Alcohol Use Disorder Treatment Market Outlook:

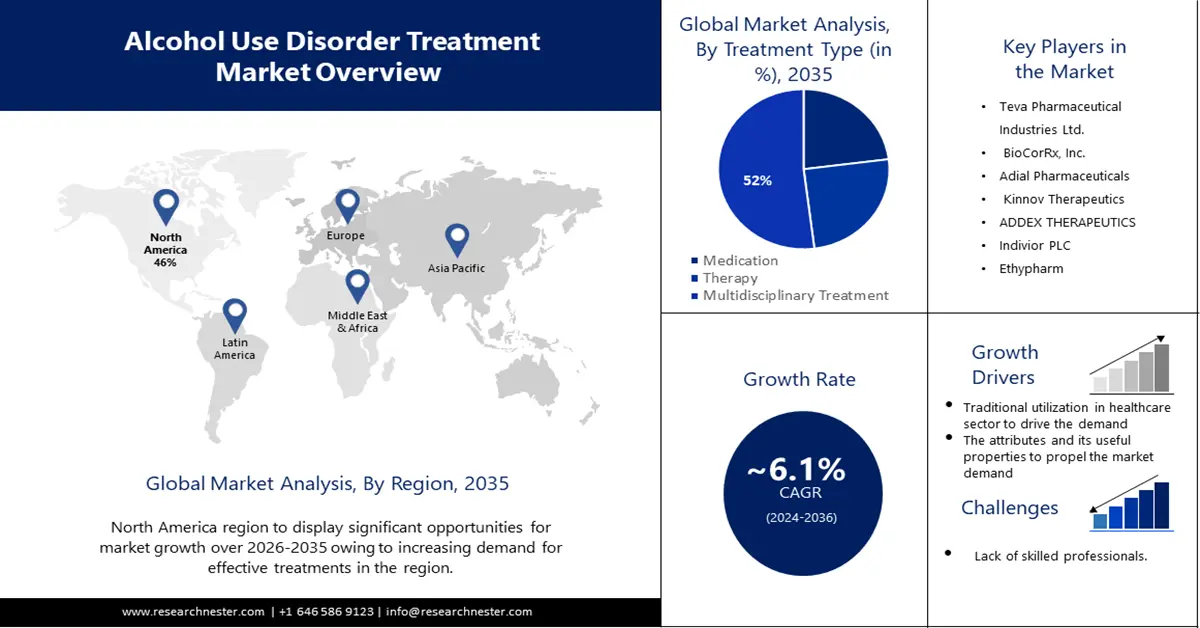

Alcohol Use Disorder Treatment Market size was over USD 1.36 billion in 2025 and is poised to exceed USD 2.46 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alcohol use disorder treatment is estimated at USD 1.43 billion.

The alcohol use disorder treatment market is witnessing exceptional growth with immense support from the rising demand for advanced therapies due to the increasing prevalence of alcohol use addiction. Furthermore, advanced management technologies, research initiatives are enhancing treatment capabilities across the world. As per the June 2024 WHO report, alcohol consumption in a year led to approximately 2.6 million deaths, which further highlighted those men accounted for 2 million deaths and women accounted for 600,000 deaths. This underscores the high prevalence among the male population, and with alcohol use disorders diagnosed in 400 million people, which is 7% of the global population.

This rising incidence, coupled with the ongoing clinical trials to explore the product’s complete potential and research, is boosting growth in the alcohol use disorder treatment market. For instance, in April 2025, Alkermes, Inc. announced that a survey conducted with The Harris Poll demonstrated that the majority of people diagnosed with alcohol use disorder are recognized after experiencing serious negative consequences like ER visits or DUI incidents. Thus, the survey highlights the unmet medical needs, encouraging an early diagnosis and treatment, and the critical role of healthcare providers in recommending management strategies, thereby augmenting the industry’s growth.

Key Alcohol Use Disorder Treatment Market Insights Summary:

Regional Highlights:

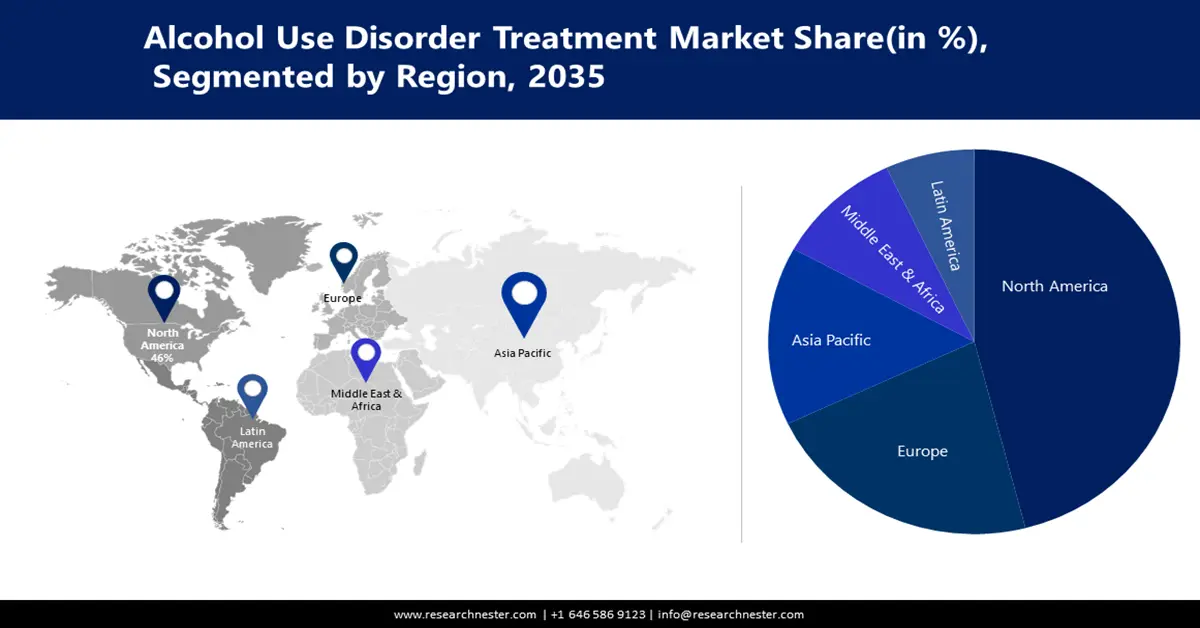

- North America alcohol use disorder treatment market will hold around 46% share by 2035, driven by the robust healthcare infrastructure and growing demand for AUD treatments.

Segment Insights:

- The multidisciplinary treatment segment in the alcohol use disorder treatment market is expected to attain a 52% share by 2035, attributed to the long-term effectiveness of multidisciplinary treatment approaches.

- The alcohol abuse segment in the alcohol use disorder treatment market anticipates considerable growth during 2026-2035, propelled by lifestyle changes, rising alcohol availability, and higher discretionary income.

Key Growth Trends:

- Treatment advancements

- Increased awareness and diagnosis rates

Major Challenges:

- Limited access to treatment

- Social stigma

Key Players: Teva Pharmaceutical Industries Ltd., BioCorRx, Inc, Adial Pharmaceuticals, ADDEX Therapeutics, Kinnov Therapeutics, Opiant Pharmaceuticals.

Global Alcohol Use Disorder Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.36 billion

- 2026 Market Size: USD 1.43 billion

- Projected Market Size: USD 2.46 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Alcohol Use Disorder Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Treatment advancements: The growing occurrence of alcohol use disorder cases is driving the requirement for innovative treatments, fueling growth in the alcohol use disorder treatment market. In May 2022, Clearmind Medicine Inc. reported successful preclinical trial results for its proprietary molecule MEAI aimed at reducing alcohol consumption. It further stated that mice treated with MEAI significantly reduced their alcohol intake, while no harmful effects on major organs indicating a strong safety profile. This, in turn, drives the demand for specialized management procedures, supporting complex development and regulatory needs.

- Increased awareness and diagnosis rates: The increased public and medical awareness about AUD as a diagnosable medical condition is accelerating growth in the alcohol use disorder treatment market, with support from the regulatory bodies. For instance, in May 2024, DURECT Corporation declared that its larsucosterol received Breakthrough Therapy designation from the U.S. FDA for the treatment of patients with severe alcohol-associated hepatitis. This will encourage the key players in the market to develop and launch more of such effective formulations, amplifying market expansion during the forecast period.

Challenges

- Limited access to treatment: One of the major restraints in the alcohol use disorder treatment market is the limited access to AUD treatment particularly in developing regions. These services require specialized care and support services making the initial procedure substantial. Additionally at the places where treatment is available patient adherence can be low due to side effects, lack of ongoing support or financial constraints. These barriers reduce the long-term effectiveness of treatment programs and hinder market expansion.

- Social stigma: Another major challenge posed by the alcohol use disorder treatment market is the persistent societal stigma surrounding alcohol use disorders. These complications occur due to the intricate nature of individuals delaying or avoiding seeking help due to fear of judgment or misconceptions about addiction. Moreover, this stigma not only hampers early diagnosis but also discourages engagement with available treatment options, leading to health disparities despite high prevalence rates.

Alcohol Use Disorder Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.36 billion |

|

Forecast Year Market Size (2035) |

USD 2.46 billion |

|

Regional Scope |

|

Alcohol Use Disorder Treatment Market Segmentation:

Treatment Type

Based on treatment type, the multidisciplinary treatment segment is expected to garner the highest share of 52% in the alcohol use disorder treatment market by the end of 2035. The segment’s dominance is attributable to the long-term effectiveness of the treatment, including medical detoxification, aversion therapy, and healthy lifestyle habits. In this regard, according to a study by NLM in May 2023, patients who received multidisciplinary treatment demonstrated better adherence, with 91.7% maintaining continued hospital visits when compared to those without such support, highlighting the effectiveness of a multidisciplinary approach. This is evidence for a wider scope, thus positively impacting the segment’s growth.

Disorder Type

Based on disorder type, the alcohol abuse segment is projected to expand at a considerable rate during the forecast period in the alcohol use disorder treatment market. The segment’s dominance is attributable to the lifestyle changes among the younger population, increased alcohol availability, rising discretionary income, and risks associated with alcohol consumption. For instance, in August 2022, the Grayken Center for Addiction at Boston Medical Center finalized the acquisition of alcohol, other drugs, and health to improve patient care in alcohol abuse. This has encouraged companies to undertake several initiatives to enhance their presence in the AUD market.

Our in-depth analysis of the global market includes the following segments:

|

Treatment Type |

|

|

Disorder Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alcohol Use Disorder Treatment Market Regional Analysis:

North America Market Insights

The North America alcohol use disorder treatment market is anticipated to register a significant share of 46% by 2035, amplifying its healthcare operations. The region benefits from a robust healthcare infrastructure and the ever-increasing demand for effective treatment measures for AUD. For instance, in December 2024, Adial Pharmaceuticals, Inc., notified that it had been granted a key U.S. patent number 12150931 expanding genotype coverage for its lead drug AD04 targeting alcohol and drug dependence. Hence, such activities strengthen their intellectual property portfolio, inspiring the global players by enabling targeted therapies based on genetic profiles.

The U.S. alcohol use disorder treatment market is witnessing significant growth driven by the ongoing efforts in research activities. Moreover, the country hosts substantial support groups, digital health initiatives, and new policies that aid in alcohol use disorder management. In November 2021, Pear Therapeutics declared that it secured a Breakthrough Device Designation from the U.S. FDA, which is a digital therapeutic that aids in the treatment of alcohol use disorder, reSET-A, with a positive outlook, widening the market scope. Furthermore, supportive regulations have enhanced innovations, leading to a surge in the number of clinical trials and approvals of advanced, groundbreaking therapies in the alcohol use disorder treatment market.

The Canada market is growing steadily, supported by the government, a strong drug research environment, and collaborative industry partnerships. With a strong focus on regulatory reforms, dependence treatment programs, and other health initiatives, the country is anticipated to witness considerable growth during the forecast period. In June 2021, Health Canada initiated three support projects with nearly USD 2 million in Alberta and Newfoundland and Labrador, aiming to address alcohol-associated disorders, including AUD. Under this project, Boyle Street Service Society, St. John’s Women’s Centre, and the McMan Youth, Family and Community Services Association will be receiving funding, thereby uplifting market growth.

APAC Market Insights

The Asia Pacific region houses a large and assorted population, including a substantial number of addicted individuals who require effective treatment measures through various strategies. This grants appreciable market prospects for healthcare facilities providing treatment in the region, further expanding market growth. The region is also widening access to rehabilitation programs, medications, and digital health innovation to support alcohol use disorder treatment in the region. Thus, these factors significantly boost the market in the region, demonstrating lucrative growth opportunities during the forecast timeline.

India’s alcohol use disorder treatment market is particularly supported by a robust pharmaceutical industry, regulatory reforms, and financial support for biopharmaceuticals. Moreover, the exceptional support from the government spurred the rehabilitation of alcohol use, aiming to position India as a regional hub for dependence therapy. In January 2024, as published by the MoSJE under the National Action Plan for Drug Demand Reduction, supports prevention, treatment, and rehabilitation of substance abuse through up to 95% financial aid to NGOs and states such as Jammu and Kashmir and the North East regions. This support from the government uplifts the market growth in the region.

The China alcohol use disorder treatment market is driven by a large patient base with a huge addiction to alcohol. The government’s commitment to supporting pharmaceutical innovation, combined with favorable regulatory adjustments for faster approvals, has fostered a favorable business environment. As per the NLM report in February 2020, alcohol dependence in the country led to 381,200 deaths in a year, with a lowered overall life expectancy by 0.43 years. It further stated that the incidence among 18 to 69-year-olds was 35.7%, in men 55.6% in women. Hence, due to the rising burden, the country’s market is anticipated to witness lucrative growth during the forecast period.

Alcohol Use Disorder Treatment Market Players:

- Alkermes Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teva Pharmaceutical Industries Ltd.

- BioCorRx, Inc

- Adial Pharmaceuticals

- ADDEX THERAPEUTICS

- Kinnov Therapeutics

- Opiant Pharmaceuticals

- Ethypharm

- Omeros Corporation

- Montisera Ltd.

- Altimmune, Inc.,

- BioCorRx Inc

- Amygdala Neurosciences, Inc

- Clearmind Medicine Inc.

- DURECT Corporation

- Adial Pharmaceuticals, Inc

- Pear Therapeutics

- Tempero Bio, Inc.

One of the key strategies adopted by the companies involved in the alcohol use disorder treatment market is investing in new drug formulations. This is mainly done through upgrading the existing drugs and undergoing substantial clinical trials to explore their complete potential with funding activities. For instance, in March 2025, Tempero Bio, Inc. secured USD 70 million in Series B financing for advancing TMP-301 into Phase 2 trials for substance use disorders such as alcohol and cocaine use disorders, which was led by Aditum Bio, Khosla Ventures, and others. These investments, in addition to other strategic collaborations, are projected to influence significant market activities, maintaining healthy competition between the global players.

Some of the prominent players in the alcohol use disorder treatment market are:

Recent Developments

- In May 2025, Altimmune, Inc., notified that it would present new data on pemvidutide-treated subjects with metabolic dysfunction-associated steatotic liver disease (MASLD), obesity, MASH, and AUD at the International Liver Congress.

- In April 2025, Amygdala Neurosciences, Inc., notified that it chose ANS-858 for clinical development, which is a small molecule inhibitor of aldehyde dehydrogenase 2 for substance use disorder that aims to lower the effects of alcohol and other substances.

- In August 2023, BioCorRx Inc. announced that it submitted an expanded access program for BICX104 (implantable naltrexone pellet) to the U.S. FDA that is used to treat opioid use disorder.

- Report ID: 3804

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.