents market in North America region is attributed to hold about 27% share during the forecast period. The market in North America is anticipated to increase as a result of the region's increasing need for ecologically friendly solvents. The region's need for aliphatic solvents is also fueled by the expanding building and infrastructure sectors, as well as the rising demand for premium paints and coatings, printing inks, adhesives, and sealants.

Aliphatic Solvents Market Players:

- Chevron Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ExxonMobil Corporation

- Reliance Industries Limited

- Marathon Petroleum Corporation

- E.I. Du Pont De Nemours and Company

- PJSC Lukoil Oil Company

- Valero Energy Corporation

- Shell Plc

- Honeywell International Inc.

- Janex S.A

Recent Developments

- October 2018: At Imperial Oil's Sarnia Refinery, ExxonMobil Catalysts and Licensing LLC and BASF Corporation are demonstrating a novel gas treatment solvents on a large commercial scale. The firms worked together to develop a novel amine-based solvents that would meet sulfur emissions criteria more effectively and raise the bar for acid gas removal and tail gas treating procedures.

- January 2024: Reliance Industries is the first company in India to employ circular polymer chemical recycling. RIL shipped the first batch of CircuRepolTM, an ISCC-Plus certified circular polymer. The largest integrated refinery and petrochemical complex in the world, Reliance Industries Limited, has made history by being the first Indian business to chemically recycle plastic waste-based pyrolysis oil into certified circular polymers that meet ISCC-Plus standards. This latest development demonstrates RIL's dedication to lowering plastic waste and promoting the circular economy in India.

- Report ID: 3328

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aliphatic Solvents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.