Albumin Market Outlook:

Albumin Market size is valued at USD 7.9 billion in 2025 and is projected to reach USD 15.1 billion by the end of 2035, rising at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of albumin is estimated at USD 8.4 billion.

The international market is growing due to the growing demand for albumin in various therapeutic areas such as liver disease, burns, trauma, and surgical applications, where it finds its importance in fluid resuscitation. The population of patients receiving albumin treatment is, however, skewed toward the critically ill and tends to get clustered in tertiary care hospitals and big dialysis or ICU centers. On the supply side, the chain of activities includes plasma collection, fractionation, purification, fill finish, and cold-chain logistics. Supply knowledge encompasses plasma collection, fractionation, purification, and cold-chain logistics for drug and API manufacturing. According to a report by the World Integrated Trade Solution, in 2023, the U.S. imports of albumins and albuminates were worth USD 133,320 million with an import volume of 10,226,500 kg in 2023, showing strong demand in the healthcare sector.

The albumin market has many more operative functions in human physiology and is also a matter of concern for the pharmaceutical industry. As per a report by NLM in December 2022, the liver hepatocytes synthesize albumin and quickly excrete it into the bloodstream at a considerable rate of 10 to 15 grams per day, showing how important albumin is anatomically. Additionally, the market operates within the framework and market forces that influence the pharmaceutical industry. Intense research and development are carried out in recombinant albumin production platforms and purity assay developments to assure product quality.

Key Albumin Market Insights Summary:

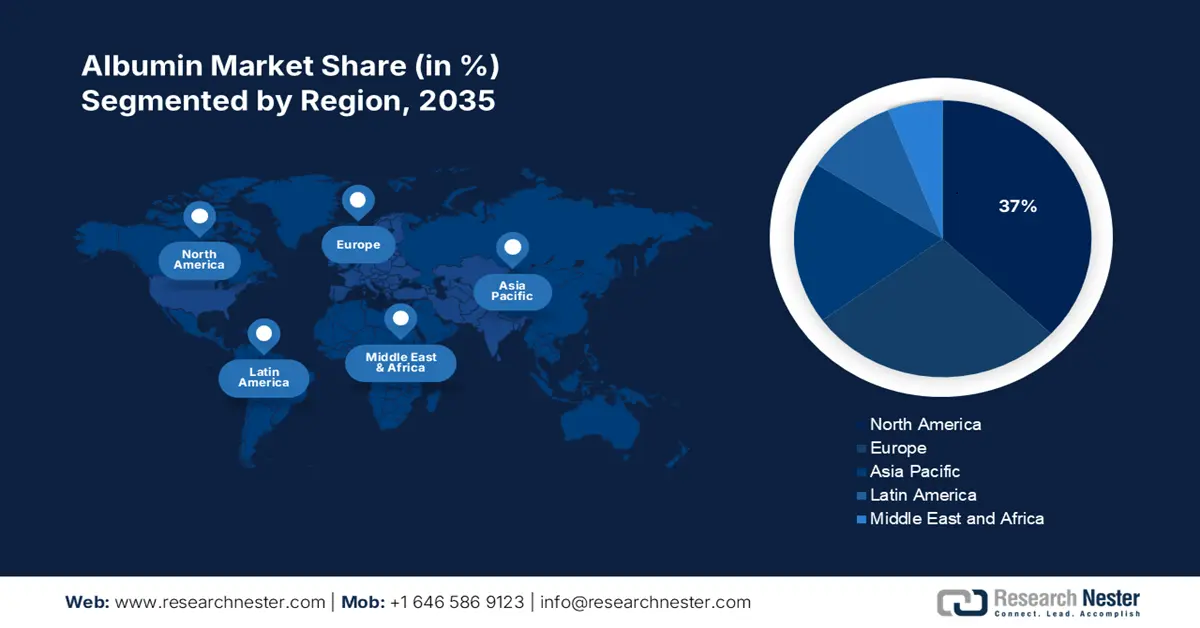

Regional Insights:

- North America is anticipated to command a 37% share of the Albumin Market by 2035, impelled by advanced healthcare infrastructure, high healthcare spending, and strong plasma collection networks.

- Asia-Pacific is projected to emerge as the fastest-growing region during 2026–2035, fueled by increasing chronic diseases and expanded investments in plasma collection and biopharmaceutical facilities.

Regional Insights:

- The plasma-derived subsegment of the Albumin Market is anticipated to account for a 58% share by 2035, propelled by its cost-effectiveness, extensive therapeutic applications, and the growing establishment of plasma fractionation centers.

- The human serum albumin segment is projected to secure the highest revenue share by 2035, owing to its widespread clinical use in managing hypoalbuminemia and chronic liver and kidney conditions.

Key Growth Trends:

- Rising prevalence of chronic diseases boosts albumin demand

- Biotechnology advancements enable safer recombinant albumin products

Major Challenges:

- Existence of black-market sales

- Limitations in clinical guidelines

Key Players: CSL Behring (U.S.),Grifols (Spain),Takeda Pharmaceuticals (U.S.),Octapharma (Switzerland),Baxter International (U.S.),Kedrion Biopharma (Italy),Biotest (Germany),LFB Group (France),Sanquin (Netherlands),Bio Products Laboratory (UK),SK Plasma (South Korea),Biological E. Ltd. (India),Serum Institute of India,Protheragen (Malaysia),Seqirus (Australia).

Global Albumin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.9 billion

- 2026 Market Size: USD 8.4 billion

- Projected Market Size: USD 15.1 billionby 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

- Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, Indonesia, Mexico, Thailand

Last updated on : 6 October, 2025

Albumin Market - Growth Drivers and Challenges

Growth Drivers

- Rising prevalence of chronic diseases boosts albumin demand: The market has been expanding due to the increasing incidence of chronic diseases such as liver cirrhosis, hypoalbuminemia, and kidney disorders, as albumin is crucial for the treatment to maintain the fluid balance and plasma volume. According to the American Liver Foundation in September 2023, approximately 4.5 million U.S. adults (about 1.8%) have been diagnosed with liver disease, which indicates a growth in the market. However, it is estimated that between 80 and 100 million adults in the U.S. have fatty liver disease, many of whom are unaware of their condition. This growing population base has, in turn, increased the circulation of albumin therapies throughout the world.

- Biotechnology advancements enable safer recombinant albumin products: Technological innovation in biotechnology and recombinant DNA techniques stood as drivers for the albumin market. According to the American Liver Foundation in September 2023, Liver disease or cirrhosis is found in different amounts among groups, such as 6.9% of the U.S. population from Japan, 6.7% of Latino people, and 4.1% of White people. Since 2022, several recombinant albumin therapies have received approval from the U.S. Food and Drug Administration (FDA), promoting their usage in drug formulation and vaccine development. While the presence of recombinant albumin therapies answers what is now a growing demand on one hand, these therapies also address safety concerns.

- Expansion of plasma fractionation infrastructure fuels albumin supply: The global growth in plasma fractionation capacity, especially in emerging markets, is paramount in satisfying the increasing demand for market. The World Health Organization (WHO) reported in October 2023 that an estimated 180,000 deaths occur annually due to burns, which require albumin for effective burn shock resuscitation. Many new plasma fractionation sites have been established in response to therapeutic needs, thereby enhancing the production capacity of albumin. Such infrastructural development shall ensure the constant supply of albumin for critical medical applications. Hence, with an improved production capacity, the demands for albumin continue to expand.

Albuminuria Categories in Chronic Kidney Disease (2022)

|

Category |

AER (mg/24 h) |

ACR (mg/mmol) |

ACR (mg/g) |

Description |

Previous Terminology |

|

A1 |

< 30 |

< 3 |

< 30 |

Normal to mildly increased |

Normal |

|

A2 |

30 – 300 |

3 – 30 |

30 – 300 |

Moderately increased |

Microalbuminuria |

|

A3 |

> 300 |

> 30 |

> 300 |

Severely increased |

Proteinuria |

Source: NLM

Challenges

- Existence of black-market sales: The existence of the illicit albumin market readily endangers patients’ lives and erodes trust, thus causing a hindrance to the market growth. Besides, the gray market in India effectively thrives, owing to gaps in the supply system, with markups increasing. Therefore, all these issues deter manufacturers, resulting in incompetence. However, rigid enforcement and public awareness campaigns are probable solutions to combat these challenges.

- Limitations in clinical guidelines: The presence of strict treatment protocols tends to curb the expansion of the market internationally. Hence, the UK’s NICE has recommended albumin for use only in burns and cirrhosis, thereby excluding off-label applications. Likewise, Medicare has authorized rules in the U.S., which have caused delays of prescriptions through bureaucratic appeals. Thus, all these limitations reflect cost risks in comparison to clinical faults, as evident in studies conducted to ensure albumin’s efficacy in post-surgical and sepsis recovery.

Albumin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 7.9 billion |

|

Forecast Year Market Size (2035) |

USD 15.1 billion |

|

Regional Scope |

|

Albumin Market Segmentation:

Source Segment Analysis

The plasma-derived subsegment is expected to hold the largest market share of 58% within the forecast period in the source segment in the albumin market, due to its established production infrastructure and cost-effectiveness. Plasma-derived albumin is used widely in treating therapies for volume expansion and burns. According to the American Liver Foundation in September 2023, over 51,642 adults died of liver disease in the U.S. many need plasma-derived albumin for proper treatment and fluid resuscitation. As recombinant albumin advances, preference is for plasma-derived recombinant albumin to be available on such a scale. The establishment of new plasma fractionation centers, especially in new markets, further fortifies the supply capacity and secures the segment's dominance until 2035.

Type Segment Analysis

The human serum albumin segment is projected to garner the highest revenue share in the type segment of the market, owing to its extensive use in clinical settings and the management of critical illnesses and chronic conditions. The product is mainly used for treating hypoalbuminemia, especially in liver and kidney-related complications. According to the American Liver Foundation in September 2023, over 100 million people in America are affected by some form of liver disease as of September 2023, and most of these could benefit from albumin therapy. While the safety and therapeutic efficacy of HSA establish it as a winner against recombinant albumin, the rising incidence of chronic diseases all over the world further promotes the sustenance of demand for HSA in the near future.

Distribution Segment Analysis

The hospital pharmacies sub-segment is expected to hold the highest market share within the forecast period in the distribution segment, primarily as hospitals are the place where care of such patients under albumin therapy is provided. Simply put, a hospital pharmacy brings essential critical care products such as serum albumin, right to the patients, so it can be used either for emergency or ongoing treatments. The World Health Organization (WHO) reported in October 2023 that more than 410,000 burn injuries were registered in the U.S., out of which about 40,000 were severe enough to require hospitalization. Thus, the surging hospital admissions caused by chronic ailments and trauma cases across the globe promote the growing demand for this sub-segment. In addition, hospital pharmacies get a boost from the developing healthcare infrastructure in developing countries.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Sub-segments |

|

Type |

|

|

Source |

|

|

Application |

|

|

End user |

|

|

Distribution Channel |

|

|

Formulation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Albumin Market - Regional Analysis

North America Market Insight

North America is expected to hold the highest albumin market share of 37% within the forecast period, driven by advanced healthcare infrastructure, strong regulatory oversight, and high per-capita healthcare spending, which leads to the broader and faster adoption of albumin therapies and other plasma protein products. Further, plasma collection networks exist well in the U.S. and Canada to supply raw material. Public health awareness is quite high, as well as diagnostic screening for kidney dysfunction, liver cirrhosis, etc., thus increasing the possibility of using albumin treatments. According to a report by NIDDK in September 2024, more than 35.5 million U.S. adults had chronic kidney disease in 2023, 1 in 7, who will require therapy with albumin or related proteins.

The albumin market for the U.S. is growing due to an increase in chronic kidney disease (CKD), liver disease, and hypoalbuminemia-inducing disorders, which have clinical applications for albumin-carrying products. According to a report by NIDDK in September 2024, around 2 in 1,000 citizens of the U.S. suffer from end-stage kidney disease (ESKD), or kidney failure. In the ICU (trauma, burns, surgeries), albumin is used as a plasma expander and to correct fluid imbalance, so the demand for it goes up. Here, the growing disease burden due to a rising geriatric population in the U.S. is also ensured.

Albumins, albuminates imports by the U.S in 2023 To Different Countries

|

Product Description |

Partner |

Trade Value 1000USD |

Quantity (KG) |

|

Albumins (excl. egg albumin), albuminates and o |

World |

133,320.16 |

10,226,500 |

|

Albumins (excl. egg albumin), albuminates and o |

New Zealand |

37,025.59 |

3,982,770 |

|

Albumins (excl. egg albumin), albuminates and o |

Denmark |

31,987.82 |

2,258,240 |

|

Albumins (excl. egg albumin), albuminates and o |

UK |

26,471.63 |

1,204,630 |

|

Albumins (excl. egg albumin), albuminates and o |

Ireland |

12,014.83 |

1,441,000 |

|

Albumins (excl. egg albumin), albuminates and o |

Slovak Republic |

7,885.40 |

65,500 |

Source: WITS

The market for Canada is growing due to a rising number of cases of ESKD (end-stage kidney disease), and chronic organ dysfunction engenders albumin demand when given as part of treatment (dialysis, transplant support, fluid management). As per a report by NLM in February 2023, the incidence of chronic kidney disease in Canada stood recently at 71.9 per 1000 persons, thereby increasing the allied protein therapies. The clinical research, biopharmaceutical investments, and collaborations in Canada with plasma collectors or importers drive the supply. The increasing prevalence of comorbidities such as diabetes and hypertension only aggravates the risks of developing CKD and hypoalbuminemia.

Asia Pacific Market Insight

Asia-Pacific market is projected to be the fastest-growing market in the forecast period, with a rise in chronic disorders such as liver disorders, kidney failure, and sepsis, which increase the medical need for therapies involving albumin. Rapid urbanization and an aging population further limit access to health facilities in countries such as China, India, and Indonesia. Investments in biopharmaceuticals and plasma collection centers are also enhancing supply chains. Notably, NLM in February 2023 cited results from a national study published in 2023 by the National Clinical Research Center of Kidney Diseases, indicating that 8.2% of adults in China had chronic kidney disease, with 6.7% having albuminuria.

The albumin market for China is growing due to the number of liver disease cases, including cirrhosis and NAFLD (non-alcoholic fatty liver disease), which is high and increasing. An urban lifestyle, poor eating habits, increased obesity rates, and diabetes cases are all contributing factors to this trend. Additionally, the Government of China is investing in healthcare manufacturing infrastructure, which includes plasma-derived therapies such as albumin. This usually implies that domestic producers are gearing up to ramp up production, thus lessening dependence on imports. A clinical study reported by NLM in February 2023 stated that among CKD adults, 73.3%, 25.0%, and 1.8% were at stage 1 to 2, 3 and 4 to 5, respectively, and awareness of CKD was 10.0%, which is significantly higher than global averages.

The albumin market is growing in India with the rapidly increasing burden of CKD cases, with demand shooting up sharply for albumin products used in renal care due to diabetes and hypertension. Further, India is developing its dialysis and critical care infrastructures, where albumin finds common administration. The biotechnology sector of India is also investing in plasma fractionation and biologics manufacturing to enhance local supply. Increased income levels and better coverage by insurance make treatments accessible to the average patient with middle and lower-class incomes. According to a 2024 meta-analysis by NLM January 2025, the pooled prevalence rate of CKD among adult Indians stands at 13.2%, and higher rates of 15.3% have been seen in rural areas.

Europe Market Insight

Europe albumin market is expected to grow steadily due to rising cases of liver cirrhosis, nephrotic syndrome, and burns, all of which ought to be treated with albumin. NHS laboratories consider albumin under pharmacotherapy for critically ill patients and also in surgical situations. The UK, through its participation in international plasma collection schemes, secures the steady supply of raw material for albumin production. As per a report by WITS in September 2025, UK imports of Egg albumin stood at USD 59,035.99 and quantity 9,037,670. Additionally, public health campaigns further help amplify awareness regarding the benefits of albumin across the different therapeutic horizons. Further, an aging population across Europe demands increased interventions for health, including albumin-based therapies.

The market for the UK is growing due to increasing rates of conditions such as liver cirrhosis, nephrotic syndrome, and burns, which require albumin therapy. The National Health Service, Netherlands, has been introducing albumin into treatment protocols for critical care and surgical patients. As per a report by WITS in September 2025, the UK imported Egg albumin from the Netherlands (USD 33,607.65, 6,085,990 kg), from Italy (USD 8,514.34, 550,186 kg), and from France (USD 5,816.74, 676,654 kg). Also, the UK's participation in international plasma collection schemes assures a continuous flow of raw materials needed for albumin manufacture. Additionally, public health campaigns have been raising awareness about the application of albumin to various therapeutic areas.

The albumin market in Germany witnesses increasing growth from the country's superiority in the medical R&D for plasma-derived therapies. With a rise in chronic diseases such as chronic kidney disease (CKD) and liver disorders, albumin becomes necessary for treatment regimes. As Germany brings advancement in healthcare with regulations, it creates a favorable environment for market growth. Collaborations between public health organizations and the private sector further foster the availability of albumin treatments. As per a report by WITS in September 2025, Germany imported Egg albumin worth USD 31,137.35 kg in 6,850,560 kg quantities, mainly from the Netherlands, confirming a huge demand for albumin in the German healthcare system.

Egg Albumin Export and Import Countries of Europe (2023)

|

Export Destination |

Export Value (USD) |

Import Destination |

Import Value (USD) |

|

Norway |

288 |

Italy |

3.56 million |

|

France |

71 |

France |

1.2 million |

|

Malta |

59 |

Netherlands |

103,000k |

Source: OEC

Key Albumin Market Players:

- CSL Behring (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Grifols (Spain)

- Takeda Pharmaceuticals (U.S.)

- Octapharma (Switzerland)

- Baxter International (U.S.)

- Kedrion Biopharma (Italy)

- Biotest (Germany)

- LFB Group (France)

- Sanquin (Netherlands)

- Bio Products Laboratory (UK)

- SK Plasma (South Korea)

- Biological E. Ltd. (India)

- Serum Institute of India

- Protheragen (Malaysia)

- Seqirus (Australia)

The worldwide market is vigorously gaining increased exposure with the presence of leading organizations, including Takeda, Grifols, and CSL Behring, collectively controlling the market with a combined share. These players have readily implemented strategies, such as biopharmaceutical partnerships and collaboration, research and development activities for recombinant albumin, plasma self-sufficiency, and market penetration. For instance, Seqirus and Baxter successfully partnered with each other to supply albumin for mRNA vaccine stabilizers. Likewise, LFB Group and Takeda initiated an investment for yeast-based alternatives to albumin, thereby creating a positive influence on the overall market.

Here is a list of key players operating in the market:

Recent Developments

- In February 2025, InVitria announced that their new product Optibumin 25 is a more consistent alternative to traditional serum-derived albumin used in making cell and gene therapies, as it is made without using any animal blood and is designed to be safer.

- In October 2022, Grifols announced its new, advanced manufacturing plant to meet the growing global demand for plasma medicines such as albumin. This new facility triples the production capacity of their special flexible container, ALBUTEIN FlexBag, which is used to store and deliver albumin to patients.

- In February 2022, Aadi Bioscience has officially launched and made available its first medicine, FYARRO, designed for adults with locally advanced, unresectable, or metastatic malignant PEComa.

- Report ID: 5035

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Albumin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.