Aerospace Forging Market Outlook:

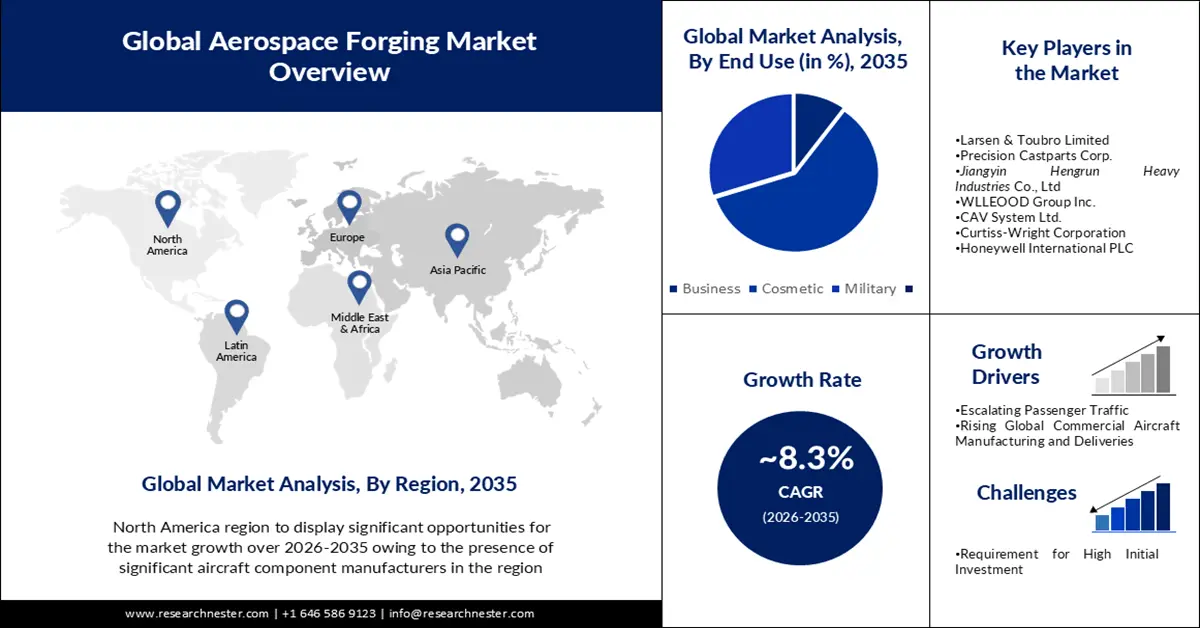

Aerospace Forging Market size was valued at USD 39.97 billion in 2025 and is likely to cross USD 88.72 billion by 2035, expanding at more than 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerospace forging is estimated at USD 42.96 billion.

The growth of this market can be attributed owing to the rising passenger traffic, big organizations such as Boeing and Airbus are expected to experience an increase in the production of aircraft manufacturing in the upcoming years. According to the International Air Transport Association, the number of people traveling by air is expected to grow by a factor of two over the following decades. By 2037, it is anticipated that 8.2 billion people will have used air transportation.

Moreover, constant investment in military equipment and demand for strong air transportation is anticipated to drive the industry growth. Also, U.S. operators are estimated to change the old models with better, lighter, and fuel-efficient models. For instance, according to estimates 9,130 new aircraft are likely to be delivered in North America by 2038. The aerospace and defense industries need a lot of forged components made from different alloys. Over the next few years, demand is expected to rise for items such as landing gears, turbines, engine parts, and machined parts. These parts are suitable for aerospace applications owing to their great strength.

Key Aerospace Forging Market Insights Summary:

Regional Highlights:

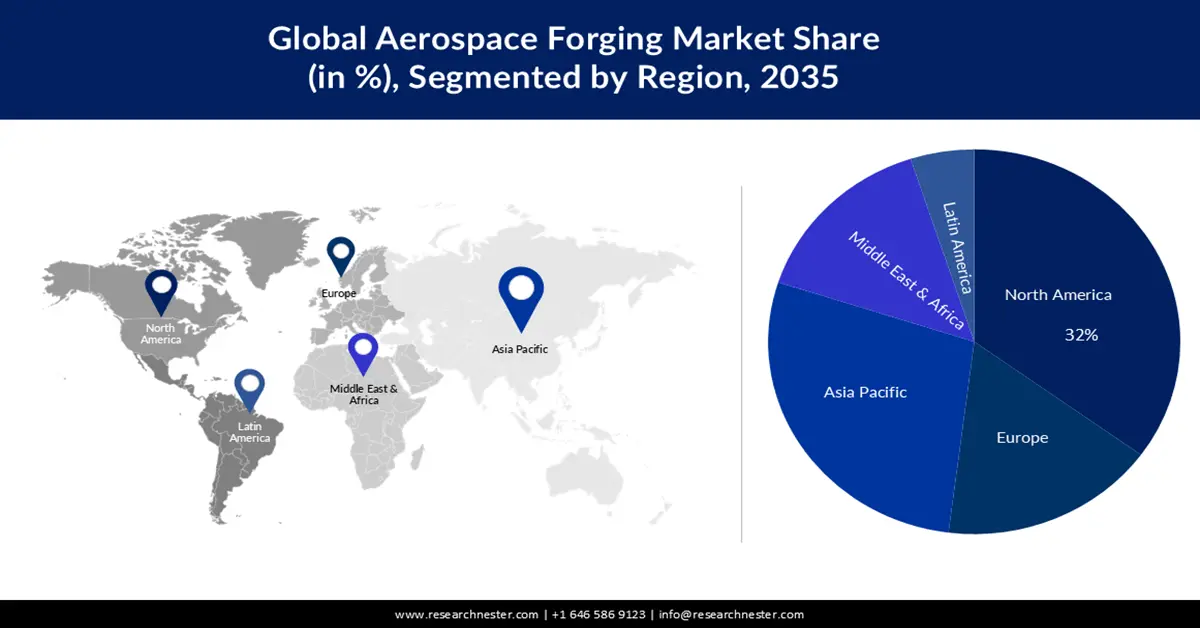

- By 2035, North America is projected to command a 32% share in the aerospace forging market, supported by the strong presence of leading aircraft and aerospace component manufacturers.

- The Asia Pacific region is anticipated to secure a significant share by 2035, bolstered by the expansion of the world’s fastest-growing aviation market.

Segment Insights:

- By 2035, the commercial segment is expected to hold the largest share in the aerospace forging market, propelled by rising investments in commercial aircraft production and increasing scheduled passenger flights.

- The aluminum alloy segment is projected to dominate the market by 2035, fueled by the surging utilization of lightweight and advanced aluminum alloys in aircraft manufacturing.

Key Growth Trends:

- Escalating Passenger Traffic

- Rising Global Commercial Aircraft Manufacturing and Deliveries

Major Challenges:

- Requirement for High Initial Investment

- Strict Rules and Regulations

Key Players: Arconic Corporation, Larsen & Toubro Limited, Precision Castparts Corp., Jiangyin Hengrun Heavy IndustriesCo., Ltd, WLLEOOD Group Inc., CAV System Ltd., Curtiss-Wright Corporation, Honeywell International PLC, Raytheon Technologies Corporation, Airbus S.A.S.

Global Aerospace Forging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.97 billion

- 2026 Market Size: USD 42.96 billion

- Projected Market Size: USD 88.72 billion by 2035

- Growth Forecasts: 8.3%

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, United Kingdom

- Emerging Countries: India, South Korea, Brazil, United Arab Emirates, Japan

Last updated on : 21 November, 2025

Aerospace Forging Market - Growth Drivers and Challenges

Growth Drivers

- Escalating Passenger Traffic – The aerospace forging market is expected to grow in the forecast period with the growing passenger traffic. As the lifestyle of people is changing, their disposable income is changing passengers tend to travel by air which gives rise to the passenger traffic in the commercial aviation sector. When compared to February 2022, total traffic increased by 55.5% in 2023. Traffic is currently 84.9% of February 2019 levels worldwide.

- Rising Global Commercial Aircraft Manufacturing and Deliveries – Growing manufacturing and deliveries of commercial aircraft globally are expected to drive the growth of the market in the forecast period. As people worldwide have increased their travel since post covid situation it has raised the demand for more commercial aircraft globally. According to estimates more than 38,000 new aircraft are to be delivered over the next 20 years, some of which will replace older aircraft in its current fleet.

- Growing Application in the Defense Sector – The defense sector demands a large number of forged components made up of lightweight alloys. These are majorly used to reduce the weight of aircraft at the same time the fuel efficiency and performance are maintained. Forged parts made from lightweight alloys such as titanium and aluminum are increasingly being used in aircraft construction to improve fuel efficiency and reduce emissions. The Aerospace Industry Association reports that the use of advanced materials such as composites, titanium, and aluminum alloys has reduced aircraft weight by 35% over the past 30 years.

- Rising Research and Development Activities - Research and development of new materials and processes, and the development of specialized high-performance alloys are other important factors likely to drive the use of forged parts in the long term. For instance, the development of third-generation Al-Li alloys is expected to benefit aircraft performance and lightweight design. These alloys have the potential to replace conventional 2XXX and 3XXX series aerospace aluminum alloys.

Challenges

- Requirement for High Initial Investment - The aerospace forging process requires a large initial investment in equipment and technology. This can create a barrier to entry for SMEs and limit competition and innovation in the market.

- Strict Rules and Regulations

- Dependency on Raw Materials

Aerospace Forging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 39.97 billion |

|

Forecast Year Market Size (2035) |

USD 88.72 billion |

|

Regional Scope |

|

Aerospace Forging Market Segmentation:

End-user (Business, Commercial, Military)

The global aerospace forging market is segmented and analyzed for demand and supply by end users into business, commercial, and military. Out of these, the commercial segment is anticipated to account for the largest market share by the end of 2035. The growth of this market can be attributed owing the growing amount of investment in the production of commercial aircraft and the rising number of scheduled flights for passengers. In recent years, strong travel demand has increased the demand for new commercial aircraft. Rising passenger numbers in the Asia-Pacific region are expected to boost long-term demand for forged parts. For instance, more than 20,000 jetliners have been delivered globally in the last ten years, a 66% increase from the previous ten years. According to the latest data, the Asia-Pacific region is expected to deliver 10,040 new aircraft from 2028 to 2038. The emerging middle class in developing countries is expected to play a key role in increasing passenger numbers. According to the same data, the middle-class population in Asia-Pacific increased from 32% in 2008 to 50% in 2018.

Material (Aluminum Alloy, Stainless Steel, Titanium)

The global market is segmented and analyzed for demand and supply by material into aluminum alloy, stainless steel, and titanium. Amongst these, the aluminum alloy segment is anticipated to hold the largest market share by the end of 2035. The use of aluminum in the aerospace industry is rapidly increasing owing to its lightweight properties. Modern planes are lighter, more modern, and more fuel efficient than older models. The development of advanced aluminum alloys in combination with other metals is another key factor likely to drive demand for aluminum forgings. Around 90% of aircraft bodies are made of aluminum, and forging with this material is essential in order to provide the metal capabilities of preventing fatigue by improving its ductility and strength.

Our in-depth analysis of the global market includes the following segments:

|

By Material |

|

|

By Aircraft |

|

|

By Application |

|

|

By End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerospace Forging Market - Regional Analysis

North American Market Forecast

North America industry is poised to account for largest revenue share of 32% by 2035. This can be attributed on the back of the presence of major manufacturers of aircraft and aerospace components in the region. Furthermore, the growth of the aerospace forging market in the North American region is directly interlinked with the growth of the aircraft manufacturing industry. For instance, in 2019, the aircraft manufacturing industry was valued at about USD 135 billion in the region. A rapid acceleration in aerospace forging and manufacturing in the region is also observed in recent decades, owing to the escalating number of people traveling via airlines. The growing number of air passengers is projected to result in a significant requirement for the highest number of aircraft. A report published by the Bureau of Transportation Statistics (BTS) in 2021 stated that 674 million passengers are carried by US airlines annually which has increased by 82.5% from 2020 when about 369 million passengers were traveling via US airlines. Therefore, all these factors are anticipated to boost the growth of the market during the forecast period in the North American region.

APAC Market Statistics

The market in the Asia Pacific region is anticipated to share significant market growth in the forecast period owing to the presence of the biggest aviation market in the region. China is the world's fastest-growing aviation market. Over the next 20 years, the region is expected to deliver over 8,000 new aircraft. Strong demand is projected to provide future aftermarket service opportunities worth USD 1.6 trillion. China also ranks second in defense spending. In 2021, China will contribute about USD 293 billion to the defense industry, up 4.7% from 2020. Therefore, in the long term, China should attract large demand for aerospace forgings. China is a major exporter of forgings to the United States and Europe.

Europe Market Forecast

The market in Europe region also is expected to experience significant market growth in the forecast period. The European aerospace forgings market is driven by the increasing demand for lightweight, high-strength parts in the aerospace industry. This demand is especially important in the commercial aviation sector, where fuel efficiency and emission reduction are key priorities.

Aerospace Forging Market Players:

- Arconic Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Larsen & Toubro Limited

- Precision Castparts Corp.

- Jiangyin Hengrun Heavy Industries Co., Ltd

- WLLEOOD Group Inc.

- CAV System Ltd.

- Curtiss-Wright Corporation

- Honeywell International PLC

- Raytheon Technologies Corporation

- Airbus S.A.S.

Recent Developments

- Curtiss-Wright Corporation is chosen by the progeny to present its Modular Open System Approach (MOSA) to be utilized by the US Navy.

- Jiangyin Hengrun Heavy Industries Co., Ltd to receive the certificate from Wuxi Engineering Research Center.

- Report ID: 4104

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aerospace Forging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.